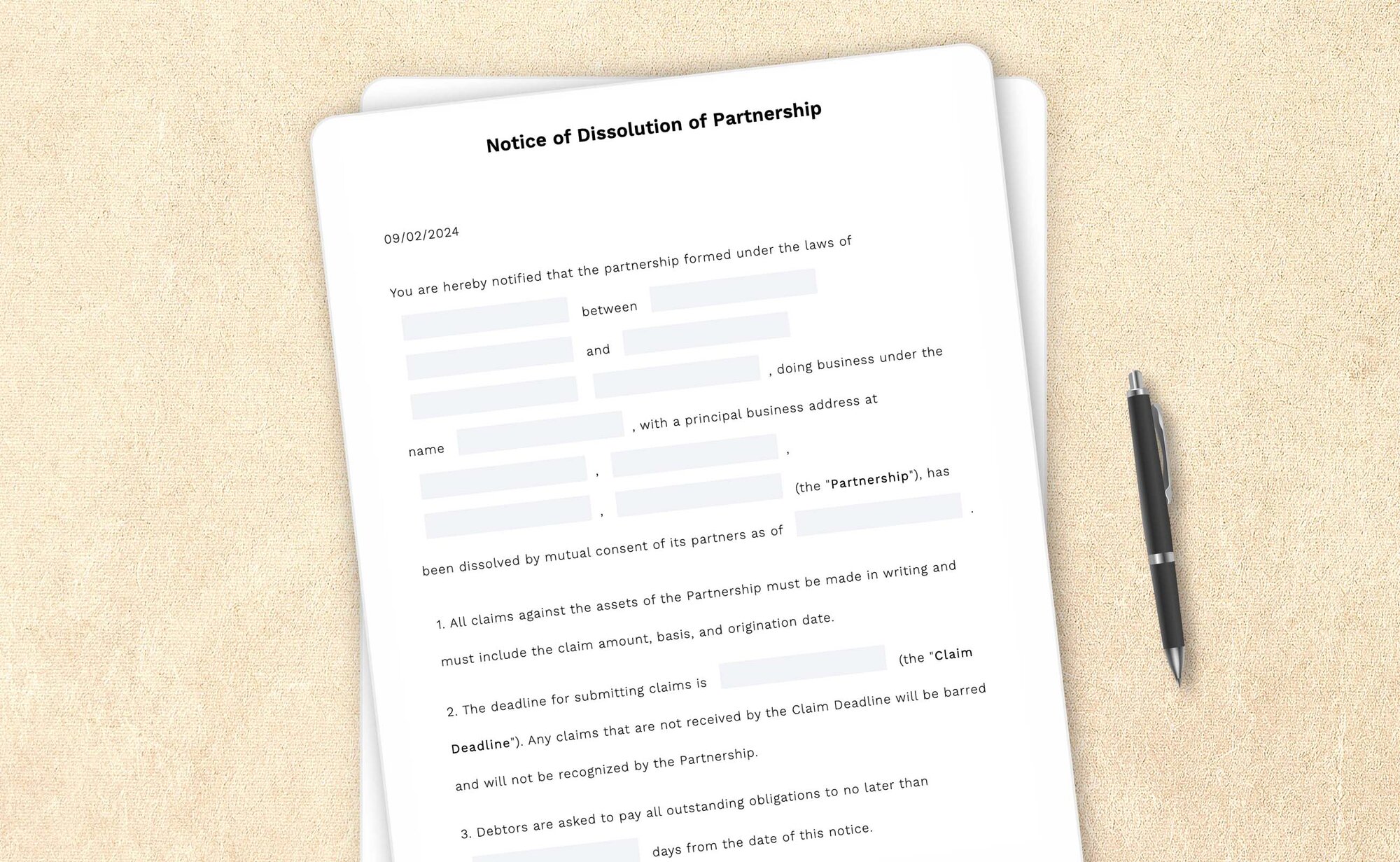

You are hereby notified that the partnership formed under the laws of

- 1. All claims against the assets of the Partnership must be made in writing and must include the claim amount, basis, and origination date.

- 2. The deadline for submitting claims is

(the "Claim Deadline"). Any claims that are not received by the Claim Deadline will be barred and will not be recognized by the Partnership. - 3. Debtors are asked to pay all outstanding obligations to

days from the date of this notice. - 4. All claims and payments must be sent to

, , , , , ,

By:________________________________________ Name: |

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Notice of dissolution of partnership: How-to guide

Partnerships, like any business endeavor, can undergo changes over time. Sometimes, despite the best intentions and efforts of all parties involved, partnerships need to be dissolved. This dissolution could stem from various reasons, such as changes in business objectives, disagreements among partners, or external factors impacting the viability of the association.

The role of partnership agreement

In many cases, partnerships operate under a written partnership agreement outlining the rights, responsibilities, and provisions governing the business relationship. A partnership agreement document plays a crucial role in guiding the dissolution process by detailing procedures for winding up affairs, distributing assets, and addressing liabilities upon dissolution.

Understanding partnership dissolution

A partnership dissolution marks the conclusion of the legal relationship between business partners. Whether it's a general partnership governed by the Uniform Partnership Act (UPA Act of 1997) or a limited liability company structured under state laws, the dissolution process entails ceasing business operations, settling debts, and distributing remaining funds or assets among partners.

When a partnership dissolves, it’s essential to follow a structured process to ensure legal and financial obligations are properly addressed and stakeholders are promptly informed. This necessitates the issuance of a notice of dissolution of partnership.

Importance of notice of dissolution of partnership

One crucial aspect of dissolving a partnership is informing all relevant parties about the impending dissolution. This is where the notice of dissolution of partnership comes into play. The notice serves as a formal announcement to various stakeholders, including creditors, employees, clients, and government entities, about the partnership's decision to cease its operations.

The notice should include essential details such as the effective date of dissolution, the reasons for dissolution, and instructions for handling any outstanding obligations or claims. It is essential to ensure that the notice complies with state laws and any specific provisions outlined in the partnership agreement.

Things to consider while creating a partnership dissolution notice

1. Check the partnership agreement and other relevant documents before initiating the dissolution process

Examine business partnership agreements, contracts, leases, loan agreements, and other documents to see how your dissolution will affect them. Sometimes certain provisions mentioned in them might become void if the partnership dissolves. There are chances that the terms in those documents may require the business partners to continue their association, even if the partnership itself is terminated.

2. End the partnership and inform stakeholders with a statement of dissolution

An essential part of dissolving a partnership is informing all the parties that the partners will no longer be responsible for each other’s debts and obligations. You must provide written partnership dissolution notices to all the partners and stakeholders like the suppliers, customers, and clients. Don’t assume that publishing notice of the dissolution in a local newspaper (or as may be otherwise required by your state’s laws) is sufficient; in many cases, it is not.

Notice should be given to each company and individual with whom your partnership has an agreement, even if you’re sure they already know about the dissolution.

3. Appointing a liquidating partner

Generally, the partner initiating the dissolution is responsible for notifying the end of the partnership. However, some partnership agreements allow you to designate a “liquidating partner,” who'll be solely responsible for winding up the partnership's business operations.

4. Close your tax liabilities

If you have (or had) employees at your general partnership, make sure all payroll tax deposits have been made, and your employment tax paperwork is complete for the tax year. You’ll also need to inform local, state, and federal tax agencies about the dissolution of your business partnership. When you’re filing the final return, you can also indicate that you won't be filing any tax returns in the future.

Ceasing operations in partnerships can be complicated, and various steps can be involved. For additional information, talk with your accountant and lawyer before dissolving your business.

5. Save your copy of the written partnership agreement

You should keep a copy of your original partnership agreement and your partnership dissolution agreement.

What details should be included in a partnership dissolution agreement notice?

The following instructions will help you understand the terms of your notice of dissolution of a partnership.

1. Details of the partnership agreement

When sending the partnership dissolution notice, you need to include the state law and section number that governs your partnership agreement. You should also provide the details of the state where the general partnership was formed. This is often, but not always, the same state whose laws govern the agreement.

2. Provide information about the partners

Add all relevant information regarding the parties involved in the dissolution. If you have two partners, address the main party as “first partner” and the other party as “second partner.” If there are more than two partners, along with including the information of the main partner, you should provide details of the remaining partners.

3. Give the partnership name

Provide the name under which the partnership conducted its business. This trade name may or may not be the same as the company’s legal name. For example, Prime Solutions, a tech company, is entering into a partnership with Easemond, an AI solutions company. They’re calling their partnership under the business name “PrimeEase Solutions.”

4. Include details of the partnership dissolution agreement

Add necessary details regarding the dissolution, like the partnership’s principal business address and the effective date of the partnership dissolution. You can also include details on whether the partnership owes any money to other companies or individuals or vice versa. If there are payments or assets to be given to the partners, provide the terms and conditions of how those remaining assets and remaining funds should be returned.

Frequently asked questions

What's a notice of dissolution of partnership?

Whatever the reason for ending a partnership, give all parties the peace of mind that comes with a clean break. A well-drafted notice of dissolution of partnership can help prevent misunderstandings in the future and strengthen your defense if lawsuits arise.

Given below are the information you'll need to complete your notice of dissolution of partnership:

- Who’s involved: Know the names and contact information of all partners

- Subject matter: Prepare important details, such as outstanding debts, information on creditors, payment deadlines, payment methods, and the name of your liquidating partner