What does LLC stand for? Plus, tax and legal considerations

An LLC, or "limited liability company," is a business structure that protects business owners from personal liability for the limited liability company's business debts. LLCs as a business structure are very popular due to the ease of formation and generally low startup cost. This comprehensive guide explains what an LLC is, how it works, the different types of LLCs, tax implications, legal considerations, and whether it's the right choice for your business.

What is a limited liability company?

A limited liability company (LLC) is a business structure that protects owners' personal assets from business debts and lawsuits while offering flexible tax options. Unlike corporations, LLCs avoid double taxation, and unlike sole proprietorships, they provide liability protection—making them ideal for small to medium-sized businesses.

LLCs protect three key areas of personal assets in the event of business bankruptcy or lawsuits.

- Financial accounts: Personal bank accounts and investment portfolios remain separate from business debts.

- Real estate: Your home and personal property cannot be seized to satisfy business obligations.

- Personal property: Vehicles, personal belongings, and other assets stay protected.

How personal liability protection works

The legal separation between you and your LLC means creditors can only pursue business assets—not your personal wealth. However, this protection has limits. Courts can "pierce the corporate veil" if you fail to maintain proper business records, commingle personal and business funds, or commit fraud.

Pros and cons of LLCs

LLCs offer a simple, adaptable corporate structure perfect for businesses of any size. More importantly, they give protection from liability and control over finances. That said, they suit some business models more than others. So, before creating an LLC, you should weigh the pros and cons.

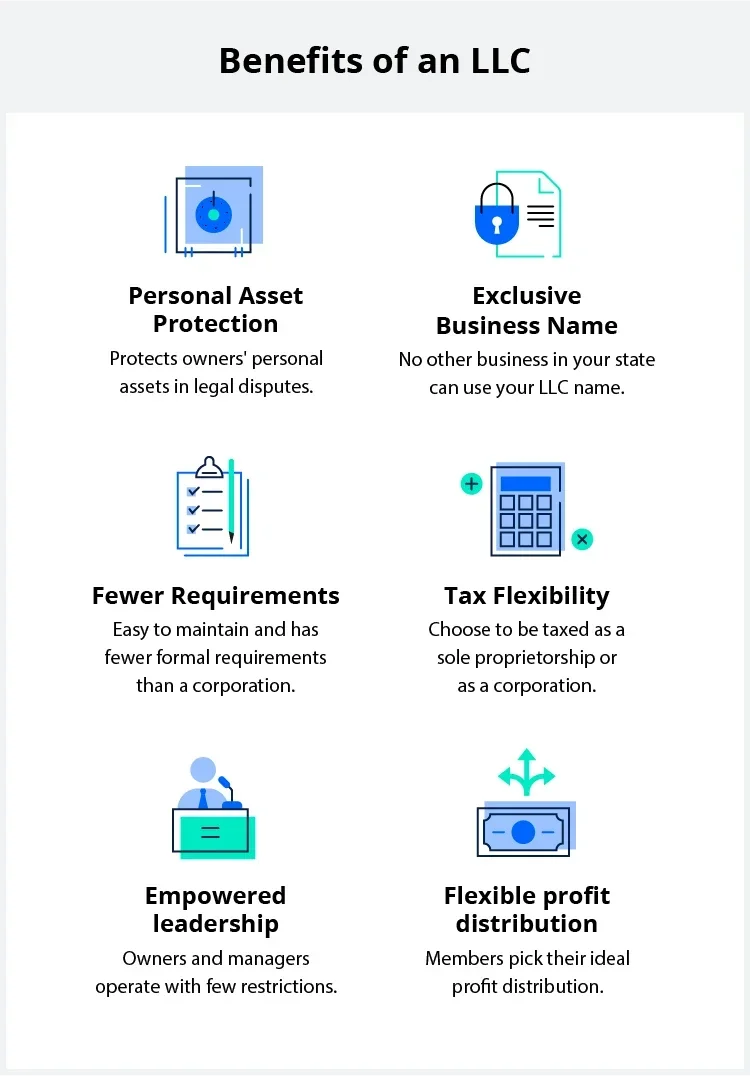

Benefits of an LLC

Beyond personal asset protection, LLCs offer several operational and financial advantages:

- Tax flexibility: Choose how you want to be taxed—as a sole proprietorship, partnership, S corporation, or C corporation. Single-member LLCs typically use pass-through taxation, where profits pass directly to your personal tax return and are taxed only once.

- Minimal compliance requirements: Unlike corporations, LLCs don't need to hold annual meetings, maintain extensive records, or follow rigid formalities. Decisions can be made by member agreement.

- Name protection: Your registered LLC name is exclusive within your state, preventing other businesses from using it.

- Flexible management: There are no restrictions on who can own or manage your LLC. You can have unlimited members and structure management however you choose.

- Customizable profit distribution: Distribute profits based on contribution, effort, or any arrangement members agree upon—not just ownership percentages.

Limitations of an LLC

Before forming an LLC, consider these potential drawbacks:

- State-specific restrictions. Some states prohibit certain professionals (doctors, lawyers, architects) from forming standard LLCs and require a PLLC instead. Others impose higher fees or franchise taxes.

- Higher costs than simpler structures. LLCs cost more to form and maintain than sole proprietorships or partnerships. Expect initial filing fees ($50–$500 depending on state), annual report fees, and potential franchise taxes.

- Limited transferability. You can't freely sell or transfer ownership interests. All existing members must approve new members, which can complicate exits or bringing in investors.

- Self-employment taxes. LLC members typically pay self-employment taxes on all business income, which can be higher than the payroll taxes employees pay.

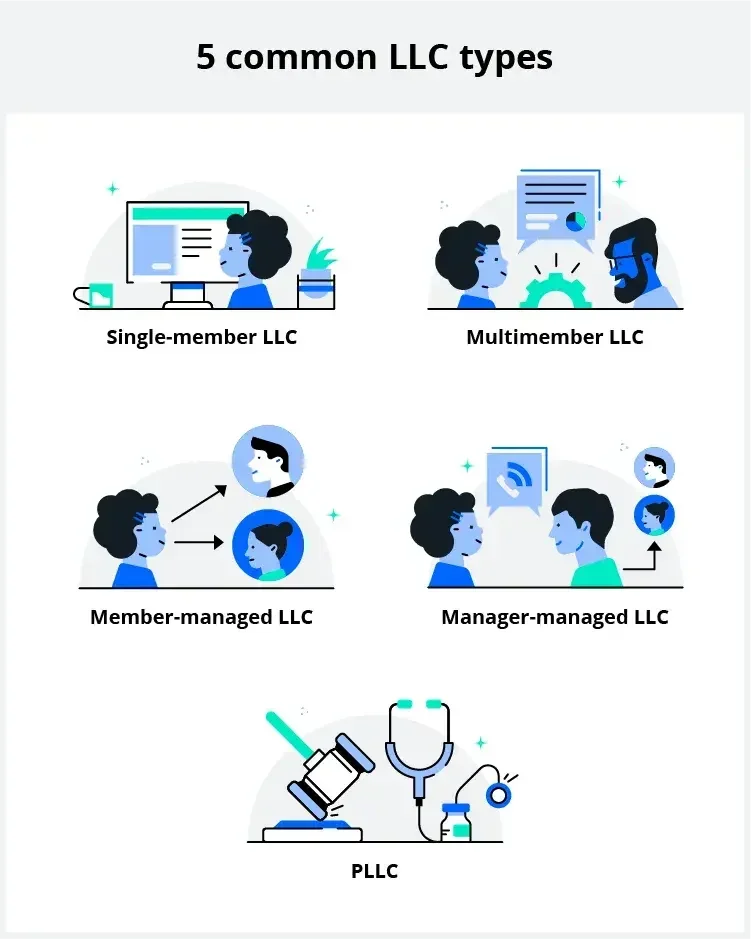

Types of LLCs

LLCs come in five main types, determined by the number of owners (called members) and how they're managed.

Five main LLC types

- Single-member LLC: Owned by one person. Offers low startup costs and simple paperwork, but the sole owner handles all compliance and tax obligations.

- Multi-member LLC: Owned by two or more people. Requires a written operating agreement signed by all members. Taxed as a partnership by default.

- Member-managed LLC: Owners actively run the business and make day-to-day decisions. Best for small businesses where all members want involvement.

- Manager-managed LLC: Owners hire outside managers or designate certain members to handle operations. Ideal for passive investors or larger LLCs.

- Professional LLC (PLLC): Required for licensed professionals (doctors, lawyers, accountants, architects) in most states. Provides liability protection but requires all members to hold active licenses in their profession.

Articles of organization

Articles of organization are the legal documents you file with your state to officially create your LLC. They establish your LLC's legal existence and outline its basic structure.

At minimum, your articles of organization must include:

- Business name

- Principal business address

- Registered agent information (name and address)

- Member details (names and addresses of LLC owners)

- Management structure (member-managed or manager-managed)

Some states require additional information, such as the LLC's purpose or duration. Check your state's specific requirements before filing.

LLC formation process overview

Forming an LLC typically takes 1–2 weeks and can cost anywhere from $50–$500 in state filing fees, depending on your location. While specific requirements vary by state, most follow these eight steps:

- Secure your business name. Make sure no other businesses in your state use your preferred name by conducting a thorough business search. If you choose a name that is already taken or is too similar to another name, your registration may be rejected. Be sure to follow your state guidelines, as every state is slightly different.

- Identify a registered agent to represent your LLC. You can appoint a third-party business or self-designate to receive legal documents in a lawsuit as your registered agent.

- Write a notice of intent to create an LLC. It's as simple as publishing a notice in your local newspaper announcing your intent. The newspaper staff can easily guide you in what to do. You may also need to file an affidavit of publication with your state. Note that this step is only required in New York, Arizona, and Nebraska.

- Create an LLC operating agreement. This document outlines ownership percentages, management responsibilities, and how decisions are made. While most states don't legally require one, it's essential for preventing disputes. A professional service like LegalZoom can help you create a customized operating agreement that complies with your state's laws.

- File articles of organization. This document is your official registration document with the state. It identifies your business name, address, registered agent, and other entity information.

- Pay your state's required fees. Initial filing fees vary by state, and an annual fee is common.

- Obtain certification from your state. After your LLC's approval, the state will provide a certificate confirming that your LLC legally exists. Once you've received this document, you can handle obtain an employer identification number (EIN) and business licenses.

- Register in other states. If your LLC operates in multiple states, you may need to register as a foreign entity in those states. Filing as a foreign entity is often similar to forming a business, but uses a different form and may carry different fees. You will need a registered agent in every state where you are registered as a foreign entity (in addition to the agent in your home state).

LLC tax overview

By default, the IRS treats single-member LLCs as sole proprietorships and multi-member LLCs as partnerships for tax purposes. However, LLCs can elect to be taxed as S corporations or C corporations if it provides tax advantages. Your tax obligations depend on your LLC type and how you choose to file.

Filing as a single-member LLC

The IRS treats single-member LLCs as "disregarded entities," meaning the LLC itself doesn't file a tax return. Instead, you report all business income and expenses on your personal tax return using Schedule C (Form 1040). You'll also need to pay self-employment taxes on your net earnings.

Filing as a multi-member LLC

The IRS treats multi-member LLCs as partnerships. The LLC files an informational return using Form 1065, but doesn't pay taxes at the business level. Instead, the LLC issues each member a Schedule K-1 showing their share of profits, losses, and deductions.

Each member reports their distributive share on their personal tax return and pays taxes at their individual rate. Members typically owe self-employment taxes on their earnings.

Filing as a corporation

Single-member and multi-member LLCs can also elect to file taxes as a corporation, which may reduce the amount your LLC owes. LLCs that file as corporations gain access to tax breaks and write-offs other structures can't use.

File Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items or flow-through taxation to a 1040 or 1040-SR from a C corporation's federal tax return. If your LLC files as an S corporation, it should file Form 1120-S, U.S. Income Tax Return.

Check out the Internal Revenue Service website for more information on LLC filing methods, and consult a CPA for expert advice on what method is right for you.

How does an LLC compare to other business structures?

The best structure for your business depends on your liability protection needs, tax preferences, and growth plans. Here's how they compare:

| Business Structure | Liability Protection | Taxation | Complexity | Best For |

|---|---|---|---|---|

| LLC | Yes | Pass-through (default) | Low to moderate | Most small to mid-size businesses |

| Sole proprietorship | No | Pass-through | Very low | Solo freelancers, low-risk businesses |

| Partnership | No (except LLP) | Pass-through | Low | Multi-owner businesses willing to accept risk |

| C corporation | Yes | Double taxation | High | Large businesses seeking investors |

| S corporation | Yes | Pass-through | Moderate to high | Growing businesses wanting tax savings |

Key differences between business structures

- Sole proprietorship: Easiest to start with pass-through taxation, but offers zero liability protection. Your personal assets are fully exposed to business debts and lawsuits.

- Partnership: Similar to sole proprietorship but with multiple owners sharing profits and unlimited liability. Consider an LLP (Limited Liability Partnership) for liability protection.

- C corporation: Strongest liability protection with unlimited growth potential, but faces double taxation (corporate and personal) and requires extensive compliance including board meetings and shareholder records.

- S corporation: Combines liability protection with pass-through taxation but has strict ownership restrictions (max 100 shareholders, all must be U.S. citizens or residents). An LLC can elect S corp taxation without these limitations.

LLC legal considerations

LLCs must maintain legal compliance in four key areas: management structure and documentation, capital contributions and financial obligations, membership transfers and withdrawals, and dissolution procedures. Your operating agreement should address each of these to prevent disputes and maintain liability protection.

LLC management

While LLCs face fewer compliance requirements than corporations, you must still maintain proper documentation. Your operating agreement should detail:

- Management authority: Who makes decisions and how voting works

- Roles and responsibilities: Each member's or manager's specific duties

- Profit distribution: How and when you'll distribute earnings

Most states also require annual reports listing your current address, members, and registered agent. These typically cost $20–$300 annually. Failing to file can result in penalties or administrative dissolution of your LLC.

Capital contributions

Your operating agreement should specify how the LLC can raise additional capital when needed. You have two main options:

- Allow existing members to contribute additional funds in exchange for increased ownership

- Permit new members to join by making capital investments

Your operating agreement should define the process, approval requirements, and how additional contributions affect ownership percentages.

Transfer or withdrawal of interest

Your operating agreement should establish clear rules for member changes to prevent disputes. Address these critical issues:

- Withdrawal rights. Can members leave voluntarily, and what's the buyout process?

- Right of first refusal. Must members offer their interest to existing members before outside buyers?

- Death or disability. How are interests handled when a member dies or becomes incapacitated?

- Transfer restrictions. Can members freely transfer ownership, or do remaining members need to approve?

Without these provisions, unexpected member departures can drain capital and create legal battles. A structured transfer process protects both the LLC and its remaining members.

Starting a business takes courage. LegalZoom makes sure the legal details don’t stand in your way, from the day you register until the day you retire.

Dissolution of the LLC

Your operating agreement should outline when and how the LLC can be dissolved. Include the voting threshold required (such as unanimous consent or majority vote) and procedures for winding down operations, paying debts, and distributing remaining assets. Clear dissolution terms prevent costly legal battles when members disagree about the company's future.

International business using an LLC

If you plan to operate internationally, understand that not all countries recognize U.S. LLCs. You'll need to comply with local business structure requirements, tax laws, and registration fees, which vary significantly by country.

Key considerations for international operations:

- Formation costs. When you start doing business overseas, you may need to register in each country where you operate. Some countries charge significantly more (e.g., UAE charges ~$7,000 setup plus $4,000 annual renewal)

- Structure recognition. Certain countries don't recognize LLCs (e.g., South Africa requires a structure called proprietary limited company)

- Tax obligations. You may face taxation in both the U.S. and the foreign country

Consult with an international business attorney before expanding overseas to ensure compliance and optimize your structure.

Is an LLC a good idea for my business?

An LLC makes sense if you want liability protection without the complexity of a corporation.

- Small to mid-size businesses: You want to protect personal assets from business debts and lawsuits

- Businesses with multiple owners: You need flexible profit-sharing arrangements beyond ownership percentages

- Growing businesses: You want the option to choose your tax treatment (sole proprietor, partnership, S corp, or C corp)

- Service-based businesses: You face potential liability from client work

An LLC may not be the best choice if you're planning to seek venture capital funding (investors typically prefer C corporations) or if you're a solo freelancer with minimal liability risk and want to avoid formation costs.