Funding your entrepreneurial dreams can be hard work. Money doesn't always stretch as far as you think it will, and loans to start your business have staunch prerequisites like credit score minimums and required collateral. That's why crowdfunding for business is popular among aspiring and even experienced entrepreneurs. Crowdfunding directs interested investors right to your bank account.

Online platforms like Kickstarter, Indiegogo, and Patreon will host your crowdfunding campaign for a fee, allowing potential investors to discover and contribute. You can market it almost any way you want, and there are fewer strings attached to raising funds than there are to acquiring a loan or attracting investors in other ways.

Below, explore tips from experts on crowdfunding for businesses, as well as tips for building a crowdfunding campaign and regulations to keep in mind during the process.

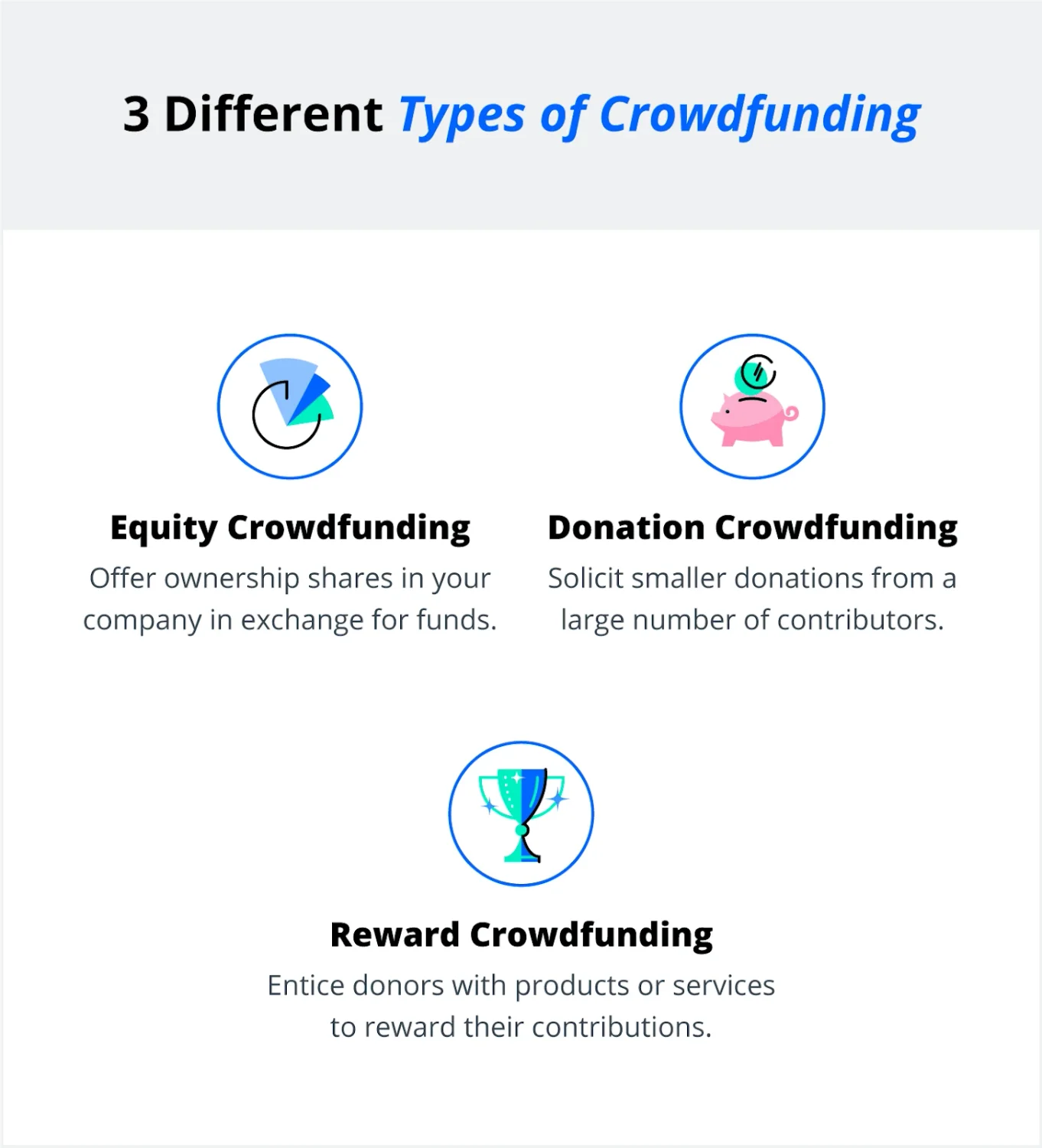

3 types of crowdfunding and their pros and cons

There are three main types of crowdfunding that you can explore to raise funds for your startup:

- Equity crowdfunding

- Donation crowdfunding

- Reward crowdfunding

Each of these presents opportunities and challenges relative to how the funds are acquired. If you're wondering whether you need to pay back crowdfunding, the answer is usually no for funds raised to launch a small business.

While other forms of crowdfunding exist in addition to the three below, they're not ideal for funding a startup or a small business. If you find your business in growth mode later on, however, and need to raise cash, you can finance your debt by crowdfunding for a business acquisition. This method isn't recommended for startups because the debt could render your company inoperable without enough funds.

Read on to see which one of these three crowdfunding methods works best for your startup idea so you can start raising money as soon as possible.

1. Equity crowdfunding

To participate in equity-based crowdfunding, be prepared to offer shares of your company to your investors in exchange for their funds. Equity crowdfunding removes debt from the equation by substituting equity for the business loans you would otherwise repay.

Pros:

- There's no need to repay costly loans or reimburse investments.

- Raise up to $5 million annually from accredited and ordinary investors.

Cons:

- Funding pitches require lots of information about company operations.

- You must adhere to state and federal filing requirements after closing.

2. Donation crowdfunding

Donation-based crowdfunding removes the question of investment and solely focuses on funds acquired. Donors give funds to a business, organization, or idea that they support or believe in without an expectation of compensation for their efforts.

Pros:

- Donated capital doesn't need to be reimbursed.

- Donors don't receive an ownership interest.

Cons:

- Donations can be much lower than funds from other sources.

- Campaigns often fail to meet fundraising goals.

3. Reward crowdfunding

Crowdfunding that offers rewards is sometimes called “seed crowdfunding." Reward-based crowdfunding is similar to donation-based but offers a reward to donors in the form of a product or service.

Pros:

- Rewards may draw more donors and more attention to your business.

- Anyone can contribute to your campaign.

Cons:

- Raising a large amount of money requires a massive donor base.

- You might have to return funds if you don't meet your goal.

How to crowdfund a business in 7 steps

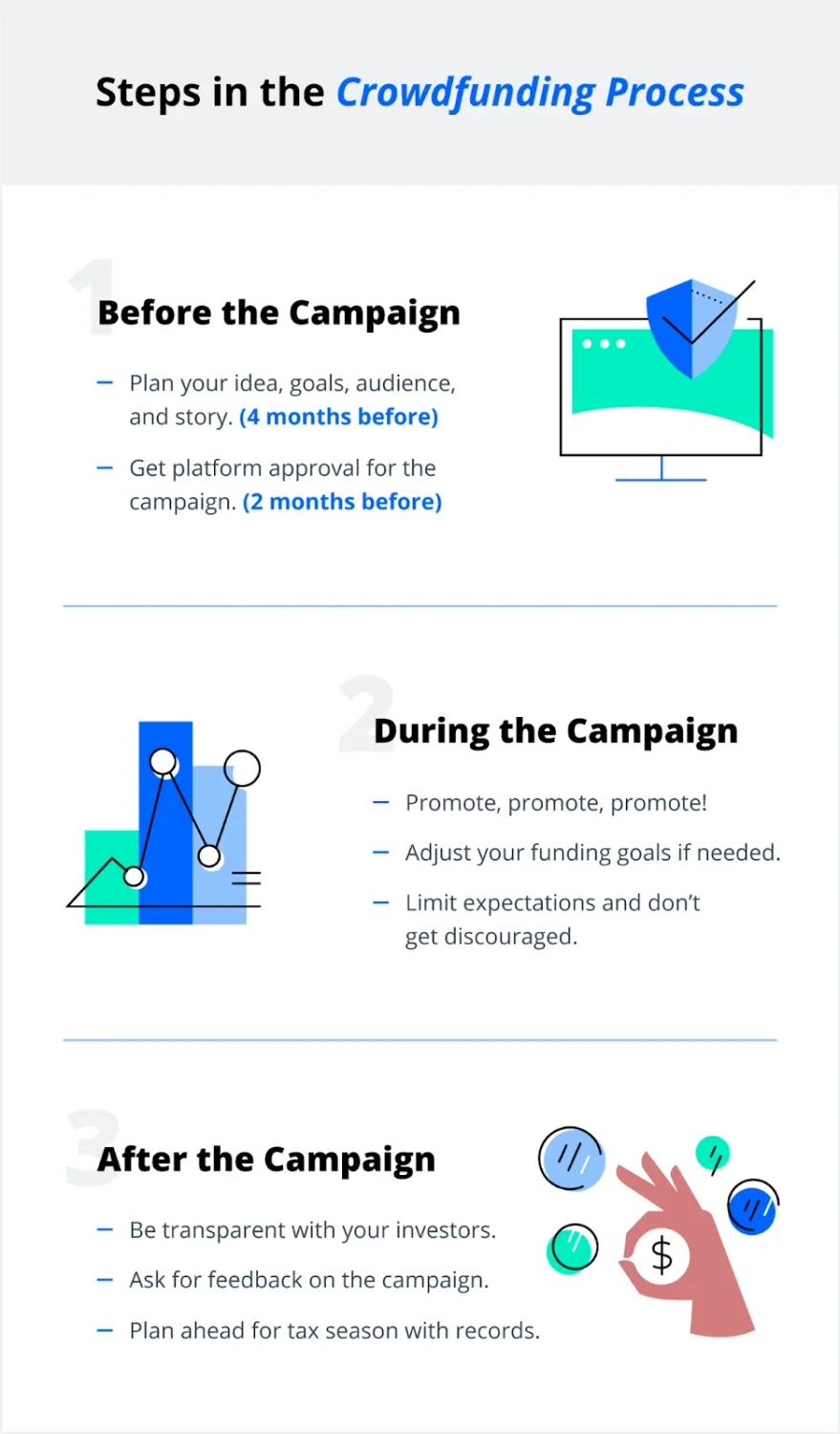

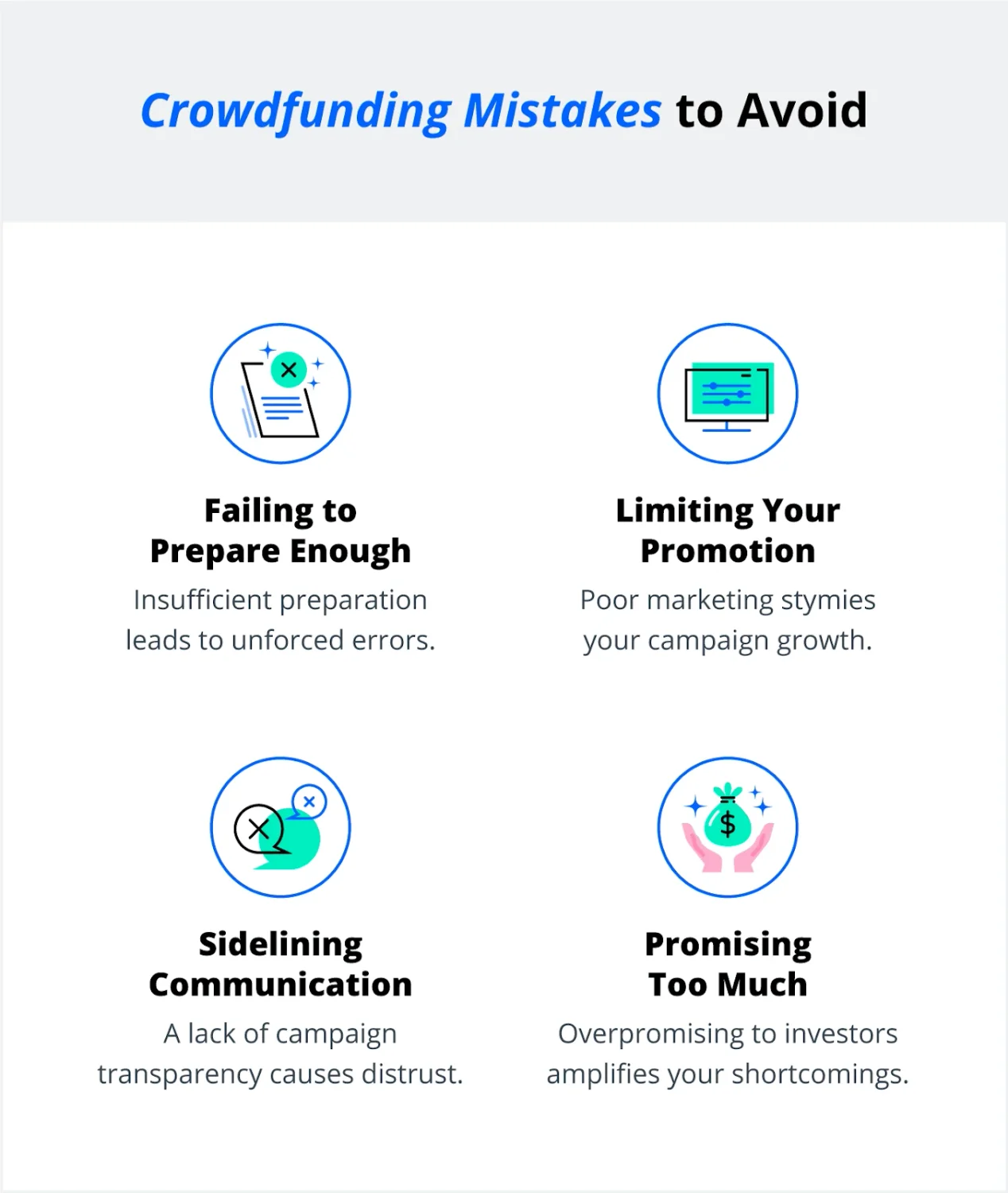

It would be nice if business funds just fell into your lap, but the reality is that securing crowdfunding takes diligent work and lots of preparation.

Knowledge of alternative funding options and awareness of regulations are both important to ensure a successful and compliant crowdfunding campaign. However, you'll want to do more to prepare for your first effort. These seven steps can guide you as you develop your business idea and move toward launching your pitch.

1. Solidify your ideea

The entire ethos of crowdfunding is securing money from as many parties as possible. To do so, you'll need to convince those parties that your idea is worth their money in the first place. Data from the U.S. Bureau of Labor Statistics shows that fifty percent of businesses fail by the five-year mark. Tellingly, the top-cited reason for small business failure is inadequate market research.

Some important considerations to ponder when working out your idea are:

- Saturation: How crowded is this industry, and what are the barriers to entry?

- Competition: How competitive will my business be among existing rivals?

- Inimitability: What truly makes my idea unique? Why will people want it?

Once you're sure your idea is solid and you've gathered data to prove its viability, you can begin to think more about the audience you'll cater to.

2. Identify your audience

The more people you're able to reach with your campaign, the more likely you are to meet your crowdfunding goal. Though not always the case, investors might be more likely to contribute to campaigns they relate to. Consider your business's audience before launching your pitch so you can tell your investors exactly who you plan to target with their funds. Think about these questions when determining the right audience:

- Motivation: What am I trying to get my audience to do?

- Intention: Who would be most interested in doing that?

- Solution: Why and how does my idea solve their problem?

Put in the work to target a receptive audience and your story's more likely to resonate with them.

3. Develop and share your story

Speaking of your “story," investors will likely take interest in the background behind your startup idea. Storytelling puts you in command as you lead investors on a journey through your reasoning for developing your idea, your plans for solving challenges, and your expectations for growth. Ask yourself these questions while you think about your story:

- Passion: Why do I believe in this idea?

- Reflection: Which challenges that I faced have contributed to this idea?

- Direction: What is my mission with this idea?

Passion is contagious, and sharing your story should make you excited. If you can make investors visualize how their contributions benefit your idea, you might have an easier time winning them over and meeting your goal.

Better yet, include a video proposal explaining your idea in-depth, in your own words. According to Marina Vaamonde, a commercial real estate investor and founder of PropertyCashin, “The best accompanying media in any crowdfunding campaign is a video." She insists that campaigns with other forms of media like charts or infographics “do not perform" in the same way as those with a video. There are videographers who specialize in crowdfunding campaigns if you require professional assistance.

4. Set your funding goals

Do you know how much you need to raise? You might be asking yourself how much it costs to start a business. It's vital to have enough money to keep operations running smoothly while you grow your business and work toward profitability. There are a few questions that can help you come up with an appropriate number for your crowdfunding goal:

- Selection: What costs are associated with the online platform I chose?

- Pivotability: If I don't meet my fundraising goal, will I forfeit funds raised?

- Expansion: If I exceed my goals, what will I do with the extra money?

You might factor in many different costs when calculating your final number. Crowdfunding campaigns might require marketing or administrative expenses. You'll also want to consider any costs associated with launching your business, like marketing and operation expenses.

You may want to avoid a round number for your final goal in order to stand out from the crowd. Research from the University of Hong Kong found that among campaigns targeting $13,000 or less, those with round-numbered goals (such as $5,000) were 6%–10% less likely to be successful.

5. Promote your campaign

After you set goals and choose a platform to host your campaign, you must receive approval from the platform to begin fundraising. Your pitch and plans take time to review, but the extra eyes on your project may catch errors you missed. The pitch you submit should entice readers and answer the basics about your “why." You have your audience, you have goals, and you have a story ready to share, so think about these questions when gearing up to market your campaign:

- Networking: Are there industry influencers that might help with promotion?

- Advertising: What industry-specific events could I target with advertising?

- Gratification: Am I showing my investors appreciation for their contributions?

Indiegogo analyzed the results of over 100,000 campaigns to dissect what makes crowdfunding successful. The research found that campaigns with promotion timeframes between 30 and 39 days achieved their goals more often than those with shorter or longer windows. Additionally, campaigns that offered perks after launch were more likely to entice new investors throughout the duration of the campaign.

Fundraising is the result of relationship-building. It may be as simple as hooking someone with your pitch, but you'll probably need to network heavily to spread the word about your campaign. Like many relationships, your bond with your investors should be built on honesty and transparency.

6. Focus on transparency

It's likely that anyone who invests in your startup won't receive direct monetary compensation in return. To reassure them during and after your campaign, create a list of important metrics that investors would want to know. A few important questions that focus on transparency are:

- Foresight: Are there any foreseeable problems I don't know how to solve?

- Insight: Do any of my investors have experience in a similar position?

- Proactivity: If I fail to meet my goal, how will I share that news?

Transparency builds trust, which reinforces your investors' belief in you and their decision to invest. Keep building that trust to encourage future investments, or even convert your investors into customers.

7. Ask for and listen to feedback

No matter how successful your campaign is, it will provide valuable lessons to inform future business decisions. Your investors might voice their feedback about your campaign, but be prepared to ask questions either way. Some ideas are:

- Hindsight: What could I have done differently to improve my outcome?

- Resourcefulness: Have I posted on a crowdfunding forum to solicit feedback?

- Personalization: Have I asked friends or family for personalized recommendations?

These questions are a jumping-off point. Ideally, you should spend time reviewing your campaign in hindsight to capture fresh takeaways. Don't be afraid to ask questions from other crowdfunders in online communities and forums, either.

Crowdfunding regulations and legal considerations

Crowdfunding is still a relatively new way to fund your small business, and regulations around this method of raising money are not set in stone. The Securities and Exchange Commission (SEC) governs federal regulations around raising money in this manner. Check out the requirements and considerations below that you should note before launching your crowdfunding campaign.

Adhere to SEC regulations

In March 2021, the SEC increased the maximum intake for certain types of crowdfunding from $1 million to $5 million annually. This change might make the tactic even more lucrative to industries like technology and health care, where barriers to entry include sky-high upfront costs.

SEC regulations apply mostly to equity-based campaigns, since they involve the exchange of securities for investments. If you decide that equity crowdfunding is right for your business idea, be sure to adhere to those guidelines to avoid future liability.

Defend your work and ideas

When you promote a campaign, you expose your ideas to a large number of people. Since you can't guess the intentions of everyone who might come across your pitch, it's important to guard your startup ideas with intellectual property protection.

If your work and ideas are protected, not only will you feel safer pitching them to others, but donors will know you're serious about limiting liability and protecting their investment.

Assess your tax liabilities

In every case when you crowdfund money for a business idea, the proceeds count as taxable income. How much tax liability you or your business incurs depends on which type of business entity you form, what state your business calls home, and what method you used to crowdsource the funds. Be sure to consult with a professional who can help you determine your correct tax liability.

Expert tips for the best crowdfunding results

Sourcing money from a large number of people means there are many eyes on your ideas once your pitch is out in the world. This is both exciting and nerve-wracking; all those eyes could convert to investors or even customers, while there are also people on the lookout to take advantage of unprotected intellectual property.

Plan ahead to score more support

Crowdfunding thrives on support from as many people as possible. To score that support and raise more money, you should plan several months in advance for your campaign.

Stephen Light, CMO of Nolah Sleep, believes it's especially important to reference past crowdfunding campaigns to influence future ones: “Use the data gathered to create another campaign that addresses these issues." Diligent planning and careful analysis of others' failures could help you meet or exceed your goals in the long run.

Prioritize transparency to create trust

If investors aren't sure about the ongoings of your operations while fleshing out your business idea, they're less likely to give you any money and “your crowdfunding campaign will likely be unsuccessful," says Nate Tsang, founder and CEO of WallStreetZen. Build a foundation of trust by communicating openly and honestly with your investors at every stage of the crowdfunding campaign and beyond.

Focs on long-term community engaggement

Communities drive crowdfunding forward. Harriet Chan, co-founder of CocoFinder, says, “Crowdfunding may provide many startups with access to cash, but it lacks the expertise of banks or angel investors. The community spirit of crowdfunding is essential for sustainable projects." Engaging with a community of crowdfunders offers access to valuable insight from veterans that many aspiring entrepreneurs might miss.

Cop successful crowdfunding camppaigns

Studying the failures of past campaigns isn't the only way to learn from them. Dave Herman, president of EZ Surety Bonds, believes that successful campaigns have lessons to offer as well: “Don't be afraid to copy crowdfunding campaigns that worked. Most startups want to be innovative...but this can also be their downfall." By copying the strongest elements of goal-exceeding campaigns, you can fortify your own endeavor with tried-and-true knowledge.

Addiional crowdfunding resoources

Crowdfunding is an especially hot topic because it democratizes business investments. People without large amounts of capital can now make contributions to business ideas they believe in without jumping through legal hoops. Because of this popularity, there are many resources available where you can learn about crowdfunding or start a new campaign of your own. Read on for a few popular options that can continue your learning experience.

Crowdfunding platforms to start raising money now

The best crowdfunding platform is one that caters to your niche needs and is scalable to the size of your endeavor. There are countless websites that act as hosting platforms for campaigns.

Patient searching and probing questions can identify the right platform for your exact goals and needs. However, there are several popular platforms that have lots to offer for most general fundraising efforts. Check out three crowdfunding websites for business below that offer unique benefits:

Kickstarter: The most popular crowdfunding platform, Kickstarter operates with binary funding rules where you forfeit proceeds if you don't reach your goal.

- Collection fee: 5% plus 3%–5% processing fee

- Best for: General campaigns, first-timers

Indiegogo: In addition to traditional crowdfunding, Indiegogo has a “global network of early adopters" of innovative products launched by the platform's users.

- Collection fee: 5%

- Best for: Unique or innovative products, services, or solutions

Patreon: Different from the other platforms mentioned, Patreon charges users a monthly subscription fee in exchange for access to a creator's content.

- Collection fee: 5% plus monthly processing and payout fees

- Best for: Creative endeavors, artist showcases

Courses to learn crowdfunding basics

Online courses allow you to immerse yourself in crowd-sourced fundraising at your own pace. Below are three examples of free, paid, and subscription-based classes that cover everything from why crowdfunding exists to demonstrations for specific platforms.

How To Crowdfund (Udemy): Udemy's course is an introduction to the topic that covers types of crowdfunding, regulations, and the history of this type of fundraising.

- Cost: $29.99

- Best for: Beginners looking for an introduction to crowdfunding

Crowdfunding (Wharton School of Business, University of Pennsylvania via Coursera): This analysis-driven class uses data from hundreds of thousands of crowdfunding campaigns to assess what separates successes from failures.

- Cost: Free (certificate requires a monthly Coursera membership, $34–$79)

- Best For: Advanced users who want data-driven insight

Other Online Crowdfunding Classes (Skillshare): Skillshare offers a large variety of instructor-led courses discussing specific platforms and crowdfunding strategies.

- Cost: $13.99+ per month

- Best for: Users seeking knowledge about niche crowdfunding topics

Thorough research is the best way to prepare for a successful campaign launch and a healthy business down the line. With a little help and determination, you'll be well on your way to meeting or exceeding your fundraising goals.