Bankruptcy is a legal means to manage debt when you've exhausted all other options. While bankruptcy can be a valuable tool for taking back control of your finances, it can feel overwhelming to figure out when to file and which type of bankruptcy to choose.

Let’s walk through common types of bankruptcy, the right time to file, and important next steps should you choose to move forward.

What is bankruptcy?

Bankruptcy can eliminate or reduce debts or offer you a solution for a fresh start if your debts have become unmanageable, you’re unable to afford your mortgage payments, or your credit cards are maxed out. However, it also has serious financial consequences that can impact multiple areas of your financial life.

It’s important to understand the potential outcomes before filing for bankruptcy. A bankruptcy attorney is an invaluable resource who can look at your financial situation, help you assess your options, and support you through the bankruptcy filing process—including determining which type of bankruptcy is most appropriate for you.

Types of bankruptcy and how they differ

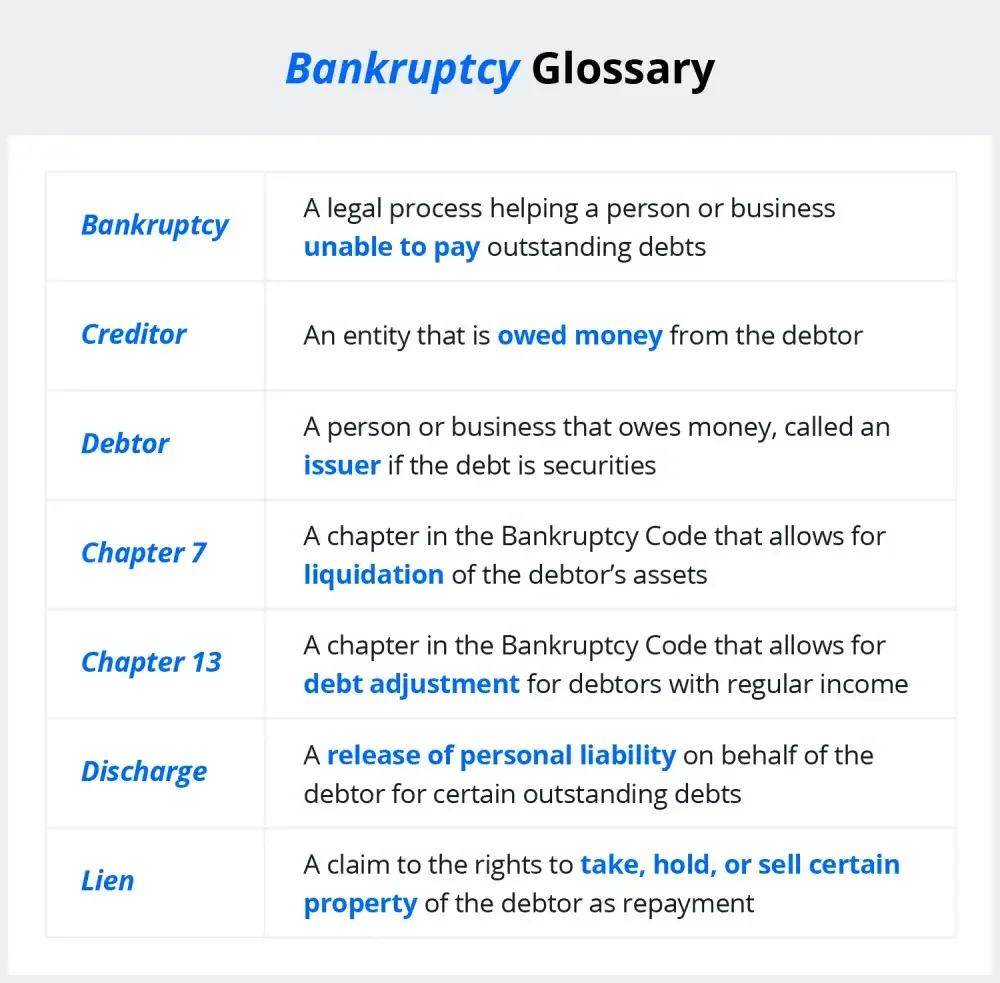

Although there are multiple types of bankruptcy, Chapter 7 and Chapter 13 are the most commonly used for personal and small business bankruptcies. Chapter 11 is less common in these situations, but is still used under certain circumstances. The major differences between these three types boil down to how the debt is managed.

- Chapter 7: Allows you to pay off approved unsecured debts by selling your assets. Unsecured debts are things like credit card bills, medical debt, or personal loan debt, whereas secured debts are backed by an asset (such as a house or car).

- Chapter 13: Allows you to pay off debt through a bankruptcy court-approved debt repayment plan over a period of three to five years. To file this type, your unsecured debt must be less than $419,275 and your secured debt less than $1,257,850.

- Chapter 11: Involves a major restructuring of your company according to a plan voted on by your creditors. This type is more costly and typically doesn't clear debts, but may protect your assets. It’s intended to be used by businesses owned by LLCs or partnerships, or those with $2.5 million or more in debt.

For a deeper dive, read our article on the difference between Chapter 13 and Chapter 11.

9 cases that may call for bankruptcy

There are a number of scenarios that may necessitate filing a petition with a bankruptcy court, including the following:

1. Insolvency

When you (or your business) are unable to meet debt obligations as they come due, it’s time to consider bankruptcy. This condition is known as insolvency. In this case, either the creditor or the debtor can hire a licensed professional known as an insolvency practitioner to liquidate your or your company’s assets. Bankruptcy may be able to prevent this outcome.

2. Severe cash flow issues

Negative cash flow is a common cause of insolvency. If you consistently spend more cash than you take in and cannot adjust operations or cost structure to reverse the trend, bankruptcy might be the only viable option.

Keep in mind, a period of negative cash flow isn't always a bad sign if the deficit comes from investments in future growth. For more details on this, check out our article on how to make a cash flow statement.

3. Legal judgments

If a business faces legal judgments from a lawsuit that it cannot afford to pay, creditors may attempt to seize assets to satisfy secured debts. Alternatively, the company may file for bankruptcy to restructure or discharge their debt. In some cases, creditors can force a company into involuntary bankruptcy.

4. Credit pressure

When pressure from creditors goes beyond collection letters to aggressive collection efforts—such as lawsuits or liens—filing bankruptcy can provide temporary protection and relief from such actions while you work through a solution to manage your debt.

5. Unsustainable debt levels

A “highly leveraged” company or individual has debt that far outweighs the value of their assets, such as when a home decreases in value below the balance of the mortgage. Companies with an unsustainable debt burden that far exceeds their current and projected cash flows might use bankruptcy as a tool to restructure their debts and reorganize their business model under more manageable terms. Individuals can find similar relief in bankruptcy, although there are more options available (more on that later!).

6. Failed restructuring efforts

When debt levels become unsustainable, a first step for a business is often to proactively restructure operations or renegotiate debts with creditors before considering drastic options like bankruptcy. It’s much the same for individuals. Analyzing finances this way is an important but arduous task that, if unsuccessful, may leave bankruptcy as the only option. Bankruptcy allows a company to formally restructure and renegotiate obligations under bankruptcy court supervision, and allows individuals to develop a path forward.

7. Market changes

One major reason a business may decide to restructure is a market crash. Significant shifts in market conditions—such as a drastic downturn in the economy, loss of a major client, or disruptive competitive activity—can lead to bankruptcy if the business is unable to adapt quickly enough.

8. Operational failures

When a business uses more resources than necessary without improving its production, it points to operational inefficiencies. If these problems persist, the business will continue to lose money and may eventually seek bankruptcy as a means to address and remedy these issues.

9. Asset protection

When an individual or business is unable to pay debts, the creditor may move to take hold of the debtor's assets. A petition for bankruptcy automatically halts claims against you and protects valuable assets from creditors. This allows the business to retain more resources to restart or continue operations.

Is filing bankruptcy right for you? Questions to ask yourself

Bankruptcy is never the first solution to resolve debts. If you're facing credit card debt and have already tried to negotiate a smaller monthly payment plan or your debt cannot be resolved by a debt management plan, bankruptcy may be the best course of action.

Here are questions to ask yourself or discuss with an attorney to see if bankruptcy is right for you:

1. Can I only afford to make minimum payments on my credit card?

Because credit cards typically carry high interest rates on open balances, your balance can quickly balloon if you only make minimum payments. This will happen even more quickly if your balance was high to begin with.

2. Do I receive frequent calls from collections agencies?

Constant phone calls from collectors are stressful—and may be a sign that it's time to file for bankruptcy. First, try to negotiate a debt settlement with your creditors to lower your balance or monthly payments. If that doesn't work, bankruptcy can halt these calls and provide a path forward.

3. Do I need to use credit cards for day-to-day expenses?

While it isn’t inherently bad to purchase necessities on a credit card, it is worrisome if that’s the only way you can afford expenses. If you don’t pay off the credit card balance in full by the end of the month, you’ll accumulate interest that can quickly become overwhelming (or insurmountable). If your credit card balances keep growing, you can’t pay them off, and you don’t have cash for daily purchases (or necessities), you may want to consider bankruptcy.

4. Am I contemplating debt consolidation?

While it’s common for major debt to stem from medical bills or legal judgments, personal debts can creep up slowly and stem from many sources. If you consolidate your payments into one large loan, you can more easily keep track of outstanding debts with a single monthly payment. This may also provide you with more time to make repayments as the new loan will come with new terms. This can be a big relief, but may indicate a larger issue with cash flow or credit obligations.

5. Do I need to sell my possessions to pay my debts?

It's never a good feeling to let go of a home or a car that's full of precious memories. However, making the difficult decision to sell these possessions can offer you a means to pay off debts and even provide a fresh start.

6. Do my expenses far outweigh my salary?

With the exception of emergencies, your monthly income should ideally be able to cover your expenses. If that’s not the case, try making a budget to see if you can pare back your expenses to better align with your monthly bills. If you’ve made a firm effort to downsize and that still isn't enough to remedy the imbalance—for example, you struggle to afford groceries—you may want to speak with an attorney about bankruptcy.

7. Have I lost track of the amount I owe?

If your debts have become so unmanageable that you can't keep track of how much you actually owe, it's cause for concern. As debt often comes from multiple sources, it can be difficult to stay up to date with changes like increased balances or debts moved to collections. Before you file bankruptcy, consider working with a professional to develop a debt repayment plan to improve your financial health.

8. Will filing for bankruptcy actually resolve my debt?

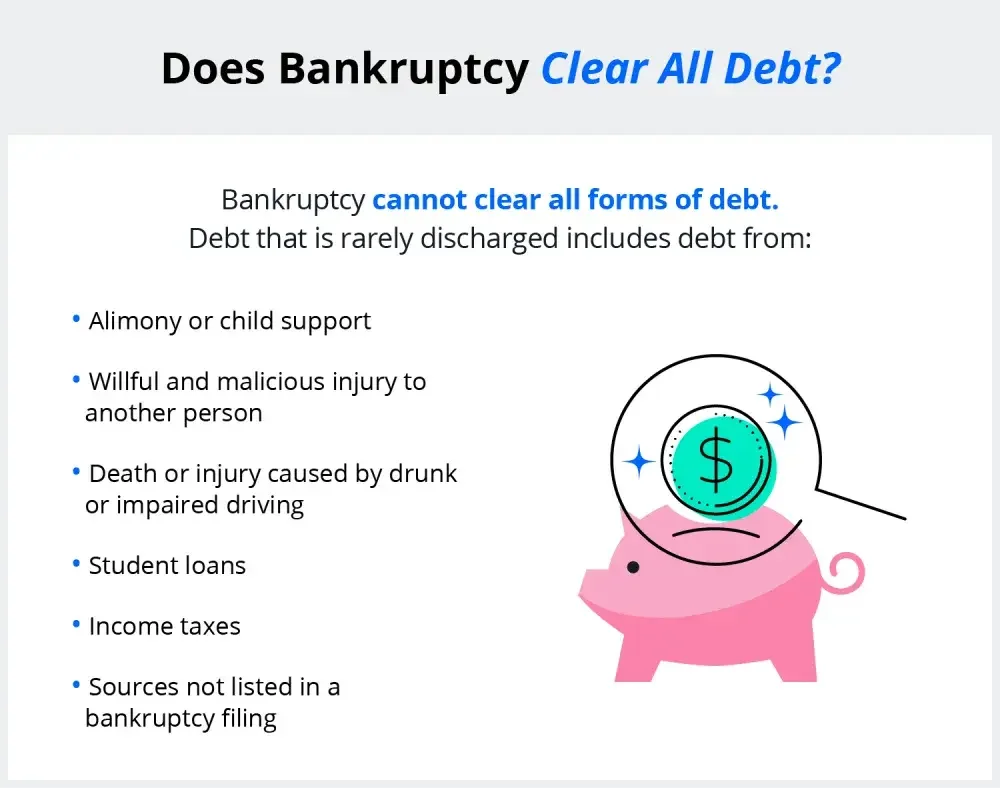

Bankruptcy may seem like a catchall for resolving debt, but that's not actually the case. Some debts—such as student loans—will not be resolved by declaring bankruptcy. Speak with a bankruptcy lawyer to determine whether or not your debt is covered by bankruptcy and to learn about alternative options.

Beginning the bankruptcy process

Declaring bankruptcy can feel daunting or even scary, but staying organized can make the whole process smoother. When trying to decide if bankruptcy is right for you, take things one step at a time to avoid feeling overwhelmed.

Here’s how to get started:

1. Gather financial documents

The first step to prepare your case is to collect all pertinent financial documents. This includes the following: recent tax returns, pay stubs, bank statements, loan documents, bills and invoices, collections notifications, information on any other debts, and details about your assets—including homes, vehicles, and other property. These documents will provide a clear picture of your financial situation.

2. Consult with a bankruptcy attorney

While this step is not required, it's highly recommended. A bankruptcy attorney can offer a detailed analysis of your financial situation and help you understand the implications of the different types of bankruptcy. This personalized consultation will help you to make an informed decision about whether or not to proceed with filing for bankruptcy and start you off on the right foot should you decide to move forward.

3. Credit counseling

Federal law requires anyone filing for bankruptcy to undergo credit counseling with an approved credit counseling agency within 180 days before filing. This session is intended to ensure that there are no feasible alternatives to bankruptcy. A certificate of completion must be filed with your bankruptcy petition—plus, this sort of counseling may even be able to give you a path forward without bankruptcy.

4. Start the filing process

When you’re ready to file bankruptcy, your attorney can help you through every step of the process and take a lot of stress off of you. Because the filing process varies by type and circumstance, having an attorney there to guide the way will allow you to move forward with confidence.

What happens after declaring bankruptcy?

Bankruptcy has many short- and long-term effects on your assets and financial stability—but it’s not a financial death sentence. Still, it’s important to understand the implications this move can have.

Creditor claims stop

Filing for bankruptcy automatically halts creditors' claims against you. Not only will your creditors have to pause efforts to collect the money you owe them, but they'll also be unable to call you to collect debts, repossess your car, or foreclose on your home.

Credit score is affected

Filing for Chapter 7 bankruptcy will stay on your credit report for ten years. Chapter 13 remains on your credit report for seven years and you can't file for it again for two years. Chapter 11 can also stain your credit for five to ten years.

A hit to your credit score can impact your ability to get a loan or credit card in the future, raise insurance premiums, and purchase property, and may even affect your freedom to travel to other countries or find employment.

Business assets may be leveraged

Assets are affected differently based on the type of bankruptcy you choose. That said, even in a Chapter 7 bankruptcy (wherein many of your assets are liquidated) some business assets can be exempt. In a Chapter 13 or Chapter 11 bankruptcy, you're able to retain your business assets while you pay off outstanding debts over time.

Personal assets may be leveraged

Similarly to business assets, filing for bankruptcy may offer some protection for your personal assets depending on the type you choose and the bankruptcy laws in your state. In a Chapter 7 bankruptcy, certain assets—such as clothing, household items, or a car—may be exempt from liquidation, but your home and car may still be at risk. In Chapter 13, your home and other assets are not liquidated.

Student loans stay put

Unfortunately, bankruptcy can't relieve student loan debt. If your student loan payments are unmanageable, consider alternatives approaches to repayment, such as debt consolidation or renegotiating terms with your creditor. The U.S. Department of Education offers income-based repayment plans for federal loans.

Frequently Asked Questions

Still not sure if bankruptcy is right for you? Here’s rundown of the basics:

Can filing for bankruptcy improve my financial situation?

Filing for bankruptcy can be a huge relief but it’s not without consequences for your financial situation. Long-term effects on your credit score can narrow your employment prospects or make it difficult to take out loans for a while. However, it can also give you a relatively clean slate and a second chance to move forward without feeling like you’re drowning or at risk of losing your assets.

Does bankruptcy forgive all kinds of debt?

Not all kinds—for instance, bankruptcy doesn’t clear student loans, certain tax debts, reaffirmed debt (a current loan with terms you've recommitted to), child support, or alimony. If you have any of those types of debts, you will need to consider alternate methods of repayment.

How much debt is worth filing for bankruptcy?

There is no one-size-fits-all number that indicates when to file for bankruptcy. Rather than a strict rule, consider your cash flow and the degree to which your income or business revenue can lessen your debt. If the gap between those numbers is steep with no signs of changing, bankruptcy may be worth it. A bankruptcy lawyer can help give you a personalized outlook.

Can I file for bankruptcy without a lawyer?

Yes, you can file for bankruptcy without an attorney. This is called a "pro see" (for himself/herself) filing. However, bankruptcy is a risk with many complex parts. It would be unwise to try to navigate it without the help of a bankruptcy attorney who understands your personal case and can guide you towards the best outcome.