A last will and testament serves as your final voice in determining how your assets are distributed and how your loved ones are cared for after you die. Whether you’re a Florida resident with a growing family, a retiree with real estate, or someone looking to plan for the unexpected, having a will helps avoid confusion, court disputes, and financial loss.

In Florida, a properly executed will is essential for protecting your family’s financial future and ensuring your wishes are honored. Without a valid will in Florida, state law determines who inherits your assets, which can lead to unintended outcomes and family disputes.

This comprehensive guide will help you understand Florida’s specific legal requirements for creating a valid will. Explore the different types of wills accepted in the state and how to make your will valid under Florida law. From understanding age requirements and mental capacity to appointing a personal representative, you’ll learn everything necessary to protect your estate and your loved ones’ future.

Key takeaways for creating your Florida last will and testament

- A last will and testament in Florida directs asset distribution, appoints a personal representative, and provides for minor children’s guardianship, and should be reviewed periodically.

- To create a valid will in Florida, one must meet specific requirements, like being of legal age (18 and older, or an emancipated minor), possessing mental capacity, and having the document witnessed and signed by two individuals.

- Wills can be revised through a codicil or revoked, but must adhere to legal formalities.

Understanding the basics of a will

1. Last will and testament definition

A last will and testament, or a will, is a legal document that outlines your wishes regarding the distribution of your property, assets, and personal belongings after your death. This document serves as the cornerstone of your estate plan, providing clear instructions for how your estate should be handled during the probate process. Beyond asset distribution, a will also allows you to name guardians for minor children and designate a personal representative to oversee the administration of your estate.

A last will and testament is a foundational estate planning document. It allows an individual, known as the testator (testator is the person who is writing or creating the will), to outline their wishes.

Our step-by-step online tool helps you make key decisions with confidence, at your pace.

2. Why is a last will and testament important?

Having a will is crucial for several reasons:

- It ensures your assets are distributed according to your specific wishes rather than state law.

- It allows you to minimize potential family conflicts by clearly stating your intentions.

- If you have minor children, a will enables you to designate who’ll care for them if both parents die. Without these provisions, a court will make these critical decisions on your behalf, potentially leading to outcomes you would not have chosen.

- You can name a trusted person as your personal representative to handle your estate.

- Without a will, your estate is distributed according to Florida’s intestacy laws, which may not align with your wishes.

For example, imagine a single parent with two children. Without a will, if the parent passes away, the court decides who will care for the children and how assets are divided. With a will, the parent can name a specific guardian and ensure assets are managed for the children’s benefit.

What is a will and testament in Florida?

A Florida last will and testament is a legal document that outlines your wishes regarding the distribution of your assets, the appointment of a personal representative (in some states they’re also called an executor), and the guardianship provisions for your minor children after your passing. A valid will in Florida simplifies the probate process, which helps reduce legal expenses, ensures all assets are addressed, and guides the appointment of a guardian for minor children.

However, a will can become invalid if you fail to adhere to state laws or if certain life events occur. That’s why you should consider reviewing your will periodically. This is particularly important in Florida, which does not recognize holographic (aka handwritten) wills.

What does a Florida will accomplish?

Some of the benefits of having a will in Florida are:

1. Simplifies asset distribution

Your Florida will specifies exactly how your probate assets (those solely under your name) should be distributed after your death. Probate assets go through the court process and include things like solely owned real estate or bank accounts without a named beneficiary. Non-probate assets can’t be named in an individual’s will since, at the time of setting up these accounts or assets, a beneficiary or the joint owner is already named. Non-probate assets can include:

- Your retirement accounts

- Payable-on-death bank accounts

- Life insurance policies

- Transfer-on-death accounts

- Jointly owned bank accounts, or jointly owned property with rights of survivorship,

For example, you might leave your primary residence to your spouse, divide investment accounts equally among your children, and designate specific family heirlooms to particular relatives.

2. Designate guardian(s) for minors

If you have children under 18, your will allows you to name guardians who will care for them. This is particularly important because, without this designation, a Florida court will decide who raises your children, and the court’s choice may not align with your preferences or values.

3. Appointment of a personal representative

You will designate a personal representative or executor who’ll be responsible for managing your estate through the probate process. This person will pay your debts, file necessary tax returns, and distribute assets according to your will’s instructions.

What happens if an individual dies without a will in Florida?

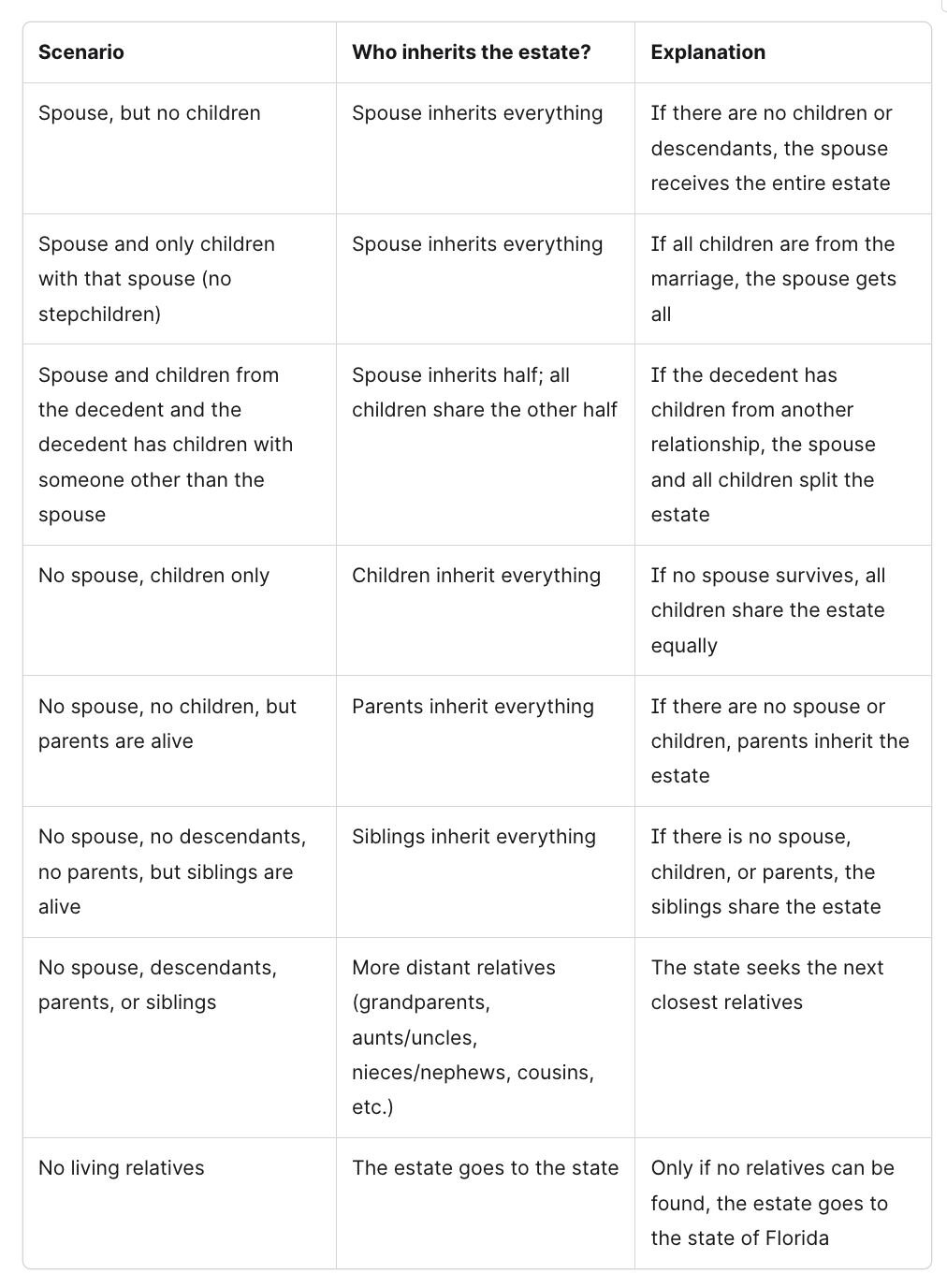

When someone dies without a will, they are said to have died “intestate,” which invokes intestacy laws. Florida’s inheritance laws determine how a deceased person’s estate is distributed when there is no valid will (intestate succession). These laws are designed to pass assets to the closest living relatives, but the specific distribution depends on the decedent’s family situation. In Florida, the decedent’s estate is distributed according to the Florida intestate succession laws, found in Florida Statutes Chapter 732. This process determines who inherits based on the deceased’s closest living relatives. This means:

- The Florida intestate succession statute will determine who inherits your property.

- The courts of Florida may appoint someone to manage your estate, possibly someone you wouldn’t have chosen.

If you have minor children, the court may decide on a guardian without your input.

Florida operates under a “per stirpes” distribution system, meaning inheritances are divided equally among heirs at the same generational level. This approach ensures fairness when multiple beneficiaries exist within the same family tier.

In Florida, if there are no lineal descendants (parent to child), a surviving spouse will generally take all property of the deceased. However, the law provides for very different results depending on whether there is a surviving spouse or lineal descendants and whether any surviving lineal descendants are also the offspring of the surviving spouse.

However, the distribution pattern becomes more complex when marriages involve children from previous relationships or when no immediate family members survive.

The succession process only applies to probate assets, which means those that require court supervision for transfer. Many valuable assets bypass probate entirely, including jointly owned property, retirement accounts with named beneficiaries, life insurance policies, and assets held in living trusts. These non-probate assets transfer directly to designated beneficiaries regardless of intestate succession laws.

Here is a comprehensive list of scenarios of intestate succession.

What are the legal requirements for a valid will in Florida?

Florida has specific requirements that must be met for a will to be legally valid. Understanding these requirements is crucial because failure to meet any of them can result in your will being declared invalid by the court.

1. Age requirement

In Florida, individuals or the testator must be at least 18 years old or an emancipated minor to create a will. This age requirement ensures that the person creating the will can legally make such an important decision. Remember that a will created by an individual below the legal age is considered invalid under Florida law. Consequently, verifying the testator’s age during the will creation process is very important.

2. Mental/testamentary capacity

In Florida, testamentary capacity is generally assumed. It means that the testator must also possess the mental capacity to create a valid will. In other words, the individual must understand the nature of the act of creating a will, the extent of their assets, and the identity of their beneficiaries. However, if the will is contested, those supporting the will must provide substantial evidence demonstrating the testator’s mental capacity when the will was created.

3. Writing

According to Florida law, the will must be in writing, which means it should be typed or printed. Florida does not recognize basic, casually written, handwritten (holographic) wills or oral (nuncupative) wills if they don’t include the testator and witnesses’ signatures. However, handwritten wills are recognized if it is prepared in compliance with the legal requirements in Florida. But, a handwritten will can be more challenging to prove in court and may be more susceptible to challenges, so typed wills are generally recommended.

4. Signature requirement

The will must be signed by the testator in the presence of two witnesses. The testator’s signature must appear at the end of the will, and it should be clear that you intended your signature to validate the entire document. If you're physically unable to sign, Florida law allows another person to sign for you, but this must be done at your direction and in your presence, as well as in the presence of the required witnesses.

What are some of the witness requirements in Florida that you should be aware of?

Florida will witness requirements that are particularly important and specific:

- You must have exactly two witnesses present when you sign your will.

- Both witnesses must be present at the same time when you sign.

- The witnesses must sign the will in your presence and in each other’s presence.

- Witnesses should be adults (18 or older) and mentally competent.

- While not required, it’s advisable that witnesses not be beneficiaries of your will to avoid potential conflicts

5. Notarization requirements

Florida does not require wills to be notarized to be valid. However, having your will notarized can provide additional evidence of its authenticity and may help prevent challenges. A Florida will can be notarized by signing your will in front of the notary public, wherein both witnesses must also sign your will simultaneously in the presence of each other. Along with notarizing your will, you can further make your will into a “self-proving” will with ease. All you do is let the witnesses and the testator sign the attestation clause of a self-proving will, or the self-proving affidavit, asserting that the testator and the witnesses signed the will in the presence of a notary public. This reinforces the integrity of the will and helps prevent potential disputes later on. A self-proving affidavit can further simplify the probate process by eliminating the need for witnesses’ testimony to prove the will’s validity.

We can help cover the essentials, plus healthcare and financial documents that go beyond naming beneficiaries.

What types of wills are accepted in Florida?

Florida recognizes several types of wills, each with specific characteristics and use cases.

1. Simple will

A simple will is the most common type and is suitable for people with straightforward estate planning needs. This type of will typically includes basic provisions for asset distribution, guardian nominations for minor children, and personal representative appointments. Simple wills usually work well for individuals or couples with modest estates, few beneficiaries, and no complex family situations.

2. Pour-over will

A pour-over will is designed to work in conjunction with a revocable living trust. This type of will “pours over” any assets not already placed in the trust into the trust upon your death. Even if you have a comprehensive trust, a pour-over will serve as a safety net to catch any assets you may have forgotten to transfer to the trust during your lifetime.

3. Joint will

A joint will is a single document executed by two people, typically spouses. While Florida recognizes joint wills, estate planning attorneys generally discourage their use because they can create complications. Joint wills typically become irrevocable after the first spouse dies, preventing the surviving spouse from updating their estate plan as circumstances change.

4. Mirror-image will

A mirror image will seem like a joint will, which is most commonly used between married couples and domestic partners, but they’re different from a joint will. In this type of will, both partners leave their assets to each other and have nearly identical asset distributions and beneficiaries. Unlike a joint will, where only one document is created, a mirror-image will has two separate wills, one for each involved party. It offers flexibility to change the will even after one spouse or the partner dies. Many simple wills executed by couples are also mirror-image wills.

5. Military testamentary instrument (MTI)

A Military Testamentary Instrument (MTI) is a legal document similar to a will that is created by a member of the U.S. Armed Forces under specific federal regulations. An MTI is created to provide members of the U.S. Armed Forces and other individuals eligible for military legal assistance a secure, federally recognized way to distribute their property upon death, regardless of where they are stationed or deployed.

Along with creating the will, according to this provision, the designated member can also create and include a Military Testamentary Instrument Self-Proving Affidavit, a Military Power of Attorney Preamble, and a Military Advance Medical Directive Preamble. It’s authorized by 10 U.S. Code § 1044d and is executed with legal assistance. MTIs are designed to be valid across all jurisdictions, including Florida, even if they don’t meet all state-specific will requirements.

Some of the key features of a military testamentary instrument are:

- It’s drafted and executed under federal law, not state law

- It’s prepared by a military legal assistance attorney

- It must include a specific MTI declaration stating it’s prepared according to 10 U.S. Code § 1044d

- It should be signed by the service member and two disinterested witnesses.

- It should also include a self-proving affidavit, making it easier to probate

The table below shows a simple and easy-to-understand representation of the types of wills accepted in Florida.

Are electronic wills legal in Florida?

Yes, electronic wills are legal in Florida as of 2019, when the state enacted legislation allowing “electronic wills” under specific circumstances.

1. What are Florida’s electronic will requirements?

Some of the requirements to make an electronic will in Florida are:

- The will must be created, signed, and witnessed using audio-video communication technology.

- You must be physically present in Florida when signing (witnesses can be anywhere).

- To make an electronic will in Florida valid, along with the testator, two witnesses are required to provide their audio-visual agreement according to the audio-video communication technology used.

- The entire signing process must be recorded, and the recording should be safely stored for future use.

- All parties must be able to see and communicate with each other simultaneously.

2. What is the process behind an electronic will creation?

The process of creating an electronic will in Florida is straightforward.

- You appear on a video conference with the required witnesses.

- You display the electronic will document to the witnesses.

- You electronically sign the will while witnesses observe.

- Witnesses electronically sign while you and the other witness observe.

- The entire process is recorded and stored securely.

3. In what situations are electronic wills particularly useful?

Electronic wills are useful during emergencies when in-person meetings aren’t possible. For instance, during an ongoing pandemic, or socio-political unrest, etc. Electronic wills also help people with mobility limitations create their will with ease, or when witnesses are geographically dispersed. Even when you need to execute your will immediately, you can seek to create an electronic will.

What types of assets are typically covered in a Florida will?

A Florida will can cover various assets individually titled under your name and doesn’t have a designated beneficiary. These assets, also known as personal and real property, can include:

- Real estate properties

- Bank accounts

- Financial assets

- Personal belongings like jewelry, furniture, collectibles, etc.

When including real estate properties in your will, you can list the decedent’s homestead property and any other real estate assets you own. Similarly, for bank accounts and other financial assets, you can specify them as part of your estate, providing details such as the account numbers and financial institution names. You can also include tangible personal property in your will.

What are the types of assets that are not covered in a Florida will?

Non-probate assets are the types of assets that are not covered in a will. These assets pass directly to designated beneficiaries regardless of what your will says:

- Retirement accounts (401[k], IRA) with named beneficiaries

- Life insurance policies with designated beneficiaries

- Jointly owned property with rights of survivorship

- Payable-on-death (POD) or transfer-on-death (TOD) accounts

- Trust assets or property already transferred to a revocable or irrevocable trust are controlled by the trust document, not your will.

What are some of the exceptions to distributing your assets in Florida?

Not all property you own can be distributed through a Florida will. For example, property jointly owned with the right of survivorship cannot be devised by will. In Florida, if you own property as “joint tenants with right of survivorship,” it means that when one owner dies, their share of the property automatically passes to the surviving owner(s), not through the will or probate process. In simpler terms, the surviving joint owner immediately becomes the sole owner of the property, regardless of what the deceased’s will says.

Other restrictions on the ability to distribute property include the following.

1. What is the homestead exception in Florida?

According to Florida’s homestead laws, a family home provides special protections. Generally, if a homeowner dies and is survived by a spouse or minor child, the homestead cannot be left to anyone else in a will. In simpler terms, the surviving spouse is entitled to live in the home for the rest of their life (a “life estate”), and after the spouse passes away, the home goes to the deceased’s children or other descendants.

2. Can I disinherit my spouse in Florida?

In Florida, you generally cannot disinherit your spouse just by leaving them out of your will. State law gives surviving spouses strong rights to a portion of your estate, regardless of your will’s instructions. Specifically, Florida’s “elective share” law allows a surviving spouse to claim 30% of the deceased spouse’s “elective estate,” which includes many assets beyond just those in probate, such as jointly held property and some trust assets.

However, spouses can waive these rights through valid prenuptial or postnuptial agreements or through specific waiver documents.

3. Can I disinherit my children in Florida?

Yes, you can generally disinherit your children in Florida, but you must do so explicitly. Simply omitting a child from your will may not be sufficient, as they could argue they were accidentally forgotten. It’s better to specifically state your intention, such as “I intentionally make no provision for my son John Smith.”

Some important exceptions to consider in disinheritance are:

- Children born or adopted after you sign your will may have rights to inherit unless the will specifically addresses future children

- Minor children may have additional protections

- Homestead property has special rules that may limit your ability to leave it to someone other than your spouse or minor children

How to write and create a will in Florida: A step-by-step guide

Creating a last will and testament in Florida involves a series of essential steps designed to ensure your wishes are clear, your assets are protected, and your loved ones are provided for. Following this comprehensive guide will help you navigate the process, whether you choose to draft your will yourself, use online services, or work with an attorney.

1. Prepare an inventory of all your assets and debts

Before you begin writing your will, create a comprehensive list of everything you own and owe. A complete inventory ensures you don’t overlook valuable assets or create confusion for your beneficiaries later.

Assets to list

- Real estate (primary residence, vacation homes, rental properties, vacant land)

- Bank accounts (checking, savings, money market accounts)

- Investment accounts (brokerage accounts, individual stocks, bonds, mutual funds)

- Retirement accounts (401[k], IRA, pension plans)

- Life insurance policies

- Personal property (vehicles, jewelry, artwork, collections, furniture)

- Business interests (partnerships, LLC ownership, corporate stock)

- Digital assets (cryptocurrency, online accounts, digital files)

Debts to document

Including your debts in your will helps provide a clear picture of your financial obligations, making it easier for your executor to manage and settle your estate efficiently. It ensures creditors are properly notified and paid in the correct order, reducing the risk of legal disputes or delays in distributing assets to your beneficiaries. Additionally, it helps prevent confusion for your loved ones during an already stressful time. By listing your debts, you also reduce the risk of hidden obligations surfacing later, which could unexpectedly diminish the inheritance your loved ones receive.

- Mortgages and home equity loans

- Credit card balances

- Personal loans

- Student loans

- Business debts

- Any other outstanding obligations

2. Choose beneficiaries and backup beneficiaries

Decide who will inherit your assets. The person who receives your assets is called a beneficiary. Beneficiaries can include family, friends, charities, or organizations. Selecting beneficiaries is one of the most important decisions in will creation. Consider both primary beneficiaries and contingent (backup) beneficiaries in case your first choices predecease you.

3. Leave special gifts and assets with specific bequests and general bequests

Besides naming your beneficiaries, you can also leave special gifts or assets with specific instructions to distribute them to certain people. This is called a specific bequest. These are particular items or amounts left to specific people, like leaving your wedding ring to your daughter. Along with specific bequests, you can also leave general bequests of your inheritance to the individual of your choice, such as leaving a percentage of your estate to each child.

Before choosing what kind of bequest you want to make, consider the implications of each approach. Specific bequests remain constant while percentage-based distributions adjust based on your total estate value.

4. Appoint an executor or personal representative

A Florida will also permit you to name a personal representative. The personal representative, also known as an executor, oversees the management of your estate after your death. They ensure that your estate is handled following the provisions of your will and in compliance with legal regulations, with oversight from the court.

The duties of an executor encompass managing the estate’s assets, settling debts and taxes, allocating assets to beneficiaries, and supervising any legal matters about the estate. When choosing an executor, consider their health, expected lifespan, and ability to fulfill the responsibilities. The will writer or testator should also let the person know that they are named as the personal representative or the executor in the will. Though it is not a legal requirement, letting the executor know about this in advance will avoid any surprises later, and the person appointed as the executor will immediately start the probate process once you die. You should also appoint a secondary executor as a backup if the primary choice cannot fulfill the role.

Some of the Florida requirements while choosing an executor are:

A person can serve as a personal representative (executor) in Florida if they meet the following requirements:

- An executor must be at least 18 years old

- An executor must be mentally competent

- An executor cannot have been convicted of a felony (unless civil rights have been restored)

Please note that non-Florida residents can serve only if they are related to you by blood, marriage, or adoption.

5. Name guardians for minor children

If you have minor children, Florida will allow you to designate a guardian for them. This provision ensures that the upbringing and care of your children align with your values and wishes. A guardian must be at least 18 in Florida and have no felony convictions. If no guardian is designated in your will, the court must establish guardianship over your minor’s person’s property first and decide who will act as guardian for your child.

Our step-by-step online tool helps you make key decisions with confidence, at your pace.

6. Draft the will

You can draft your will from the following options.

- DIY will: You can write your own will or refer sample Florida will to draft yours

- Online will-writing services: You can use online will-writing services, such as LegalZoom. They also provide access to attorney consultations and review of your documents.

- Attorney: Hire a Florida estate planning attorney for professional guidance and for drafting your will.

7. Execute your will according to Florida law

Proper execution is critical for your will's validity in Florida.

Signing requirements

- Sign your will at the end of the document

- Sign in the presence of two witnesses simultaneously

- Witnesses must be adults and mentally competent

- Witnesses should sign in your presence and each other's presence

- Consider having witnesses who are not beneficiaries to avoid potential conflicts

8. Make the will self-proving

While this is not a mandatory requirement according to Florida law, it is highly recommended. Making your will self-proving can streamline probate. This involves you and your witnesses signing a notarized affidavit acknowledging the will’s execution. This eliminates the need for witness testimony during probate.

9. Store your will safely and inform trusted individuals

Keep your original will in a secure location, such as a fireproof safe or a safe deposit box. Inform your personal representative and trusted family members where to find it.

Probate process: When and where to file your Florida last will and testament

Creating a last will and testament is only part of the estate planning journey. Once the testator (the person who created the will) dies, the will must be filed with the appropriate Florida probate court to be legally recognized and enforced.

1. Where to file your Florida will

State law requires that the custodian of the will, often the personal representative (executor) named in the document, must file the original will with the Clerk of the Circuit Court in the county where the decedent resided at the time of death. This filing must occur within 10 days of learning about the death. The custodian will also need to provide either the date of death or the last four digits of the decedent’s Social Security number.

If the person was not a Florida resident but owned property in Florida, the will should be filed in the county where the property is located.

County-specific examples

- If the deceased lived in Miami, file in the Miami-Dade County Circuit Court

- If they resided in Orlando, file in the Orange County Circuit Court

- If they lived in Tampa, file in the Hillsborough County Circuit Court

- If a person resided in another state, but owned a vacation home in Naples, file in the Collier County Circuit Court

2. What is the process for filing a Florida will?

- Locate the appropriate county’s probate division

- Bring the original will (not a copy)

- Complete any required filing forms

- Pay applicable filing fees

- Obtain a receipt showing the will has been filed

3. How to file a will in Florida if the deceased owned properties in multiple Florida counties

If the deceased owned property in multiple Florida counties, you may need to file the will in the county where the deceased registered or had their official permanent residence. This means the county listed as their official home address or domicile, which can be confirmed by the decedent’s death certificate or other official records. Filing in the county of residence is required by Florida Statute section 733.101 and ensures the probate court has jurisdiction over the primary estate.

If the deceased owned real estate in other Florida counties beyond their county of residence, you generally do not need to file the will separately in each county. Instead, the probate case is handled in the county of residence, and the court there will have the authority to direct the transfer of property located in other Florida counties. However, if there are complex issues or disputes regarding out-of-county property, the court may coordinate with other counties as needed.

4. What happens when a non-Florida resident dies owning property in Florida?

When a non-Florida resident dies owning property (mostly real estate properties like a vacation home, land, or other property) in Florida, a special probate process is required, called an ancillary proceeding or ancillary probate. This process allows the out-of-state decedent’s Florida property to be legally transferred to their heirs or beneficiaries. The ancillary probate is also required if the non-resident decedent had some debts to collect from Florida residents or liens on Florida property. The ancillary probate process protects the interests of local creditors and ensures a clear title for beneficiaries.

In any of the cases, the main probate (called “domiciliary probate”) happens in the decedent’s (non-Florida resident) home state, but a separate, secondary proceeding, ancillary probate, must be opened in Florida to deal with the Florida assets.

The process of starting an ancillary proceeding involves the personal representative (executor) of the decedent’s estate filing a petition for ancillary administration with the Florida court in the county where the property is located. To avoid confusion and delays, you can always consult an estate planning attorney for professional advice.

5. How does a Florida will handle assets in other states?

A Florida will can direct the distribution of assets located in other states. However, those out-of-state assets may require an ancillary probate proceeding in the state where the real property is located. It’s often advisable to consult an attorney to coordinate your estate plan if you own property in multiple states.

6. What happens if a will is not filed within 10 days of the passing of a decedent in Florida?

Failing to file a will within Florida’s 10-day deadline can have serious legal and practical consequences, though the severity depends on the circumstances and whether the delay was intentional.

Some of the legal consequences of late filing are:

- Civil liability. The person who fails to file the will may be held civilly liable for any damages caused by the delay if another party (the petitioner) files a petition to submit the decedent’s will in the probate court. In such cases, the custodian (the person in charge of submitting the will) who fails to submit the will can face penalties, including additional attorney fees incurred due to the delay, costs associated with locating the will, financial losses to beneficiaries caused by delayed estate administration, and interest and penalties on unpaid estate taxes.

- Court sanctions. Probate courts have discretion to impose sanctions on individuals who unreasonably delay filing a will, including ordering payment of additional court costs. For example, imagine another interested party files a petition against the custodian of the will if the executor has made delays or hasn’t filed the decedent’s will. During such circumstances, the petitioner will incur some legal and attorney costs to file the petition. And this cost at the end of the hearing will mostly be levied from the custodian. The court can also remove someone from their role as personal representative. Otherwise, they can ask the custodian to provide an explanation under oath for the delay.

Some of the practical consequences of late filing are:

Delayed estate administration. Late filing can significantly delay the entire probate process, which affects beneficiaries waiting for their inheritances, bill collectors seeking payment from the estate, tax filing deadlines, potential penalties from late filing, and issues regarding property maintenance and other management decisions.

- Asset protection issues. During the delay, estate assets may be at risk, such as real estate may deteriorate without proper maintenance. Investment accounts may experience losses, insurance coverage might lapse, and business interests could suffer from a lack of management.

- Family conflicts. Late filing often creates or aggravates family disputes, such as when beneficiaries suspect someone is hiding assets, different family members might make competing claims about estate administration, and relationships can be permanently damaged by perceived dishonesty or incompetence.

7. What to do if you’ve missed the 10-day deadline of filing a will in Florida

If you realize you’ve missed the 10-day deadline, file the will immediately. Don’t wait longer, hoping the situation will resolve itself.

Secondly, you should document the reasons before the court. It means you have to explain to the court why the filing was delayed. Acceptable reasons might include:

- You didn’t know about the death until after the 10-day period.

- You were searching for the will and didn’t find it immediately.

- You were hospitalized or had other legitimate emergencies.

- You were waiting for an attorney’s guidance and experienced delays.

Another way is to consult an attorney. If you’re facing potential liability or complications from late filing, consult a Florida probate attorney who can help minimize consequences and guide you through the process.

And lastly, be honest with the court. Courts tend to be flexible with this rule because they understand that there are many delays that can occur.

8. What happens if a will is lost or destroyed in Florida?

If your original will is lost or destroyed, Florida law provides mechanisms for probating the will, but the process becomes more complicated and expensive.

To probate a lost or destroyed will, your personal representative must prove:

- The will was properly executed according to Florida law

- The contents of the will

- The will was not intentionally destroyed by you with the intent to revoke it

- The will was lost or destroyed without your knowledge or consent

If the original will was lost or stolen, but you can prove that it existed, you must provide evidence. Valid evidence includes the following:

- Copy of the will (if available)

- Testimony from witnesses who saw the original will

- Testimony from people familiar with the will’s contents

- Evidence about how the will was lost or destroyed

- Proof that you did not intend to revoke the will

Proving a loss of will presents some specific challenges, such as the following:

- Higher burden of proof than with an original will

- More expensive probate proceedings

- Potential family disputes about the will's contents

- Courts may be skeptical about lost will claims

Revising, amending, or revoking a will in Florida

Life circumstances change, and your will should reflect these changes to ensure your estate plan remains current and effective. Florida law provides several methods for modifying or completely revoking your will, each with specific requirements and implications.

1. When should you consider revising your will?

You should consider revising your will when major life events happen, such as:

- Marriage or divorce

- Birth or adoption of children

- Death of beneficiaries or personal representatives

- Significant changes in financial circumstances

- Moving to or from Florida

- Changes in relationships with family members

- Acquisition or sale of major assets

- Changes in tax laws that affect your estate

2. How should you revise, amend, or revoke your will in Florida?

Some of the methods for changing your will in Florida are:

- Using a codicil (amendments to your existing will). You can modify your Florida will by executing an amendment known as a codicil. A codicil is a legal document that amends specific provisions of your existing will without replacing the entire document. This codicil must adhere to the exact legal requirements as the creation of the original will. Codicils are best for minor changes, such as updating a beneficiary or executor, but multiple codicils can create confusion, so for significant updates, a new will is recommended.

- Revoking an existing will and creating a new one. Alternatively, you can entirely nullify your will by either drafting a new one or physically destroying the original one. To revoke a will through written means, a subsequent writing must be produced explicitly revoking the previous will. You must sign the new will in the presence of two witnesses, as required by Florida law. To avoid confusion, destroy the old will and any copies once the new one is executed. You can destroy your old will by tearing, burning, or otherwise obliterating the document. You can also have someone else destroy it at your direction and in your presence.

3. What are the common mistakes to avoid while revising wills?

Some of the common mistakes that can happen when you revise your will are:

- Partial revocation confusion. Attempting to revoke only parts of a will by crossing out sections can create legal ambiguities. Courts must determine whether you intended to revoke specific provisions or were simply making notes.

- Multiple documents. Having multiple wills or amendments can create confusion about which document represents your final wishes. Always clearly revoke previous documents when creating new ones.

- Informal changes. Writing changes in margins or on sticky notes attached to your will document does not legally modify the document. All changes must follow proper legal procedures.

Common pitfalls to avoid when creating a Florida will

Crafting a Florida will is a key step in estate planning. However, it’s essential to be aware of common pitfalls that could complicate the process. One major pitfall when creating a Florida will involves the state’s strict homestead laws. In Florida, if you own a primary residence (homestead) and have a surviving spouse or any minor children at the time of your death, you generally cannot leave that property to anyone else in your will, even if you try to do so.

In simpler terms, Florida law automatically protects your spouse and minor children. According to the homestead property law, the homestead property will pass directly to the spouse, regardless of what your will says. Typically, the surviving spouse receives a “life estate” (the right to live in the home for the rest of their life), and after the spouse passes away, the property goes to your children. If you attempt to mandate the sale of the homestead and distribute the proceeds in your will, those proceeds will lose their special creditor protection under Florida law, potentially exposing them to claims from creditors.

Another pitfall is the improper storage of a will. Improperly stored wills can raise doubts about their authenticity, potentially resulting in legal conflicts or invalidation. If your will is lost, damaged, or inaccessible, it may be presumed revoked or could trigger legal disputes among your heirs. In some cases, if the original signed will cannot be found, Florida courts may assume you intended to revoke it, which could result in your estate being distributed according to state intestacy laws rather than your wishes. Securely storing your will in a fireproof safe or another secure location and notifying reliable individuals about its location is very important.

Avoid probate with living trusts

Setting up a revocable living trust is an alternative to a last will and one method to bypass the probate process in Florida. This legal instrument enables the transfer of assets into a trust while you’re alive. The trust can be altered or annulled at any point during your lifetime and serves to circumvent the probate process upon your death.

Various assets, including real estate, bank and investment accounts, and business interests, can be transferred into a revocable living trust. However, certain retirement accounts should not be transferred into a living trust.

Establishing a revocable living trust has several benefits, including avoidance of probate, preservation of privacy, and adaptable asset management. However, potential disadvantages may include initial setup and ongoing maintenance expenses, and the need to transfer assets into the trust.

DIY wills vs. hiring an estate planning attorney

In Florida, residents have the legal right to draft their own will, and self-prepared wills are recognized as valid. The legal requirements for drafting a will are covered in the above section, "What are the legal requirements for a valid will in Florida?" However, drafting a DIY will come with its own set of challenges.

Though drafting your own will might appear attractive, hiring an estate planning attorney or using an online service helps ensure that your will adheres to state laws. You’ll also get proficient advice on creating a thorough estate plan. Hiring an attorney to draft an essential will in Florida can vary, but it typically costs between $500 - $1,000. However, more intricate drafting requests will result in a higher fee.

Use LegalZoom to create your estate planning documents with ease and confidence

If you want the convenience of a DIY will but the security of getting advice from an estate planning attorney, you should consider using an online company like LegalZoom. At LegalZoom, you can get access to estate planning templates while having the option of having an experienced estate planning attorney review your will with you.

For individuals and families (including blended family structures) who are concerned about the complexity and cost of traditional estate planning, LegalZoom’s Will & Trust services offer a user-friendly, affordable, and legally sound solution. By combining attorney guidance and review options, LegalZoom simplifies the process of creating estate plans, giving customers peace of mind and control over their future.

Some of the benefits you’ll get while using LegalZoom’s Will & Trust services are:

- You can create your estate planning documents from the comfort of your own home, at your own pace

- You can access your estate planning documents 24/7 via secure online storage

- Step-by-step guidance is provided, and resources are provided to help you make informed decisions

Get peace of mind with us—join the 1.4 million who have confidently created their last wills online with us. With thousands of 5-star reviews on TrustPilot, here’s what our customers have to say:

It amazes me something so important was so easy to do...everything was exactly as I had stated. I have peace of mind now.

– Jan F., last will & testament customer

[The] lawyer … was so helpful in explaining the process, what to expect, and when we'd move on to the next steps. Amazing. I highly recommend this service!

– Nicholi P., last will & testament customer

Summary

Having a comprehensive Florida last will and testament is crucial to estate planning. From understanding the key requirements of a Florida will to avoiding common pitfalls, this guide offers a deep dive into the essential elements of creating a valid will.

While the process may seem daunting, remember that the effort you put into creating a comprehensive will today can provide peace of mind for you and your loved ones in the future. So take that first step, consult a qualified estate planning attorney, and ensure your last wishes are honored.

Frequently asked questions

1. Can I write my own will in Florida?

Yes, as a Florida resident, you can write your own will without an attorney or document service, but you must ensure it meets all the requirements outlined in Part V of Chapter 32 of the Florida Statutes.

2. Do wills have to be filed with the court in Florida?

Yes, in Florida, the custodian of the deceased person’s original will must file it with the Clerk of the Circuit Court in the county where the person’s main residence was. The will must be filed within 10 days of learning about the testator’s death.

3. Who inherits when there is no will in Florida?

If you die without a will in Florida, generally, state-specific intestacy succession laws take precedence in asset distribution. To know more about this, you can refer to the “What happens if an individual dies without a will in Florida?” section above.

4. How do you set up a simple last will and testament?

To create a simple last will and testament, decide whether to hire a lawyer or write your own will online. You can create your estate planning documents online with the help of LegalZoom’s Will & Trust services for an affordable price. The user-friendly and state-specific questionnaire allows you to fill out and create your documents with ease. Irrespective of how you are creating your last will and testament, you need to identify your beneficiaries, choose a legal guardian for the health care of your child, and decide on an executor for your estate.

5. How do I make my will self-proving in Florida?

To make your will self-proving, you and your two witnesses must sign a self-proving affidavit in front of a notary public at the same time as the will is executed. This affidavit affirms that the will was signed and witnessed properly. A self-proving will allows the probate court to accept the will without requiring the witnesses to appear in court, streamlining the process.

6. Can I create a will online in Florida?

Yes, you can create a will online in Florida, provided it meets all legal requirements: It must be in writing, signed by the testator, and witnessed by two people in each other’s presence. Online services like LegalZoom can help draft the document, but the signing and witnessing must still be done in person.

7. How to contest a will in Florida?

To contest a will in Florida, an interested party (such as a potential heir or beneficiary) must file a formal objection with the probate court. Common grounds for the contest include lack of testamentary capacity, undue influence, fraud, improper execution, or the existence of a later valid will. The challenger bears the burden of proving the will’s invalidity, and the process can be complex, often requiring legal representation.

8. What are some of the practical limitations of electronic will creation?

The practical limitations are:

- Requires specific technology and technical knowledge

- More complex requirements than traditional paper wills

- Limited attorney availability for this service

- Questions about long-term storage and accessibility of electronic documents

- Potential authentication challenges in probate

9. How to draft your Florida last will and testament?

When it is time to write your last will and testament, you must make sure that your will meets these basic requirements for a Florida last will and testament.

- Age: The testator must be at least 18 or an emancipated minor.

- Capacity: The testator must be of sound mind, capable of making decisions and reasoning when the will is signed.

- Signature: The testator or another person must sign the will under their direction and in their presence.

- Witnesses: Two competent witnesses must be present when the testator signs a Florida last will and testament to be valid. The witnesses must also sign the will in the presence of the testator and each other. It is recommended that your will be witnessed in front of a notary public.

- Writing: Florida wills must be written. Holographic wills are not recognized as valid in Florida.

Michelle Kaminsky, Esq., contributed to this article.