Nondisclosure agreements, or NDAs, protect confidential business information from being prematurely disclosed to the public or falling into the hands of competitors. Whether used in employment contracts, business negotiations, or product development, NDAs establish clear boundaries for handling sensitive information and potential legal consequences for breaches.

What is a nondisclosure agreement (NDA)?

Also known as a confidential disclosure agreement, an NDA creates a confidential relationship between a person or business that has confidential or trade secret information and another person who has access to that information. The NDA protects these business secrets by defining confidential information and limiting the way it can be used or disclosed.

A trade secret is any type of confidential and proprietary information that a business wants to keep private so it can enjoy an economic advantage over its competitors. The term “trade secret" may sound high-tech—and in fact, technology companies often deal in trade secrets—but trade secrets aren't relegated to any one industry.

Trade secrets can take many forms:

- Customer lists

- Expansion plans

- Information about new products or developments

- Details about pending litigation

- Data about a company's clients

What's included in a nondisclosure agreement?

An NDA may be a stand-alone legal agreement or may exist in confidentiality clauses in another document, such as an employment agreement, an independent contractor agreement, or another contract that establishes a business relationship.

A standard NDA or confidentiality agreement includes the following:

- Parties involved. This section identifies two or more parties bound by the agreement, including the disclosing party (the one sharing confidential information) and the receiving party (the one agreeing to keep the information confidential).

- Explanation of confidential information. This clearly defines what is considered confidential under the agreement, such as trade secrets or financial data.

- Exclusions. This is a description of any information that is excluded from confidentiality. For example, confidential information may be disclosed if required for legal or accounting purposes. Likewise, information is usually not considered confidential if it has already been publicly released.

- Obligations. This describes the receiving party’s obligations and acceptable uses of the confidential information. In addition to keeping the information confidential, the receiving party may be required to destroy or return confidential information when the agreement ends.

- Duration. Establishes the time period during which the agreement remains in effect. It may be a specific term (e.g., five years) or continue indefinitely until certain conditions are met (e.g., the information becomes public knowledge).

- Miscellaneous terms. Like most contracts, an NDA may contain standard contract terms, including terms related to modifications, choice of law, choice of venue, arbitration, and attorney fees.

What happens if an NDA is breached?

It depends on the terms of the NDA. Breaching or violating an NDA is a serious offense and can result in one of several courses of action.

Here are some actions that can come from NDA violations:

- Termination. The violating party can be terminated from their position.

- Fines. They can be mandated to pay back what was lost due to their actions.

- Court action. They may be the subject of a lawsuit.

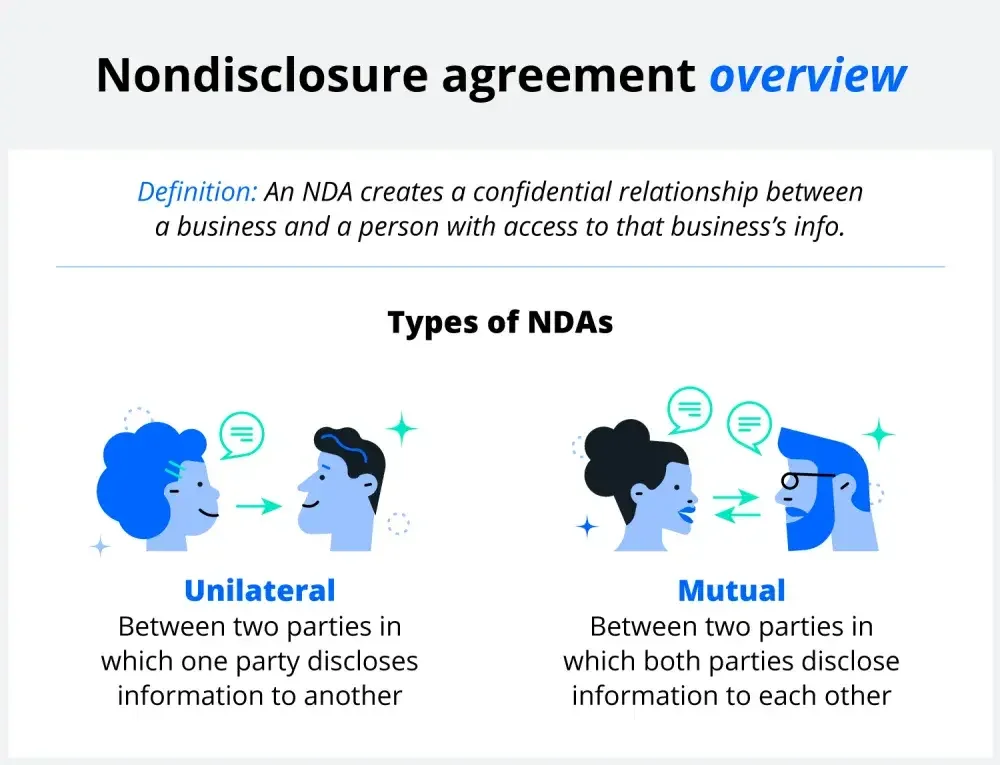

Types of nondisclosure agreements: MNDA vs. NDA

There are a couple types of nondisclosure agreements to consider, depending on the situation. Some are one-sided, while others contain restrictions on both sides.

1. Unilateral (NDA)

Unilateral nondisclosure agreements are the most common NDAs available. They act as a one-way contract, as only one party discloses information to another party. Some common examples of unilateral NDAs include:

- Employer-employee NDA: Restricts employees from revealing trade secrets and business information

- Company-contractor NDA: Restricts hired contractors from taking business information and sharing it with competitors or using it for themselves

- Inventor-evaluator NDA: Restricts evaluators from stealing someone's invention and patenting it as their own

2. Mutual (MNDA)

Mutual nondisclosure agreements (MNDA), also known as bilateral agreements, are used when two parties disclose confidential information to each other. Each party can then decide how their information is restricted and used.

For example, a company contemplating a merger or joint venture with another company may enter into a mutual nondisclosure agreement. This way, they're both able to share private company information without fear of it being used against them.

Use cases for nondisclosure agreements

Nondisclosure agreements have become increasingly common in various situations. Here are a few examples:

Employee nondisclosure agreements

If your business deals with sensitive information, inventions, research, or product development, you'll want to make sure your employees don't divulge company information to outsiders. Even if you just have ordinary business information such as sales data and customer lists, an employee nondisclosure agreement can help keep that information out of the hands of competitors.

Independent contractor agreements

Whether it's your virtual assistant, your part-time bookkeeper, or the person you hired to help with a special project, independent contractors may have access to information that you don't want to be made public. Like an employee NDA, an independent contractor NDA can help keep business information private.

Agreements with people from whom you're seeking funding

If you approach venture capitalists or other investors for funding, you'll likely need to divulge information about your products, your finances, and your business plans. An NDA can help ensure that they don't share your ideas with a competing business.

Agreements with the people with whom you do business

Lawyers are obligated to keep their clients' information confidential, but that's not true of most other businesspeople. If the people with whom you do business receive or have access to your confidential business information, you may want them to sign an NDA.

Agreements in litigation or arbitration

When two parties are in a dispute, there is a formal process for exchanging information. Both parties must sign confidentiality agreements that prohibit disclosure or use of the information outside of the litigation. This prevents competition and theft.

Pros and cons of using an NDA

An NDA is crucial for protecting sensitive information, regardless of the industry or business purpose. Still, it’s essential to be aware of the implications, both positive and negative, before creating or agreeing to an NDA:

Pros

- Maintain confidentiality. NDAs protect sensitive data, trade secrets, and intellectual property from further disclosure.

- Clear boundaries among parties. These agreements establish explicit rules for handling and sharing the specified information.

- Legal protection. NDAs provide a legal framework for seeking damages if confidentiality is breached.

- Encourages open communication. With protections in place, parties can discuss sensitive topics and ideas more freely.

- Competitive advantage. NDAs prevent valuable information from reaching competitors.

Cons

- Complex and costly. Drafting and enforcing NDAs requires considerable resources, especially for smaller businesses and individuals.

- Potential for abuse. Overly broad or restrictive NDAs can unfairly limit innovation or an individual’s career opportunities.

- Duration limits. NDAs typically have expiration dates, after which the protected information might become vulnerable.

- Negative perception. These agreements can create feelings of distrust or secrecy, potentially damaging professional relationships or reputations.

- Not foolproof. Breaches may still occur, and proving a violation can be difficult and costly.

Like other legal documents, you should carefully read and understand the terms before you sign a nondisclosure agreement. Better yet, you can ask your attorney to draft or review your NDA, freelancer agreements, or any other confidential disclosure agreements to confirm they work in your best interests.

Parameters and limitations of NDAs

Nondisclosure agreements may act as a safety net for your business information, but they're not a catchall. NDAs possess certain limitations when it comes to protecting your ideas. These limitations include:

- Existing ideas. If an idea builds upon prior knowledge or existing ideas that are already public, it'll be hard to make an NDA stick legally.

- Proof of breach. Most breaches of confidentiality are by word of mouth, which is hard to prove without tangible evidence like a recording.

- Litigation cost. Odds are a government agency won't assist you in enforcing your NDA. You'll have to hire a lawyer and pony up for court costs. In the end, it may not be worth the cost to pursue legal action.

FAQs

Keep reading for answers to some exploratory questions regarding NDAs.

Do NDAs expire?

Yes, many NDAs have expiration dates. The duration typically ranges from one to five years, though some may last indefinitely. The expiration date (if any) should be clearly stated in the agreement, after which the protected information may no longer be considered confidential.

When can a nondisclosure agreement be broken?

Within nondisclosure or proprietary information agreements, there is an exclusions clause containing information that is omitted from the agreement. On the other hand, if an agreement is too vague or tries to include nonconfidential information, it can be legally challenged.

How enforceable is a nondisclosure agreement?

Nondisclosure agreements are legally binding contracts and are therefore legally enforceable.

What to do if you're asked to sign an NDA form

During the course of your business or employment, it's likely that you will be asked to sign a nondisclosure agreement. Remember that nondisclosure agreements can be contained in other documents, so you should look for headings such as "Confidentiality," "Confidential Information," or "Nondisclosure."

Also pay attention to the amount of time the NDA will remain in effect for, as some NDAs can remain in effect past the term of employment. Look for the information that is deemed confidential to ensure it's not too vague or overreaching.

Finally, make sure what's considered a breach of contract is included in the NDA.

How much does an NDA cost?

The cost of an NDA can vary significantly. Simple, template-based NDAs may be free or cost under $100. Depending on complexity, custom NDAs drafted by lawyers often range from $200 to $1,000 or more. Ongoing legal support for NDAs (such as enforcement or modifications) can also incur additional costs over time.

Does an NDA cover noncompete?

A noncompete and NDA agreement are different types of contracts that protect a company’s interests, but they can sometimes overlap. An NDA primarily protects confidential information, whereas a noncompete restricts future employment. However, the FTC recently announced a ban on noncompete clauses, so it’s crucial to consult a lawyer regarding these agreements.

Protecting your business with an NDA

While NDAs might seem straightforward, especially with dozens of templates online, the specifics of contract law and the potential long-term implications of these agreements make it advisable to seek legal guidance. An employment attorney is best equipped to handle your NDA, as they can:

- Ensure your NDA is legally enforceable and compliant with current laws

- Tailor the agreement to your specific industry and business needs

- Include appropriate contingencies and enforcement mechanisms

- Help you navigate complex situations, such as multi-jurisdictional issues

NDAs are crucial for protecting your business interests, but their effectiveness hinges on proper drafting and implementation. If you have any questions or doubts about the process, it might be wise to find an attorney to ensure your NDA provides the protection your business deserves.