BY REGISTERED MAIL

RE: Demand for Full Payment of Installment Promissory Note

Dear

This letter relates to the promissory note dated

Sincerely,

__________________________

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

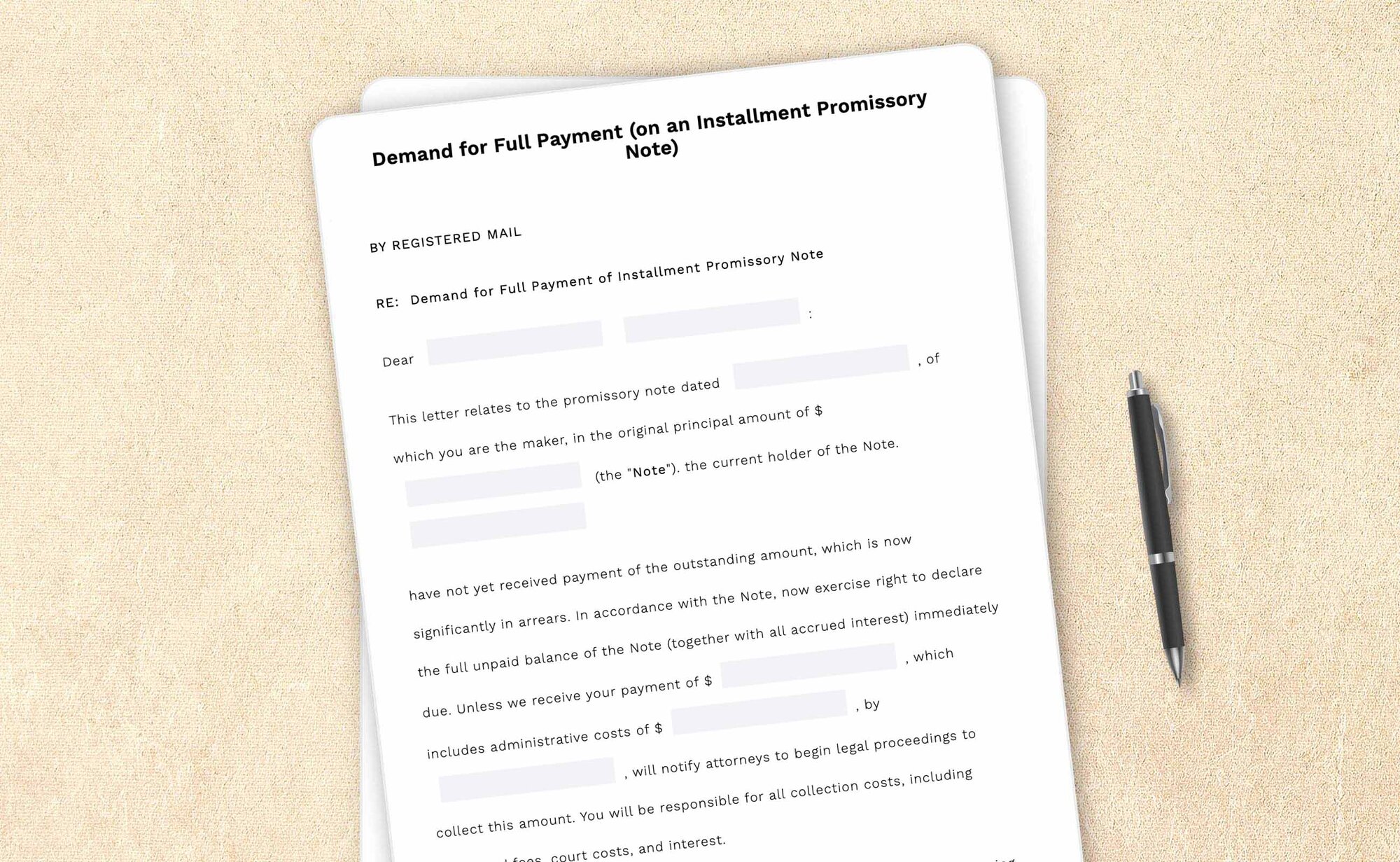

What's a demand for full payment on an installment promissory note?

Every lender hopes that the repayment of their loan money will come on time. But sometimes, it doesn’t happen. As the lender, you want to make sure you are paid back. Often, all it takes is to send a notice reminding the payment of the loan amount. This is called a demand for full payment. If an installment promissory note has been issued, it’s called a demand for full payment on an installment promissory note. Collect the full amount of loan money that is due to you.

Here's the information you'll need to have handy to complete your demand for full payment on an installment promissory note:

- Who it's going to: Know who this document is going to and have the individual or business name and contact information ready

- Date: Have the date the original promissory note was issued handy