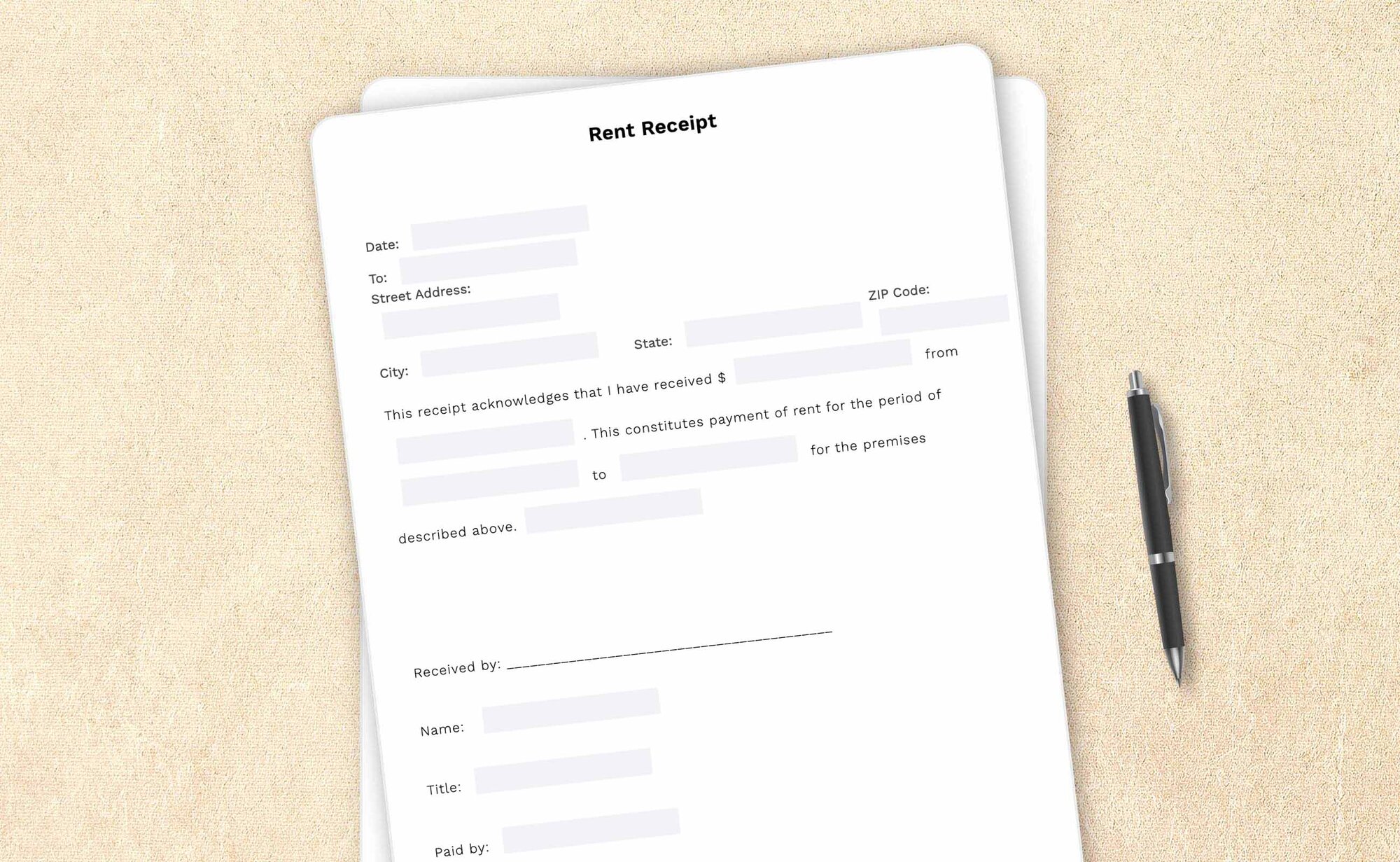

| Date: |

||

| To: |

||

| Street Address: |

||

| City: |

State: |

ZIP Code: |

This receipt acknowledges that I have received $

Received by: __________________________________________

Name:

Title:

Paid by:

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

A guide to creating rent receipts

As a regular part of our lives, we are accustomed to using receipts to prove that something has been purchased and paid for. The smallest purchase at a convenience store creates a piece of paper acknowledging the transaction. It makes sense that a person’s largest monthly expense should also be recorded and a written document issued.

A rent receipt provides evidence of a tenant’s rent payment and a landlord’s receipt of it. It protects tenants, particularly those who pay in cash or cashier’s checks, who might otherwise have no way to prove they paid their rent. It also protects landlords, who may be required by law to provide these documents.

With a rent receipt, both parties can continue the rental relationship with confidence that their interests have been considered and will be guarded.

Providing receipts to a tenant once isn't enough. Both the landlord and the property manager should give rent receipts to tenants till the rental agreement remains valid. In other words, rent receipts should be given for the entire rental period or whenever the tenant pays the rent.

Creating rent receipts from scratch on a month-to-month basis can be confusing and time-consuming. To avoid such hassles, a rent receipt template is always preferable, which makes the landlord’s job easier. Using a rent receipt template offers many benefits, such as:

- There are many online platforms that provide rent receipt templates. LegalZoom is one such platform where you can get your template for an affordable price. To create your document, you just need to fill out certain details provided in the rent receipt form, tailor it further to your needs with the help of the rich editor, and download the document to keep in your records.

- Using a template gives your receipts a professional appearance.

- As a landlord, you don’t have to type out repetitive information every single time you create a rent receipt from the template. All the basic information will already be in the template; you just need to update the date when the tenant makes the payment, payment amount, late payments (if any), payment type, and rent receipt number.

Basic guidelines you should follow while creating a rent receipt

1. Follow state laws to record rent payments

Some states require landlords to provide tenants with receipts after rent has been paid. Review your state’s laws to determine if this is a requirement in your area and if you must regularly provide a receipt or if you need to provide it only at a tenant’s request.

2. Creating rent receipts for bad checks provides evidence of business transactions

A receipt given for a bad check doesn't prevent a landlord from obtaining full payment from a tenant. A record of the bad check will disprove claims you have already been paid.

3. Property owners create receipts for tax purposes and tax deductions

Some states provide a renters’ tax credit, which may be taken when filing income taxes. If you have tenants who pay in cash or cashier’s checks in those states, they may need a receipt to take advantage of this credit. Talk to a financial professional if you have additional questions about local requirements and how they may affect your business.

4. Provide a rental receipt to avoid fines

If you don't provide receipts to your tenants after they have requested them in a jurisdiction where this is required, they can file a complaint with the local department of consumer affairs or its equivalent. You may be subject to fees and fines for any delay.

5. Provide rent receipts only after tenants pay the rent

Don't give a copy of the completed receipt to your tenant until you have received the payment. Although providing this document without meeting the formalities may be tempting and convenient, particularly as a favor to a long-term tenant, this simple act may prevent you from collecting the amounts you’re owed.

6. Keep rent payment receipt for your own records

Make a copy of every completed receipt for your records. Keep the copies together with the tenant’s lease and other correspondence.

Frequently asked questions

What's a rent receipt template?

From a pack of gum at a convenience store to a new laptop, we offer receipts for almost everything we sell. Receipts provide proof that something was paid for and other details about the transaction. A rent receipt template records how much a tenant has paid or owes. A rent receipt protects both parties from disputes in the future.

If you’re using a rent receipt template, keep the following information ready to complete the form:

- Who the tenant is: Name and contact information of the tenant

- How much the tenant has paid: Know how much rent they've paid and whether they still owe more