Every company faces some kind of risk—even the most careful ones. But owners can protect themselves with business insurance.

The right coverage can make or break a business. Theft or fire, for example, can cause devastating losses to businesses without insurance, and a personal injury lawsuit could leave you struggling. Good business insurance can be a financial safety net when you need it most.

In this guide, we'll explain the ins and outs of insuring your business.

What is business insurance?

Business insurance protects companies from financial losses and liability after events such as:

- Employee illness and injury

- Property damage and vandalism

- Income losses

- Property damage

- Theft

- Fire

- Lawsuits

Business insurance works like medical insurance and other types of coverage. First, a business owner buys coverage based on the operational risks. Then, after an incident, the business can submit a claim for coverage. Business insurance can also reduce legal liability.

What is business liability?

Business liabilities refer to debts and legal obligations your business owes now or in the future. More often than not, they refer to financial debts. Insurance can protect a business against these liabilities.

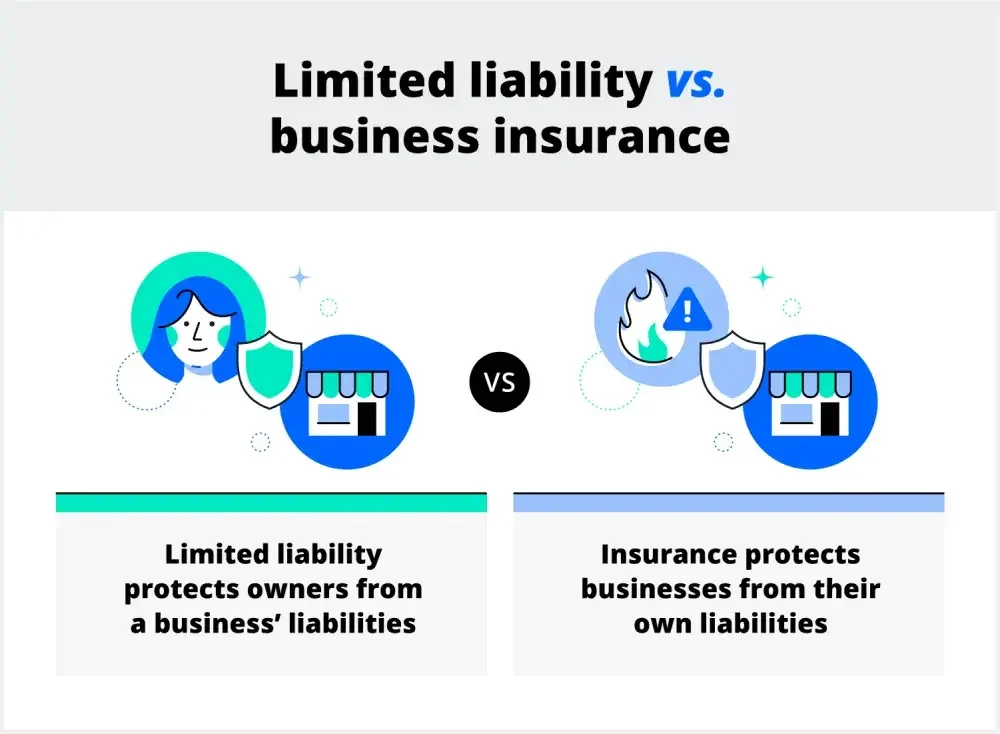

What's the difference between limited liability and insurance?

Limited liability companies (LLCs) protect owners from lawsuits and financial debts. The “limited liability" in the name refers to this protection. Liability insurance coverage refers to business insurance that can offer liability protections for specific risks. Here is more on the distinction:

- Limited liability protects owners from a business' debts and fines. For example, if an LLC goes bankrupt, owners won't have to use personal assets to pay the debts.

- Insurance protects businesses from liabilities and debts they incur. It also offers businesses financial protection from natural disasters, data theft, and some lawsuits.

When do you need business insurance?

To decide whether you need business insurance, ask yourself two questions:

- Does your business have property—including inventory, computers, and other equipment—that you would need to replace? If your only business property is a laptop, you may not need to insure it. But, insurance is a good idea if you have equipment, inventory, and other items that you need to do your work.

- Is there a reasonable chance your business could get sued? For example, you might face a lawsuit if someone has an accident on your premises, if you suffer a data breach, or if an item you make or sell is defective and injures someone. If you sell directly to consumers, you should consider this risk.

If you answered yes to either of these questions, commercial and legal business insurance would help you minimize risk. You can get a free quote from LegalZoom's trusted partner, NEXT insurance.

Types of business insurance

The best type of business insurance depends on your business model. "Business insurance refers to a broad set of insurance coverages that protect businesses against loss or damage from different types of risks," says Chris Rhodes, chief insurance officer at NEXT Insurance.

“Depending on your business activities and operations, your business insurance package might include a combination of a few different insurance products, such as general liability, workers' compensation, and property insurance," he says.

To narrow down your options, we'll explain the different types of business insurance.

Types of liability insurance

Limited liability insurance covers legal or medical fees when you're held responsible for damages. The main types include:

- General liability insurance can help cover expenses if you are responsible for a non-employee injury involving your business or damage to property you don’t own.

- Professional liability insurance protects from liability in the case of negligence or a mistake in professional duties.

- Product liability insurance coverage can protect manufacturers, wholesalers, distributors, and retailers. Anyone who makes and sells products may face liability if a product causes an injury.

- Employment practices liability insurance (EPLI) can help protect companies from employment-related claims such as wrongful termination or discrimination

Types of commercial property insurance

Commercial property insurance protects your physical assets and offers financial support if your physical workspace faces damage. You can purchase different policies such as:

- Commercial property insurance could reimburse you if your property gets damaged or destroyed due to fire, storm, or theft.

- Commercial auto insurance, which may cover damage to—or caused by—vehicles used for business purposes.

Types of business income insurance

You can compensate for lost income with insurance such as:

- Business interruption insurance can help cover the cost of relocating, paying employees, and paying rent if you have to move or shut down because of a fire or other event. Some insurers refer to it as business income insurance.

- Extra expense insurance pays for unusual expenses after a disruptive event affects your workplace. The funds typically go toward repairs and property replacement.

Other types of business insurance

Other common types of business insurance include:

- Workers' compensation insurance, which is often required coverage for businesses with employees in most states. This can help pay for lost wages and medical care for employees with a work-related illness or injury.

- Business interruption insurance, which may help cover the cost of employee payroll and rent if you have to close temporarily because of a fire or other event. Some insurers refer to it as business income insurance.

- Cyber insurance, which can provide liability coverage to businesses that suffer a data breach, wire fraud, a ransomware attack, or fall victim to other types of cybercrime. It may also cover the cost of notifying and providing services to your customers who end up as victims as well.

- Commercial umbrella insurance, which can help extend your liability coverage to losses exceeding other policies' limits.

- A business owner's policy (BOP) that combines general liability insurance, commercial property, and business interruption insurance for a broad swath of coverage—often at a more reasonable cost than buying each of these policies separately. This is a popular option for small business owners.

- Home-based business insurance usually covers commercial property damage and business liability for companies that run out of an owner's home.

What type of business insurance do I need?

The insurance your business needs depends on its structure, industry, and stage of development.

What insurance do I need to start a business?

Assuming your business will go on to hire employees and grow, you need:

- General liability insurance

- Professional liability insurance

- Workers' compensation insurance

These policies cover the most common expenses growing businesses encounter. Many blanket policies include these types of insurance, which can lower your overall bill.

What insurance do I need to sell a business?

If you want to sell your business, the right insurance can lower investors' risk. This boosts the value of your company and helps seal the deal. When selling, you need:

- Representations and warranties insurance: Protects against losses caused by sellers breaching an acquisition or merger agreement.

- Tail coverage: Protects your business from claims reported after your insurance expires.

These policies help ensure a smooth transition and give buyers the most protection during an acquisition.

Do I need business insurance for an LLC?

Even though LLCs give owners liability protection, you should still consider business insurance, especially in high-risk fields such as construction and agriculture. Even low-risk industries run the risk of:

- Equipment damage

- Legal liability

- Medical bills and lost wages for employees who get sick or injured on the job

Running your LLC without company insurance is like going without health care. You may not expect an illness or injury, but the insurance can save much more money in the long term. Even simple, low-cost business insurance for an LLC beats no coverage at all.

Do I need business insurance for a sole proprietorship or partnership?

Government agencies such as the IRS treat sole proprietorships and partnerships as disregarded entities, meaning the business and the owner are the same for legal purposes. This means that business owners are personally liable for all business activities. Liability insurance could help to protect your personal assets in the event of court costs or another catastrophic event.

Do I need business insurance for a corporation?

Because C and S corporations operate on a larger scale than other business types, you have extra liabilities to consider. Instead of investing in one blanket policy, take out insurance designed to cover your most important activities. While this costs more upfront, it can save substantially more than you invest.

How much does insurance for a business cost?

The general rule of thumb is that small business insurance can cost between $25 and $75 a month for each policy in your insurance package.

The amount your business will pay can vary based on several factors, including:

- Business location

- Business size

- Industry

- Number of employees

- Past claims

- The type of coverage you choose

- The deductible you choose

- The size of your business property

How to get business insurance

You can get just the insurance you need with our partners at NEXT Insurance in about 10 minutes.

Here’s how it works: You’ll answer a few online questions about your business, such as its size, location, the line of work you’re in, and more. You select your coverage options and see the exact price you’ll pay annually or monthly. If you like what you see, you can buy your policy immediately. A certificate of insurance (proof of coverage) will be available immediately. And, you can manage your policy 24/7 via web or mobile app.

If you have questions, NEXT’s licensed, U.S.-based insurance professionals are available to help.

By evaluating your risks, choosing appropriate coverage, and staying on top of the claims process, you can give your business the protection it needs. You can break this process into four steps:

1. Contact an insurance agent

Contact an insurance agent specializing in businesses that share your structure or field. While owners can conduct their own research, an agent will offer valuable insight and expertise. In addition, insurance agents can route you to the best policy options much faster.

2. Narrow your options

As with most things, it pays to shop around. However, beware of choosing the cheapest insurance or eliminating certain types of coverage to save money. Policies at different price points offer varying degrees of coverage. Ask yourself:

- What coverage does your business need?

- How much are you willing to spend?

- Are there additional terms you want in your policy?

By deciding on your nonnegotiables, you can narrow down your policy options.

Since we know this is a need for many of the business owners we work with, we partner with a trusted insurance provider so you can easily review tailored and affordable options for your business.

You can also shop online for business insurance. Many insurance carriers offer 100% digital options for you to quickly get the coverage you need.

Note: A bare-bones policy may not protect you if you have to make a claim. Worse, many policies have "coinsurance" clauses that may lead to only a partial payment if the insurance company determines you were underinsured.

3. Assess your risk

Research the kinds of accidents and legal liabilities companies in your field face. Construction teams should invest in workers' compensation due to the risk of injury. On the other hand, financial firms need to protect against legal liability if they mismanage funds.

You should also choose a policy that protects against natural disasters common in your area. For example, businesses in California should invest in wildfire insurance. Conversely, Florida businesses need hurricane protection.

By anticipating these risks, you can find liability insurance coverage suited to your needs.

4. Buy insurance

Once you've found the right policy, you're ready to buy. Be sure you know what your insurance covers, and ask your agent for clarification as you need it. To purchase insurance, bring relevant information like:

- Your business' tax ID number

- Business registration or incorporation forms

- A list of assets and liabilities

- Employee information

- Deeds, licenses, and other documents you need to operate

Finally, when your policies come up for renewal, check out the competition to make sure you're getting the best deal.

FAQs about business insurance

Still not clear on where to start with insuring your company? We've answered some of the most common questions about business insurance.

What are the most common types of business insurance?

While different businesses prioritize unique types of coverage, the most popular options include:

- Workers' compensation

- General liability

- Commercial property

- Business owner's policy (BOP, which combines general liability and commercial property)

- Professional liability (also errors and omissions insurance, or E&O)

- Commercial auto

- Product liability

- Cyber insurance

When is the best time to buy business insurance?

Businesses should switch policies or invest in new insurance after changing their structure or operations. This can occur when a company:

- Introduces a new product or service

- Switches to using new equipment

- Transfers to another state

- Conducts a hiring surge

- Lays off a large portion of their staff

- Experiences a dramatic change in cash flow

Do all businesses have insurance?

Almost all businesses have some insurance. Depending on state law, sole proprietors with no employees or contractors may not need insurance. However, most of these businesses still invest in coverage. Additionally, federal law requires that all companies with employees pay for:

- Workers' compensation

- Unemployment insurance

- Disability insurance

How much would $1,000,000 liability insurance cost?

You can get liability coverage of $1 million for a few hundred dollars a year. This cost may go as high as $1,000 a year if you:

- Retain a large staff on payroll

- Work in industries with high exposure to risk

- Have a long history of insurance claims

Do I need LLC insurance in every state I operate?

Most business insurance policies offer coverage over state lines. If you have liability insurance for an LLC in one state it should apply to others. It’s important to check with your insurance company and read your poilcy documents closely.

Insuring your small business' success

Business insurance and liability protection can make or break startups or large enterprises. While owners should always plan for success, investing in or reevaluating your business insurance can provide the coverage you didn't expect to need. In short, insurance gives you the resources needed to bounce back from any hurdle.

If you do have to make a claim, be sure to provide complete and accurate information, file your claim right away, and consider seeking legal advice if your claim is denied.

By evaluating your risks, choosing appropriate coverage, and staying on top of the claims process, you will help ensure that your business has the protection it needs when it needs it.

Unlock the potential of your business with special offers from LegalZoom’s trusted partners. Discover a wide range of services, from business banking and insurance to websites and payment systems. Let LegalZoom’s partners help you turn your big idea into a big business.