| BY CERTIFIED MAIL | ||||||||||||||||

Dear

This letter concerns the residential lease agreement, dated

I am hereby returning the security deposit to you.

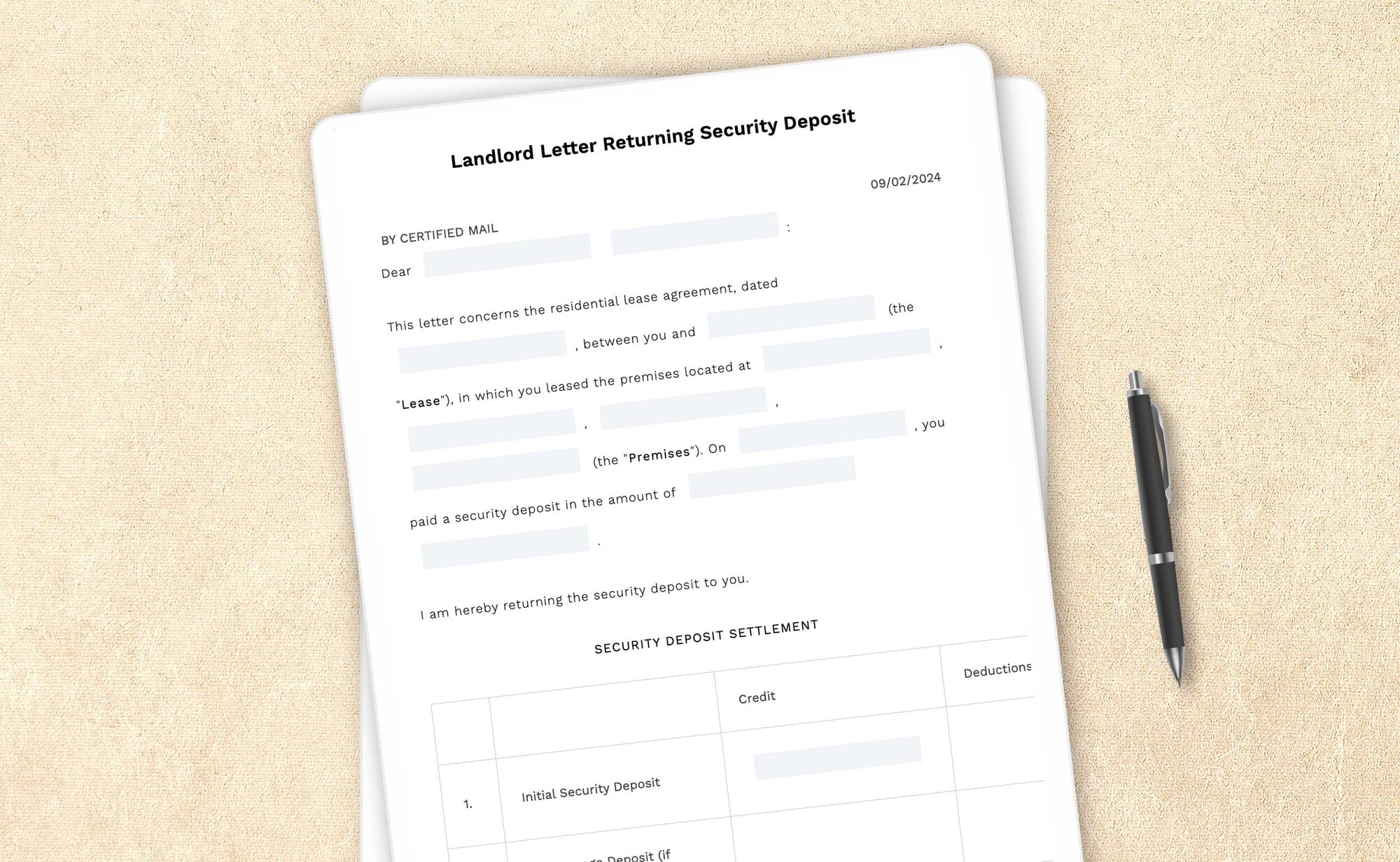

SECURITY DEPOSIT SETTLEMENT

| add border | |||||

|---|---|---|---|---|---|

| Credit | Deductions | Total | Comments | ||

| 1. | Initial Security Deposit | ||||

| 2. | Pet Damage Deposit (if applicable) | ||||

| 3. | Interest on the deposit(s) (at |

||||

| 4. | Total of 1-3 | ||||

| 5. | Repairs and maintenance (if available, attach photos of damage taken during walk-through) |

||||

| 6. | Cleaning (a) General Cleaning (b) Curtains (c) Carpet |

||||

| 7. | Painting | ||||

| 8. | Missing fixtures or appliances | ||||

| 9. | Damaged fixtures or appliances | ||||

| 10. | Pet damage (if applicable) | ||||

| 11. | Unpaid rent (if applicable) | ||||

| 12. | Total of 5-11 | ||||

| 13. | Balance due (4 minus 12) |

You must respond to this notice by mail within 7 days after receipt of same, otherwise you will forfeit the amount claimed for damages.

| Sincerely, |

| ____________________________________________________________ |

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Landlord security deposit return letter: How-to guide

Landlords have many legal responsibilities, including collecting and returning security deposits. This security deposit from tenants safeguards against any potential damage to the rented property during their stay.

Security deposits help to ensure tenants leave the rental units in good condition and that landlords receive all payments they owe before a tenant's departure. If a tenant causes damage or owes rent, the landlord can utilize the security deposit to cover the expenses. Once the tenant moves out, the landlord must send a letter enlisting the deductions made and the security deposit balance.

This guide contains everything you'll need to draft a letter returning a security deposit, ensuring you provide all relevant information about the security deposit's deductions and return.

What are the aspects to consider for a landlord security deposit return letter?

1. Covering the cost of repairing damage

A security deposit is intended to cover the costs of repairs or replacements that may be necessary due to any damage caused by the tenant during their stay. It is important to note that this deposit usually doesn't give coverage for normal wear and tear. The purpose of this deposit is to prevent the landlord from taking legal action to recover the costs of repairs or replacements.

2. Reviewing the relevant lease information

Before drafting your letter, review the relevant lease information, such as the lease period, including any provisions about termination and its consequences. Ensure you have met all your obligations under the lease before moving forward. It is imperative to adhere to these steps to avoid any potential legal complications that may arise.

3. Examining the property damages

It can be challenging to prove any significant changes in the condition of a rental property since the tenant moved in, which can create issues with security deposits. To avoid this problem, having non-tenant(s) witnesses inspect the property at the beginning and end of the lease period is a good idea. You can ask them to sign statements about the apartment's condition and any other details they may notice. It'll help to ensure that you have documentation to support any claims regarding the condition of the property.

4. Providing an inventory checklist

Provide the tenant with an inventory checklist at the start of the lease term. The list should have all the items in the unit and space for the tenant to note the condition of each item before they move in. The landlord can accompany the tenant on the walkthrough when they record the impressions in the checklist. Both the tenant and landlord should keep a copy of the completed checklist.

5. Listing changes to the condition of the property

At the end of the lease, it is a good practice to take another walkthrough of the property with the tenant and complete an inventory checklist. This checklist can be the same one used at the beginning of the lease agreement while the tenant was moving in. During this walkthrough, list any damage or changes to the condition of the property on the inventory checklist. It is also a good idea to take pictures of the unit to document its state at the time of the tenant's departure.

6. Deductions from the security deposit

A landlord may use the security deposit to take care of the charges of the cleaning costs when a tenant vacates the property by producing the repair and cleaning bills. However, they can only deduct an amount that'll return the unit to its same condition when the tenant first moved in. They can't deduct for routine cleaning to prepare the unit for the next tenant. These cleaning expenses differ from repair or replacement costs and can't be deducted from the security deposit.

Providing a list of deductions

A landlord must give the tenant a notice in writing that lists all deductions from their security deposit when they move out of a rental property. They should provide this notice within a specific timeframe after the lease has ended. In cases where the landlord couldn't provide a list of deductions, the tenant is entitled to the entire security deposit.

7. Utilizing the security deposit as rent

A security deposit isn't rent. It's the tenant's money, held by landlords for possible damages caused by the tenant or to clear any unpaid rent or dues. The landlord can't use the security deposit as the last month's rent unless agreed upon by both parties.

8. Complying with the state's security deposit laws

a) Informing tenants of security deposit rights in writing

Some states require informing tenants of their security deposit rights when they pay the deposit. Landlords are responsible for notifying the tenants in writing about their rights regarding the security deposit. These may include the right to be present during the property inspection. It is crucial to adhere to the rules set by your state regarding security deposits, as failure to do so may result in the loss of some or entire deposit.

b) Maximum security deposit amount

Certain states limit the maximum security deposit allowed to be held by landlords. Review your state's laws before demanding the security deposit for your property.

c) Types of institutions and timeframe

Specific state laws establish which types of institutions are authorized to collect residential security deposits. These laws also outline the timeframe the tenant must get the security deposit back after vacating the property. If your state enforces such regulations, it is crucial to comply with them.

d) Deductions

Landlords are usually allowed to deduct costs on various grounds. These may include property damage, unpaid rent, and unpaid late fees.

In some states, landlords can deduct expenses for professional cleaning, carpet cleaners, painters, and handypersons.

It is important to note that every deduction must have a receipt or an estimate accompanying it. Landlords must provide these documents to tenants. It is recommended to review your state's rules to determine what is required or permitted in your area according to the local laws.

e) Paying back the interest on the original security deposit

Landlords are typically required to pay interest on security deposits. This interest rate varies depending on the state but usually falls between 2% and 5%. Landlords need to pay the required interest within the designated period. By doing so, they can avoid any potential fines, fostering a good reputation as a responsible landlord. It ultimately benefits both the landlord and their tenants.

9. Refunding the security deposit

A security deposit is usually refundable in full. However, if a landlord needs to make deductions from it, they should provide a list of acceptable deductions in the lease. Communicate to the tenants about the circumstances under which you'll deduct and clarify these conditions in the lease.

It's important to note that even if the repair cost exceeds the security deposit amount, the landlord must still send a letter to the tenant explaining the damages and their intent to use the security deposit to pay for them.

10. Sending the letter and check via certified mail

As a landlord, you must return the remaining security deposit to your tenant along with an itemized letter.

However, before they move out, ask for their forwarding address. It's always a good idea to send this letter and check via certified mail. By doing so, you ensure that you have a documented delivery record. In case of any dispute, you'll have concrete proof that you have fulfilled your obligations. It helps in reducing potential conflicts and promotes transparency in the process.

Understanding the clauses of the landlord security deposit return letter

The following will help you understand the terms and clauses of the security deposit return letter.

1. Address

When your tenant moves out, make sure to ask for their new address where you can send their deposit. If you need clarification on the address they gave you or you don't have it, contact them to confirm the address. This way, you can be sure that the letter and the deposit balance will reach the correct address.

2. Introduction

This part of the security deposit letter refers to the original lease, its effective date, the tenant's move-out date, and the security deposit amount. Enter the appropriate dates and amounts. Write in the applicable state's name, and the days you must return a security deposit under your state's laws.

3. Security deposit settlement chart

This section mentions the detailed deductions from the security deposit. Each deduction should be included under the appropriate headings. Finally, calculate the amounts and determine the balance to be returned to the tenant.

- Initial security deposit: Enter the total amount received from the tenant as a security deposit at the beginning of the lease term, apart from amounts designated and used to pay the last month's rent or for similar purposes.

- Pet damage deposit: This section is applicable if the tenant made a pet damage deposit at the beginning of the tenancy. Enter the total amount you received from the tenant as a pet damage deposit. If the amount was initially included in the security deposit, don't include it again here.

- Interest rate: Enter the applicable interest rate in your state here. This interest rate will also apply to any pet deposit you've requested. Write in the amount of interest you have received on the security deposit and the pet damage deposit.

- Original security deposit amount: Add the amount obtained from 1,2,3 above.

- Repairs and maintenance: When listing expenses for repairs and replacements, attach pictures of the property taken during the walkthrough with the tenant.

- Cleaning: This includes the costs of cleaning the premises, carpets, curtains, and appliances, but only to the extent that this cleaning encompasses more than normal wear and tear. Itemize cleaning costs (e.g., for curtains or carpets) as applicable from case to case.

- Painting: This amount is the cost of repainting the premises. Deduct repair expenses from the security deposit only for damages beyond normal wear and tear, leaving those that occurred during a regular stay on the premises.

- Missing fixtures or appliances: Use the checklist prepared at the beginning of the lease term (listing the unit's fixtures and appliances) to check for missing items. Include any amounts paid or estimates for replacing these items in this section.

- Damaged fixtures or appliances: If you prepared a checklist at the beginning of the lease term that listed the condition of fixtures and appliances, use this list to compare the original condition to the condition at the end of the lease. Include any amounts paid or estimates for repairing these items here.

- Pet damage: This is applicable if the tenant's pet causes any damages.

- Unpaid rent: This is applicable if the tenant hasn't paid rent to the landlord in the previous month; the landlord may deduct the amount of that unpaid rent from the security deposit.

- Deductions: Add the amount obtained from 5, 6, 7, 8, 9, 10, and 11 above.

- Balance: The original security deposit amount (from section 4) minus any deductions (from section 12 above) by the landlord will leave a balance. This is the amount you'll send to the tenant.

Send a letter even if you don't owe it to your tenant (i.e., the balance is zero or the tenant owes you money). If your tenant owes you money, it may be a good idea to draft a letter that demands payment within a certain period. You can even send a late payment collection letter to the tenant notifying them of the default. Use LegalZoom’s wide collection of templates to make your letter drafting easier. LegalZoom also provides many other letter form templates that can be used by landlords and tenants.

If you owe a significant amount and are concerned about receiving it, you may contact an attorney to help ensure you receive the payment.

4. Conclusion of the letter

Attach a check for the balance of the security deposit (if any). Mention "partial" if you return only part of the security deposit and "full" if you return the entire amount. Insert your name under the signature line, and sign the letter.

5. Enclosures

Include receipts or estimates for repair or replacement costs. Keep copies of these documents for your records.

Frequently asked questions

What's a landlord security deposit return letter?

A landlord security deposit return letter lets a former tenant know they might be getting (at least some of) their deposit back.

When it's time for a tenant to move out, it's also time to assess whether or not they're getting all or any of their security deposit back. Considering the state of the place—appliances, furnishings, fixtures, paints, and more—you can easily calculate how much you'll pay back. This document keeps the process straightforward, detailing what deductions might have been made and why.

What information is needed to complete the landlord security deposit return letter?

- Who's the tenant: Have their name and contact information ready

- Who's the landlord: Have their name and contact information ready

- Where's the rental property: Have the address handy

- What deposits the tenant paid: Know what kind of deposits they paid and what they were for