Understanding the concept of "next of kin" is essential for effective estate planning. It ensures that your assets are distributed according to your wishes upon your death.

While the concept of next of kin may sound simple, state laws determine who can act as next of kin and the order in which they become heirs. In the rare instance that a next of kin can't be found, assets may end up in the state's hands.

If you don't have a will, however, it's essential to understand what happens to your estate. Generally, the decedent's next of kin, or closest family member related by blood, is first in line to inherit property.

Keep reading to understand the legal definition of next of kin, its meaning, and its significance in estate planning.

What does next of kin mean?

Next of kin means a person's closest living blood relative. It's a term often used when sorting out inheritances after a person's death.

The legal definition of next of kin includes individuals connected to the deceased by blood or by law.

Examples of next of kin relationships include surviving spouses, biological children, and adopted children. Such a broad line of kinship reflects the diverse structure of family connections that play a crucial role in inheritance.

While legally adopted children and spouses aren't blood relatives, most states consider them next of kin. The determination of who qualifies as next of kin may vary by a state's intestate succession laws, jurisdiction, and local policy.

Why does the next of kin matter?

When someone passes away with a will, their property is distributed to the beneficiaries specified in that will. While wills can simplify estate management and establish an executor to handle specific roles, not everyone has a will in place.

If a person dies without a will, this legal process is known as intestate succession. Next of kin status determines inheritance rights when a person dies intestate, without a valid estate plan.

Note: Establishing who is next of kin becomes complicated when multiple children or siblings qualify.

Next of kin vs beneficiary vs heir: What's the difference?

It's important to understand the differences between heirs, beneficiaries, and next of kin in estate planning, as each plays a unique role that impacts how assets are distributed upon the death of an individual.

1. Heirs

Heirs are individuals defined by legal relationships and recognized by state law as entitled to inherit assets from a deceased person's probate estate when there is no valid will in place. Generally, heirs include the first degree of closest relatives, determined by legal ties, such as a surviving spouse, or by blood relations such as children or parents, and other direct descendants. Heirs may not receive any assets if a valid will directs them elsewhere.

2. Beneficiaries

Beneficiaries are individuals or entities explicitly named in a will, trust, or through a beneficiary designation to receive specific assets.

The difference between beneficiary and heir lies in that heirs are defined by legal relationships, whereas beneficiaries can include friends, charities, or organizations and don't necessarily have to be related to the deceased. Thus, a person can be a beneficiary without being an heir.

In summary, while heirs are determined by law and typically include close relatives, beneficiaries are designated by the deceased's wishes in estate planning documents.

3. Next of kin

The legal definition of next of kin includes the living relatives of the deceased. It extends up to varying degrees, such as uncles, aunts, cousins, nephews, or nieces, depending on the state's laws. However, it typically focuses on immediate family members, such as the surviving spouse, children, and parents, depending on state laws. It serves as a foundational term impacting the determination of heirs.

Keep in mind:

- When writing a will, one can name beneficiaries at one's discretion.

- Conversely, there is no say over the next of kin.

To understand the concept of next of kin versus beneficiary, remember that while spouses and children are usually considered next of kin and also heirs, they may not be the beneficiary unless specifically mentioned in the will, if the deceased person left one.

To understand the concept of next of kin versus heir, remember that though both relate to inheritance, these two terms have distinct meanings. "Next of kin" typically refers to the closest living relatives of a deceased person who may be entitled to inherit under intestacy laws and involved in making decisions for an incapacitated or deceased individual, especially in medical, financial, or other crucial matters such as funeral arrangements. "Heir" refers explicitly to an individual entitled to inherit property from a deceased person, often designated in a will or trust, or, if no valid will exists, then by intestacy laws.

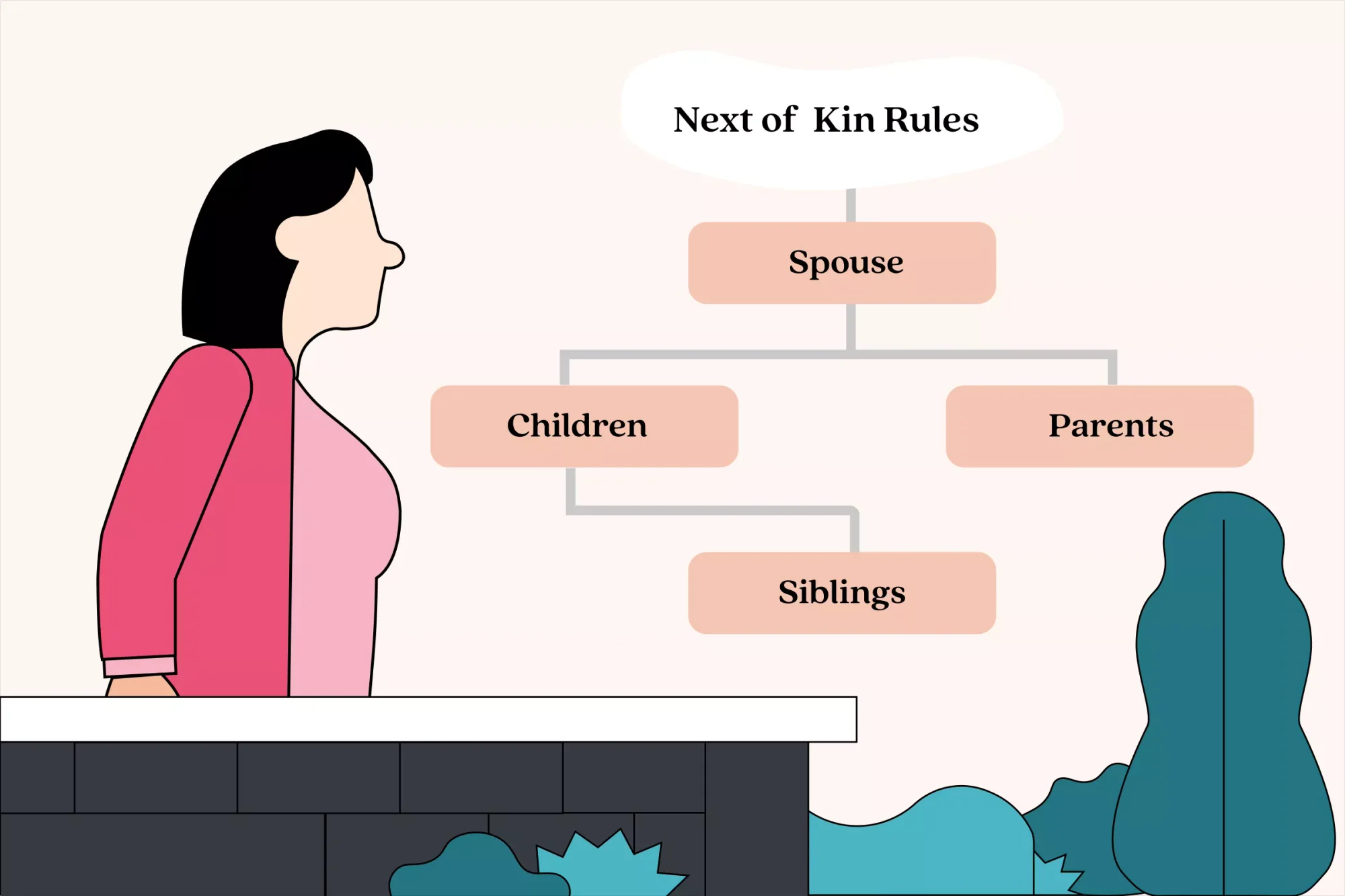

What is the order of the next of kin?

So, who is the next of kin? Next of kin relationships generally follow a legal order of priority for inheritance and decision-making. The order of next of kin determines who has priority for inheritance and decision-making when a person dies without a will.

1. Surviving spouse

The spouse is usually first in line to inherit the estate. The surviving spouse holds the primary position in the next of kin hierarchy for inheritance, typically being the first in line to inherit the deceased's estate. This partner, who has shared a life and often a home, is usually granted the most significant claim to the assets left behind by the deceased. In many cases, if there are no surviving children or parents, the spouse may inherit the entire estate.

2. Children

In the absence of a surviving spouse, the children of the deceased, or their descendants such as grandchildren, are the next of kin to inherit. The term 'children' may also encompass biological or adopted children of the decedent, although the specifics may vary depending on the state's inheritance laws.

Stepchildren and adopted children may also have specific legal standing in certain jurisdictions.

3. Parents

In the absence of a surviving spouse or children, the next in line for inheritance are the deceased's parents who are still living. Their significant role as caregivers and nurturers throughout the deceased's life places them in an important position within the inheritance hierarchy.

4. Siblings, including half-siblings

If there are no living spouse, children, or parents, siblings—both real and half siblings—follow in line.

5. Collateral heirs

When there are no surviving spouse, children, or parents, inheritance may extend to more distant relatives, known as collateral heirs. These can include:

- Grandparents

- Aunts and uncles

- Nieces and nephews

- Cousins (if no closer relatives survive)

6. Extended family ("Great" Generations)

Some state laws also recognize more distant relatives, such as:

- Great-grandchildren

- Great-grandparents

- Great-aunts and great-uncles

The exact order and rights of next of kin vary by jurisdiction. It is advisable to consult local laws or an estate attorney for specific guidance on this matter.

Proving who is next of kin also requires proof of identity, such as a birth certificate or government-issued photo ID. You may also need an affidavit from someone who can swear to the blood relationship with the decedent.

What happens if your next of kin is a minor?

Children under the age of 18 can't directly inherit assets or accept assets by beneficiary designation, such as the proceeds from a life insurance policy. Therefore, if your next of kin is a minor, a probate court may, among other options, need to appoint a guardian to oversee the management of assets. This court-appointed guardian will protect the minor's assets and make financial decisions in the best interest of the minor.

Once the child reaches the age of majority (18 years old), the assets will be transferred to them, and the guardianship will terminate, granting them complete control over their inheritance.

Is a stepchild considered next of kin?

While stepchildren are often treated as family in personal relationships, they don't have the same automatic legal rights as biological children, especially in matters such as inheritance or medical decisions, unless specified in a will or other legal documents. However, some states, such as New Jersey and California, have specific laws or exceptions that may grant stepchildren inheritance rights under certain circumstances, including when there is no surviving spouse or children from a prior marriage or if the stepparent relationship began during the child's minority and continued until the stepparent's death. It's always a good idea to consult with a legal professional for specific situations or guidance related to family law.

What are the rights and responsibilities of the next of kin?

The responsibilities of a next of kin may involve critical aspects post-death, such as making necessary arrangements and completing the required paperwork. Here are some of the most important responsibilities that a next of kin is expected to fulfill.

1. Registering the death

As the next of kin, one of the primary and most crucial responsibilities is to register the death. The next of kin must reach out to the vital records office in the state where the death took place.

Typically, a medical certificate stating the cause of death is required, along with other documents specific to that state. Once the registration is complete, the concerned offices shall provide the death certificate.

The next of kin is expected to handle the original copies of the death certificate with utmost care, as it is a vital document for various legal and administrative purposes.

2. Funeral arrangements

The next of kin will often have the final say in funeral decisions for the deceased and is responsible for arranging the funeral smoothly without any confusion or misunderstandings among the family members.

3. Medical decisions

If someone is incapacitated due to a healthcare or medical emergency and is unable to make medical decisions on their own, and they have left no advance medical directives, the next of kin can decide their treatment.

4. Probate filing

The next of kin can initiate the probate process, particularly in cases where there is no will, governed by the "Rules of Intestacy." These rules help to determine the deceased's heirs and dictate how their estate should be divided among them. If appointed as administrator, they can hire an attorney to assist them in completing the probate process.

5. Acting as a point of contact

Once the court appoints the estate administrator, the next of kin are responsible for responding to legal, medical, and personal questions about the deceased. They would also ensure that the estate is distributed fairly according to intestate laws, which involves managing the estate, settling debts, and overseeing the overall settlement. The next of kin may also need to represent other family members in probate court for legal matters such as guardianship proceedings or inheritance disputes.

6. Tallying assets and debts

The next of kin shall manage the deceased's existing trusts following their wishes and legal requirements. Once appointed by the court as administrator of the estate, the next of kin needs to research the decedent's finances, debts, and valuable assets. This may include responsibilities such as addressing obligations to creditors and other essential aspects of proper estate administration.

How to inherit property as next of kin

When dealing with the estate of a deceased person, the need for probate depends on the type and value of the property they owned. The estate encompasses all the property legally owned by the deceased. Even if there is a will, the estate may still be required to go through the probate process. Most documents filed in probate must be verified to confirm their authenticity and accuracy. However, when there's no will, the next of kin may be required to follow the process to get the inheritance. Here, the steps involved are:

1. Determining the next of kin

If there is no will, the next of kin (a close blood relative or a legal relative), such as surviving spouses, children, parents, grandchildren, or siblings, shall be the point of contact.

2. Understanding intestate succession

Every state has its intestate succession laws, which differ from one another. It's crucial to follow the specific regulations of the state where the deceased resided.

3. Gather the deceased's information

The next of kin must first gather comprehensive information about the deceased's assets and debts, and the relevant documents.

4. Provide proof of kinship

The next of kin has to provide documentation proving their relationship to the deceased, such as birth certificates, marriage certificates, or adoption papers.

5. Distributing the assets

The next of kin shall gather the deceased's assets, pay debts and taxes, and distribute the remaining assets to the rightful heirs following state laws.

Next of kin affidavit for inheritance

An heir may need a next of kin affidavit to get an inheritance. This notarized document establishes the heir's claim to the estate property. Depending on the jurisdiction, this affidavit may be sufficient to transfer some types of property to the heir legally.

Real property usually requires further documentation to transfer ownership. This may include a copy of the deceased's death certificate, a notarized deed, and probate documents. Real property consists of:

- Land owned

- Any buildings on the property

- Any plants on the land

- Roads, sewers, fences, and other artificial structures

Next of kin rules: How do state inheritance laws affect inheritance rights?

The determination of the next of kin order may vary from state to state, depending on the context in which the next of kin status is required, such as for inheritance, medical decisions, or other legal matters. Here are a few examples of what inheritance laws look like for next of kin in a few states:

1. Who is considered next of kin in California?

According to California legislative information, the distribution of assets among next of kin typically follows this order:

In California, if a person dies without a will, their surviving spouse receives half of the community property and the quasi-community property that belonged to the deceased.

In the case of intestate succession concerning separate property, the share allocated to the surviving spouse varies based on the decedent's surviving relatives.

- If the decedent leaves no surviving children, parents, siblings, or the descendants of deceased siblings, the surviving spouse inherits all the separate property.

- If no surviving spouse, then the child inherits everything if there is only one child of the decedent.

- If there are only surviving parents, but no children, spouse, or siblings, then the surviving parents inherit everything.

- If there is one child or the issue of a deceased child, the spouse receives half of the separate property, and the child or their descendant gets the other half. The same one-half share applies when the decedent has no children but has surviving parents or their descendants.

- In situations where the decedent leaves more than one child, the surviving spouse is entitled to one-third of the separate property, and the rest of the separate property is divided equally among the children or their descendants. This one-third share also applies if there is one child along with descendants of deceased children, or if there are descendants from two or more deceased children.

2. Who is considered next of kin in Georgia?

In Georgia, when someone dies intestate, the next of kin is determined according to Georgia's intestate laws of succession. The distribution of a deceased person's assets is decided based on their surviving family members. It may vary depending on whether the deceased has living close relatives, such as children or parents, at the time of death.

In Georgia, if a person is married and dies without a will, their spouse's share will be determined by whether they have living descendants, including children, grandchildren, or great-grandchildren.

- If they don't, their spouse inherits all their intestate property.

- If they do, their spouse and the descendants will share the intestate property equally, except that their spouse's share can't be less than ⅓ according to the Official Code of Georgia Annotated (OCGA) Section 53-2-1.

- For instance, Michel is married to Emma, and they have three adult children. Michel and Emma own a house in joint tenancy, and Emma is also the named beneficiary of Michel's retirement account. When Michel dies, Emma automatically inherits the house and any remaining retirement funds, not intestate property. Michel also owns $600,000 worth of other property that would have been transferred under a will, so Emma inherits 1/3—that is, $200,000 worth—of that property. The three children split Michel's remaining $400,000 worth of intestate property.

3. Who is the next of kin in South Carolina?

South Carolina's inheritance laws significantly influence how property is distributed after someone's death, especially when a will or estate planning documents aren't in place. In such cases, intestacy laws dictate the distribution of the deceased's assets based on their family situation.

- If a person dies without a will, their spouse inherits the entire estate if there are no children. However, if there are surviving spouses and children, the spouse receives a half share of the estate, while the remaining half portion is divided equally among the children.

- If there is no surviving spouse but children, the property passes to the children. However, if a child doesn't survive, then their children take the share the child would have taken if they had survived.

- In the absence of a spouse, children, or grandchildren, the estate goes to the parents. However, if no parents survive, then the siblings of the decedent (brothers and sisters) get the property.

- If no living relatives exist, the state of South Carolina will ultimately inherit the property.

South Carolina also protects spouses from being completely disinherited, ensuring that a surviving spouse may still claim their share of the estate, regardless of any prior wills created that intended to exclude them.

4. Who is considered next of kin in New Jersey?

The determination of the next of kin and the asset distribution would take place in

New Jersey differs in different life scenarios as follows:

- If only a surviving spouse remains, with no children or parents, the spouse inherits all the assets.

- If there is no surviving spouse and only children are present, the children inherit all the assets.

- If the decedent has a surviving spouse and children of the decedent, all of whom are also children of the spouse, and no other descendants, the spouse will receive 100% of the estate, and no bond will be required. The children receive nothing.

- If there is a surviving spouse and stepchildren (not the children of the surviving spouse), the spouse inherits all the assets.

- If there is a surviving spouse and children from previous marriages, the spouse inherits 25% of the intestate property (with a minimum of $50,000 and a maximum of $200,000), plus half of the remaining balance, while the children divide the rest of the assets.

- If there is a surviving spouse and children—whether with the current spouse or from another relationship where paternity is established—the spouse inherits 25% of the estate, with a minimum of $50,000 and a maximum of $200,000, and the remaining estate is divided among the children.

- If the decedent has a surviving spouse and parents, but no children, then the surviving spouse receives the first 25% of the estate, but not less than $50,000 or more than $200,000, plus three-fourths of the balance of the estate; parents receive all other remaining assets.

- If there is no surviving spouse or children, the surviving parents inherit all the assets.

- If there is no surviving spouse, children, or parents, the siblings inherit all the assets.

5. Who is considered next of kin in North Carolina?

In North Carolina, "next of kin" is legally defined as those who would inherit under NC Law NCGSA § 130A-420 if a person dies without a will. When someone dies without a will in North Carolina, the following property rights of the surviving spouse are typically followed according to N.C. Gen. Stat. §§ 29-14; 29-15; 29-16 (2024):

- Only the surviving spouse. The spouse receives all assets.

- Surviving spouse and one child or the descendants of the child. If an individual dies without a will in North Carolina, the surviving spouse receives a half share of the real estate property and a half share of the personal property. If the value of the personal property is worth $60,000 or less, the surviving spouse receives all of it. If it is worth more than $60,000, the surviving spouse receives $60,000 plus half of the amount over $60,000. The child or descendants will receive half of the real estate and any remaining personal property after the surviving spouse's share.

- Surviving spouse and two or more children, or the descendants of any child. The surviving spouse is entitled to get the first $60,000 of personal property. Following this, they are allocated one-third of the remaining personal property and one-third of the real estate property. The remaining personal property and real estate are then distributed equally among the children.

- Surviving spouse and one or more parents. If an individual dies without a will, the surviving spouse typically receives half of the real estate and a share of the personal belongings. If the personal property is worth $100,000 or less, the spouse gets all of it. If it's worth more, the spouse receives $100,000 plus half of the remaining amount. The parents inherit half of the real estate and any remaining personal property.

- Parents only. The entire estate will be divided equally among the decedent's parents. If there is only one parent, that person receives everything.

- Children only (or their descendants). The entire property is divided evenly among the children. If a child predeceases the decedent, their descendants receive their share. If there is only one child, that person gets everything.

- No spouse, no children, no parents surviving. The law says that if a person passes away, their property will be divided evenly among their closest surviving family members. This includes, in order: siblings, grandparents, uncles and aunts, and others who are entitled to inherit.

- No surviving blood relatives. The estate's assets revert to the State of North Carolina in a process known as "escheat."

6. Who is considered next of kin in Texas?

Under Texas law, the determination of next of kin differs depending on whether the property involved is classified as separate or community property.

A separate property is a property owned before marriage by either spouse or acquired during marriage by gift or inheritance. A separate real property encompasses land and any improvements on it, as well as oil, gas, and other mineral rights. A separate personal property refers to everything that is not real property, such as cash, bank accounts, clothing, personal effects, household furnishings, vehicles, stocks and bonds, life insurance policies, and government, retirement, or employee benefits.

A community property is a property acquired during marriage by the spouses.

Community property in Texas is distributed as follows:

1. If survived by a spouse and children, all of whom are descendants of the surviving spouse, all of the community property goes to the surviving spouse.

2. If there are children not shared with the surviving spouse, the deceased's half share of the community property goes to their children, and the spouse retains their half.

3. If survived only by a spouse and no children, all community property goes to the spouse.

Separate property in Texas is distributed as follows:

1. If the decedent is survived by a spouse and children.

- The separate personal property is divided, with one-third going to the spouse and two-thirds to the children.

- The children inherit separate real property, while the spouse receives a life estate in one-third of that property, allowing the surviving spouse to use one-third of the real property during their lifetime. After the surviving spouse's death, full ownership passes to the children or their descendants.

2. If the decedent is survived by a spouse but no children.

- All separate personal property goes to the spouse.

- Separate real property is divided so that one-half passes to the surviving spouse, and the other half goes to the decedent's parents or collateral relatives, such as siblings or their descendants. However, if no parents, siblings, or their descendants survive, the entire separate real property passes to the surviving spouse.

3. If only the children or their descendants survive, all separate personal and real property passes to them.

4. If both parents survive the decedent, but the spouse, children, and descendants of children don't, then all separate personal and real property is divided equally, with one-half passing to each parent.

5. Only one parent and siblings survive; both real and separate property are divided equally between the parent and the siblings. If no brothers, sisters, or their descendants survive, then all separate property passes to the surviving parent.

6. If no spouse, children, or parents survive, the property is divided among siblings or their descendants.

7. If no immediate family members survive, the property passes to the grandparents.

8. If no grandparents survive, the property passes to more distant relatives, such as nephews, nieces, and cousins.

7. Who is considered next of kin in Illinois?

In Illinois, the next of kin or the order of inheritance for individuals who pass away without a will is guided by the Illinois Probate Act (755 ILCS 5). According to the Illinois Legal Aid Online, in such situations of intestate death, the following order of inheritance is followed:

- The surviving spouse gets everything if the decedent had no children.

- If there is a surviving spouse and two children, the spouse receives half of the estate's assets. The children get the other half divided equally between them.

- If there is no spouse, but three children, the children get everything divided equally.

If the decedent had no spouse or children, their property would then pass to their next of kin, or their closest surviving relatives. The order of intestate inheritance is as follows:

- The estate is divided equally between the parents and siblings, but if only one parent is alive, that parent receives twice the share.

- If there are no parents but siblings, the estate is divided equally among the siblings.

- If there are no parents or siblings, but nieces and nephews, the nieces and nephews divide the estate equally.

- If there are no living parents, siblings, or children of siblings, the estate is inherited by the grandparents and their descendants. This group includes relatives such as aunts, uncles, and cousins.

- If there are no living parents, siblings, nieces or nephews, grandparents, or their descendants, the estate will pass to the great-grandparents and their descendants.

- If there is no spouse or close relatives, the entire estate is given to the nearest relatives who can prove their family connection.

- If there is no surviving spouse or relatives, the decedent's real property goes to the county where it is located, and any personal property becomes the property of the state.

Our platform helps you create or update your plan—step-by-step, with attorney support when you need it.

8. Who is considered next of kin in Indiana?

According to Indiana's next of kin laws, the first step in the process is understanding who qualifies as a legal next of kin under Indiana law. The next of kin is identified following the IC 36-2-14-10 in hierarchical order as follows:

- Spouse

- Children over the age of 18

- Parents

- Siblings

- Distant relatives, in descending order of familial connection

If no identifiable next of kin exists or is willing or able to fulfill the responsibilities, the Marion County Coroner's Office may designate another individual once all legal requirements have been met.

9. Who is considered next of kin in Iowa?

According to the next of kin laws in Iowa, the determination of the next of kin follows the order as:

- Spouse

- Adult children

- Parents

- Grandchildren

- Siblings

- Grandparents

- A person in the next degree of kinship to the decedent

10. Who is considered next of kin in Arizona?

According to the Arizona State Legislature, the intestate share of the surviving spouse follows 14-2102 and 14-2103, which means the following:

- The surviving spouse will inherit the entire estate if the surviving heirs include only the surviving spouse, but no children.

- For those who were married and have descendants with their spouse, the spouse will inherit the entire estate.

- For individuals with a surviving spouse and children from a previous partnership, the surviving spouse will inherit half of all separate property and all community property with rights of survivorship. The children will get the other half of the separate property.

- If the surviving heirs include only children but no spouse, the estate will be distributed equally among the decedent's children (or their descendants such as the decedent's grandchildren, if the decedent's children predecease the decedent).

- The decedent's parents will inherit the entire estate equally if both are alive. If there is only one surviving parent, then this parent receives the entire estate, provided the surviving heirs don't include a spouse or descendants (such as children or grandchildren).

- If the decedent has no children or parents, their entire estate will pass to the descendants of their parents, which means their siblings will inherit equally.

If the decedent dies without surviving children, parents, or siblings, but has living grandparents or relatives of grandparents, their estate is divided in the following specific manner:

- Half of the estate goes equally to the decedent's paternal grandparents if both are alive. If only one paternal grandparent is alive, they receive half of the share. If both paternal grandparents have died, their descendants will inherit that half by representation.

- The other half of the estate will go to the decedent's maternal relatives in the same way as mentioned above.

- If there are no surviving grandparents or their descendants on one side (either paternal or maternal), the entire estate will go to the relatives on the other side, following the same division as above.

11. Who is considered next of kin in Minnesota?

In Minnesota, the determination of next of kin follows the intestate inheritance rules outlined in Minn. Stat. § 524.102 and § 524.103. These statutes outline how the distribution of an intestate estate is prioritized based on the surviving relatives of the deceased.

If the decedent had a surviving spouse, the inheritance structure is established by considering the relationships of the decedent's survivors as follows:

- If there is only the surviving spouse, 100% of the estate goes to the spouse.

- If there are surviving spouse and children from this relationship only, 100% of the estate goes to the spouse.

- If the decedent is survived by a spouse and descendants from this relationship, but the surviving spouse also has descendants from another relationship, and the decedent has descendants from a different relationship, then the first $225,000 shall be distributed to the surviving spouse, plus one-half of the remaining balance. The remaining balance shall be distributed to the decedent's descendants.

If there is no surviving spouse, the order of next of kin is as follows:

- The estate goes to the decedent's children or grandchildren.

- If there are no children or grandchildren, the estate is divided equally between the decedent's parents, if both are alive; if only one parent is alive, that parent receives the entire estate.

- If there are no surviving children or parents, the estate goes to the children of the decedent's parents (the decedent's siblings or their children).

- If there are no surviving children, parents, or siblings, but there are grandparents or their descendants, half of the estate goes to the paternal grandparents equally, or to the surviving grandparent, or their descendants if both grandparents are deceased. The other half goes to the maternal relatives in the same way. If there are no surviving grandparents or their descendants on one side, the entire estate is divided equally among the relatives on the other side.

- If none of the above relatives survive, the estate goes to the next closest relatives in equal rank. If there are several relatives at the same level but from different branches, those related through the nearest ancestor inherit first.

12. Who is considered next of Kin in Pennsylvania?

The next of kin is determined by a hierarchy established through laws and court decisions in the state of Pennsylvania, particularly 16 Pa. Stat. § 1218-B(C), which states that the coroner is responsible for determining the identity of a deceased person and notifying the next of kin.

The current hierarchy established in Pennsylvania (PA) is as follows:

- Living spouse

- Adult child (over the age of 18)

- Living parent

- Adult sibling

- Living Grandparent

- Any other person related to the decedent either by blood, marriage, or adoption [living uncle/aunt, if none are living, then their child (cousin), etc.]

- Guardian of the decedent at the time of their death

- Commonwealth. If there are no living relatives or other persons responsible for the final disposition, then the Commonwealth of Pennsylvania (County Coroner or Medical Examiner) becomes responsible for the final disposition of the decedent.

13. Who is considered next of kin in Ohio?

The Ohio legislature has created various methods for transferring a decedent's probate estate through the probate court. Determining which method is most suitable depends on the specific circumstances of each estate. However, the three main types of probate procedures are:

- Summary Release From Administration

- Release of Estate From Administration

- Full Administration

The basic guidelines in Ohio's statute of descent and distribution can be summarized as follows:

- If the decedent is survived by a spouse and has no children or descendants from deceased children, the entire estate is awarded to the spouse.

- If a decedent is survived by a spouse and one or more children or their descendants, and all such children or descendants are also children of the surviving spouse, then the entire estate passes to the surviving spouse.

- If the decedent has a child (or the child's descendants) and the spouse isn't the natural or adoptive parent of that child, the spouse receives the first $20,000 from the estate plus half of what remains, with the rest going to the child (or their descendants if the child predeceased the decedent parent).

- If the decedent is survived by a spouse and more than one child or their descendants, the spouse is entitled to the first $60,000 of the estate if they are the natural or adoptive parent of at least one, but not all, of the children. If the spouse is not the natural or adoptive parent of any of the children, they receive the first $20,000. After this initial amount, the remaining estate is divided, with the spouse receiving one-third and the children sharing the remaining two-thirds equally. If any child has predeceased the decedent, that child's share is divided equally among their descendants.

- If no surviving spouse but there are children or their descendants, the estate is divided equally among the children, with the descendants of any deceased child taking their parent's share equally.

- If there are no surviving spouses or children, the estate goes to the decedent's surviving parents, or to their siblings or their descendants if both parents are deceased.

14. Who is considered next of kin in Maryland?

In Maryland, the next of kin is determined based on Maryland Intestacy Laws, which list them as follows:

- If a decedent has children but no surviving spouse, the children inherit the entire estate.

- If the decedent is survived by a spouse but has no living children, the spouse inherits the entire estate.

- If a decedent is survived by a spouse and minor children (under 18), the spouse inherits half of the intestate property, while the children inherit everything else.

- If a decedent is survived by a spouse and adult descendants who are not also descendants of the surviving spouse, the spouse inherits the first $100,000 of the intestate estate plus one-half of the remaining property, while the descendants inherit the remainder.

- If the decedent is survived by parents but no spouse or descendants, the parents inherit the entire estate.

- If the decedent has siblings but no surviving spouse, descendants, or parents, the siblings inherit everything.

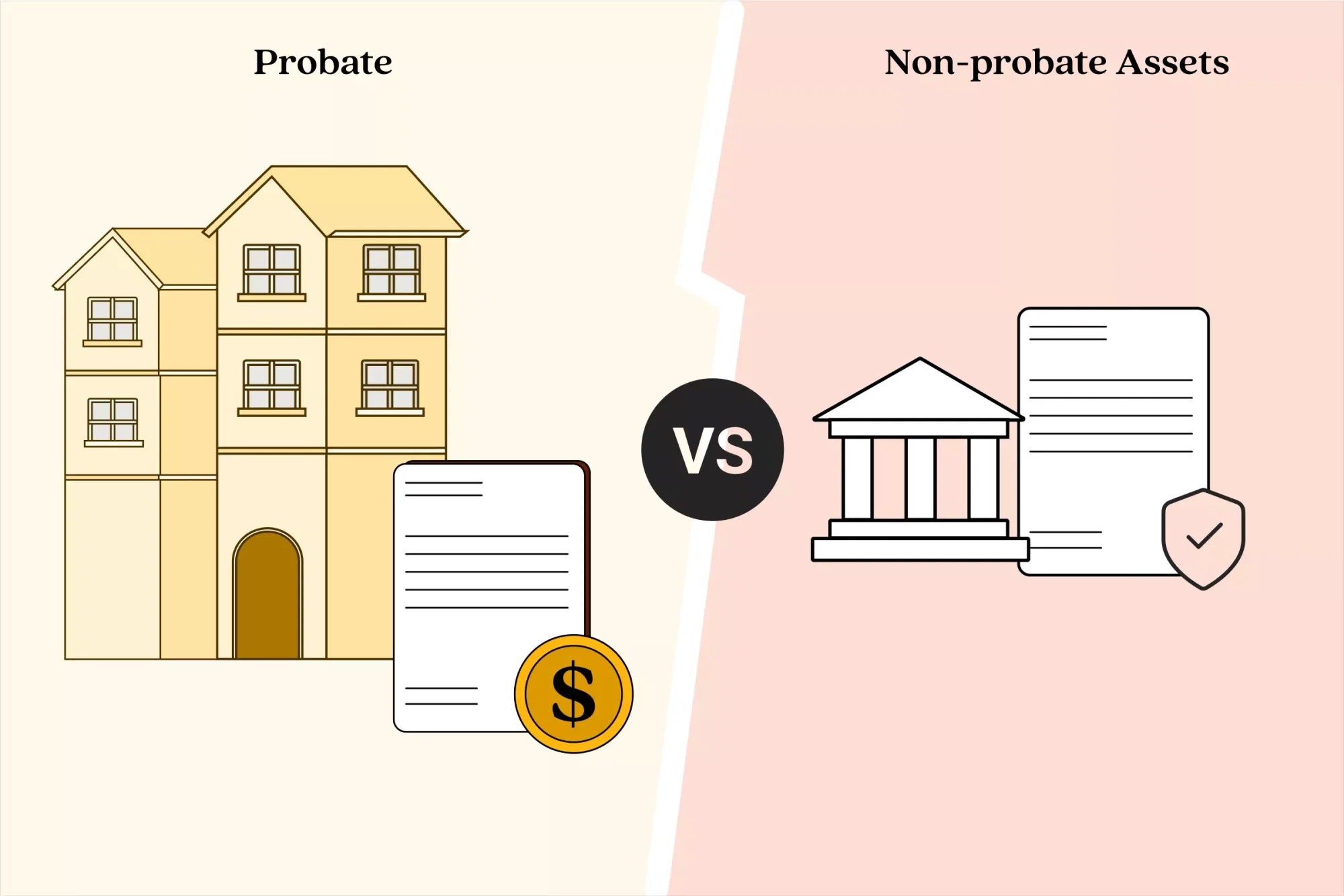

Will the next of kin go through probate court?

If someone dies with a legally valid will, their assets usually have to go through probate court. While some states make exceptions for very small estates, most call for a probate court to appoint an administrator who distributes the assets and closes the estate. Usually, this person is next of kin, such as a spouse or child.

After receiving a letter of administration (called "letter of testamentary" if there is a will), the administrator pays off the deceased's debts, if there are any, and handles the paperwork to transfer assets according to state intestacy laws.

What is the difference between probate vs. non-probate assets?

There are two kinds of assets: probate and non-probate. Probate assets are assets without beneficiary designations that must go through the court to be distributed. Meanwhile, non-probate assets are assets that have beneficiary designations and can bypass the court and go directly to the beneficiaries.

Common non-probate assets

Not every asset has to go through court. Common non-probate assets include:

- Assets placed into a trust

- Insurance payouts

- Retirement accounts

- Certain bank accounts with beneficiaries

Insurance and retirement plans, such as IRAs and 401(k)s, differ from other bequests in that these usually require you to name beneficiaries on the policies. This means that even if there wasn't a will, these assets won't go to the next of kin, unless they are specifically named on the account, or, in some cases, if the listed beneficiaries are no longer living.

Common probate assets

These assets commonly go through probate court:

- Personal collections and possessions like clothing or jewelry

- Titled assets in the deceased's name, including real estate

How long after someone dies can the inheritance be claimed?

When someone dies, the timeframe for claiming an inheritance can vary significantly based on state laws and the specific circumstances of the estate. Generally, it's crucial to begin the process shortly after the individual's death. It's strongly recommended to start the process as soon as possible. While probate can be filed technically at any time after the death, delaying it can lead to complications. Generally, filing within 30 to 60 days is advisable to avoid potential issues, such as the estate becoming unmanageable or creditors taking legal action against the estate.

If there is a will, in most cases, heirs can start to claim their inheritance once the probate court validates it and appoints an executor to manage the estate. This process might take several months, and the time allowed to claim inheritance differs from state to state. For example, certain jurisdictions, such as Maine, Washington, and Kansas, may have statutes of limitations ranging from four months to a few years for filing the inheritance claim against the estate. States may also offer varying exceptions to these rules based on individual circumstances, such as if the heir was unaware of their inheritance.

Ultimately, the best course of action for heirs is to stay informed and work closely with the executor or an estate attorney to understand their rights and responsibilities regarding claiming the inheritance while adhering to the governing laws of their state.

Managing debts and inheritance

Alt text: A picture of a person wearing a yellow open shirt, calculating and noting down his assets and inheritances for tax filing and other documentation purposes.

When someone dies, their debts are typically settled using the funds or property included in their estate. If the estate lacks sufficient funds to pay off these debts, or if there are no individuals who shared legal responsibility for them, those debts may go unpaid. Generally, survivors, including spouses, aren't held accountable for the deceased's debts unless they were co-signers, joint account holders, or fall under specific legal exceptions.

1. Is the next of kin responsible for the debt?

The next of kin may be responsible for a deceased individual's debt in specific scenarios, including:

- If they co-signed on a loan

- If they held a joint credit card account

- If the deceased’s spouse live in a state where the law mandates spouses to cover specific debts

- If they serve as the estate's executor or administrator and didn’t follow certain state probate laws

For instance, in community property states such as Texas, surviving spouse might be required to utilize jointly held assets to settle the deceased spouse's debts.

In cases where there is no estate or the estate can't pay, any remaining debt will generally not be recoverable. For instance, if state laws prioritize survivors' claims on the estate's assets, there might be insufficient funds left to cover outstanding debts.

2. Handling disputes and missing beneficiaries

In cases where clear legal documents exist, such as a will that names beneficiaries or a quitclaim deed for transferring property, clarifying the ownership of the estate becomes easier. Often, disputes arise about who owns a property or who should care for the minor children of a deceased person in cases where a person dies without a will. In such cases, when dying intestate, a detailed probate process may be required to determine who their heirs are and to establish a clear title of ownership to the estate among the heirs.

The term "title" pertains to the ownership of a property (including both the house and the land) and the rights associated with using, selling, leasing, or transferring the ownership of that property. Typically, attorneys employ two specific terms—clear title and cloudy title—to assess whether there is sufficient evidence to establish that an individual owns a property.

a. Clear title: A clear title refers to an individual being the sole owner of a given property. They possess documentation supporting their ownership. No other individual or group of people can legally claim ownership over it.

b. Cloudy title: Also called "clouded title" or "cloud on title", indicating that the ownership of the property is unclear or there are disputes regarding who legally owns it.

3. What types of title disputes may arise when someone dies intestate?

When someone dies intestate, the following problems may arise:

a. Issues of clouded title in a heirs' property

Heirs' property refers to a piece of land handed down without formal documentation. It may lead to multiple owners and potential disagreements. Family members should discuss ownership, rights, and responsibilities to prevent future conflicts and ensure a clear understanding of their roles and responsibilities.

b. Issues of guardianship and conservatorship

Guardianship is a legal arrangement in which an individual is appointed to make decisions on behalf of a person who is unable to make their own decisions. The most relevant type in probate cases is guardianship of a child. A child's guardian is an individual appointed to care for and make decisions on behalf of a child until the child reaches the age of 18.

Guardianship issues can come up in probate when a parent with minor children dies. The deceased parent might have named a guardian for their children in their will. If the parent didn't leave a will or didn't name a guardian, the court will choose a guardian based on what is best for the children.

In probate, guardianship and conservatorship are often used interchangeably, though there is a difference between these two. A guardian for minor children is often named in a will; however, if none exists, a court-appointed guardian, known as a conservator, will be assigned. The court may also appoint a guardian or conservator for adults unable to make decisions. Consulting an attorney familiar with guardianship and probate laws is essential.

c. Issues of ownership in non-probate assets without named beneficiaries

For certain non-probate assets such as bank accounts, retirement accounts (like an IRA), or life insurance, it's crucial to have a beneficiary designated. In case no beneficiary is designated, the non-probate assets go back to the decedent's estate and usually follow the general order of next of kin, such as surviving spouse, children, parents, siblings, and so on.

Many people choose to create a will or an estate plan that specifies how they want their assets to be distributed after their death. This can help avoid complications among their relatives in asset distribution. Some people establish trusts to manage and transfer their assets more efficiently, thereby avoiding probate and ensuring their wishes are carried out. Consult with an estate planning attorney to understand the best options for your situation.

Can inheritance be given before death?

Yes, a person can still give away their assets as an inheritance while they're alive. When considering wealth transfer, typically, many people plan to pass their assets to their heirs after their death. However, an alternative approach—giving while living is also prevalent nowadays. It offers notable benefits such as:

- It enables a person to maintain control over how their assets are utilized and provides a chance to instill their values and long-term vision in their heirs.

- By gifting assets during their lifetime, many people can teach their heirs about wealth management under their guidance, helping them become more comfortable with their inheritance.

- Ultimately, this proactive approach ensures that everyone is better positioned for the future and gives the person joy of giving before they are gone from this world.

Create your estate planning documents confidently with LegalZoom

While the concept of next of kin is straightforward, your best bet is to execute a last will and testament or a living trust to have a say in how your assets are distributed. This approach allows you to select your beneficiaries, making it easier for everyone when dividing up your entire estate after your death.

If you want to create an estate plan but feel unsure, LegalZoom can be of great help. We provide easy-to-use estate planning templates and offer the chance to talk to a skilled estate planning attorney who can review your estate planning documents with you. LegalZoom's Will & Trust services are easy to use and affordable, making estate plans accessible for everyone. We combine modern technology with support from experienced attorneys to help you create your estate plan. This approach gives you the confidence to ensure your wishes are honored while caring for your loved ones.

Some of the benefits you'll get while using LegalZoom's Will & Trust services are:

- User-friendly interface: Our user-friendly interface makes it easy to create and customize your estate planning documents.

- Flexible document options: Choose from a variety of estate planning options, such as wills, trusts, and powers of attorney, to fit your specific needs and goals.

- Regular updates: Keep your documents current with our easy update options, ensuring that your estate plan evolves with your life circumstances.

- Secure storage: Store your documents securely online, ensuring they are easily accessible whenever you need them.

- No time constraints: Complete your estate planning documents at your convenience, taking the time you need to think through your options without feeling rushed.

We’ll help guide you through your estate plan—whether you need a will or trust.

Join the extensive community of clients who have securely crafted their wills online with us. Our platform receives thousands of glowing 5-star reviews on TrustPilot, demonstrating the satisfaction of our users. Here's what our delighted customers have to share about their experiences:

It amazes me something so important was so easy to do...everything was exactly as I had stated. I have peace of mind now.

- Jan F., last will & testament customer

[The] lawyer … was so helpful in explaining the process, what to expect, and when we'd move on to the next steps. Amazing. I highly recommend this service!

- Nicholi P., last will & testament customer

Conclusion

Understanding "next of kin" is crucial for every individual to start effective estate planning. It's vital to gain clarity on terms such as next of kin, heirs, and beneficiaries, as well as their roles in various scenarios, to ensure that your wishes are honored.

Identify your next of kin and understand the order of their recognition under inheritance laws, which can vary by state. Start your estate planning as early as possible to address any concerns you may have with the right resources.

While the information provided is valuable, seeking advice from a qualified estate planning attorney for tailored guidance is recommended.

Glossary

- Decedent. A decedent is the individual who is dead.

- Estate. The decedent's estate is all the property owned by the decedent at the time of their death.

- Blood relative. A person related by birth, rather than by marriage, including those of half-blood, including parents, brother, sister, aunt, uncle, nephew, niece, first cousin, or any of the above prefixed by "grand," "great-grand," or "great-great-grand."

- Immediate family. Immediate family generally refers to a person's closest relatives and typically includes their parents, siblings, spouse, and children.

- In-laws. In-laws are the close relatives of one's spouse, such as parents, siblings, and other relatives who are related to a person through marriage.

- Stepchildren. A stepchild is a child of one's spouse from a previous marriage or relationship. This child isn't biologically related to one of the parents in a new marriage or relationship.

Frequently asked questions

We've answered some frequently asked questions about the complete next of kin meaning, or establishing who is the next of kin.

1. Will the spouse be the next of kin?

A spouse is typically considered the first in line as next of kin, especially in the context of inheritance and medical decisions. While "next of kin" legally refers to the closest blood relative, statutes often give priority to the surviving spouse when determining who inherits an estate or makes healthcare decisions if the individual is incapacitated and hasn't left a will or other legal instructions.

2. Can a spouse override a beneficiary?

Generally, a spouse is unable to directly change the beneficiary designation on non-probate assets, such as a bank account. This means that the designated beneficiary will inherit the funds regardless of the spouse's preferences, unless the account holder alters the designation before their death. However, community property laws in some states might influence the distribution of assets. Therefore, it's important to seek legal advice to grasp the specific laws that apply in such cases.

3. Can a friend or unmarried partner be your next of kin?

Unmarried partners and friends aren't considered next of kin. If you want them to receive your assets after death, name them as a beneficiary in your will or trust.

4. What does next of kin mean for adopted children vs. blood relatives?

Children adopted legally count as heirs under next of kin laws. These policies make no distinction between biological and adopted relations. So, if the deceased has an adopted and a biological child, the state treats them the same.

The same legal principle works in reverse. If the deceased person was adopted into a family, the adoptive family members could act as the next of kin. In both cases, legal adoption stands at the same level as biological relation.

However, it's important to note that step-children and foster children typically don't qualify as next of kin, depending on your state's intestate succession laws.

5. Who is your next of kin if you're not married?

If you are unmarried, your next of kin is usually determined by a hierarchy of relationships. This generally starts with your children, if you have any, followed by your parents, and then your siblings. If none of these relatives are available, the definition of next of kin can extend to more distant family members, such as grandparents, nieces, nephews, and even further relatives, depending on the specific laws of your state.

6. Does the next of kin override a will?

Typically, next of kin can't override a will.

7. What happens if you have no next of kin?

When a person doesn't have their next of kin, several challenges may arise:

- Healthcare decision-making. In the absence of a next of kin, medical practitioners may struggle to obtain consent for treatments, leading to ethical and legal challenges that may necessitate court authorization.

- Funeral arrangements. Without a next of kin, funeral arrangements can't be properly managed, often requiring close friends or social services to step in.

- Legal proceedings. Legal processes for guardianship or asset distribution can become lengthy and require court intervention without a designated next of kin.

- Asset distribution. In the absence of known relatives, intestate succession laws dictate that distant relatives or the state may inherit the deceased's estate.

8. Can you change your next of kin?

Typically, the designated next of kin can be changed through specific legal documents, such as a will or a power of attorney.

9. What happens if a person lacks a next of kin?

If a person dies without any identifiable next of kin, their estate typically escheats (reverts) to the state. Escheats means the state government becomes the recipient of any assets after debts and taxes are paid if no will is present and no legal heirs can be found. Every state has its laws and regulations regarding escheat rights.

Usually, property that has been escheated can be reclaimed at a later time. Most states, such as Florida and South Dakota, may impose a statute of limitations, which establishes a deadline after which recovering property is no longer permitted.

10. Can you refuse to be next of kin?

Anyone can refuse to act as the next of kin for a deceased relative. In this case, the role passes on to the next candidate in line. The state may claim the deceased's property if no one accepts the position.

11. What is a child entitled to if a parent dies without a will?

State laws usually decide what happens to an estate if a parent dies without a will. In most cases, the estate goes to the surviving parent, and the law determines how it's split between the parent and child.

However, if there is no surviving parent, then the entire estate typically goes to the biological or adopted child. If the child is a minor, the court may need to appoint a conservator to manage the assets until the child turns 18.

12. Does the oldest child inherit everything?

No, the oldest child doesn't inherit everything. While it will depend on state laws, most jurisdictions consider all biological and adopted children next of kin, so each child will receive an equal share of the estate, regardless of age or birth order.

13. Does the next of kin inherit debt?

Family members aren't usually obligated to pay off debts a deceased individual owes directly. Even with married couples, a surviving spouse doesn't have to pay unless it's a shared debt in their name.

But, money that a deceased individual owes is paid from their estate, which reduces the overall shares of the next of kin heirs. Debts are to be paid out of the estate first before any heirs inherit.

14. What happens if there is no beneficiary on a bank account?

When there is no beneficiary, assets (such as a bank account or real estate) held jointly with another person typically pass directly to the surviving joint owner, thereby skipping the probate process. If there is no joint account holder or beneficiary for a bank account, it becomes part of the deceased person's estate. This means it will be handled during probate, where the court manages how to distribute the assets according to the person's will or local laws if there is no will. The bank account will be frozen during the ongoing probate process.

15. What does next of kin mean in medical?

In medical situations where someone can't communicate or make decisions for themselves, healthcare providers often look to the next of kin to make those tough calls about treatments and procedures. It's quite the responsibility for those family members, especially during such critical times.

16. Which sibling is next of kin?

When someone dies intestate, the order of next of kin typically prioritizes the spouse, then children, then parents, and finally, siblings. So, siblings are next of kin after a spouse and children, and after parents, if those relatives exist. If there is no spouse, children, or parents, then siblings become the next of kin. Usually, siblings of the deceased are all considered equally as next of kin, regardless of their birth order.

17. Who inherits if the beneficiary is deceased?

If the beneficiary is deceased before receiving their inheritance from a will or trust, as established by the person who made the will (the testator), their share of the inheritance typically passes to their descendants, such as children or grandchildren. This rule is known as "anti-lapse," as seen in states such as Iowa, Maine, and Florida.

18. Who should be your beneficiary if you are single?

Estate planning for single individuals differs from that of married couples. It's important that singles draw up an estate plan that provides specific instructions on how to manage their affairs. When a person dies intestate, the surviving parents and siblings, as a rule, inherit equal shares of the estate. If one parent is deceased, however, the surviving one inherits both shares. If a sibling died and is survived by descendants, their descendants inherit their share. If there are no surviving first-degree relatives, the estate is divided equally between the remaining family members.

19. What is a child entitled to when a parent dies without a will in California?

According to California law, if there's only one child, they get the other half of the separate property (the remaining part after the surviving spouse gets their share). With two or more children, the spouse's share of separate property drops to one-third, and the children inherit two-thirds.

20. What is a child entitled to when a parent dies without a will in Georgia?

If a parent dies without a will in Georgia, the rules of inheritance state that their children will receive an "intestate share" of their property. The surviving spouse receives one-third, and the remaining two-thirds are divided equally among the children. If there are only children of the decedent left, without a surviving spouse, the entire estate is divided equally among the children. If there are legitimate children from multiple marriages, all children inherit equally, regardless of the order in which the marriages occurred. This can be understood from the flowchart provided by the Athens Clark County Unified Government of Georgia.

21. What is a child entitled to when a parent dies without a will in New Jersey?

For children dealing with losing a parent without a will in New Jersey, their guardians need to understand the following:

- If only children and no surviving spouse, the children inherit all assets

- If a surviving spouse and stepchildren (from that spouse), the spouse inherits all assets. In this case, the stepchildren don't get any share of the assets.

- If a surviving spouse and children from a previous spouse, the spouse inherits 25% of the intestate property (which can't be less than $50,000 or exceed $200,000) plus half of the balance. Children divide the remaining assets.

- If a surviving spouse, children from the present spouse, and children from another relationship (unmarried relationships, given that the paternity is established). Spouse inherits 25% of the estate (not less than $50,000 or more than $200,000). Children divide the rest.

22. What is a child entitled to when a parent dies without a will in North Carolina?

When a parent dies without a will in North Carolina, the child is entitled to the following:

- The children or descendants will receive half of the real estate and any remaining personal property after the surviving spouse's share if the decedent had only one child.

- The children or their descendants receive two-thirds of the real estate and any personal property left after the spouse's share is taken out, if the decedent had two or more children.

- The entire property is divided evenly among the children if the decedent didn't leave a surviving spouse. If a child is predeceased, their descendants receive the share of the deceased child. If there is only one child, that person gets everything.

23. What is a child entitled to when a parent dies without a will in Texas?

If a surviving child or descendant of the deceased spouse isn't a child or descendant of the surviving spouse, the deceased spouse's one-half of the community property passes to their children (and the descendants of any deceased child).

If the decedent is survived by a spouse and children (or descendants of deceased children): Subject to the surviving spouse's rights regarding the homestead and exempt personal property

- The separate personal property passes one-third to the spouse

- Two-thirds to the children (and their descendants).

The separate real property

- Passes to the children (and descendants of deceased children) subject to a life estate in one-third of the property for the surviving spouse.

- The surviving spouse can use one-third of the real property during their lifetime.

- Upon the surviving spouse's death, the children (or descendants) will have full title to the separate real property.

If only children or their descendants survive, all separate personal and real property passes to the children or their descendants.

24. Do grandchildren get an inheritance if a parent dies in Texas?

In Texas, grandchildren can inherit from their grandparent's estate if their parent (the grandparent's child) is deceased. This process is known as inheritance by "right of representation" or "per stirpes." If the grandparent dies without a will (intestate), the grandchildren will inherit the share that their deceased parent would have received.

25. Do grandchildren usually get an inheritance?

Grandchildren generally don't have an automatic right to inherit from their grandparents unless their parent (the grandparent's child) is deceased. If a grandparent dies without a will (intestate), state laws, such as those in Georgia, typically dictate that the estate is divided among the surviving spouse and children. If a child has already died, their share of the inheritance may pass to their children (the grandchildren), but this is only if the grandchild's parent is deceased. Grandparents can, however, include grandchildren in their will as beneficiaries to ensure they receive an inheritance, regardless of whether their parents are alive.

26. Does the issue include grandchildren?

In the context of wills and trusts, the term "issue" generally refers to grandchildren as a group but is not limited to them. The term "issue" is often used to denote the descendants of the testator, such as those in Delaware. This means that if a will or trust document uses the term "issue," it's likely intended to encompass children, grandchildren, great-grandchildren, and so on.

27. What happens when a child dies before their parents?

In most states of the U.S., if a child dies before their parents, and the parent has a will, the inheritance designated for the child typically goes to the child's descendants, such as their grandchildren. For instance, if a son dies before his mother and the mother had created a will, including a "per stirpes" or "by representation" clause, then the inheritance would go to the son's children. If there's no will, state laws of intestacy determine how the inheritance is distributed, often to the deceased child's descendants as well. If there are no descendants, the inheritance may go to other relatives or, in some cases, the state.

28. What happens when someone dies without a will in New Jersey?

When someone dies without a will in New Jersey, it can be confusing for the family left behind, especially figuring out what happens to their stuff. In probate law, there are some important things to know, apart from the ones stated above.

- If a person owned assets solely in their name at the time of their death, those are considered probate assets. If there's no will, those assets will be distributed according to intestate succession laws, which means the state has a set process for determining who receives what.

- There are also non-probate assets. These include assets such as joint properties, life insurance payouts, retirement accounts with designated beneficiaries, or any assets held in a trust. It goes directly to the individuals named as beneficiaries or co-owners.

So, even if the estate doesn't have a considerable value, those intestate succession rules still apply.

Chloe Packard contributed to this article.