Delaware's advanced corporate legal framework has fostered a first-class business economy with over 60% of Fortune 500 companies and more than 1.5 million businesses worldwide choosing to incorporate there.

As a result, investors often view Delaware corporations as uniquely credible with a high potential for raising capital. Before you follow in the footsteps of the titans of industry, it's wise to thoroughly weigh the pros and cons of forming a corporation over another type of business structure, and whether or not Delaware is the right place for you.

Learn how corporations differ from other structures, Delaware rules, and the step-by-step guide to DE incorporation.

Delaware corporation vs. LLC

Corporations and LLCs are two of the most common types of business structure. Both offer liability protections and formal recognition by the state, though they are not interchangeable. When choosing between a Delaware corporation and a Delaware LLC, the key differences to consider are structure, taxation, and compliance requirements.

- Structure and governance. A corporation has a formal board of directors, shareholders, and officers that each have defined roles. Directors and shareholders also need to hold regular meetings with formal minutes. In contrast, LLCs have more flexibility in terms of management and operations.

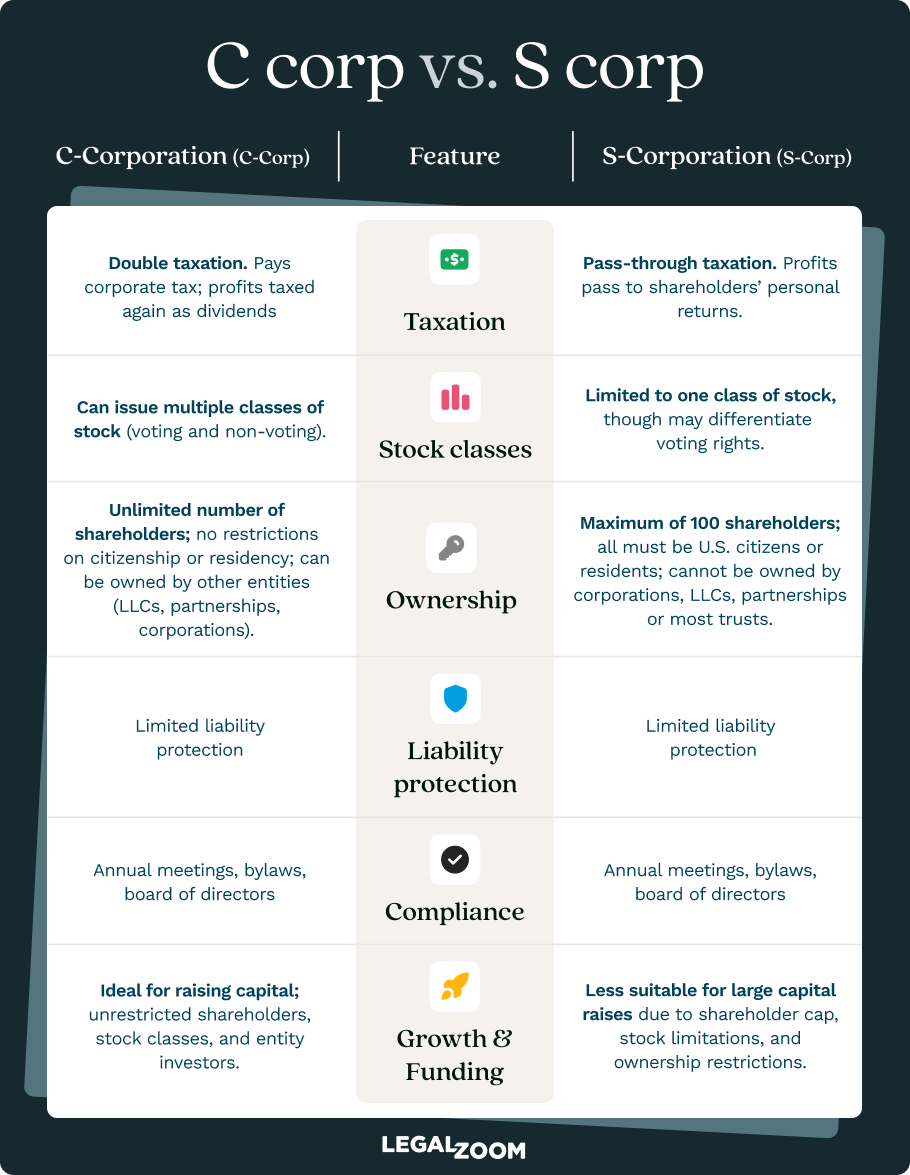

- Taxation. Corporations have more complex filing requirements and risk double taxation because they pay both corporate and individual income tax. LLC members pay taxes only on their personal income tax by default. However, an S corporation can also elect to pay LLC-style pass-through taxes in exchange for more restrictions on shares.

- Investment and growth opportunities. Venture capitalists and institutional investors prefer corporations because of their greater stock options. LLCs have less opportunities for outside investment, but can more easily add new members.

Delaware-specific advantages

Delaware offers certain advantages for both LLCs and corporations.

Benefits for corporations:

- Extensive legal precedent for corporate law

- Investor familiarity and preference

- Established merger and acquisition procedures

Benefits for LLCs:

- Delaware LLC Act grants more management and operational flexibility than is available to corporations

- Lower annual franchise tax ($300)

- No need to file an annual report

- Greater privacy protections

Why incorporate in Delaware?

Below are some of the unique advantages of Delaware incorporation compared to other states and business structures.

- Delaware’s highly-evolved corporate legal structure (Title 8 of the Delaware Code) provides one of the most comprehensive and flexible corporate legal frameworks in the U.S., with over 200 years of established case law from the Delaware Court of Chancery.

- Delaware's Court of Chancery is a specialized court that handles corporate disputes without juries. It’s well known for its predictable legal outcomes, fast resolutions, experienced judges, and well-established legal principles for corporate operations and governance.

- No state corporate income tax on Delaware corporations that don't conduct business within the state.

- No personal property tax on intangible assets like stocks and bonds.

- Investors favor Delaware corporations thanks to the state’s standardized legal framework. Plus, many big investors have likely invested in other Delaware corporations, since so many companies are formed there, so they’re already familiar with how the state works.

- Greater ownership and management flexibility compared to other states. While not as flexible as a Delaware LLC, Delaware law allows corporations a high degree of flexibility in how they structure their board.

- More privacy protections. Only the person filing the formation documents needs to make their name public. The certificate of incorporation doesn’t require you to share director and officer names.

- Liability protection for shareholders. A corporation is a separate legal entity, which means it can sign contracts and take out loans in its own name. This limits its owners’ liability for business debts.

How to start a Delaware Corporation

To officially form a Delaware corporation, you need to file a certificate of incorporation with the Delaware Department of State Division of Corporations. But first, you need a valid business name and a registered agent.

Once you form your business, there are a few more steps to get it up and running in the state.

Here’s a breakdown of the process.

Step 1: Choose a name for your corporation

To avoid unnecessary confusion in the marketplace, Delaware has strict rules for business names that you need to be aware of.

- It must be unique from all other registered businesses in the state.

- It must contain one of the following words: association, company, corporation, club, foundation, fund, incorporated, institute, society, union, syndicate, or limited (or an abbreviation of the word).

- It can’t contain the word “bank” unless the business is an actual bank that has received authorization from the proper authorities.

You can search business names by conducting a Delaware business search on the Department of State's website. The Department of State updates the Delaware entity search database in real time, but there is the possibility that a business name won’t display while a new application is still processing.

If you want to secure your business name while you prepare the rest of your application, you can file a name reservation for a $75 filing fee. The Department of State will then hold your business name for up to 120 days.

Step 2: Choose a Delaware registered agent

Delaware law requires all corporations to maintain a registered agent. A registered agent is a person or entity that a corporation designates to receive official and legal correspondence on behalf of the business. Their role is to ensure that the corporation is promptly informed of any important documents so that it can defend itself in court or protect its legal standing.

A Delaware registered agent must have a physical street address in Delaware (not a P.O. box) and be one of the following:

- An individual who resides in Delaware

- A business entity that’s authorized to conduct business in the state

Agents have the following responsibilities:

- Accept service of process (the formal delivery of court documents, such as a lawsuit) and other official documents from the state

- Forward documents to the corporation immediately

- Maintain regular business hours at their Delaware office address (typically Monday through Friday, 9 a.m. to 5 p.m.)

- Notify the businesses they serve and the state if they change their address or resign

You can review a list of registered agents on the Delaware Division of Corporations website. LegalZoom also offers a registered agent service based in Newark, DE that comes with additional perks like cloud storage and digital access to your mail.

Step 3: Prepare and file the certificate of incorporation

Your corporation officially exists once the Department of State accepts your certificate of incorporation. This document serves as the corporation's charter (the official document that grants it authority) and must include the following information:

- The name of the corporation

- Corporate purpose (a pre-written statement that you only need to acknowledge)

- Registered agent's name and Delaware address

- The number of shares your corporation will issue and the value of each share

- The name, address, and signature of the incorporator (person completing the form)

You can file your certificate online through the Division of Corporations or mail it to their office if you plan to pay the filing fee by check. You’ll need to attach a cover letter with your form if you file by mail. The minimum filing fee is $109, but it could increase based on how you issue your stock shares.

Step 4: Draft corporate bylaws and appoint directors

A corporation's bylaws are its internal rules and operating procedures. You don’t need to file them with the Delaware Division of Corporations. But they are essential to help govern how your corporation will run, and can offer a framework for resolving legal disputes.

Even though Delaware doesn’t require corporations to have bylaws, the law does specify certain requirements if you do choose to have them:

- Incorporators or directors must approve initial bylaws and have the power to adapt, amend, or repeal (cancel) bylaws going forward.

- Corporate bylaws can’t include anything that’s inconsistent with the law or the certificate of incorporation.

- Bylaws can include any clause that relates to the business and affairs of the corporation or the rights and powers of the corporation and its directors, officers, shareholders, and employees.

Here are a few common elements to include in your bylaws:

- Board of directors composition and meeting procedures

- Officer roles and responsibilities

- Shareholder meeting requirements and voting procedures

- Stock transfer restrictions and procedures

- Indemnification provisions

- Amendment procedures

You can draft your own bylaws, but it's wise to have a business attorney review them to ensure they are effective and consistent with Delaware law. LegalZoom’s bylaw service can help you draft your bylaws if you aren’t sure where to start.

Step 5: Obtain an employer identification number (EIN) and register for taxes

In order for your corporation to file taxes each year, you'll need to obtain an employer identification number (EIN). This number acts as your federal tax ID number and allows the IRS to identify your company for tax purposes.

You can apply for an EIN directly through the IRS website or LegalZoom can help you apply.

Step 6: Open a business bank account

This step is helpful to maintain your limited liability status and protect your personal assets. A separate business bank account will also help ensure your business keeps proper financial records.

Here’s what you’ll generally need:

- Certificate of incorporation

- EIN

- Corporate bylaws

- Board resolution authorizing account opening

- Identification for authorized signers

Tax obligations for Delaware corporations

Delaware taxes

If your corporation will conduct business in Delaware, you must register with the Delaware Division of Revenue for the following taxes:

- Corporate income tax rate is 8.7% due on April 15 or the 15th day of the fourth month of your fiscal (financial) year.

- Gross receipts tax rates range from around .1% to .7% based on your business activity. Payments are due either monthly (on the 20th of each month) or quarterly (by the end of the month following the close of each quarter) depending on your total receipts.

- Withholding tax. The Department of Revenue has a helpful guide to withholding taxes with tax tables based on your payroll schedule. Make sure to also report new hires on Delaware One Stop within a 20-day time frame.

- Unemployment insurance ranges from 0.6% to 5.6%. You or your registered agent will receive a tax return (forms UC-8 and UC-8A) at the end of each quarter. File it by the end of the month following the end of each quarter.

Remember, businesses that don’t actually have any operations in Delaware generally don’t have to pay any state corporate income taxes.

Federal tax obligations

In addition to Delaware taxes, there are a number of federal tax obligations for corporations that your business will need to stay on top of. Your main obligations will be federal corporate income tax and employment taxes. A CPA can help you understand your tax liability.

Delaware annual reports and franchise tax

Delaware corporations must file annual reports and pay franchise taxes by March 1 every year to maintain good standing with the state.

How to calculate Delaware franchise tax

The franchise tax is essentially a tax for the privilege of doing business in Delaware. The state offers two methods for calculating franchise tax, and corporations can choose the method that results in the lower tax.

The authorized shares method is based on the number of authorized shares in the certificate of incorporation.

- Minimum tax is $175 for corporations with 5,000 shares or less

- Corporations with 5,001 to 10,000 shares pay $250

- For each additional share after 10,000, add $85

- Maximum tax is $200,000

The assumed par value capital method is based on the assumed value of your shares.

- Divide your total gross assets by your total issued shares. The sum is your assumed par value.

- Multiply the assumed par value by your total authorized shares (the maximum number of shares it can legally issue). The resulting number is your assumed par value capital.

- Your franchise tax is $400 for every $1,000,000 of assumed par value capital.

- Minimum tax is $400

- Maximum tax is $200,000

Annual report: Deadlines and fees

Annual reports serve to update the Department of State on your business’ basic information. You must file one every year on March 1 to stay compliant with the state. The filling fees are as follows.

- Domestic corporations: $50

- Domestic exempt corporations: $25

- Foreign corporations: $125

Penalty fees for missed deadlines range from $125 for foreign corporations to $200.00 plus 1.5% interest per month for domestic entities.

Pay online through the Delaware Division of Corporations website or send a check or money order through the mail. You can also have LegalZoom file for you to help ensure you never miss a payment.

Start your Delaware corporation with LegalZoom

There's a reason more than 4 million businesses have chosen LegalZoom to help them get off the ground. Our incorporation services offer a fast, easy, and affordable way to form your Delaware corporation.

Here are some of the perks:

- Streamlined process. LegalZoom combines technology and expertise to take the guesswork (and paperwork) out of business formation. Our online process can help you start your corporation in minutes.

- Expert support. All of our corporation formation packages include consultations with a LegalZoom small business specialist and a tax specialist from 1-800Accountant.

- A full suite of services. Beyond just incorporation services, LegalZoom can handle an array of business filings. We also provide year-round compliance management, bookkeeping tools, dedicated business attorneys, registered agent services, and trademark registration.

Delaware corporation FAQs

What is a Delaware corporation?

A Delaware corporation is an incorporated business entity that one registers with the Delaware Division of Corporations under the Delaware General Corporation Law. It provides limited liability protection for shareholders and heightened opportunities for growth due to its ability to issue shares of stock.

While all corporations have limited liability and can issue stock (if a stock corporation), Delaware entities also benefit from heightened credibility as a result of the state’s extensive corporate legal framework.

Why do companies incorporate in Delaware?

Companies choose Delaware incorporation for several reasons:

- Specialized Court of Chancery with corporate law expertise

- Extensive body of predictable case law

- Flexible Delaware General Corporation Law

- Investor and lender familiarity

- Potential tax advantages for out-of-state operations

- Strong privacy protections

How much does it cost to form and maintain a Delaware corporation?

Delaware corporation costs depend on a number of factors, including the number of shares of stock you authorize and more.

Formation Costs

- State filing fee: $109 (minimum)

- Registered agent: Varies (LegalZoom charges $249/year)

- Name reservation (optional): $75

Annual Maintenance Costs

- Franchise tax: $175–$200,000 depending on calculation method and number of shares

- Annual report fee: $50

- Federal and state taxes: Varies by the nature of your business and its profitability

What is the Delaware franchise tax?

The Delaware franchise tax is an annual tax that Delaware entities pay for the privilege of doing business in the state. Corporations can choose between two calculation methods:

- Authorized shares method (from $175 to $200,000)

- Assumed par value capital method (from $400 to $200,000)

The tax is due March 1 every year along with the annual report.

Do I need a registered agent?

Yes, Delaware law requires every corporation to maintain a registered agent with a physical street address in Delaware. The registered agent receives legal documents and official correspondence on behalf of the corporation.

How do I search for a Delaware corporation?

Use the Delaware Division of Corporations' online entity search database. This real-time system allows you to search for existing corporations and verify whether or not another legal entity in the First State is using your desired business name.

Delaware corporation vs. LLC: Which is better?

The choice depends on your specific needs:

- Choose a corporation for venture capital funding, heightened credibility, or to eventually go public.

- Choose an LLC for operational flexibility, pass-through taxation, and simpler compliance requirements.

Sarah Jones and Jane Haskins, Esq., contributed to this article.