A grantor trust is a type of trust in which the grantor is considered the owner of the trust assets for income and estate tax purposes, meaning that any income, deductions, or credits from the trust are reported on the grantor’s tax return.

Trusts like these are important elements of estate planning because they can help you manage your assets, facilitate the transfer of wealth, and generate tax benefits. Trusts can be complicated, so let’s take a look at everything you need to know about grantor trusts, from what they are to how to implement them and what to discuss with your attorney.

What is a grantor trust? Definition of grantor trust

A grantor trust is defined as an estate planning tool that allows the grantor (the individual who creates and funds the trust) to retain control over the trust's assets. They oversee all income taxes associated with the trust, causing the trust to be treated as a “disregarded entity” for income tax and estate tax purposes.

To understand the definition of a grantor trust, you should know what is a grantor in a trust.

The grantor of the trust is treated as the owner of the trust. They fund the trust with their assets, select who will receive those assets, and determine distribution instructions. Grantor trusts are living trusts, meaning the grantor retains control and manages the trust assets during their lifetime, rather than distributing those assets only after their death.

Grantor trust rules state the grantor must report the trust's generated income, such as deductions and dividends, to the Internal Revenue Service (IRS) using the grantor's own tax identification number (TIN). This is different from standard irrevocable trusts, which are treated as separate entities for tax purposes and require their own TIN. In exchange for this ability, grantors have to pay taxes on any income associated with the trust since the trust assets are considered taxable income rather than a separate tax entity.

Grantor trusts are unique as the grantor oversees tax payments associated with the trust's income instead of passing it on to the beneficiaries, providing a tax shelter (a financial arrangement that reduces or eliminates tax liability). Therefore, the trust isn’t subject to the gift tax, so the trust's beneficiaries can accept the trust assets without making any additional payments.

Difference between a grantor and a non-grantor trust

You have read all about the grantor trust definition and its characteristics above. Here, let’s understand how a grantor trust is different from a non-grantor trust.

A non-grantor trust is initially created and funded by the grantor, who appoints a trustee—either an individual or a legal entity—to manage the trust’s activities according to the terms specified in the trust document. The grantor relinquishes the power to amend or revoke the trust and surrenders control and beneficial interest, allowing the trust to operate independently.

For income tax purposes, the non-grantor trust operates differently. Unlike a grantor trust, a non-grantor trust is a separate taxable entity and is responsible for paying taxes on its earnings with its own TIN. If the trust’s income is distributed among the beneficiaries, then the beneficiaries must pay the income taxes.

Now let’s compare the grantor trust aspects to a non-grantor trust in the below table.

| Grantor trust | Non grantor trust | |

| Appointing a trustee | The grantor appoints another person as a trustee to manage the trust's activities. In some cases, the grantor chooses to serve as a trustee and appoints a successor trustee to take over in the event the grantor becomes incapacitated or dies. | The grantor appoints a trustee—either an individual or a legal entity—to manage the trust's activities in accordance with its terms. |

| Grantor powers and trust control | Grantor retains their powers and becomes the owner of the trust. | The grantor relinquishes the powers and control of the trust. |

| Flexibility | The trust is flexible, as the grantor retains the power to amend or revoke the trust, as well as modify the terms of the trust document. | The trust isn't flexible, as the power to amend or revoke the trust can only be done if explicitly mentioned in the trust document or the court allows it. |

| Income tax responsibility | The trust is considered a non-taxable entity, as the grantor pays all the income taxes on the trust's assets using their 1040 form. | The trust is a taxable entity and is required to pay an individual income tax return on the trust's assets. |

| Asset protection | For this trust, the assets held within it offer limited protection from creditors. This means that if the grantor faces legal issues or financial obligations, their personal creditors may be able to access the assets in the trust. | These trusts offer strong asset protection from creditors because the grantor is no longer in control of the trust assets. Hence, if the grantor faces legal issues or financial obligations, their personal creditors generally can't access the assets held within the non-grantor trust. |

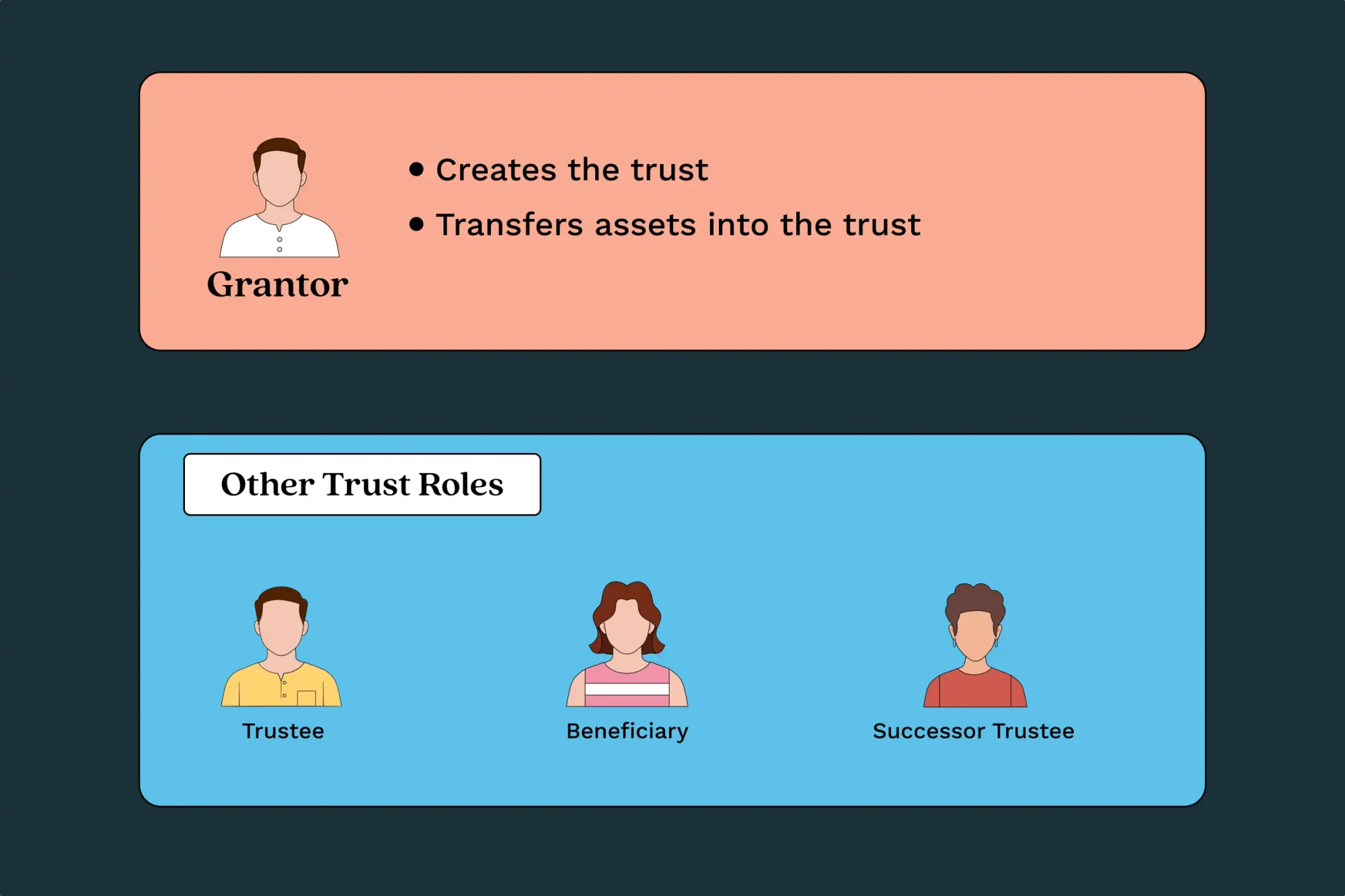

Who is the grantor in a trust? What does grantor mean?

The grantor of a trust, also known as the settlor or trustor, is the person who creates, funds, and owns the trust. They play a crucial role in maintaining control over the trust assets through certain powers, which are key to preserving the grantor trust status.

The IRS determines that the grantor retains control over the trust's income and assets and is responsible for paying the trust’s income tax.

What powers does a grantor retain in a grantor trust?

The IRS considers a trust a grantor trust if the grantor retains certain powers, such as:

- Choosing how the assets must be distributed among the beneficiaries

- Defining the duties and powers of the trustee

- Replacing existing trust assets with other assets of equal value (substitute assets)

- Retaining the right to income

- Controlling trust investments

- Changing the trust beneficiaries as and when required

- Amending the trust terms in the trust document

- Revoking or terminating the trust

- Borrowing from the trust or even reclaiming the assets

- Relinquishing control of the trust and making it irrevocable

What are the responsibilities of a grantor?

Along with creating a trust, the grantor has a bunch of associated responsibilities, like:

- Choosing the trust type (revocable or irrevocable) while creating the grantor trust

- Allocating or funding the trust with assets

- Adding a trustee to administer the trust

- Naming beneficiaries such as friends, family, or other organizations who will benefit from the trust

- Managing the trust, such as defining how and when the trustee should divide the assets to the beneficiaries, etc.

- Retaining control over the income generated by the trust by reporting all the trust’s monetary activities under their personal income tax return

- Paying taxes on the trust’s income under their own tax return

Differences between a grantor and other trust roles

It is vital to understand the different roles involved in trust management, such as:

1. Grantor vs. Grantee: What's the difference?

The terms “grantor” and “grantee” are commonly used in many legal documents involving property transfer as equivalents to “provider” and “receiver”. For example,

- In mortgages, the grantor is the lender who provides funds to the grantee, who is the borrower.

- In deeds, the grantor is the seller transferring ownership to the grantee, who is the buyer.

- In trusts, the grantor is the person who creates the trust and funds assets to be held by the trust, which are then distributed to the grantee, the recipient.

2. Grantor vs. Trustor: What’s the difference?

A trustor is a synonymous term for a grantor who is responsible for creating, funding, and administering the trust.

3. Grantor vs. Trustee: What’s the difference?

While a grantor spearheads the establishment of the trust, they will appoint an individual or organization, called the trustee, to manage the assets transferred to the trust on behalf of the beneficiaries. The trustee’s powers are determined by the grantor and are mentioned in the documents in the early stages of trust creation.

In some cases, the grantor can name themselves as trustees and manage the trust during their lifetime. They must also appoint a successor trustee for the trust who will manage the trust once they pass away.

4. Grantor vs. Settlor: What’s the difference?

Just like a trustor, a settlor is a synonymous term in a grantor trust who establishes the trust and funds it with assets.

5. Grantor vs. Beneficiary: What’s the difference?

A beneficiary is an individual who is entitled to receive benefits from a trust that is created by the grantor and managed by the trustee. All the benefits that the beneficiary will receive are defined in the trust documents.

What is the purpose of a grantor trust? Why should you create it?

Here are several advantages to setting up a grantor trust:

1. Trust control

Grantor can transfer assets efficiently while maintaining complete control. This can be achieved through various trust structures, allowing you to dictate how and when assets are distributed, or even to retain the right to amend, alter, or revoke a revocable trust.

2. Probate process avoidance

Assets in grantor trusts don't have to go through the probate process upon the grantor’s passing. They can be distributed to your beneficiaries privately and efficiently, without the need for court supervision, which can be a costly and lengthy court procedure.

3. Tax advantages

As there is no separate TIN or income tax return for the trust, the grantor can achieve more favorable income tax rates on the income generated in the trust. This prevents the beneficiaries from paying any income tax on the assets. Additionally, if the trust is irrevocable, the beneficiaries can avoid estate taxes upon the grantor's death, as the assets in the trust are excluded from the grantor’s taxable estate.

4. Strategic distribution of assets to beneficiaries

By transferring assets to a grantor trust, you can leverage your annual gift tax exclusion or lifetime exemption to reduce your taxable estate. As the grantor covers the income taxes and the gift tax doesn't apply, the trust assets can grow tax-free. In turn, the beneficiaries can enjoy tax-free income from the trust, essentially increasing their wealth.

5. Smooth succession planning

By designating a successor trustee, you can ensure that your assets are managed according to your wishes, even if you are unable to make decisions yourself while you are incapacitated.

A trust helps your family avoid the extra cost, time, and stress of probate. We’ll guide you through the setup.

When does a grantor trust status end?

The grantor trust status is not necessarily permanent. Several events or actions can trigger its termination, resulting in significant changes to how the trust and its beneficiaries are taxed and administered. Understanding the mechanisms for losing grantor trust status and the subsequent consequences is crucial for grantors, trustees, and beneficiaries.

Here are some of the circumstances leading to the loss of grantor trust status:

1. Grantor's actions. The grantor's deliberate actions, such as the formal release or renunciation of a retained power, can trigger the loss of grantor trust status. This requires careful legal documentation to ensure its effectiveness. A grantor generally decides to give up their power when they wish to:

- Remove assets from their taxable estate,

- Protect the assets from creditors

- Shift the income tax responsibility to the trust or beneficiaries

2. Expiration due to time or event. Certain grantor trusts are triggered by the passage of time or the occurrence of a specific event stipulated in the trust document. For instance, a trust might specify that the grantor's income from the trust assets must terminate when a child reaches a certain age, at which point the trust transitions to a non-grantor trust.

3. Trust modifications. If the trust is modified in a way that removes the powers or interests that made it a grantor trust, then it will no longer be considered a grantor trust. However, any modifications must be carefully evaluated for their potential tax and legal ramifications. For instance, if you modify a trust to remove a grantor's retained power, it may inadvertently alter the trust's tax status, resulting in unexpected income or estate tax implications.

4. Grantor’s death. Upon the grantor's passing, the powers or interests that caused the trust to be classified as a grantor trust typically cease to exist with respect to the grantor. As a result, the trust generally converts to a non-grantor trust.

The termination of grantor trust status is a significant event with substantial tax and administrative ramifications. Understanding the various ways this can occur, the triggers that initiate the change, and the resulting consequences is vital for effective trust management and tax planning. Consulting with legal and tax professionals is highly recommended to navigate these complexities.

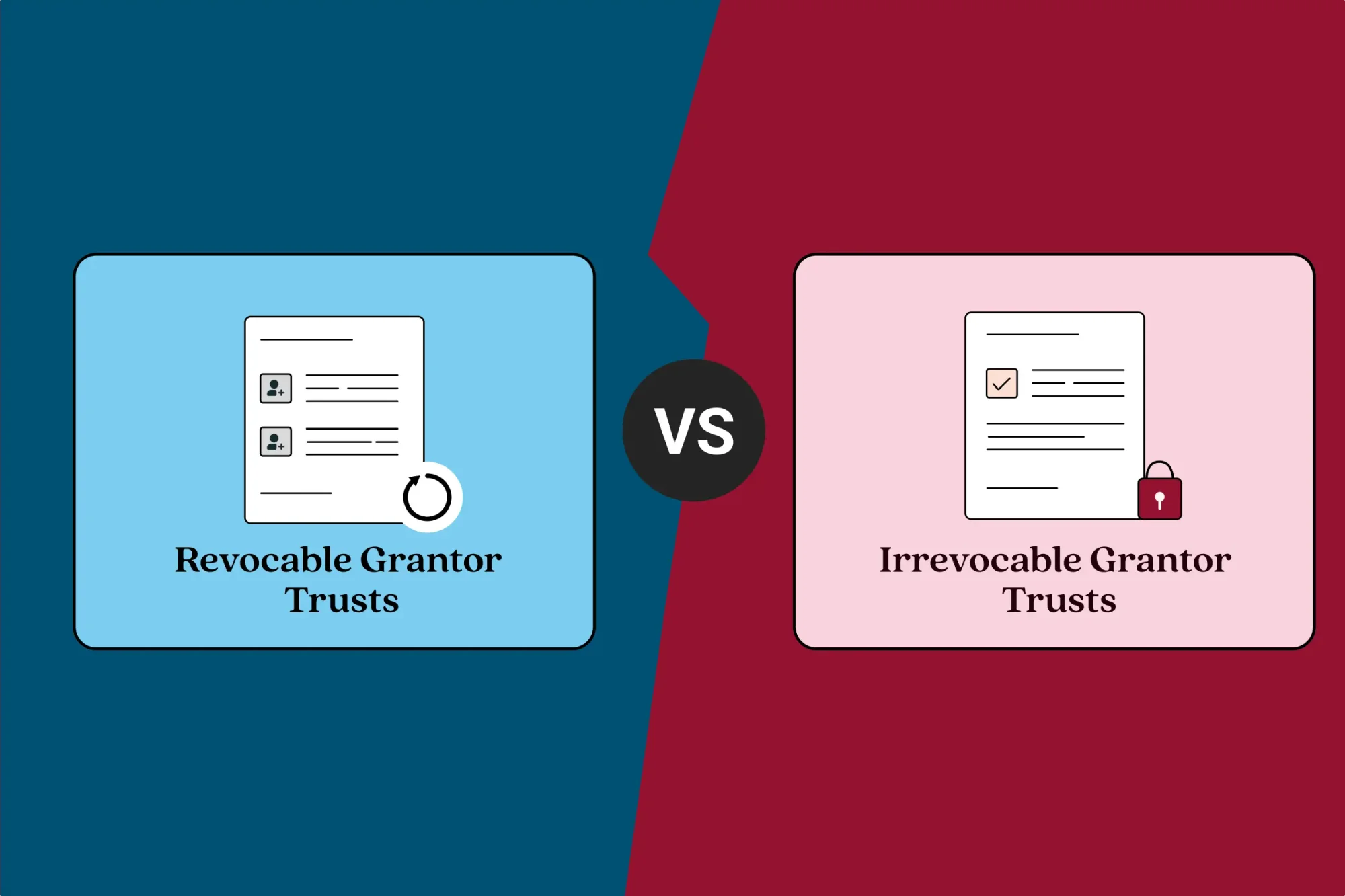

Types of grantor trusts: Revocable vs. irrevocable grantor trusts

1. Revocable Grantor Trusts

The simplest type of grantor trust operates as a revocable living trust. After all, a revocable trust is a type of trust in which the grantor or trustee (who can be the same person) maintains control over the assets and can amend or revoke the trust at any time. This control extends to the assets held within the trust, allowing the grantor to add or remove assets as needed.

With a revocable grantor trust, the grantor is responsible for reporting the trust income as personal income. Also, assets are considered part of the grantor's estate and subject to estate taxes after the grantor's death. Creditors (money lenders) can also access and claim these assets when the grantor faces financial difficulties or legal issues. Hence, revocable grantor trusts don’t offer asset protection from creditors.

Keep in mind that “revocable grantor trust” is a broad term that can describe many other, more specific types of grantor trusts. So, if you are wondering whether all revocable trusts are grantor trusts, there are some grantor trusts that aren’t revocable, known as irrevocable grantor trusts. Let’s learn about them.

2. Irrevocable Grantor Trusts

An irrevocable grantor trust, on the other hand, is a trust that the grantor cannot alter, amend, or revoke once it has been established. While the grantor loses control over the trust assets, they still retain certain powers (e.g., the right to receive income from the trust, or the power to determine who receives the income) that cause the trust to be treated as a grantor trust for income tax purposes.

The assets in an irrevocable grantor trust belong to the trust and not the grantor. Hence, this structure provides a strong asset protection from creditors (money lenders) as they can’t access or claim the assets when the grantor has financial liabilities or legal complications.

Difference between irrevocable grantor trusts and non-grantor trusts

The similarity between an irrevocable grantor trust and a non-grantor trust is that the grantor loses the power to amend or revoke the trust and their control over the trust assets.

The primary difference between an irrevocable grantor trust and a non-grantor trust lies in who is liable for paying the taxes on the trust's income. With irrevocable grantor trusts, the trust is considered a non-taxable entity, and the grantor will pay the income taxes. But, in a non-grantor trust, the trust pays taxes on its earnings as it is considered a taxable, separate legal entity.

In essence, "irrevocable" describes the trust's legal structure and the grantor's loss of control over the assets, while "non-grantor" describes who bears the tax burden for the trust's income. All non-grantor trusts are irrevocable trusts, but not vice versa.

Here’s a list of grantor trusts that are irrevocable, meaning that the rules and regulations by which they are governed are much stricter overall.

2.1. Intentionally Defective Grantor Trust (IDGT)

Also known as IDGTs, intentionally defective grantor trusts allow grantors to remove certain assets from their own estate by gifting or selling those assets to the trust itself. While this means that the grantor will need to pay personal taxes for any appreciation experienced by those assets, the structure avoids most types of estate taxes.

In many ways, intentionally defective grantor trusts straddle the line between irrevocable and revocable trusts, incorporating the risks and benefits of both. One benefit, for example, is the “swap power,” which allows a grantor to substitute assets within the trust for other assets of equal value.

That said, this type of grantor trust is one of the more complex estate planning tools available, so it’s essential to consult with a qualified estate planning expert for assistance in setting it up. If possible, find an attorney who has previously created IDGTs.

2.2. Grantor Retained Annuity Trust (GRAT)

Grantor-retained annuity trusts, or GRATs, are a unique structure of a grantor trust that establishes a regular annuity payment to be paid to the trust’s grantor across a fixed time period.

When the GRAT is created, these annuity payments are calculated using the total value of the trust’s assets, the IRS’s Section 7520 interest rate, and the duration of the trust term. These annuity payments can be structured to increase, decrease, or remain static over the life of the trust.

Regardless of how it is structured, annuity payments are made using the assets within the trust itself, with any appreciation of those assets passing to the beneficiaries tax-free. When the GRAT ends (as determined by the timeline established at its creation), any remaining assets not used to make annuity payments will pass to the beneficiaries.

2.3. Qualified Personal Residence Trust (QPRT)

Qualified personal residence trusts allow the grantor to transfer their primary or secondary residence into the trust while living there rent-free for a specific period known as the “retained interest” period.

Once the retained interest period ends, the residence passes to the designated beneficiaries without being included in the grantor's taxable estate. If the grantor continues to live in the residence after the retained interest period expires, they must pay fair market rent to the beneficiaries, which can further reduce the grantor's taxable estate.

The value of the gift for gift tax purposes is discounted, as it's not the full value of the residence but rather the future value after the retained interest period, considering the grantor's right to live there. This discount is influenced by the length of the retained interest period and the IRS's Section 7520 interest rate.

Here are some of the benefits of QPRT:

- Estate tax reduction. A QPRT effectively removes the residence from the grantor's taxable estate. This is particularly advantageous if the property is expected to appreciate in value, as any future appreciation also bypasses estate taxes.

- Control (for a period). The grantor can continue to live in and enjoy their home for the retained interest period, maintaining a level of control over the property during that time.

- Strategic gifting. It enables a strategic approach to transferring a significant asset to future generations while potentially minimizing tax liabilities.

- Reduced gift taxes. By transferring the residence into the QPRT, the value of the gift for tax purposes is significantly less than the current market value of the home, as it accounts for the grantor's retained right to live there.

2.4. Irrevocable Life Insurance Trust (ILIT)

If you’re thinking, can a grantor trust own life insurance? The answer is yes. An irrevocable life insurance trust (ILIT) is a specialized type of grantor trust designed to own a life insurance policy. This has a significant advantage for estate planning, particularly for individuals with large estates who are looking to minimize estate taxes.

Upon the grantor’s death, the life insurance proceeds are typically paid to the ILIT. Since the ownership of a life insurance policy is transferred to an ILIT, the policy's final amount won’t be counted as a part of the grantor’s taxable estate, thereby maximizing the inheritance for your beneficiaries.

To establish an ILIT, a grantor can create a trust with an attorney’s assistance, name a trustee and beneficiaries, and fund it by transferring an existing policy (subject to a three-year rule) or contributing funds for a new policy. The three-year rule states that if you transfer an existing life insurance policy into an ILIT and then die within three years of that transfer, the IRS includes the full value of the policy proceeds in your taxable estate. This means that the money from the insurance could be taxed as part of your estate, which is what the ILIT is typically intended to avoid. The three-year rule is designed to prevent individuals from evading estate taxes by transferring assets shortly before their death.

To avoid this three-year rule problem, the best approach is for the ILIT trustee to buy a new life insurance policy directly owned by the trust from the start. Because the insured never owns or controls this new policy, it remains outside the estate even if death occurs within the three-year period.

Key benefits of ILIT are:

- Irrevocability. The trust cannot be altered, amended, or revoked by the grantor once established.

- Trust ownership of the policy. The trust owns the life insurance policy, not the grantor, which is key for estate planning.

- Exclusion from the taxable estate. The life insurance proceeds are not included in the grantor's taxable estate upon death, reducing estate taxes.

- Potential liquidity for estate expenses. The trust proceeds can provide funds to cover estate taxes or other expenses without forcing the sale of other assets.

- Control over distribution to beneficiaries. The grantor can specify how and when the life insurance proceeds are distributed to beneficiaries.

- Possible creditor protection. Assets held within the ILIT are generally protected from the grantor's creditors.

2.5. Spousal Lifetime Access Trust (SLAT)

A spousal lifetime access trust (SLAT) is a special type of irrevocable trust in which one spouse transfers money or other assets into a trust for the benefit of their partner. Once the assets are in the trust, the spouse who set it up (the grantor) no longer owns them directly. Instead, their partner (the beneficiary) can use the money or assets from the trust.

SLAT has a few key advantages:

- It can help reduce estate taxes because the assets are no longer in the grantor’s name.

- It can protect the assets from creditors.

- The assets can eventually go to other family members, like children, after both spouses have died.

Even though the grantor gives up direct control, they still benefit because their spouse can use the trust’s assets, which helps both of them. The transfer of assets to the trust is treated as a gift, but there are tax rules that may allow this gift to be tax-free up to a certain limit.

However, before creating an SLAT, here are some important scenarios you must consider:

- Avoiding reciprocal trusts. This prevents two spouses from creating identical trusts for each other, which the IRS might view as a single trust, negating tax benefits.

- Loss of direct control. Once assets are transferred to the SLAT, the grantor gives up direct ownership and control over them.

- Divorce implications. In case of divorce, the grantor loses access to assets held in the SLAT, as the beneficiary spouse retains control.

- Administrative costs. Establishing and maintaining an SLAT involves legal and administrative fees.

- Gift tax reporting. The transfer of assets into an SLAT is considered a gift and must be reported to the IRS, potentially utilizing a portion of the grantor's gift tax exemption.

SLATs are suitable for any high-net-worth individual with a higher tax bracket seeking estate tax minimization with indirect spousal access, which requires expert consultation due to their complexity and irrevocability.

2.6. Dynasty Trusts (for multigenerational planning)

Dynasty trusts are powerful, irrevocable estate planning tools designed for the long-term transfer of wealth across multiple generations. They are specifically structured to minimize federal estate and generation-skipping transfer (GST) taxes as assets pass down through a family.

The grantor establishes the trust and funds it with assets, typically utilizing their gift and GST tax exemptions to shield these assets from future taxation for their descendants. The trust document outlines how these assets will be managed and distributed to beneficiaries over extended periods, often for centuries. This involves careful planning, including the selection of a trustee to manage the trust's affairs and a clear definition of asset distribution rules.

While not legally recognized in every state, a dynasty trust is typically set up to benefit multiple generations of a family. For example, John creates a trust with assets to be distributed to his children, grandchildren, and subsequent generations, for as long as permitted by law in the state where the trust is established. The trust continues to hold assets and distribute income or principal to beneficiaries for an extended period, potentially avoiding estate taxes for multiple generations.

Here are the key advantages of a dynasty trust:

- Estate tax protection. Protects significant wealth from estate taxes for many generations by removing assets from the grantor's taxable estate and avoiding future estate taxes for heirs.

- Wealth preservation. Ensures more wealth is preserved and passed on to future generations.

- Asset protection. Assets within the trust are protected from creditors and potential divorce settlements for beneficiaries, thereby enhancing the family’s financial security and legacy.

Due to their complexity and long-term implications, establishing a dynasty trust requires expert legal and financial advice to ensure it is properly structured and maximizes its benefits.

3. Differences between revocable and irrevocable grantor trusts

The key differences between the two types of trusts are shown in the table below:

| Revocable grantor trust | Irrevocable grantor trust | |

| Revocability | Can be altered or revoked | Cannot be altered or revoked |

| Control | Grantor retains their powers and control over the trust assets | The grantor relinquishes control over trust assets but retains certain powers, such as the right to receive income from the trust or the power to determine who receives the income |

| Asset protection from creditors | No protection | Good protection |

| Estate tax | Assets included in the taxable estate | Assets generally excluded |

| Probate | Avoids probate | Avoids probate |

| Income tax paid by | Grantor pays with their individual TIN | Grantor pays with their individual TIN |

How to set up a grantor trust

Before setting up a grantor trust, it's crucial to understand everything this kind of trust involves, from grantor responsibilities to tax implications. When following the steps to set up a grantor trust, we recommend consulting with an estate planning attorney or financial advisor and taking advantage of our trust services to ensure your grantor trust is compliant and legally sound.

Step 1: Determine assets

The first step involves determining what assets you want to set aside for the grantor trust. These can include cash, bonds, stocks, bonds, and investments, as well as real estate, personal property, life insurance premiums, and business interests.

Step 2: Choose your trustee and successor trustee

A trustee refers to the person who manages your grantor trust. In the case of a revocable trust, you can be the trustee, or you can appoint a trustee to oversee those responsibilities. Either way, it's important to select a successor trustee who will step in if you become incapacitated or when you die.

Step 3: Select beneficiaries

Next, you must decide on your trust's beneficiaries or those who will receive your assets. You can select just one beneficiary or name several, such as your spouse and children.

Step 4: Draft the trust document

Now, it's time to establish the terms of your grantor trust. This involves setting certain conditions or instructions for the distribution of your assets. For example, you could determine trustee powers, such as allowing them to make certain investment decisions, and declare distribution provisions, including how and when the beneficiaries receive their assets.

Step 5: Maintain and administer the trust

Once the trust is established, the grantor or the trust is responsible for maintaining and operating the trust properly. This includes key steps such as managing assets, distributing assets to beneficiaries, managing accounting, and staying compliant with tax and legal requirements.

Legalities around grantor trusts

The legal landscape surrounding grantor trusts is multifaceted and demands careful consideration. Several key aspects govern their creation, operation, and tax implications.

1. Grantor trust filing requirements: Establishing and maintaining a grantor trust necessitates adherence to specific filing requirements. These obligations are primarily dictated by the Internal Revenue Service (IRS) and may involve submitting specific forms and schedules along with the grantor's annual income tax return. Accurate and timely filing is crucial for maintaining the trust's grantor trust status and avoiding potential penalties.

2. Key IRS rules governing grantor trusts: The Internal Revenue Code (IRC) sections 671 through 679 provide the foundational legal framework for grantor trusts. These sections outline the circumstances under which the grantor is considered the owner of the trust assets for income tax purposes. The grantor trust rules address various powers and interests retained by the grantor, such as the power to revoke the trust, borrow from the trust without adequate security, or control who benefits from the trust assets (known as beneficial enjoyment), or to use or possess the trust property itself. Understanding and complying with these intricate IRS regulations is paramount in structuring and administering a valid grantor trust.

3. State law implications: While federal tax law plays a significant role, state law also has implications for grantor trusts. State statutes govern the creation and validity of trusts, fiduciary duties of trustees, and the rights of beneficiaries. The specific requirements for establishing a trust document, transferring assets, and administering the trust may vary depending on the jurisdiction. Therefore, it is essential to consider the relevant state laws in conjunction with federal regulations. Here are some examples of state-wise laws:

- Grantor trust in California. If the grantor trust has California-source income (e.g., rental income from California property, a business operating in CA), California will tax that income even if the grantor lives elsewhere. If the grantor is a California resident, worldwide income in the grantor trust is taxed by California.

- Grantor trust in Florida. Florida allows grantor trusts to reimburse the income taxes paid by the grantor, but only if it is explicitly mentioned in the trust document under the tax-reimbursement clause.

4. Importance of precise drafting and administration: The language and provisions within the trust document are critical in determining and preserving its grantor trust status. Ambiguous or poorly drafted language can inadvertently trigger non-grantor trust treatment, leading to unintended tax consequences. Furthermore, the ongoing administration of the trust must align with the terms of the trust agreement and applicable laws to maintain its intended status. This includes meticulous record-keeping, proper management of trust assets, and adherence to fiduciary responsibilities.

5. Legal risks and compliance obligations: Establishing and operating a grantor trust involves inherent legal risks and compliance obligations. Failure to comply with IRS regulations or state law requirements can result in adverse tax consequences, penalties, and potential legal challenges. Trustees bear significant fiduciary duties to the beneficiaries, and any breach of these duties can lead to litigation. Moreover, changes in tax laws or interpretations may necessitate adjustments to the trust structure or administration to ensure continued compliance. Therefore, seeking expert legal and tax counsel is crucial throughout the lifecycle of a grantor trust.

How are grantor trusts taxed?

A key advantage of establishing a grantor trust is its straightforward tax treatment. The following are some considerations for income tax in grantor trusts:

- The grantor pays income tax on the trust’s generated income, which is taxed to the grantor at the grantor's income tax rate instead of the trust's tax rate.

- For tax purposes, a grantor trust can be treated as a tax shelter as the grantor is paying taxes on behalf of beneficiaries, and the trust assets are allowed to grow undiminished.

- A grantor trust is not a separate entity for federal tax purposes. So the grantor must claim all income generated through the trust, including deductions, dividends, and credits on their personal income tax return, using their own TIN.

- Under grantor trust tax rules, gift taxes aren’t applied to income taxes paid by the grantor. The IRS sets an annual exclusion limit, meaning the grantor can gift a certain amount each year to the beneficiaries without incurring a gift tax. If the value of the gift exceeds this annual exclusion limit, then the gift tax rules apply.

- Taxation of grantor trusts can be beneficial for estate tax purposes. It can freeze the value of the grantor’s estate at the time the trust is created and help lower the amount of income on which beneficiaries are taxed.

For example, if you set up an Intentionally Defective Grantor Trust and put a growing asset, like a piece of real estate, into it, any increase in the value of that real estate won't be taxed as part of your estate when you die. However, according to grantor trust taxation, the grantor will still be liable for paying regular income taxes annually on any rent or other income generated by the asset during their lifetime.

Points to consider before creating a grantor trust

While grantor trusts offer certain advantages, it is crucial to acknowledge a few points that fall outside the scope of the grantor trust and which can significantly impact the grantor and the trust's beneficiaries.

1. Income tax liability

The grantor is responsible for all income taxes generated by the trust's assets, whether the income is distributed to the grantor or remains within the trust. This can be a financial burden as the grantor must have sufficient personal funds to cover these tax obligations.

2. Absence of asset protection from creditors

In a revocable grantor trust, the grantor is considered the owner of the trust assets for creditor claim purposes. This means that if the grantor faces legal judgments or financial liabilities, the assets held within the trust may be subject to their creditors' claims.

3. Potential complexity in trust formation and associated legal expenses

Drafting a grantor trust that accurately reflects the grantor's intentions and complies with relevant tax regulations can be a complex legal process. This complexity often necessitates the expertise of experienced estate planning attorneys, leading to potentially higher legal fees associated with the trust's creation and ongoing administration.

4. Risk of unintentional conversion to non-grantor status

Under any circumstances, if the grantor relinquishes their powers, the trust becomes a non-grantor trust. This shift in tax status can have significant and often unexpected income and transfer tax consequences for both the grantor and the beneficiaries.

Estate planning is a complicated process, and you very well may decide that a grantor trust doesn’t fit your needs. In that situation, consider looking at other types of trusts or speaking with a qualified estate planning attorney to help explain your options.

Use LegalZoom to create your grantor trust

LegalZoom's Will & Trust services provide a user-friendly, affordable, and legally sound solution for individuals and families seeking to protect their assets and ensure the well-being of their loved ones. Addressing concerns about the complexity and cost of traditional estate planning, LegalZoom simplifies the process of creating estate plans by combining technology with attorney guidance. This approach offers customers peace of mind and control over their future.

Here is what our customer has to say:

The process was fast, easy, and met my needs. The final product I received in the mail was spectacular! It exceeded my expectations!

- Barbara F., living trust customer

When you choose LegalZoom as your partner to create a living trust, you can access the following features:

- State-wise documents created by experienced estate planning attorneys that can be customized to your interests.

- Step-by-step questionnaire to guide you through the document creation process.

- Consult with an experienced attorney, get your documents reviewed, and update your estate plan accordingly.

- Store your documents securely online for easy access and updates.

Beyond Wills and Trusts, LegalZoom’s plans also include:

- Healthcare Directive (Living Will & Medical Power of Attorney) to describe your wishes regarding medical treatment if you are unable to communicate.

- Financial Power of Attorney to appoint someone to manage your finances if you become incapacitated

- HIPAA authorization to grant access to your medical information for a designated representative

Conclusion

Grantor trusts represent a sophisticated tool in the world of financial and estate planning. When implemented thoughtfully and with expert guidance, they can offer significant advantages in terms of wealth transfer, tax efficiency, and flexibility. It’s a distinct type of trust where the grantor, or the person establishing the trust, retains significant control and is considered the owner of the trust assets for income tax purposes.

However, the ongoing tax obligations and the potential for estate tax inclusion necessitate a thorough understanding of their implications. Ultimately, the decision to utilize a grantor trust should be based on a comprehensive assessment of individual circumstances, long-term financial goals, and a clear understanding of both the benefits and drawbacks associated with it.

FAQs

1. Is a revocable living trust a grantor trust?

Yes, a revocable living trust is a type of grantor trust. It is also known as a revocable grantor trust, wherein the grantor retains control over the trust assets and can amend or revoke the trust at any time.

2. Can the grantor be the trustee?

Yes, a grantor or settlor of a trust can also serve as a trustee. The grantor typically appoints a trustee when establishing the trust or decides to serve as the trustee as well. In a trust, the grantor and the trustee are two different roles with distinct responsibilities.

3. Can a grantor be a beneficiary?

Yes, a grantor can be a beneficiary and receive distributions from the trust’s assets. This can only happen in revocable trusts, because in irrevocable trusts, the grantor has limited access to the assets and therefore cannot be a beneficiary.

4. What happens to a grantor trust when the grantor dies?

If it's a revocable trust, the successor trustee appointed by the grantor will assume control of the trust upon the grantor's death. They are responsible for distributing the assets to the beneficiaries and settling all debts and tax liabilities. After the distributions, if there are any remaining assets that aren’t allocated within the trust, they’re merged into the grantor’s personal estate. This consolidated estate subsequently becomes liable for estate taxes, which are imposed on the transference of wealth from the deceased to their beneficiaries.

If it's an irrevocable trust, the trustee will continue to manage the trust. However, with this type of grantor trust, the unallocated remaining assets of the trust (after distributing the assets to beneficiaries) would remain separate from the grantor’s personal estate and avoid estate taxes.

5. Can a grantor trust be irrevocable?

Yes, a grantor trust can be irrevocable, in which the grantor relinquishes control over it, and then the grantor cannot revoke or make changes to it. However, in rare circumstances, if the trust document explicitly states so, or the court allows it with the consent of all trust beneficiaries, then the trustee may revoke or modify the trust.

6. Do I need a lawyer to create a grantor trust?

Even after doing your due diligence and researching grantor trusts, you may be unsure if they’re right for you. In such cases, we recommend consulting a qualified attorney for estate planning advice. These experts can answer your questions, review your specific circumstances, and provide you with straightforward advice on the best path to securing your legacy.

7. When should I not create a grantor trust?

Creating a grantor trust is not ideal when:

- Protecting your assets from creditors is a top priority. If your main goal is to shield your assets from potential lawsuits or creditors, a revocable grantor trust is generally not effective. Because the grantor retains control over the assets in this type of trust, creditors may still be able to access them.

- The grantor doesn't want ongoing income tax responsibility. In a grantor trust, the grantor is responsible for paying income taxes on the trust's earnings, even if they don't receive that income directly. If you want to avoid this ongoing tax responsibility, a non-grantor trust, where the trust itself or its beneficiaries pay the income taxes, might be more appropriate.

Chloe Packard, contributed to this article.