What does LLC stand for? Plus, tax and legal considerations

An LLC, or "limited liability company," is a business structure that protects business owners from personal liability for the limited liability company's business debts. LLCs as a business structure are very popular, but how do you know if it's your right choice? Let's explore all that you need to know in our definitive LLC guide.

What is a limited liability company?

A limited liability company is a business designation that limits the personal responsibility of its owners for their company's debts and liabilities while also allowing them to avoid the double taxation often associated with corporations. Instead, the responsibility falls on the LLC, meaning the firm is its legal entity.

In bankruptcy or a legal dispute with the business, LLCs protect owners' personal assets like bank accounts, homes, and cars. Thanks to these LLC advantages, they're popular among many new business owners of small and medium-sized businesses.

Personal liability

LLCs are so popular because they limit the personal liability of their members and owners, protecting their personal assets. LLCs are designed to keep their owner's assets separate from their business assets so that in the case of bankruptcy or lawsuit, the personal assets and personal income of the LLC's owners and members are protected from business liability.

Pros and cons of LLCs

LLCs offer a simple, adaptable corporate structure perfect for businesses of any size. More importantly, they give protection from liability and control over finances. That said, they suit some business models more than others. So, before creating an LLC, you should weigh the pros and cons.

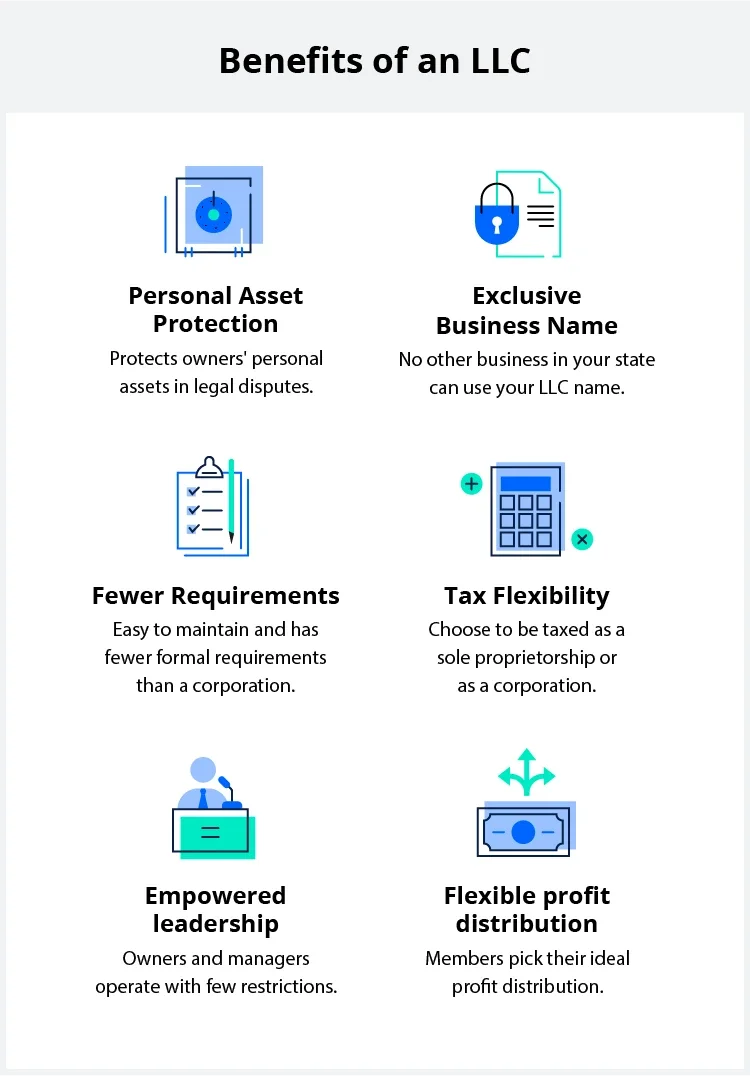

Benefits of an LLC

While personal asset protection is one of an LLC's most attractive features, other benefits come into play, such as:

- Flexibility in filing taxes. Single-member LLCs often file taxes as sole proprietorships, and profits only get taxed once. As the owner, the tax liability "passes through" to your personal tax return—known as pass-through taxation. A single-member LLC can also elect to pay taxes as a corporation. A single-member LLC is a disregarded entity with related tax benefits.

- Little bureaucracy and red tape. An LLC is easy to maintain and has fewer formal requirements than a corporation. You can carry out any leadership decisions all members agree on. Members can even open bank accounts and credit cards in the company's name.

- No other business in your state can use your name. By registering your LLC's name, you secure exclusive use of that name.

- Protects your personal assets. LLCs protect their owners' assets in the case of a legal dispute. Without limited liability protection, creditors consider owners as company assets. With this protection, company liability doesn't fall on the members.

- Few restrictions on ownership and management. Unlike corporations, LLCs have fewer constraints on the type of leadership they operate under and do not restrict ownership. LLCs can have as many members as the leadership agrees on and a flexible management structure. Also, LLCs aren't as beholden to shareholders and board directors as corporations are, giving management more control.

- Flexibility in profit distribution. LLCs don't need to distribute profits equally or according to ownership percentages. Instead, members can determine how they distribute profits based on work contributions or past performance.

Limitations of an LLC

Despite the benefits of LLCs, they come with drawbacks, too. Owners need to weigh operational costs, registration, and legal compliance against an LLC's other tax advantages and disadvantages. The main disadvantages include:

- State-by-state restrictions. Some states impose extra fees on running an LLC. Additionally, certain states restrict professions like doctors and dentists from working through an LLC.

- Increased cost. LLCs cost more to start and maintain than a general partnership or sole proprietorship. Annual reports and franchise tax fees further increase the price.

- Restrictions on transferability. Unlike a corporation, all LLC members must approve each new member and membership transfer.

- Extra taxes on split income. All income an LLC earns could be subject to self-employment taxes or payroll taxes.

Articles of organization

The articles of organization are legal documents that are filed with the Secretary of State when you form your LLC. The articles of organization outline the basics of your LLC. Articles of organization include:

- Business name and address

- LLC's registered agent

- Names and important information on LLC members

Articles of organization are also used to set up how the new company will be run, including the rights, powers, duties, liabilities, and other obligations each LLC member has. Having the guidelines in an official document can help your LLC run smoothly as your business moves forward.

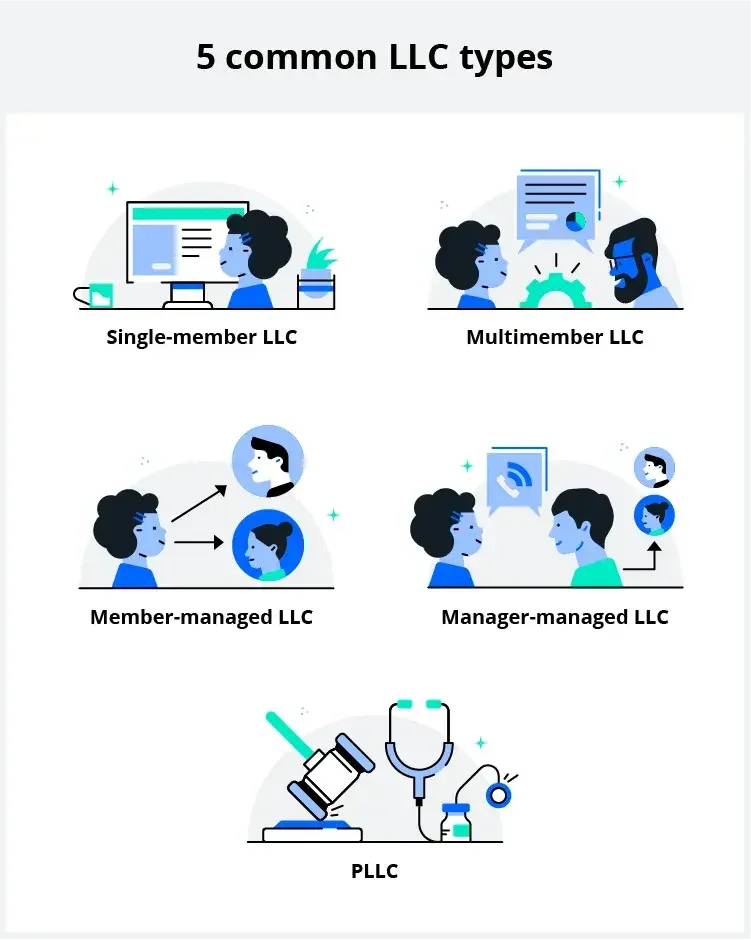

Types of LLCs

LLCs include single-member, multimember, multi-member, -managed, manager-managed, and PLLCs—professional limited liability companies.

The individuals who own and run LLCs are called members. Limited liability companies' members invest capital, or membership interest, to claim a stake in the business. The number of members involved and their managerial approach determines the type of LLC they run. We've outlined the main LLC types below to break down the differences in limited liability companies.

Single-member LLCs

If you're the sole owner of an LLC, it's a single-member entity. Single-member firms benefit from low startup costs and minimal paperwork compared to other LLCs. However, you are held personally responsible for legal compliance, debt payoffs, and tax filing.

Multiple-member LLCs

An LLC with more than one member is known as a multiple-member or LLC. All members must sign off on the firm's written operating agreement to run legally. Besides that, setting up this type of LLC is similar to its single-member counterpart.

Member-managed LLCs

An LLC is member-managed when members manage the business themselves. These members can act on the company's behalf so long as they adhere to the operating agreement.

Manager-managed LLCs

Manager-managed LLCs involve members hiring managers to run operations. This allows owners to place leadership decisions in trusted staff's hands. The details of a manager-managed corporate structure should go in the operating agreement.

PLLCs

A professional limited liability company runs like other LLCs but focuses on certain professions. PLLCs form when states with regulatory board licenses on specific professional services or trades prevent these professionals from forming normal LLCs. In these cases, accountants, legal advisers, or medical workers often work under PLLCs instead.

How does an LLC compare to other business structures?

The most common alternatives to an LLC are corporations, partnerships, and sole proprietorships. Each business structure presents benefits and drawbacks over LLCs. Here's a brief explanation of other kinds of business structures.

Sole proprietorships vs. LLCs

With sole proprietorships, the business owner—or sole proprietor—has total control over the business and benefits from pass-through taxation. Its biggest drawback is unlimited personal liability. The sole proprietor is completely liable for all the company debts.

Partnerships vs. LLCs

Partnerships include two or more owners who agree to share a jointly owned business' assets, liabilities, and legal burdens. Partnerships place no caps on business liabilities. As a result, owners can have their assets seized to pay off debts. Unlike an LLC, partnerships aren't legal entities in themselves.

Corporations vs. LLCs

A corporation is a more formal business entity involving bureaucracy, ongoing paperwork, and stricter reporting than an LLC. There are shareholders instead of members, and stock is issued to raise money. In addition, you must elect a board of directors to lead operations. Finally, even though LLCs aren't corporations, they can still elect to be taxed and file taxes as one.

S corporations vs. LLCs

S corporations are a form of business entity that uses pass-through taxation to pass their income, losses, credits, and deductions to shareholders. As a result, the S corporation shareholders report their income and losses on their owners' personal income and personal tax returns at individual tax rates instead of the corporate tax rate. The S corporation business entity also avoids double taxation on corporate earnings. An S corp has some specific advantages.

LLC legal considerations

While LLCs shield members from liability, they also must adhere to certain legal guidelines. State and federal law compliance involves research, planning, and careful leadership. Your operating agreement needs to address these concerns and provide a roadmap when legal questions arise.

LLC management

Generally, an LLC has fewer entity-related responsibilities than a corporation. However, LLCs are legally obligated to create an operating agreement that details:

- How the company's members, managers, and officers conduct business

- Who is responsible for what tasks

- How you distribute income

Many states require LLCs to file a report yearly, which includes a filing fee. These reports detail their current business locations, activities in the state, and any changes in their current members and managers. Filing the report and paying the related filing fees keep management compliant with state law.

Capital contributions

Businesses, including LLCs, look for inventors when capital is low. Operating agreements outline the terms for adding capital contributions to the owners of an LLC.

Some LLCs allow new members if they invest significantly in the company. However, some LLCs prefer to keep the current leadership. In this case, the operating agreement will outline a process for drawing more capital from existing members.

Transfer or withdrawal of interest

LLC owners and members decide how owners can transfer or withdraw their interests. Control over business interests ensures that all members approve of new additions and departures. For control over your members, answer these questions in your operating agreement:

- Can members withdraw their interest in the LLC? What is the process for doing so?

- Do members have a right to match offers made for a member's interest?

- How are interests transferred after the death or injury of a member?

- Can members voluntarily transfer their interest to anyone they choose? If not, who is eligible to replace them?

If members can withdraw their capital from the LLC anytime, the small business owners' personal finances take a hit. However, building a process around the transfer of interest allows you to change members without jeopardizing the company. It will also avoid legal disputes and court fees.

Dissolution of the LLC

In rare cases, members will choose to dissolve their LLC. First and foremost, the operating agreement should outline a dissolution process. Additionally, it needs to set guidelines in case some members want to dissolve the LLC, and others don't.

Members could avoid facing a legal battle or bidding war for company interests if one owner of the agreement controls this process.

International business using an LLC

LLCs that operate overseas are called offshore LLCs. Even though you can run an offshore LLC from your home state, there's a catch. Your business must meet the laws and tax guidelines of any country you operate in. Depending on where you do business, LLC laws apply: There may be extra guidelines, costs, or LLC components the U.S. doesn't recognize.

For example, the United Arab Emirates imposes setup fees on LLCs of about $7,000. In this case, forming an LLC abroad is much more expensive. On top of that, you'll need to renew your license each year for about $4,000.

Sometimes, LLCs aren't recognized. South Africa, for example, uses a proprietary limited company (Pty Ltd.). A Pty Ltd. C corp isn't expensive to form and protects shareholders from personal liability. However, they can only have up to 50 shareholders, and Pty Ltd. shares are more difficult to transfer.

Tip: Before doing business abroad, research the costs and guidelines of doing business in another country.

State-by-state LLC requirements

An LLC must qualify to run in any state where it conducts intrastate business. Some states also require qualification if you conduct interstate business from that location.

Registering as a foreign business in other states is similar to registering in your home state. We've included a table summarizing important registration information, including for foreign entities, below.

LLC tax overview

Different types of LLCs pay taxes through unique forms and channels. Your forms and tax rate depend on the structure of your business and filing decisions. LLCs generally file taxes as a sole proprietorship, partnership, or corporation. LLC taxes and filing statuses fall into three categories:

Filing as a single-member LLC

If your business is a single-owner LLC, the Internal Revenue Service, or IRS, views it similarly to a sole proprietorship for federal tax purposes. That means the LLC doesn't need to file a return with the IRS. However, as the sole owner, you must report all profits and losses when you file your personal taxes with the Internal Revenue Service.

According to the Internal Revenue Code, in order to file taxes, report your operating results by submitting Profit or Loss Form Business (Sole Proprietorship) (Form 1040, Schedule C) with your 1040 personal tax returns.

Filing as a multi-member LLC

In the case of a multiple-member LLC, the IRS views your business as a partnership. Therefore, the co-owned LLC doesn't pay income taxes. Instead, each LLC owner pays taxes on their share of the profits on their income tax returns.

File the return on Form 1065, U.S. Return of Partnership Income. Each owner should show their pro-rata share of partnership income, credits, and deductions on Schedule K-1.

Distributive shares refer to each member's share of the LLC's profits. Members must report this sum on their own personal income and tax returns. The IRS reviews each member's tax return to ensure that LLC members report their income correctly.

Filing as a corporation

Single-member and multi-member LLCs can also elect to file taxes as a corporation, which may reduce the amount your LLC owes. LLCs that file as corporations gain access to tax breaks and write-offs other structures can't use.

File Form 1120, U.S. Corporation Income Tax Return. The 1120 is the C corporation income tax return, and there are no flow-through items or flow-through taxation to a 1040 or 1040-SR from a C corporation's federal tax return. If your LLC files as an S corporation, it should file Form 1120-S, U.S. Income Tax Return.

Check out the Internal Revenue Service website for more information on LLC filing methods.

LLC formation process overview

The process of starting an LLC is fairly simple. Although specific requirements vary by state, most LLC formation processes tend to follow these general steps:

- Secure your business name. Make sure no other businesses in your state use your preferred name. When registering, your state will let you know if there's an issue. And often, you must add "LLC" or "limited liability company" to your name.

- Identify a registered agent to represent your LLC. You can appoint a third-party business or self-designate to receive legal documents in a lawsuit as your registered agent.

- Write a notice of intent to create an LLC. It's as simple as publishing a notice in your local newspaper announcing your intent. The newspaper staff can easily guide you in what to do. You may also need to file an affidavit of publication with your state.

- Create an LLC operating agreement. Most states require an operating agreement, helping members of an LLC avoid issues down the road.

- File articles of organization. This document identifies your business name, address, and other entity information. Your state may already have a form that's easy to fill out.

- Pay your state's required fees. Initial filing fees vary by state, and an annual fee is common.

- Obtain certification from your state. After your LLC's approval, the state will provide a form confirming that your LLC legally exists. Once you've received the documents, you can handle business processes like obtaining a tax ID number and business licenses while opening a business bank account.

- Register in other states. If your LLC operates in multiple states, you may need to register in those other states and consider an additional registered agent. Thankfully, most states have a similar process. First, find the founding documents that went into your first registration. Next, you can attach these forms to your new state's paperwork. Finally, find a registered agent in each state your business runs in.

Is an LLC a good idea for my business?

If you're in a sole proprietorship or partnership looking to develop your business, you might want to consider forming an LLC. Pivoting to an LLC is perfect for businesses and owners that want:

- More protection from individual liability for business debts and lawsuits

- Flexible profit distribution

- Additional filing options on your taxes

- Leadership power in the hands of core members

Now that you better understand the ins and outs of an LLC, you can see why it's a popular structure that may be right for your new business venture. Whether you run a small business or a growing corporation, learning the strengths and weaknesses of your model can help improve operations.