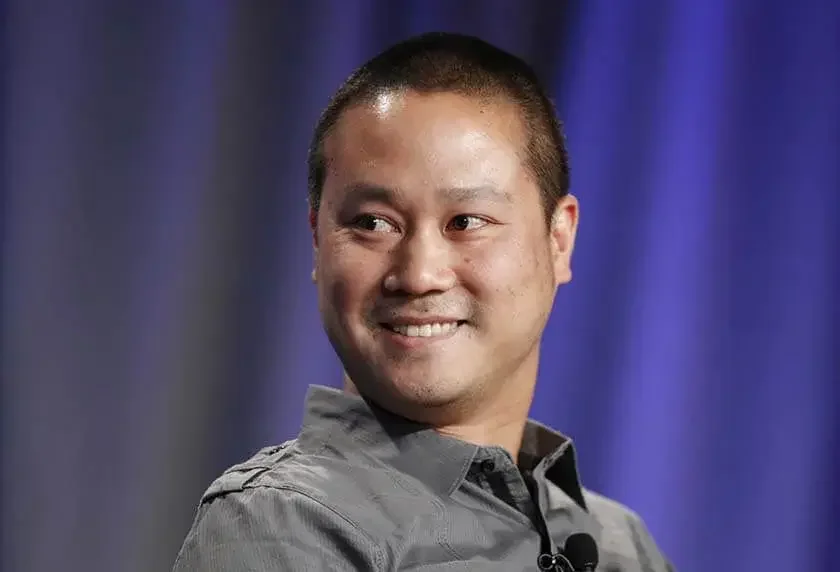

When Tony Hsieh, the former CEO of Zappos, died tragically in 2020, many were shocked to learn he had left no will. What happens to his fortune now is a knot that could take years to untie.

What will happen to Hsieh's fortune now?

Because Hsieh died intestate, meaning without a will in place, the courts were heavily involved with what happened to his assets. His fortune went into probate, the process the government uses to decide how to distribute the deceased's property.

According to Chris Castanes, president of Surf Financial Brokers, the first order of business will be to identify any outstanding bills that need to be paid. "His estate could be tied up for years as people come forward making claims," he says. "If he had borrowed money, all of his creditors will be first in line."

After any creditors are satisfied, a process that can take months, a probate court judge will decide how to distribute Hsieh's property.

Hsieh was a resident of Nevada, a community property state. That means a spouse would usually inherit his fortune, but Hsieh was unmarried. In Hsieh's case, his parents and his two brothers are his next of kin.

Andrew Chen, Founder of Hack Your Wealth, says that if Hsieh had no next-of-kin, his entire fortune could have ended up going to the state.

"Since Tony's estate is very large (reportedly approaching $1 billion), if no next of kin is found, this could mean a very large windfall to the state of Nevada and/or other states where Tony holds property," Chen says.

The drawbacks of dying without a will

Particularly if you have a large estate, dying without a will has the potential to cause a great deal of added stress to mourning loved ones.

Hsieh died suddenly, and so his family is grieving this tragic loss unexpectedly. About a month after his death, Hsieh's father and brother were named special co-administrators of Tony Hsieh's estate. His brother later resigned.

Kiara M. Santos, Founder and Managing Partner of Santos Legal Group, says having a plan in place eases your family members' burden and ensures your wealth stays with them.

"The importance of having a will or estate plan, especially for someone with such a high net worth, is that you want to protect your loved ones and make sure unintended parties don't receive your hard-earned money," Santos says.

If you die without a will, your passing might also cause familial strife and division. Many states will designate a family member to serve as executor, leaving that individual to make decisions about your estate. This can result in chaos, with the decision-making powers potentially falling into the wrong hands.

Jake Hill, CEO of DebtHammer, suggests that the court's choice of executor can mean disaster in extreme cases.

"The state will almost always find a family member to manage the estate," says Hill. "It then becomes their job to distribute assets as they see fit, which means a family member you didn't want inheriting anything can just cut out the rest of your family."

Why you should have a will

Whether or not you have a fortune like Tony Hsieh, having a will protects your assets from falling into the wrong hands and prevents an undue burden from being placed on your loved ones.

According to Chen, the probate process can be time-consuming as well as expensive.

"It can take a year or more to finish for large or complex estates like Tony's," he says. "Depending on the size of the estate, it's not uncommon for it to cost 10-20% of the estate's assets before any heirs actually get anything. That is why having a will is important: to reduce the time and expense involved in probate administration."