Conducting a Nebraska business search is important for various reasons: name uniqueness, compliance with state guidelines, and even trademark availability. Learn the steps to search business names, including an NE LLC search and an NE corporate search, as well as specific naming considerations in Nebraska.

Nebraska Secretary of State business search contact information

Here is the Nebraska Secretary of State (SOS) contact information, according to the official Nebraska government website:

- Phone: (401) 471-2554

- Business Services address: 1201 N Street, Suite 120, Lincoln, NE 68508

- Mailing address: P.O. Box 94608, Lincoln, NE 68509-4608

- Online contact: sos.nebraska.gov/contact

Step-by-step guide to an NE SOS business search

Follow these steps for conducting a Nebraska SOS business search.

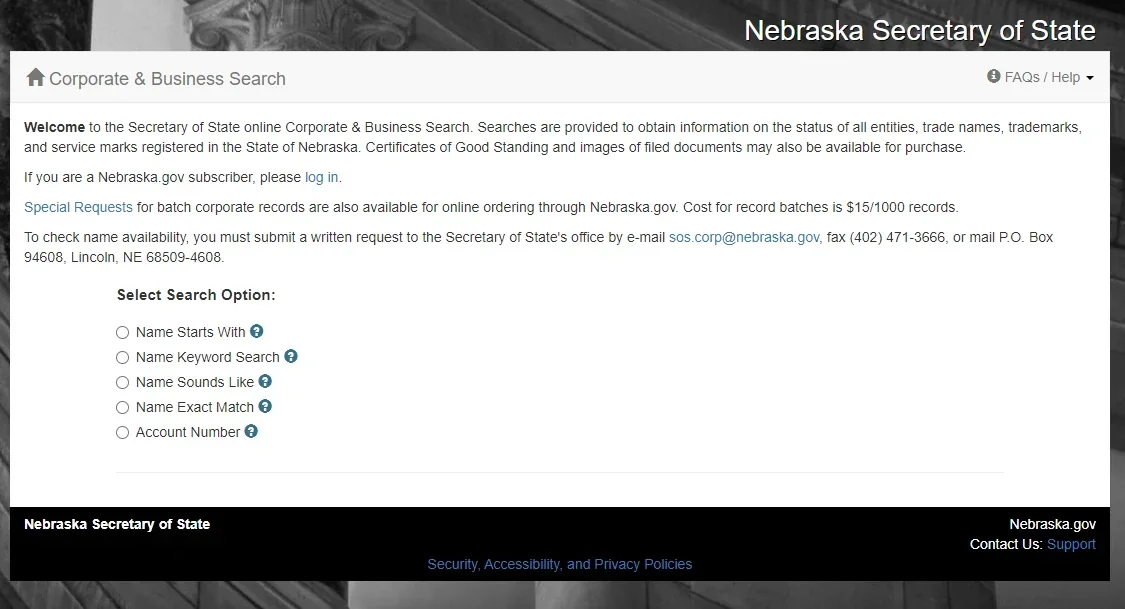

Step 1. Visit the corporate and business services page of the Secretary of State’s website. On the left-hand side of the page, click “Corporate and Business Search,” which will take you to the NE business search page.

Step 2. Conduct an NE business lookup. Use different options to broaden or narrow your search and ensure comprehensiveness. For example, “Name Exact Match” could be used to ensure that the exact name doesn’t already exist, while “Name Keyword Search” will show all of the existing business names that contain the word or phrase.

Step 3. In the results, check the Status column to determine if the name of the business entity is active (in good standing) or inactive. An inactive name might mean that it’s available.

Why conduct a Nebraska entity search or LLC lookup?

An NE business search (also called an NE entity search) lets you see if your preferred LLC or corporation name is available in the state. The Nebraska Secretary of State oversees the Business Services Division, which ensures that all businesses are compliant with state regulations. If you don’t conduct a preliminary NE Secretary of State business search online and check your name, then your business filing could be rejected by the SOS office.

Important naming guidelines in Nebraska

Nebraska naming regulations for limited liability companies (LLCs) note that the name must include the words “limited liability company,” “limited company,” or their respective abbreviations.

Corporation names must include the words “incorporated,” “corporation,” “company,” “limited,” or abbreviations of those words. Furthermore, corporate names cannot be misleading, and certain professional services will undergo more scrutiny, like real estate, legal, accounting, medical, and other services.

Regardless of the business entity type, Nebraska law states that the name must not be deceptively similar to or the same as another business name on record.

Other naming considerations

A Nebraska LLC lookup or corporate search on the Secretary of State’s website isn’t the only place to check business name availability.

- Check domain name availability. Matching your domain name to your business name is crucial for creating a seamless online presence. Ensure that your preferred domain name is available by checking sites like GoDaddy, Bluehost, and Squarespace. It’s also a good idea to do a social media name search.

- Conduct a trademark search. To avoid trademark infringement, check if your business name has a state trademark using the Nebraska business lookup site. Visit the U.S. Patent and Trademark Office website to conduct a federal trademark search.

Next steps to start your business in NE

When your Nebraska business lookup for available names is complete, you’re ready for the following next steps in the business formation process.

- Register your business. File articles of incorporation or articles of organization with the SOS to register your business. The Secretary of State lists forms and fee information. If you’re not ready to file, you can reserve your business name before registering.

- Get an EIN. Not every business entity needs an employer identification number (EIN), but some do, like corporations and limited liability partnerships. Find out if you need to obtain an EIN on the Internal Revenue Service’s website.

- Apply for a trademark. Learn how a trademark can help protect your business name, and determine if applying for one is right for your business.

- Purchase your domain name. After finding an available domain name, purchase it, then set up your website.

Nebraska business searches made easy

Setting up a business is exciting, but it can also be time-consuming. Let LegalZoom help business owners like you conduct a Nebraska LLC search or a Nebraska corporate search, get an EIN, craft operating agreement forms or other documents, determine which licenses you might need, and much more. We even offer a simple-to-use, completely free business name generator to help you come up with naming ideas. Kickstart your business formation today.

FAQs

How much does it cost to register a business in Nebraska?

The cost to register a business in Nebraska depends on the type of business entity you choose. For example, filing the necessary business documents for a corporation or limited liability company costs $110, while the fee for registering a nonprofit organization is $30. For specific forms and filing fees, visit the Nebraska Secretary of State’s website.

How do you register a business in Nebraska?

To register a business in Nebraska, you can either mail the documents to the Secretary of State’s office or file online via the Nebraska Secretary of State website’s Corporate Document eDelivery page.

Does Nebraska require a business license?

The state of Nebraska doesn’t require general business licenses, but certain counties and cities might have specific licensing requirements. However, some types of business services, like insurance, banking, and healthcare, are subject to state licensing. Visit the Nebraska Business Licensing portal to learn more.