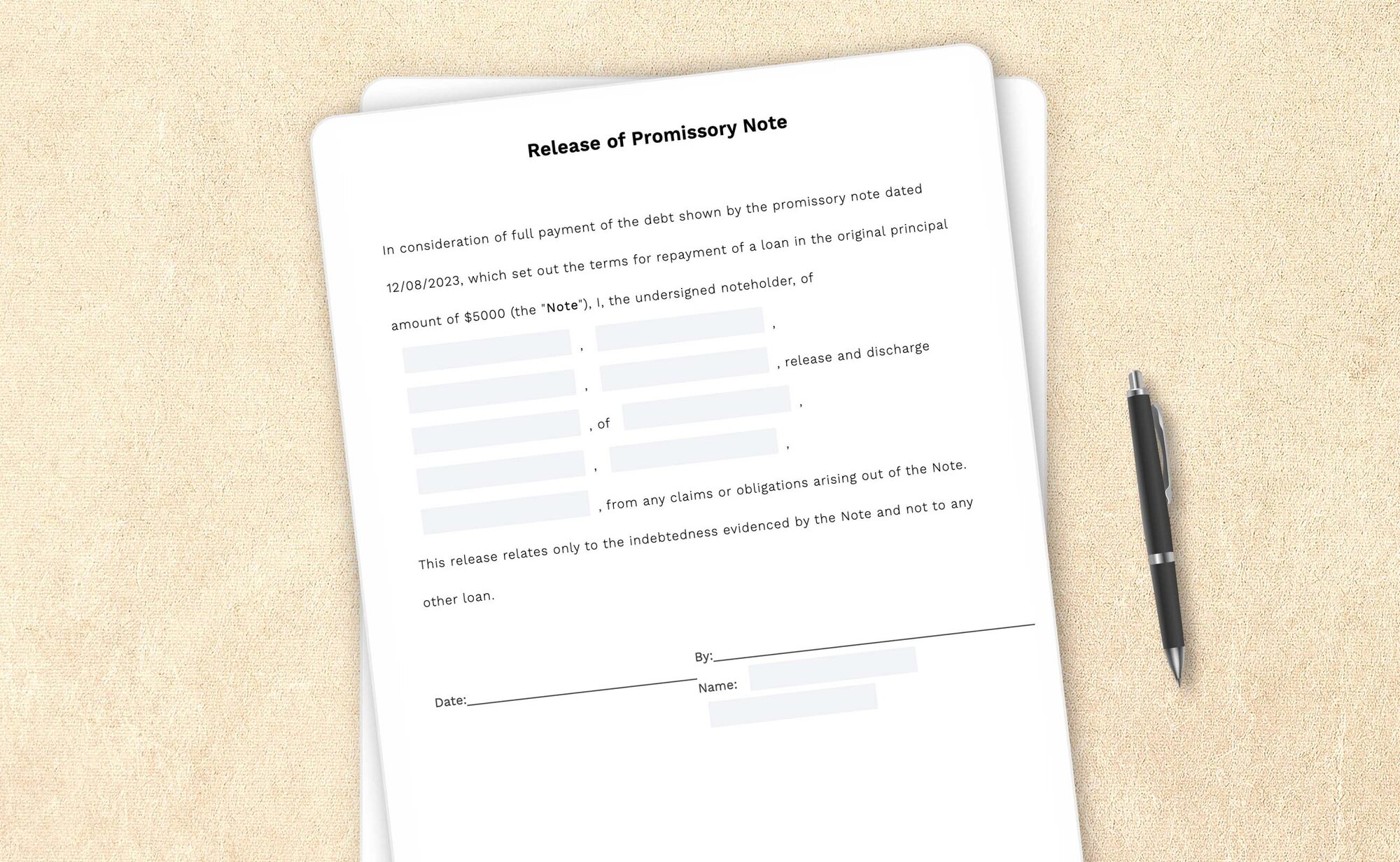

In consideration of full payment of the debt shown by the promissory note dated

Date:__________________________________ |

By:______________________________________________________________ Name: |

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Release of promissory note: How-to guide

It is vital to pay attention to the end of an agreement, just like it is to the beginning. Once a promissory note has been paid off, releasing the parties from their duties of debt owed is crucial. It'll discharge all further obligations of the original principal amount or the interest for the lender and the borrower, leading to an amicable conclusion.

A release is the definitive end of the parties' commitments under a note. A well-crafted release form can prevent future misunderstandings and disputes. While it may not guarantee complete protection, it can strengthen the defense.

It is important to note that the end of a loan arrangement isn't the end of a relationship. It may open avenues of discussion with the other party that might otherwise have been closed. You can review your mutual expectations and concerns, assess the project's successes and failures, and lay the groundwork for future agreements and interactions. A thorough evaluation of each party's performance allows for a better understanding of the requirements for the release. This can be executed in the best interest of all.

What are the key aspects to consider before releasing a promissory note?

The following are the key points to consider:

1. Ensure completion of duties before signing

Ensure both parties have performed all their duties before signing a release: once the document is signed, the note is void. Review the note and any related loan documents, and draft a list of each party's obligations and rights. Take a moment to ensure that your interests have been satisfied.

2. Release the liens

If the promissory note was secured by the borrower's property, ensure that any documents evidencing those liens are terminated or canceled. For example, if the lender filed a UCC filing statement with a government authority, it must make a termination filing to release that lien.

3. Provide ample review time

Allow each party to review the original note, loan agreements, and release. It’ll reduce the likelihood, or at least the efficacy, of a claim that a party didn’t understand any terms or how those might affect their rights and obligations.

4. Review the terms

Review the terms of your promissory note and loan agreements. They may include information about the steps that must be taken to end the arrangement. If there are specific procedures you must follow according to your agreement, ensure that you have followed them.

5. Comply with the obligations

The terms of your original agreements are still in effect, so ensure both parties continue to perform their obligations under that agreement until the release is completed and signed.

6. Get the release notarized

It's a good idea to have your release notarized. It'll limit later challenges to the validity of the signature or of the release itself.

Important components of promissory note release

1. Identifying information

Mention all identifying information about the promissory note, including its original amount and effective date.

2. Mentioning addresses

Provide the address for each party.

3. Sending the release

It is a good practice to send the release form by registered mail to keep a record of your actions in case any disputes arise later.

Frequently asked questions

What's the release of a promissory note?

To end an agreement made through a promissory note after the borrower has paid back the loan, you can use a release of promissory note form. It marks the deal as completed and helps tie up any loose ends.

What information is needed to complete the release of a promissory note?

Here's the information you'll need to complete your release of promissory note:

- Who the lender is: Know if a business or individual signed the promissory note and made the loan, and have their name and contact information ready

- Who the borrower is: Know if the borrower is a business or individual and have their name and contact information ready

- When the note was signed: Know the month, day, and year when the original promissory note was signed

What is a promissory note release form?

A promissory note release form is issued by a lender to a borrower after the final payment on the note. This would absolve the borrower from any future obligations. It is usually issued after all the terms of the note are satisfied.