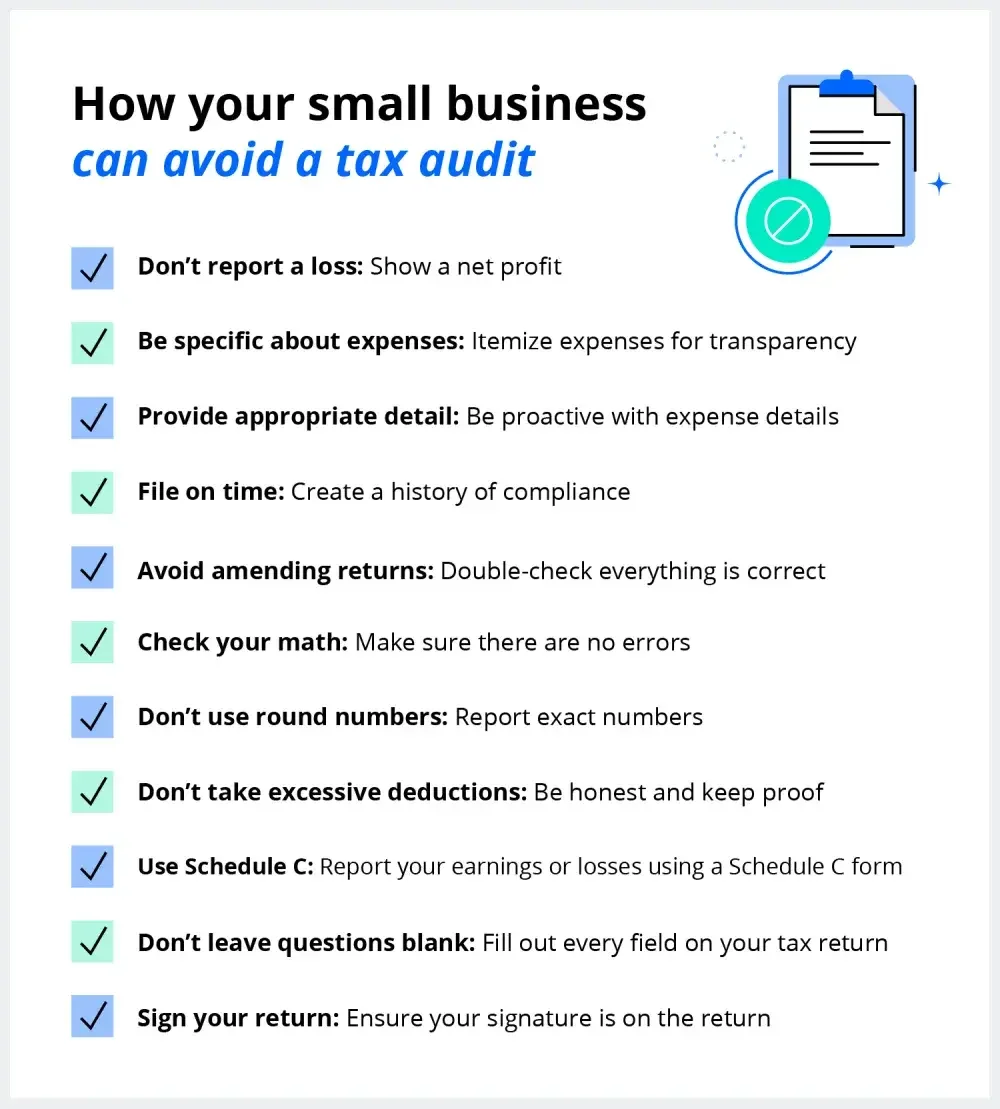

There's no guaranteed way to avoid an audit, but there are precautions you can take to keep your business from raising red flags.

Until recently, the odds of having your small business tax return audited were low. Bloomberg cites IRS data that only 140 small business returns—out of 4 million— filed in 2018 were audited. The numbers were only slightly higher for S corporations but still less than 0.5%.

But in late 2020, the IRS announced it would add auditors to allow the agency to increase its audits by 50%.

Learn best practices to avoid an audit with these 11 tips.

Key takeaways

- Avoid careless mistakes—like math errors, leaving questions blank, or not signing your tax return—can trigger an audit.

- Don't take excessive deductions.

1. Be careful about reporting all of your expenses

Reporting a net annual loss—especially a small loss—can put you on the IRS's radar. The IRS may see the loss as an indicator of underreported income, prompting them to take a closer look at your return.

"When the IRS sees a net business loss, it is practically begging to be audited," says Steven Jon Kaplan, CEO of True Contrarian Investments, LLC. He adds, “You are required to report all of your income, but you don't have to report all of your expenses, so leave out a few expenses if that results in a small net profit for the year."

While you must always report 100% of your income, you can avoid reporting excessive losses by reducing the number of deductions you claim. For example, writing off rent, car expenses, mileage, and technology can save you money, but they can also trigger an IRS audit if the numbers amount to more than you earned.

2. Itemize tax deductions

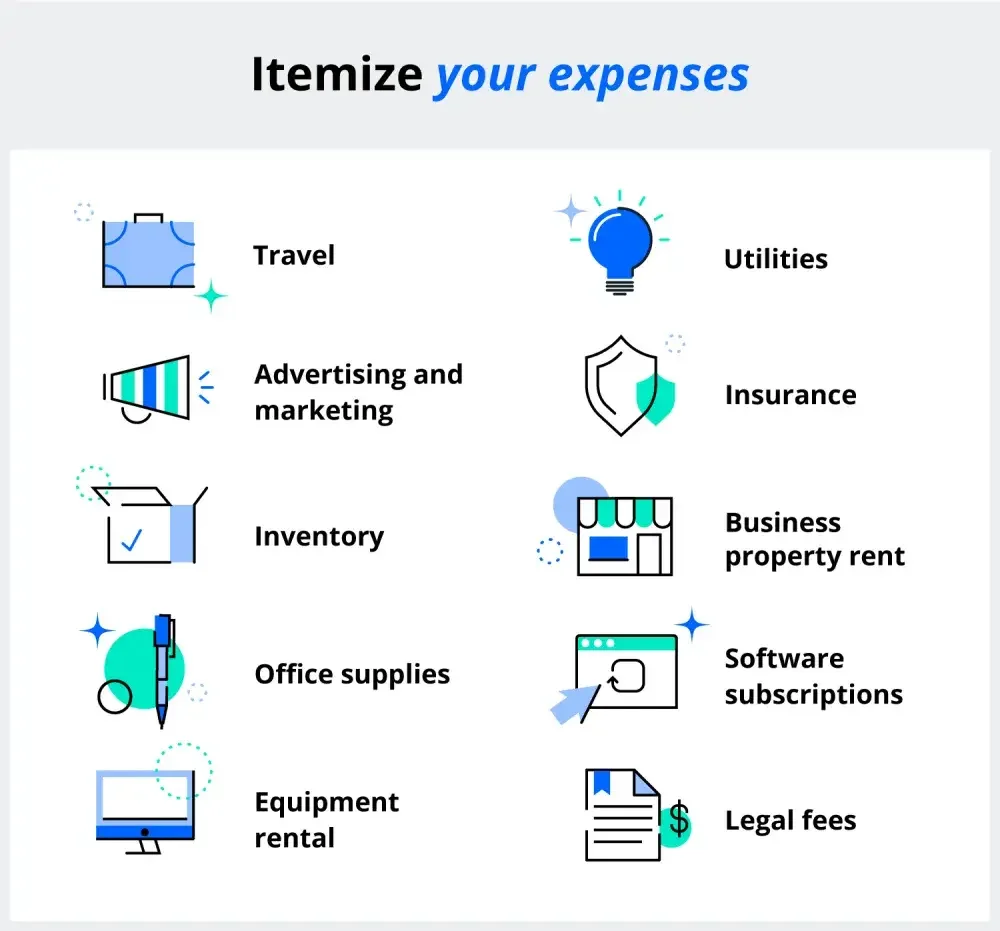

Itemizing your business expenses shows transparency and prevents the IRS from questioning the information you provide. Being ambiguous about business expenses might cause the IRS to think there's an issue or that you're intentionally misreporting your earnings.

Here are examples of expenses that you can itemize:

- Travel

- Advertising and marketing

- Inventory

- Office supplies

- Equipment rental

- Utilities

- Insurance

- Business property rent

- Software subscriptions

- Legal fees

"Whenever you have a choice between putting a particular expense in a general category or specifically listing it under 'other expenses,' always favor explicitly listing it," Kaplan advises. "The IRS might think you are trying to invent nonexistent expenses if you lump together advertising or travel, rather than itemizing each specific advertising or travel expenditure."

3. Provide appropriate detail

Rather than assuming a potential auditor will understand why your travel expenses suddenly dropped by 100% in the past year, or why your online advertising expenses ballooned by 300%, complete additional paperwork to explain in detail what happened and attach it to your return when you file.

That way, if your return is flagged and gets in front of a human being, you've already answered many of the questions they'll have regarding the sudden changes.

4. File on time

Some people think that filing at the beginning of tax season increases the chances of an audit because there are fewer returns in the pool to pick from. This myth causes people to file late, even requesting an extension. But Steven Terrigino, a CPA and partner at the Bonadio Group, says that filing late isn't a good way to avoid an audit.

"File on time and pay on time," he says. “[Doing this will] create a history of compliance, including all ancillary returns—i.e., payroll and sales tax."

Don't worry about the e-file vs. paper file audit risk, either. Pick the one you're most comfortable with, as the method of filing doesn't increase the chances of an audit either way.

5. Avoid amending returns

Some businesses believe that submitting an amended return admits to the IRS that you didn't do your return right the first time. While submitting an amended return doesn't automatically trigger an audit, it could increase the chances if you make substantial changes without sufficient justification. This is because amended returns more than three years old cannot be e-filed, so suspicious returns are flagged for manual processing and closely examined by a human.

If you do have to submit Form 1040-X, report these three items:

- Your original return with changes documented in column A of the 1040-X form

- The net change in column B and an explanation in Part III

- The correct amount after the changes in column C

Remember to attach documents that support the changes on your return. However, if it isn't important to the change, it's best not to overwhelm the IRS with unnecessary documents that could lead to an audit.

Most IRS audits are determined by paperwork discrepancies and math errors. Terrigino recommends that you "make sure all government-issued forms, such as 1099-INT and 1099-DIV, match what you report on the tax return."

Double-check your math to make sure your documents are free of any errors. If the numbers don't match, the IRS will notice.

7. Don't use round numbers

Because round numbers can look suspicious, try to use exact numbers when possible. The IRS generally doesn't mind if you round up to the nearest dollar, but rounding up by tens or hundreds of dollars to make a tidy, round number might trigger an audit.

- Acceptable: Rounding up from $2.60 to $3

- Not acceptable: Rounding up from $260 to $300

Make sure you aren't using the same numbers year after year unless the numbers are correct and you have documentation. Expenses are expected to change, and if yours haven't, that could raise some red flags.

8. Don't make excessive deductions

How much can you claim in charitable donations without getting audited? The answer is to just be honest and report the actual amount you donated—or any other deductions you're eligible for. Keep details and documentation of your deductions and donations so you can show proof if needed.

“Don't overestimate the extent of your donations, take an excessive home office deduction, or excessive deductions for meals and travel," Terrigino says.

These and other expenses like bad debt, casualty losses, and medical expenses are examined with extra care. Also, don't suddenly include a large number of deductions you've never taken before. That gets noticed.

9. Use Schedule C to report profits and losses

Schedule C is an IRS tax form to report profits or losses for your business. If you own a small business, always report your earnings or losses using Schedule C for best chances at avoiding an audit.

"Although there are other methods which may sometimes avoid paying part of your Medicare tax or have other advantages," Kaplan says, “they also greatly increase the likelihood of an audit."

10. Don't leave questions blank

Fill out your tax return carefully and don't leave any questions blank. Each question on the tax form should have an appropriate answer, even if that answer is $0. An unintentional oversight could get your return some extra attention.

11. Sign your return

Submitting a tax return without signing it is more common than you might think. Failing to do something as simple as signing can cause the IRS to think you may have overlooked other parts of the return, warranting a closer look. Be sure to check and recheck your return for your signature before you submit to lower your chances of being audited by the IRS.

What to do if you get audited

The IRS audit process timeline for 2022 has a three-year window, so your tax year for 2019 could still get picked. Even if you've followed every tip on how to avoid getting audited it's possible it could still happen. Here are a few things you can do if you receive the dreaded IRS letter in the mail.

- Be honest with the auditor

- Gather your documentation

- Respond promptly with copies of requested documents

- Request help if you need it

- Pay, if you owe money

Ultimately, your odds of an audit are small. Following these tips on how to avoid an audit of your business can help lessen the odds even more. Don't give the IRS a reason to take a closer look at your figures, and you'll save yourself some time and stress.

Now that you know how to avoid IRS audits using our tips, you can get back to doing what you do best—running your business.