A legal document called a power of attorney (or POA) can help take care of financial and healthcare matters if you aren't present to sign documents or become incapacitated. Power of attorney is the linchpin of estate planning.

POA is typically used by those who cannot manage their affairs. This circumstance is generally due to an illness, aging, disability, or simply being away for an extended period. In the event that you can't make financial or health decisions, POA puts a trusted individual in charge. Read on to learn the ins and outs of this legal arrangement.

What is power of attorney?

POA is a legal document that grants someone the authority to represent another person in financial and medical matters. The agreement always includes two parties:

- The agent. Agents represent someone else for predetermined legal decisions. Some forms list them as an “attorney-in-fact."

- The principal. Principals sign POA forms so their agents can represent them.

What an agent can or can't decide for the principal depends on their agreement. Different forms grant varying degrees of authority for different lengths of time. The agreement may include clauses on when the powers take effect and when they end. As a result, no two agreements share the exact same purview.

Illinois power of attorney types

The types of POAs in Illinois include:

- Durable power of attorney

- General power of attorney

- Limited power of attorney

- Minor power of attorney

- Financial

- Medical power of attorney

- Tax power of attorney

- Vehicle power of attorney

Let's explore the different POA forms:

Financial power of attorney in Illinois

Financial POAs are some of the most popular. Generally, principals sign this form so agents can manage their finances during illness or absence. The document lists several types of transactions. Your agent will have the power to engage in all types of transactions unless you cross out the ones you do not want your agent to have.

The best way to understand financial POAs and to be sure you satisfy the power of attorney requirements in Illinois, is to use the Illinois Statutory Short Form Power of Attorney for Property created by the Illinois legislature. You can find this form in the Illinois Compiled Statutes, Chapter 755, Article 45, Section 3-3. It includes instructions for each section of the form.

Note: Principals must sign financial power of attorney forms before at least one witness and a notary public. There is a place for a second witness because many other states require more than one. The witness section of the form states that certain persons may not be a witness, including:

- Certain healthcare providers

- Relatives of the principal and agent

- The agent

Healthcare power of attorney in Illinois

Healthcare POAs make medical decisions on the principal's behalf. Interested principals can find this form in the Illinois Compiled Statutes, Chapter 755, Article 45, Section 4–10. The principal and one witness must sign the form. However, no one has to notarize a medical POA form in Illinois.

Like with the financial form, this form includes detailed instructions, including an explanation of who may not serve as witnesses. You can also cross out specific health provisions, as the instructions indicate. This limits the scope of an agent's healthcare power, should the principal choose to restrict it.

Note: The Illinois legislature recently altered the Illinois Power of Attorney for Health Care form in Public Act 102–794. As of Jan. 1, 2023, agents can "present an electronic device displaying an electronic copy of an executed form as proof of the health care agency." Before this change, agents needed a physical copy of the healthcare directive.

Other types of power of attorney in Illinois

Outside of health and finance, you can find other types of POA. Forms that give the agent broad powers to represent the principal in any matter are “general" POAs. A "limited" or "special" POA limits the agent's authority in some way. Principals can limit the agents to a single transaction, a certain type of decision, or a limited amount of time.

The eight Illinois power of attorney forms include:

- Durable (statutory) power of attorney. Provides broad legal powers to an agent and continues if the principal becomes incapacitated.

- General (financial) power of attorney. Gives broad financial powers to an agent but ends once the principal becomes incapacitated.

- Limited power of attorney. Grants limited power over specific transactions or a specific period and voids once the transaction or period ends.

- Minor power of attorney. Appoints an agent to make decisions for a minor if their guardian is unavailable.

- Medical power of attorney. Allows an agent to make healthcare decisions when you cannot.

- Revocation of Power of Attorney. Cancels a past POA agreement.

- Tax Power of Attorney (IL-2848). Lets an agent act on your behalf when filing taxes or dealing with the IRS.

- Vehicle Power of Attorney. Grants agents the power to register and title vehicles.

Among these eight forms, there is no best option. Instead, principals should find the agreement most suited to their needs. Even if they change their mind, principals can amend their agreements later.

What's the difference between durable and regular power of attorney?

While durable POA agreements stand after the principal's incapacitation, a regular, or springing, power of attorney doesn't. Illinois forms include a space for you to fill in when the POA becomes effective. Two standard provisions help explain this distinction:

- For a durable power of attorney in Illinois: "This power of attorney shall be effective immediately, and shall not be affected by the subsequent incapacity of the principal."

- For a regular power of attorney in Illinois: "This power of attorney shall become effective upon the incapacity of the principal, as determined by written certification of incapacity by two physicians who have examined the principal."

Because of this distinction, regular POAs won't grant agents power over medical emergencies and end-of-life decisions. However, a durable POA will offer that power in cases like these.

Why is power of attorney important and necessary?

POA forms allow an agent to legally manage a principal's property, medical, and financial choices. Crucially, this isn't for the agent's sake. Power of attorney lets principals get ahead on estate planning decisions. The agent can still uphold their best interests whether a principal is sick, absent, or unwilling to act.

POA forms serve a similar function to wills. Wills often include provisions on health and finances up to and after a person's death. By contrast, power of attorney includes provisions that apply while a principal lives. Both documents help execute their best interests in times of duress.

Limitations on power of attorney

Power of attorney grants a wide range of legal powers and responsibilities. However, even someone with a durable POA can't do anything on behalf of the principal. At the same time, principals can't control all their agent's decisions. POA agreements come with a few limitations along these lines:

- Agents have no direct oversight besides the principal

- Agents may ultimately act in a way the principal wouldn't want

- Third parties like a bank may not accept POA to avoid fraud or abuse

- Agents cannot alter a principal's will

- Principals must write out their agreement on the proper statutory forms

- Agents can only transfer their POA to someone else with the principal's consent

Illinois also places limitations on agents. Someone can only represent a principal if they:

- Are over 18 years old

- Demonstrate the ability to make financial, property, and medical choices in your place

- Are of sound mind and understand the legal implications of their agreement

Illinois power of attorney requirements

Power of attorney depends on more than mutual agreement. Even if an agent and principal strike a deal, the state won't recognize a POA unless it meets the legal criteria. In Illinois, the basic requirements for a power of attorney include:

- The form must designate the agent and the agent's powers

- The principal must properly sign the agreement

- Certain forms make the principal acknowledge their signature before a witness or notary public (the notary public may not also be the witness)

- Principals must demonstrate a sound mind when signing their agreement

- Inclusion of statutory language

Note: You can find more laws governing POAs—both financial and medical—in the Illinois Compiled Statutes, Chapter 755, Article 45, known as the Illinois Power of Attorney Act.

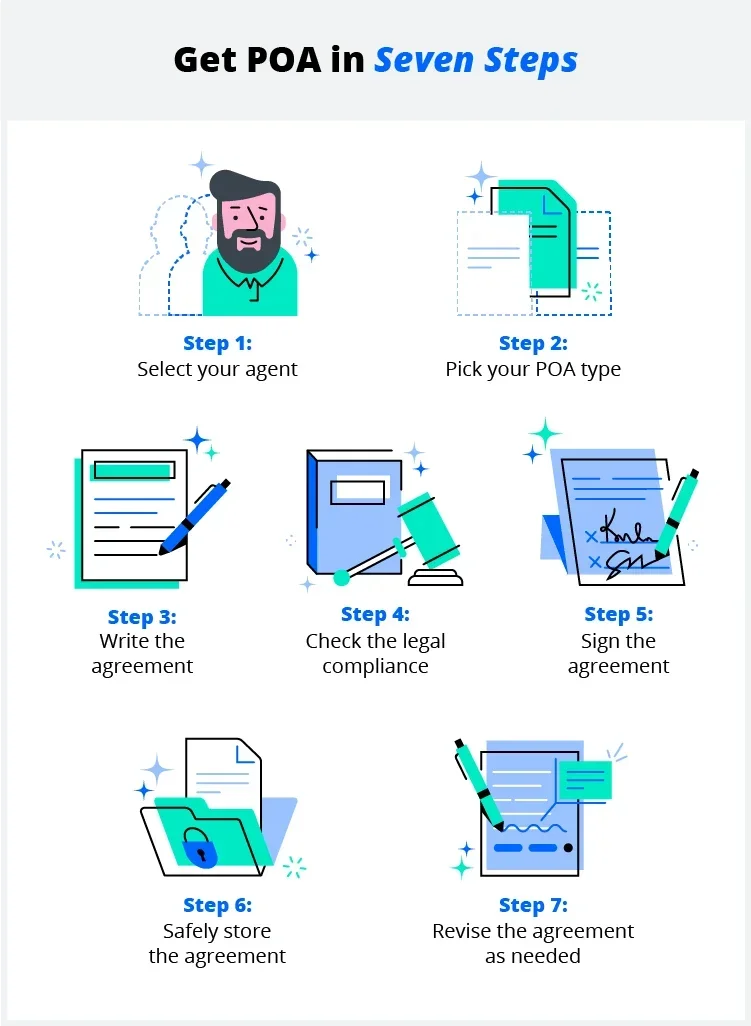

How to get power of attorney in Illinois

While power of attorney takes time to understand, executing an agreement is straightforward. Illinois residents can sign a POA agreement by following these steps:

- Select your agent and discuss financial, medical, or general responsibilities

- Choose the right type of POA to suit your needs

- Write the POA agreement on the statutory forms

- Ensure the document complies with state laws

- Sign and execute the POA form according to Illinois law

- Store your agreement in a safe place like a safety deposit box

- Update your POA as the need arises

When will the POA take effect and end?

Power of attorney can take effect in two ways:

- Immediately after the principal and agents execute the agreement

- Upon meeting the predetermined criteria outlined in the agreement

A power of attorney form voids if:

- The principal dies

- The principal revokes their POA agreement

- A court invalidates the agreement

- The agent is unavailable (sick, in prison, unwilling to person their duties, etc.)

Why use the statutory forms?

Some principals use off-the-shelf or do-it-yourself power of attorney forms. More often than not, this hurts the credibility of your agreement. You can create a secure POA in Illinois that meets every legal requirement by using the state's official forms. These statutory forms also make it more likely that the people and organizations meeting your agent will accept them.

You can find the statutory forms:

- At stationery stores selling legal forms

- With an estate planning attorney

- On state websites or within government offices

POA frequently asked questions

After learning the basics of POA, many legal questions remain. A few of the most popular ones include:

Can two people share power of attorney?

Principals can name more than one agent on a power of attorney form. For example, some principals give their siblings or children durable POAs so that at least one can help in an emergency.

As a general rule, principals should offer POA to only one person. If two agents conflict, neither can make decisions on the principal's behalf. As a result, most principals defer to one trusted agent.

Who makes decisions without power of attorney in place?

Without POA in place, the state may appoint a third party to help an indisposed principal. With financial estate management, probate courts may appoint a guardian or conservator to manage someone's property. Family members can petition for access to the principal's finances when this occurs.

If someone becomes medically incapacitated, family members will make decisions in place of an agent. Medical staff will act in the patient's best interest if the hospital cannot contact relatives. If the patient left a will, it provides a roadmap to medical staff.

Does power of attorney grant ownership of property?

No, agents with power of attorney do not own their principal's property. Instead, agents can make predetermined financial decisions about the principal's property if the situation demands it. An agent can't transfer or sell any assets without written consent.

How much does power of attorney cost?

Obtaining and filing a POA form costs little to no money in Illinois. However, hiring an attorney to review your form will drive up the cost. Some lawyers charge $100–$300 to review a standard form. More complex arrangements can cost far more.

Can you revoke power of attorney?

So long as they demonstrate a sound mind, principals can revoke an agent's POA at any time. Principals can revoke this privilege for any reason they choose.

How do you sign as power of attorney?

An agent's signature won't represent the principal unless it fits a specific format. To sign for your principal, write their full legal name, then the word “by," and, finally, sign your name. For example, if Eric Burress is Jessica Kane's POA, Eric would sign: "Jessica Kane by Eric Burress" on documents.

Secure your health and finances with POA

You can never ensure what the future has in store, but estate planning allows people to set provisions and make choices in their best interests while they still can. Although wills apply after a person passes, power of attorney offers the same benefits well before that point. It also provides enough flexibility to select the perfect form for your needs.

By learning about the rights and responsibilities involved in executing a power of attorney document in Illinois, you'll be better prepared to appoint a power of attorney or serve as a power of attorney for someone else. From there, you can decide if power of attorney is right for you. Ensure your loved ones and property are protected.