Financial power of attorney (POA) gives another person the ability to conduct your financial matters when you cannot be present.

In this article, we'll discuss the definition and importance of a POA, the types you can choose from, and how you can make a POA for financial purposes by yourself.

What is a financial power of attorney?

A financial power of attorney is a legal document that authorizes an agent to act on your behalf in financial matters. Financial POAs function as proof that the designated agent has the power to manage the principal's finances.

Financial POA example

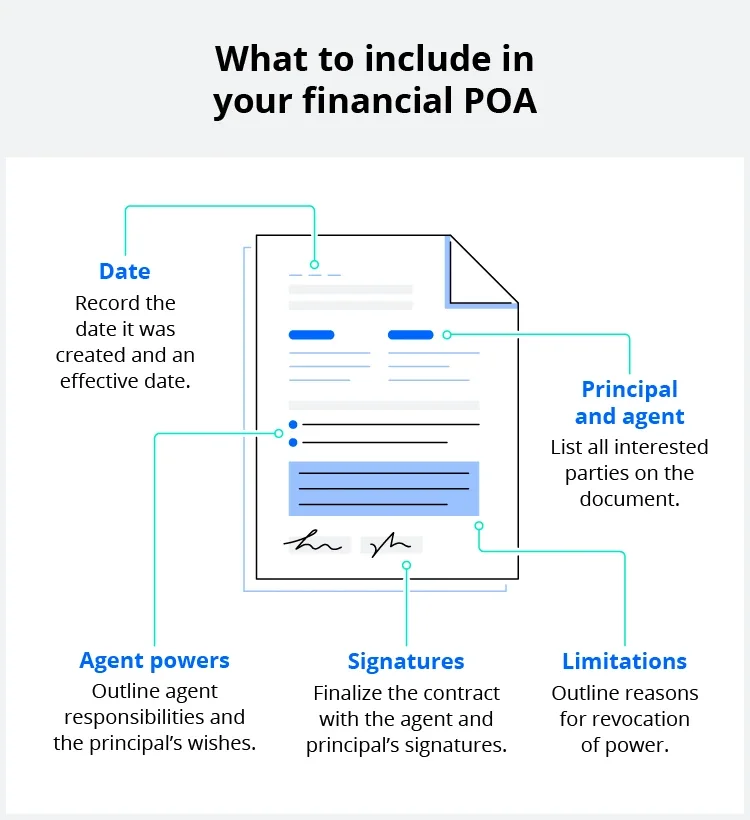

See an example snippet of a financial power of attorney below. A standard financial POA should include the:

- Certification and powers of your agent

- Duties and limitations of your agent

- Events for revocation

- Signature of the principal

- Effective date

- Witness and notary public confirmation

The components listed above are standard nationwide for creating a power of attorney for banking. However, different states may require additional information. Check your state's website for more information about their legal requirements for POAs.

How does a financial POA work?

Once principals execute the power of attorney document, they give the original to their agent, who may present it to a third party as evidence of the agent's authority to act on your behalf.

A financial POA grants agents the power to carry out finance-related tasks, such as withdrawing money from your bank account or signing papers for you at a real estate closing.

For an agent to use a financial POA:

- The principal should file the POA with their bank, lenders, and other finance professionals well before the agent needs to work with them

- Request confirmation that their organization will honor the power of attorney

- If they cite reasons for refusing to honor your agent's authority, revise the contract to their specifications and resubmit

- Instruct your agent to present their copy of the POA to invoke their power when completing financial transactions

POA agent responsibilities

Your agent may do as much or as little as you wish, depending upon the powers you grant in the POA. If the agent is disinterested in being your agent, rescind their power. Otherwise, they're free to decline the role as your attorney-in-fact by tendering a written resignation letter.

Some people grant an agent the authority to handle all financial matters, while others only authorize a single financial transaction (such as signing documents at a real estate closing).

It's your right to select which powers you wish to grant and to whom. See our comprehensive list of traditional agent responsibilities for financial POAs below.

When does a POA expire?

The authority conferred by a POA always ends upon the principal's death. The agent's authority also ends if the principal becomes incapacitated—physically or cognitively unable to make their own decisions—unless the POA states otherwise.

Additionally, the agent's authority ends if you revoke it, if a court invalidates it, if your agent can no longer serve, and you haven't appointed a successor, or—in some states—if your agent is your spouse and you get divorced.

If the authority continues after the principal is mentally or physically incapacitated, the agent will need a durable power of attorney (or DPOA). This document will prevent someone from having to go to court to be appointed the guardian of your property (some states refer to this as conservatorship).

Third-party acceptance of a power of attorney

Generally, a third party is not required to accept a power of attorney. A third party is any person or business that assists with financial management and transaction but isn't listed in the POA and represents someone other than the principal.

Some state laws enforce penalties for businesses and third parties that refuse to accept a power of attorney using the state's official form. You can help assure its acceptance by contacting anyone you think your agent may need to deal with and ensuring they find your POA acceptable.

Types of financial POAs

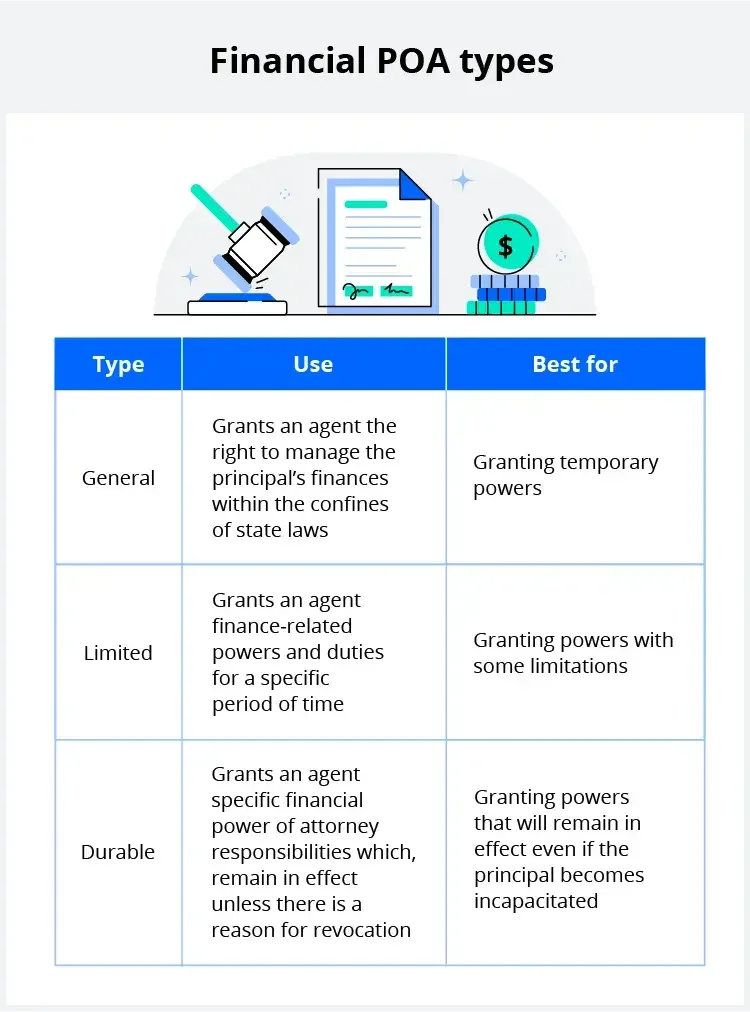

The three types of financial POAs are general, limited, and durable. While all financial POAs serve the purpose of ensuring that your money, property, and investments are well-taken care of—the type you select dictates how much power your chosen agent holds and when their responsibilities take effect.

1. General POA

This type of banking power of attorney grants your agent the right to handle all of your finances within the confines of state laws. In most states, they can manage your bank account, sign checks, file your taxes, and even sell property.

The only caveat to this financial POA type is that it expires when you, the principal, are no longer coherent, mentally capable as determined by a qualified health care professional, or die.

For that reason, this isn't always the best option for those who are elderly or ailing and may need help managing their finances when they're no longer able. However, it is a strong option for people who intend to take recurring trips and is a popular choice among those serving in the military.

2. Limited POA

A limited financial power of attorney is a legal document that outlines who the principal has allowed to carry out certain asset-related tasks. For example, if you welcome help with paying bills and depositing checks but don't want to give your agent the power to make withdrawals or sell your property, this type of POA cements your wishes.

Limited POAs can take effect immediately and are time-bound. Generally, it will expire when the principal no longer needs finance management assistance.

This is a good option if you will be traveling or have temporarily limited mobility.

3. Durable POA

The durable financial POA (DFPOA) remains in effect even if the principal is mentally incapacitated, has Alzheimer's disease, is in a coma, or is otherwise incapable of advocating for herself or himself. This makes it an option that the elderly and terminally ill prefer.

Like a limited POA, the principal can detail who can access their finances and any limits to their responsibilities. If the principal decides they don't want the POA to go into effect immediately, they can create a springing POA and describe the events or level of incapacitation needed before it goes into effect.

How to make a financial POA

Generally, a financial power of attorney must be signed before a notary public, especially if the sale or purchase of real estate is involved. It may also need to be signed before witnesses. In a few states, the agent must also sign to accept the position of agent.

Regardless of your state's unique requirements, you can write your own financial POA or use a financial power of attorney form.

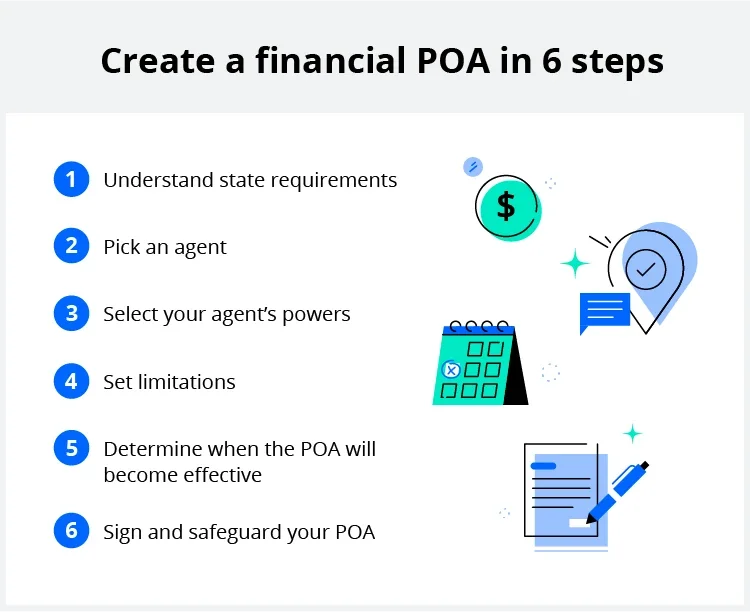

1. Understand your state's requirements

Before you get started, review your state's guidelines for information about the following requirements:

- Agent, principal, and witness signatures

- Document format

- Language about actions and limitations

- Age to create a POA

- Approved witnesses

- Guidelines for incapacitated principals

Gathering this information ahead of time helps ensure you have everything needed to create a legally binding power of attorney document.

2. Pick an agent

Once you've selected a reliable agent to help manage your finances, adding them to your POA is simple (as long as they meet your state's requirements):

Generally, the only information you need to grant them the power to assist with your finances and banking is their:

- Full name

- City and state or residence

You can add multiple agents to your power of attorney if that's your preference. Just be sure to clearly outline their respective duties to avoid confusion. If there are instances where you expect them to come to an agreement or want one person's opinion to take precedence, you should also note that.

3. Select your agent's powers

Selecting agent powers is one of the most important components of a financial POA because it clearly describes their scope of responsibility and adds a layer of protection for you.

Some common responsibilities include:

- Real estate: Buy, sell, rent, and manage property; sign leases and mortgages; and execute deeds.

- General property: Manage the purchase, sale, and upkeep of valuable property such as vehicles, furniture, and jewelry.

- Bank transactions: Sign checks, withdraw money, open accounts, make investments, and access safe deposit boxes.

- Stocks and bonds: The power to buy, sell, and exchange stocks, bonds, and mutual funds and to vote as a shareholder.

- Business operations: Operate or sell any businesses you own, including partnerships and closely held corporations; sell a business or acquire a new one; and act in your place as a business partner or shareholder.

- Retirement plan: Manage retirement and pension plans, designate beneficiaries, and make contributions.

- Insurance: Take out insurance policies for yourself or your family, borrow against them, file claims, and surrender them for cash value.

- Legal representative: Hire attorneys for you, represent you in legal matters, sign legal documents, and sue on your behalf.

- Government assistance: Collect and use government benefits like Social Security, Medicare, Medicaid, and Survivor Benefits on your behalf.

- Family care: Ensure your family's needs are taken care of and that they have access to the funds needed for them to maintain their standard of living.

- Gift property: Gift your property and assets to others while preventing your agent from taking ownership of your assets.

- Pet care: Care for your pets and maintain their standard of living, including paying for shelter, food, medicine, grooming, and veterinary care.

- Taxes: File and pay business and income taxes.

4. Set limitations

When it comes to money, you can never be too careful about protecting yourself. Even a well-intentioned agent can make serious mistakes. That's why it's crucial to put certain checks and balances in place.

To prevent any abuse of power or other crisis, ask yourself these questions during the POA planning process:

- Can your agent profit from completing financial transactions on your behalf?

- Are there any powers you want to grant or limit?

Include your answers to these questions in your POA.

5. Determine when the POA will become effective

Decide if you want the financial POA to go into effect immediately, at a certain date, or if you become incapacitated. This will determine the type of POA you create:

- General POA: Effective immediately unless otherwise specified

- Limited POA: Effective within clearly defined start and end dates

- Durable POA: Effective immediately unless the principal sets up a springing POA that describes certain events that must occur first.

6. Sign and safeguard your POA

Once you finalize your POA, you should get the necessary signatures, give your agent a copy, and file the original away for safekeeping. Depending on your state, you may also have to notarize the document and file it with a government office. Check your state's requirements, because standards vary widely across the U.S.

Finally, if you only appoint one attorney-in-fact, we recommend disclosing the location of the original financial POA form to a trusted friend or family member in case you ever become incapacitated.

Financial POA requirements by state

There isn't a standard POA form or requirements used in all 50 states. However, many states have an official durable power of attorney form available for download (usually a durable financial power of attorney form).

Some banks and brokerage firms do have their own power of attorney forms, but you can defer to your state's financial POA form as long as bank-owned property such as a car or house isn't involved.

Here are the requirements for finance POAs in the highest-searched states:

- Arizona: Financial POAs must be in writing, the principal and agent must be adults, the principal must designate a start and termination date if applicable, someone other than the notary public and the agent's immediate family must witness the principal signing the document, and a notary public must sign or stamp it.

- California: The principal must have the “capacity to contract," depending on the form you use; you must sign in the presence of a notary and witnesses; and you must file a copy with the land records office.

- Georgia: The principal or an appointed representative, a witness, and the notary public must all sign the POA.

- Florida: The principal and two witnesses must sign the POA, and the notary public must stamp the document. If the principal is incapacitated, the notary public may sign on their behalf.

- Illinois: The principal must designate an attorney-in-fact and clearly define their powers. The principal, the notary public, and a witness over the age of 18 must sign the document.

- Missouri: The principal must be mentally stable and capable of making sound decisions, and they must sign durable POAs before the notary public.

- Ohio: The principal must be of sound mind and capable of making firm contractual decisions.

- Pennsylvania: The principal must sign the dated POA before two witnesses, and it must be notarized.

- Texas: A durable financial POA must be in writing and list the agent's name. The principal must also detail the agent's powers, sign the document, and have a notary sign it.

Tips for choosing a trustworthy agent

The only legal requirements to be an agent are that the person is of sound mind according to a health care professional and at least 18 years of age. If there is evidence the agent doesn't meet these requirements, the courts can assess the contract's validity.

It is essential that your agent be someone whom you trust totally. Your agent has the legal obligation to act in your best interest, to keep records of transactions, not to mix your property with theirs, and not to engage in any conflict of interest.

Some other factors to consider aside from trustworthiness include the agent's:

- Ability to collaborate with other agents: This is crucial if you appoint multiple agents to care for your financial affairs.

- Manage your family's expenses: If you have a family, ensure that your agent will use your finances responsibly to maintain their care.

- Knowledge of your financial situation: If you have a business, investment portfolio, or other important assets, educate your agent about them and explain your wishes for those assets.

- Financial literacy: Verify that your chosen agent has the budgeting, investing, and accounting skills needed to buy, sell, manage, and safeguard assets for you.

Start your financial POA today

Whether you plan to be away for a while, will be out of commission due to health issues, or just want to get a jump-start on your future, a financial POA is one of the primary legal documents you should create to protect your estate. Start writing your POA today and connect with an attorney in our network for easy access to answers about estate planning.