When you are forming your business in New York state, you must file your business entity with the New York Department of State. You’ll need to check the database to ensure you are legally allowed to use your chosen name for your own business entity. Adhering to state guidelines, choosing a unique name that builds authority, and protecting yourself from the implications of trademark infringement should be a top priority.

New York Secretary of State business search contact information

Website: https://apps.dos.ny.gov/publicInquiry/#

Phone: (518) 473-2492

Physical address: One Commerce Plaza, 99 Washington Ave., Albany, NY 12231

Mailing address: New York Secretary of State, 99 Washington Ave., Albany, NY 12231

Hours: Monday-Friday, 8:45 a.m.–4:30 p.m. Eastern time

Email: https://dos.ny.gov/form/contact-us

Step-by-step guide to conducting a NY SOS business search

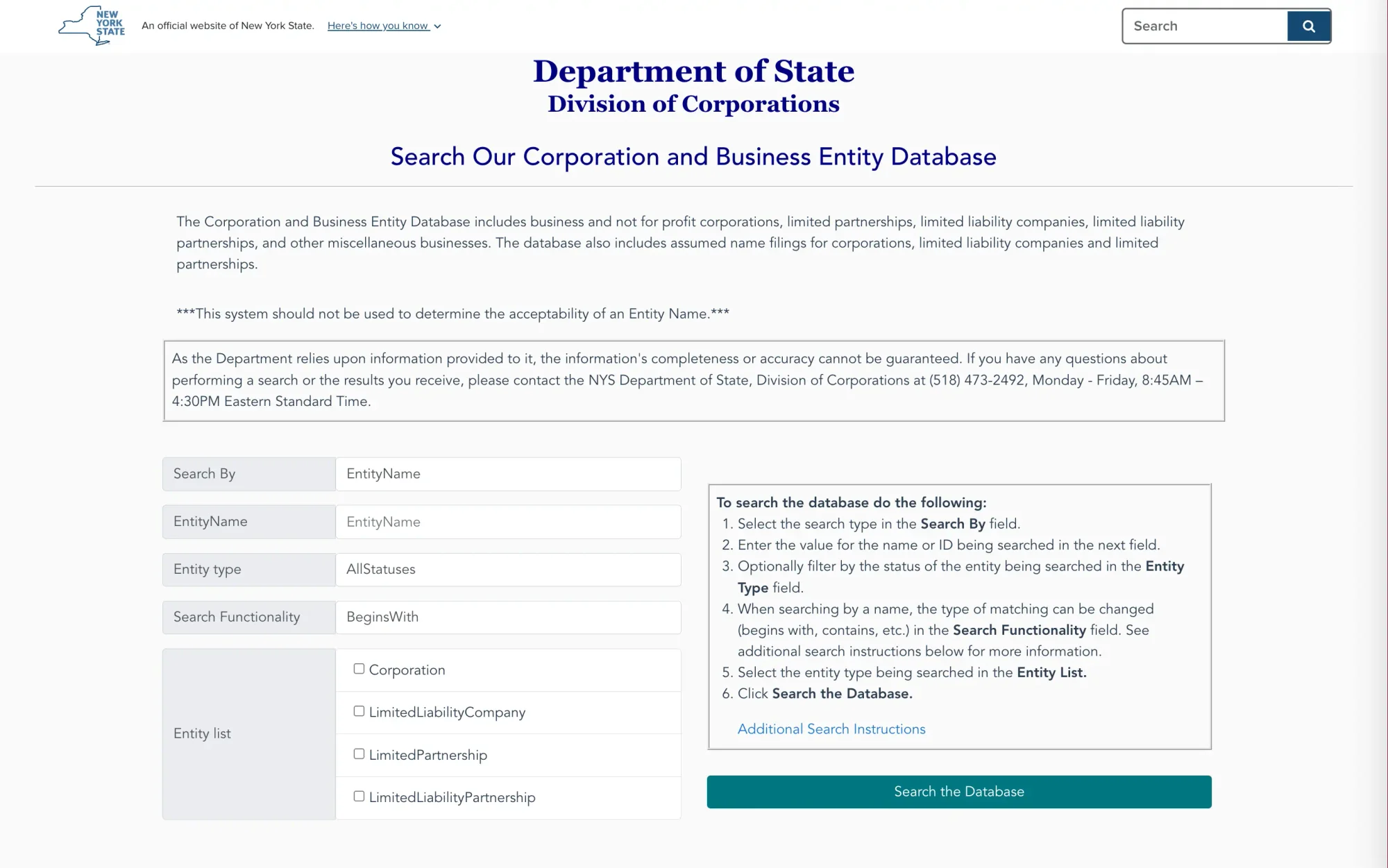

When you are ready to conduct a name search, visit the New York Secretary of State Division of Corporations website.

Step 1: Search database

The New York Secretary of State Business Entity Database is free to use and stores all information about registered entities, such as limited liability companies, corporations, and limited liability partnerships. It also has assumed name filings. To perform the search:

- Enter the name, assumed name, or Department of State (DOS) ID

- Select entity status (active, inactive)

- Add the type of matching, such as "contains” or "begins with”

- Select entity structure

- Click on the "Search the database" icon

Tip: If your business name has multiple words, also search just the first two words together for more comprehensive results.

Step 2: Refine search results

Multiple types of business entities may pop up, including:

- S corporation

- C corporation

- Limited liability company

- Limited liability partnership

- Limited partnership

You can further refine your search results by DOS ID, trademark, register agent, address, EIN, assumed name ID, assumed name, and other parameters.

Step 3: Get more information

Your name search doesn't have to end on the results page. Click on any of the name results to access more detailed information. You will be directed to a page where you can see whether the company is still active, its address, filing details, and registered agent data.

Why conduct a New York business entity search

Skipping a name search can backfire. Your selected name may not meet the state's naming requirements, and therefore, your formation paperwork may get rejected. Or you might end up using a name that's already in existence or is too similar. Not only can this create confusion among customers, but you can also get served with a cease and desist letter or lawsuit.

Understanding naming guidelines in New York

Also, understand the specific legal naming requirements that come with LLCs or corporations. For example, you may be required to add certain words like “LLC” to your business name for legal reasons.

You may also be prohibited from using specific terms unless you have approval, such as "insurance" or “bank.” You should select a name that is distinguishable not only to protect your new company but also to set it apart from competitors in the same industry.

Other naming considerations

The following extra checks will help you create a cohesive brand presence while avoiding name conflicts with existing businesses.

- Conduct a trademark search to avoid infringement with the U.S. Patent and Trademark Office (USPTO)'s trademark database.

- Check domain name availability through tools and services such as GoDaddy to build your online presence.

- Find a matching social media handle to make it easier for customers to find you.

Next steps to start your business or LLC in NY

When you are ready to start a new business here in New York, you should:

- Decide on your company’s legal structure

- Choose a business name

- Reserve your business name

- Register your business

- Register your domain name and website

- Trademark the business name

FAQs

How much is it to start a business in NY?

The registration fees vary depending on the type of business. For example, if you are hoping to run a registered agent service, you might pay $400. If you needed to file and secure an operating agreement, you might pay up to $1,000.

What qualifies as a small business in NY?

According to Section 131 of the Economic Development Law, New York State considers any independently owned and operated company with fewer than 100 employees a small business.

Is a DBA or LLC better?

LLCs offer personal liability protection for your company. A DBA, while cheaper, only gives your business the option to operate under a different name. Your personal assets are at risk if there are any legal disputes.