Dear

| Sincerely, |

| ____________________________________________ |

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

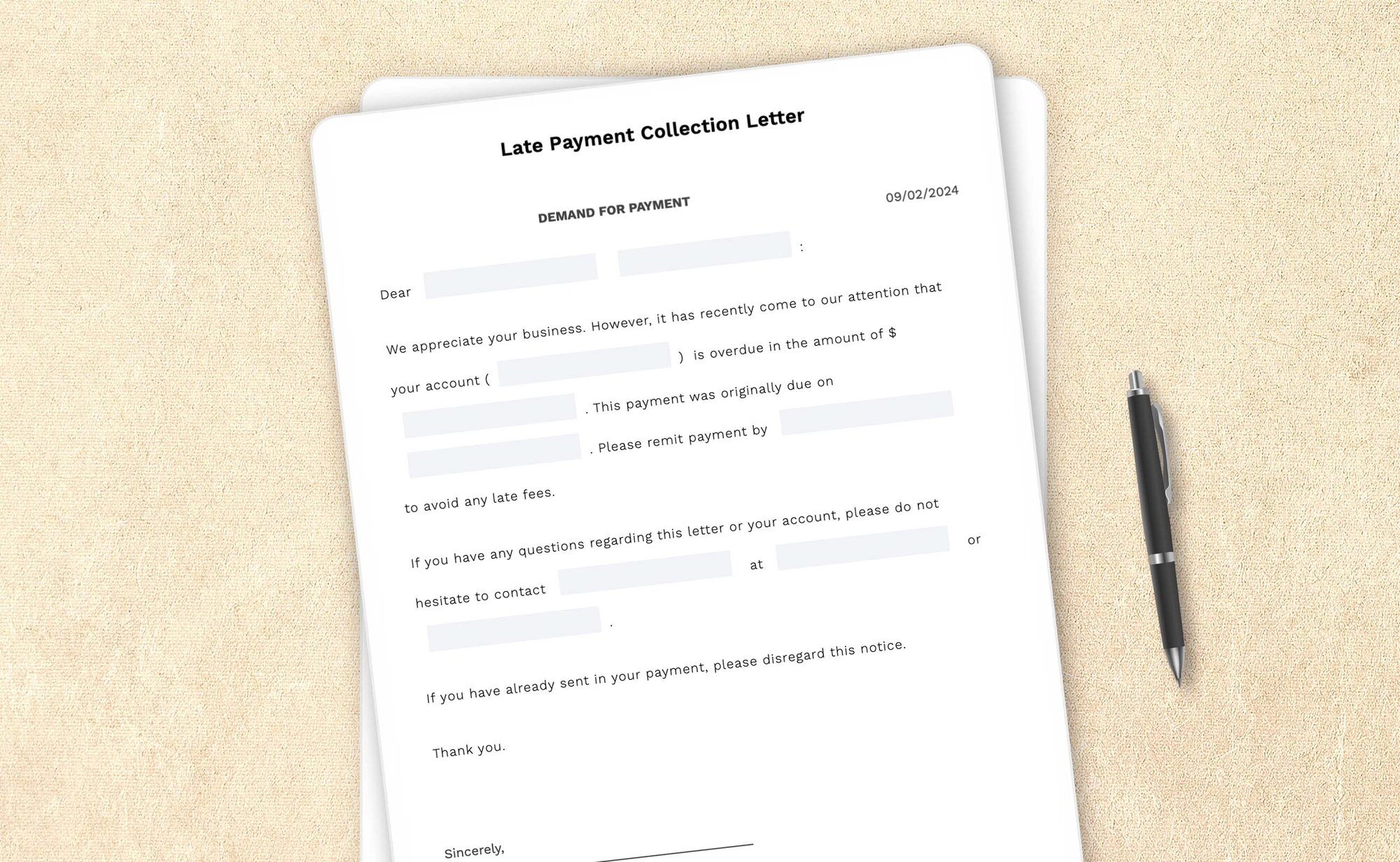

Late payment collection letter: How-to guide

You’ve started a business, created a marketable product, and attracted customers—the rest is easy, right? Unfortunately, one of the most complex and time-consuming activities for a new business owner may lie ahead—collections.

Although a customer has purchased your product, the transaction isn’t complete until the money is in your hands. Customers fail to make payments for many reasons—they forget, lose their jobs, are dissatisfied with the product, can’t raise the money, or don’t want to pay. Whatever their reason, the business owner must determine how to ensure these customers make their promised payments.

A well-prepared late payment collection letter is a good starting point to help you get what is rightfully yours. The correspondence sets a professional approach to your customers to pay the amount they owe you.

To create your late payment collection letter, you can check out LegalZoom’s letter template given at the top of this page. Start creating your letter by choosing the type of notice you want to send to your customer. LegalZoom provides you with a series of late payment collection letters, which you can send as first, second, third, last, and final notice before proceeding with legal action. You can pick the one that suits your requirements and create your letter document with ease. Just answer some simple questions, customize and fill out the document, and download it as a .pdf file.

In case you want to create other business letters, you can check the professional letter templates provided by LegalZoom.

Frequently asked questions

How can I collect an overdue payment from customers?

Collecting late payments can be one of the most frustrating chores for any business owner. Aggressive collection letters have their place, but they can alienate customers and erase the possibility of future business. An amicable first letter might get better results. You can also create a series of collection letters to pick the best tactic for your business and give customers ample chances to settle their debts with these notices.

What information do I have to add to a late payment collection letter?

Here's the information you'll need to have handy to complete your late payment collection letter:

- Who it's going to: Have the customer's contact information ready, including their full name and address

- Important details: This consists of the amount owed, the account number associated with the customer, and the due dates for paying the outstanding amount