Incorporating your business in Idaho offers significant advantages, including limited liability protection and potential tax benefits. This comprehensive guide walks you through Idaho's specific requirements and procedures for forming a corporation in the state.

What is an Idaho corporation?

A corporation is a legal business entity formed under Idaho state law that provides limited liability protection to its owners (shareholders). Under the Idaho Business Corporation Act, a corporation is defined as a separate legal entity distinct from its owners, with the ability to enter contracts, own property, and conduct business in its own name.

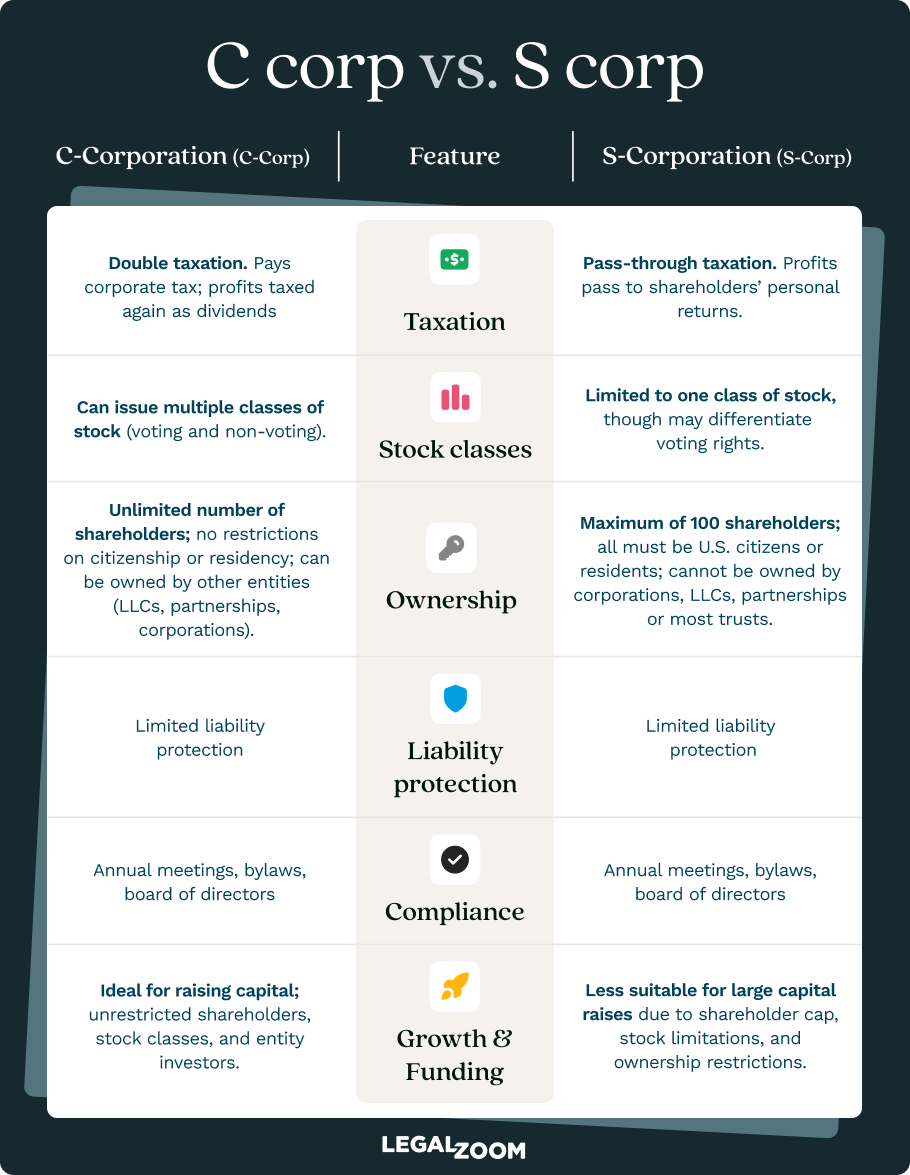

Idaho corporations can elect either C corporation or S corporation tax treatment, each of which has different advantages or disadvantages based on your unique circumstances.

How do I form a corporation in Idaho?

If you’re ready to form your Idaho corporation, you’ll need to follow these steps to ensure compliance with state requirements.

Step 1: Choose a corporate name

Your corporation's name must comply with specific requirements under Idaho law:

- Required designators. The name must contain "corporation," "incorporated," "company," or "limited," or the abbreviations "corp.," "inc.," "co.," or "ltd."

- Prohibited words. Your business name cannot contain any terms considered “grossly offensive.”

- Distinguishability requirement. The name must be distinguishable from any other formally organized entity in Idaho Secretary of State records.

You can check the availability of your desired business name through the Idaho Secretary of State's SOSBiz portal at sosbiz.idaho.gov. If you’re not yet ready to file your articles of incorporation, you can opt to reserve your name with the Secretary of State for a $20 fee. Name reservations are good for a period of four months.

Step 2: Appoint a registered agent

Every Idaho corporation must designate a registered agent to receive legal documents and official correspondence on behalf of the corporation.

Idaho registered agent requirements:

- Must have a physical street address in Idaho (P.O. boxes are not sufficient)

- Must be an Idaho resident or a business entity authorized to conduct business in Idaho

- Must be available at their physical address during normal business hours

- Can be a commercial registered agent service or a noncommercial agent

Step 3: Prepare and file articles of incorporation

Your corporation's legal existence begins when you file articles of incorporation with the Idaho Secretary of State. The articles must contain the following mandatory information:

- Corporate name: This name must comply with all Idaho naming requirements.

- Stock structure: Details about authorized shares (such as class and total number of shares)

- Registered agent: Name and Idaho address

- Incorporator information: Names and addresses of incorporators

You can submit your articles of incorporation online through the SOSBiz portal, by mailing it to the Idaho Secretary of State, or in person at the Secretary of State office.

Step 4: Create bylaws and hold organizational meeting

Although bylaws are not filed with the state, they are required internal documents that govern your corporation's operations. Your corporation’s bylaws cannot conflict with Idaho law or your articles of incorporation, and should outline details such as shareholder meeting procedures, and corporate governance.

Bylaws are typically created during an organizational meeting, which is also used to elect directors if you haven’t already named them in your articles of incorporation. Your named directors will then approve bylaws and elect officers, if needed.

Step 5: Issue shares and record stock ownership

After incorporation, you must issue shares to your initial shareholders and maintain proper stock records to ensure compliance with federal and state securities laws.

Step 6: Obtain an EIN

An employer identification number (EIN) from the IRS is required when you file your corporate taxes and if you plan to hire employees. It can also be helpful to have an EIN if you plan to obtain a business bank account, though requirements can differ by financial institution.

Step 7: Apply for business licenses and permits

Business license requirements for your Idaho corporation will vary depending on your business type and location. For example, you may need to register for a sales and use tax license if you plan to collect sales tax on goods and services. Or, you may need to obtain state or federal permits or licenses if your corporation operates in a specific industry.

Check with your city clerk’s office for guidance on which licenses and permits you may need.

How much does it cost to incorporate in Idaho?

It costs $100 to file articles of incorporation in the state of Idaho. Any other costs associated with your corporation will depend on a number of factors, such as which licenses you need to obtain and whether you serve as your own registered agent or not.

Ongoing Idaho compliance requirements

All Idaho corporations have ongoing compliance requirements to meet to ensure they remain in good standing with the state.

One of the most critical of these is the filing of an annual report with the state, which is due every year at the end of the anniversary month of incorporation. There’s no fee to file this annual report in the state of Idaho, but failing to file on time may subject you to late fees, penalties, and—in extreme cases—the dissolution of your corporation.

Most business licenses and permits also require regular renewal, typically annually, and may include a fee. It’s important to maintain an accurate compliance calendar to ensure you don’t miss any deadlines for renewal.

Finally, it’s essential that you maintain records of your shareholder and director meetings, board resolutions, stock transactions, and director meetings. Shareholders have rights to inspect certain corporate records, so it’s important to maintain these records at your registered office or principal place of business.

FAQs

How long does it take to form an Idaho corporation?

Processing times for Idaho corporation filings are typically 7–10 days. Expedited processing is available for an additional fee, with a turnaround time of 8 hours.

Do I need an attorney to incorporate in Idaho?

While not legally required, consulting with an attorney is always wise, especially if your corporation will be complex or if you have questions about corporate governance, tax elections, or compliance requirements.

Can a foreign corporation register in Idaho?

Yes, out-of-state corporations can register to do business in Idaho by filing a Foreign Registration Statement and appointing an Idaho registered agent.

Can I serve as my own registered agent?

Yes, if you have a physical address in Idaho and can be available during business hours. However, using a commercial registered agent service provides privacy and reliability benefits.

Jane Haskins, Esq. contributed to this article.