Whether you want to hire employees, open a business bank account, or apply for an operating permit, your business needs legal recognition. An employer identification number (EIN) identifies your company for legal and tax purposes. But you can only get one if you file an SS-4 form with the Internal Revenue Service (IRS).

An EIN will allow your business to expand or adapt to new challenges, and proper filing can ensure you get your new tax ID in time for smooth operations. To help your growing business along, we'll explain SS-4s, EINs, and how to move through the application process. process.

What is an SS-4?

IRS Form SS-4 is the application form for an employer identification number (EIN). Like other tax ID numbers, EINs aren't issued automatically; you can only receive an EIN by filing this specific form.

Not just anyone can fill out and submit Form SS-4. The IRS wants a "responsible party" to complete the document, with or without help from an attorney. The IRS defines a responsible party as the owner or individual who exercises effective control over the entity. Government entities can also serve as responsible parties.

EIN definition

An EIN is a taxpayer identification number (TIN) required for certain businesses and other entities. EINs don't only apply to employers or owners; they identify an organization itself. EINs allow a company or other entity to:

- File certain forms with the IRS

- Legally operate under local or federal laws

- Open business bank accounts

- Apply for business licenses

Note: A Social Security number, individual taxpayer identification number, and employer identification number are all different TINs. An EIN has nine digits, the same as a Social Security number. However, it uses one dash instead of two, such as 66-6666666.

Why do you need an SS-4 for EIN verification?

Banks and other lenders need to verify a business' EIN before lending to them. Since SS-4s go through the IRS, lenders consider them the most reliable source, unlike tax returns or W-9s that could contain typos. Ultimately, sharing an EIN with Form SS-4 speeds up the underwriting and lending process.

What’s the difference between a W-9 and an SS-4?

SS-4s help businesses apply for an EIN, while Form W-9 allows companies to share and verify their EIN with other entities. Over a business's life cycle:

- Form SS-4 provides the tax ID (EIN) it needs to operate

- Form W-9 shares that same tax ID (EIN) with business partners for payment, ID verification, or compliance purposes.

Note: As mentioned above, lenders may not accept a W-9. Other organizations may prefer an SS-4, as well.

When does your business need to fill out IRS Form SS-4?

A business needs to file an SS-4 and receive an EIN if it:

- Files business taxes as anything but a sole proprietorship

- Hires employees and pays employment taxes

- Pays alcohol, tobacco, firearm, or excise taxes

- Operates as a limited liability company (LLC), partnership, or corporation

- Opens a business bank account

- Has a qualified retirement plan (also called a Keogh plan)

- Applies for certain permits or licenses

In other words, your business needs an EIN unless you’re a sole proprietor who doesn’t pay employment, alcohol, tobacco, firearm, or excise taxes. However, sole proprietors can still choose to operate under an EIN at their discretion.

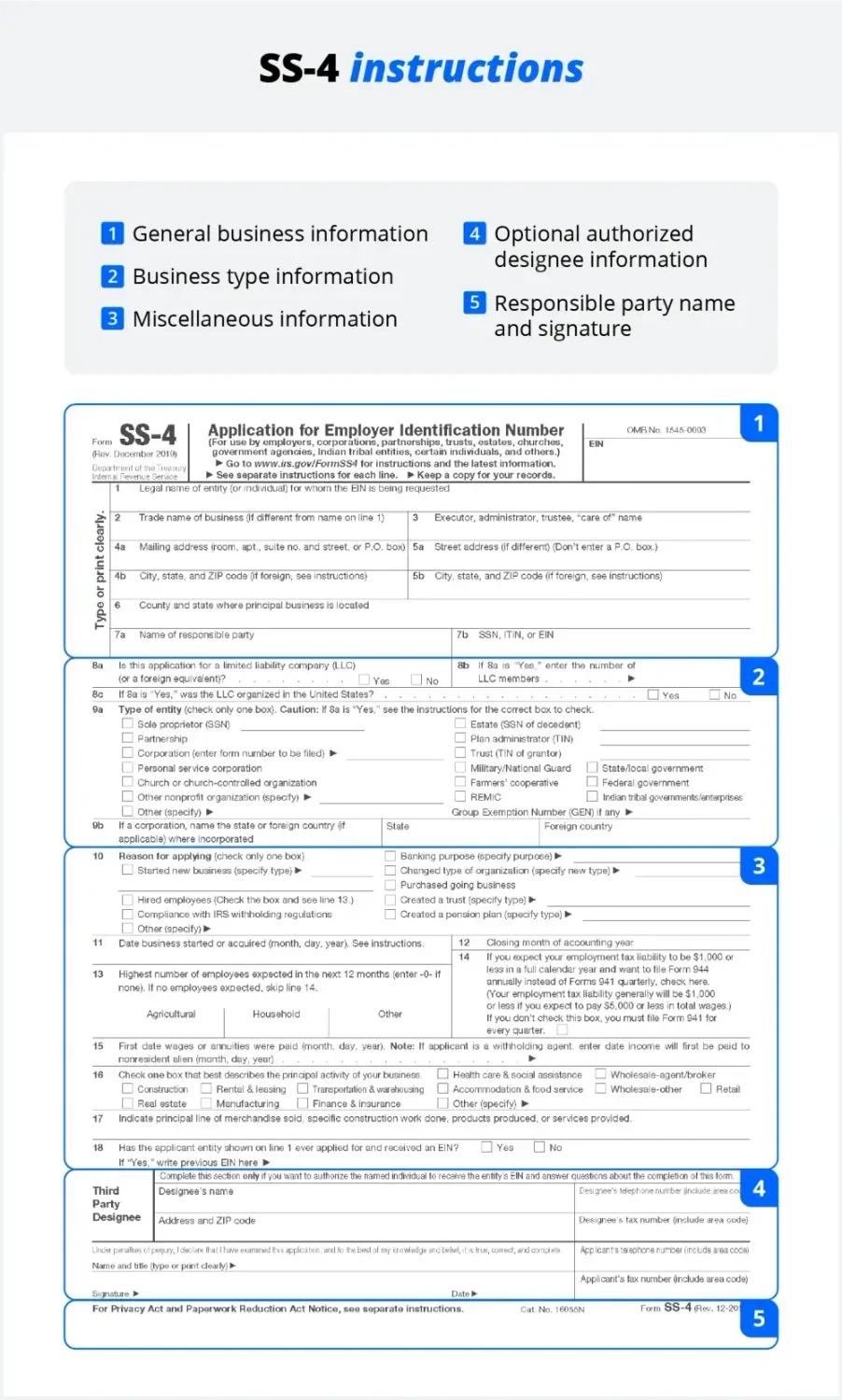

What does an SS-4 Form look like, and what’s included?

An SS-4 looks like a standard IRS document. Like most business-oriented IRS forms, it contains sections for different types of business information:

- Section 1: Lines 1–7 account for general business information. This includes the entity’s names, addresses, and your responsible party.

- Section 2: Lines 8–9 confirm your business structure.

- Section 3: Lines 10–18 highlight business activities and why you need an EIN.

- Third-party designee: This section allows you to appoint a third party who receives the EIN and answers questions about the form. Business partners and lawyers often work as designees.

- Name and signature: The bottom portion where a responsible party signs and dates the form.

What information do you need for an EIN application?

You will need the following information to complete the form, including:

- Legal name of your business

- Trade name of your business, also called a DBA, if you will operate under a name that is different from the legal name

- Optional “in care of" person if you wish to designate someone to receive tax information

- Mailing and street addresses of the business

- County and state where the principal place of business is located

- Responsible party—this is typically the owner, a general partner, or a principal officer

- Social Security number, Individual Taxpayer Identification Number, or EIN of the responsible party

- Business entity type (e.g., sole proprietorship, partnership, LLC, corporation)

- Date your business began or got acquired

In addition, you will need to provide information about your business’ expected employees, principal activities, and history.

An EIN will allow your business to expand or adapt to new challenges.

How to complete form SS-4

You can complete the application by planning ahead, obtaining the right documents, filling out the application, authorizing the form, and sending it to the IRS.

1. Plan ahead: How long does it take to complete Form SS-4?

Businesses can complete Form SS-4 within an hour with the right information on hand. Owners with less IRS experience can also consult a tax expert for help.

Depending on your application method, you may have to wait days or weeks to receive your EIN. The average turnaround times include:

- Mail: Four to five weeks

- Fax: Approximately four business days

- Online: Immediately after the IRS verifies your information

2. Obtain the form and your business info

As with other IRS forms, you must prepare information such as the business’s legal name, address, and current tax ID (see the full list of items above). You can find this information on tax statements, founding documents, and other federal or state forms.

How to get Form SS-4

There are three ways to obtain an SS-4 form from the IRS. You can obtain the document from:

- The IRS website

- Your local IRS office

- Mail order forms

Applicants can also obtain an SS-4 from local libraries or various tax websites.

3. Fill out the application

An SS-4 includes sections for business and designee information. While the designee section is optional, it can ensure your EIN falls into the most qualified hands. To ensure accuracy, you can ask a lawyer to review the form. They will make sure the SS-4 reflects accurate business information.

4. Authorize the document

A responsible party must sign the SS-4. The responsible party is the fiduciary of an estate or trust, the president or principal officer of a corporation, and the owner or authorized member of other business structures.

- Fiduciary of an estate or trust example: An executor, guardian, or conservator of an estate will qualify.

- Principal officer of a corporation example: Chairs, CEOs, COOs, CFOs, and vice presidents may all qualify as principal officers.

- Other authorized member example: Secretaries, controllers, treasurers, or top managers can authorize the form at a principal officer’s request.

5. Send your SS-4 to the IRS

After reviewing the form, you can send it to the IRS for review—submission methods include online, by fax, and by mail.

You can find details on the full submission process below.

Note: If they encounter any issues, they will contact you or the form-appointed designee.

3 ways to file Form SS-4

There are three ways to file an SS-4 form with the IRS: online, by fax, or by mail. Even if you file your form via fax or mail, you should consult the IRS website to ensure you send it to the correct fax number or address, as these may change over time.

Online filing process

You can complete the form and file it on the IRS website. This will enable you to get your EIN immediately.

Fax filing process

You will get your number in about four business days if you file by fax. The correct fax number depends on your location:

- If your principal place of business or legal residence is in one of the 50 states or the District of Columbia, fax your SS-4 to 855-641-6935.

- If your principal place of business and your residence is outside of the U.S., fax it to (855) 215-1627 from inside the U.S. or (304) 707-9471 from outside the U.S.

Be sure to check the most current version of the IRS Instructions for Form SS-4 and the most current version of the SS-4 form itself to be sure you have the most current information.

Mail filing process

It will take about four weeks to get your number if you file by mail. Send Form SS-4 to Internal Revenue Service, Attn: EIN Operation, Cincinnati, OH 45999. Check the current version of the IRS Instructions for Form SS-4, and the SS-4 form itself, to be sure you have current information.

How to get a copy of your SS-4 form

You can obtain a copy of your verified SS-4 by:

- Returning to the IRS online portal where you applied for an EIN. From here, you can re-download the form as a PDF.

- Contacting the IRS at its Business and Specialty Tax Line and EIN Assignment line. The number is: (800) 829-4933.

Why get an EIN for your business?

While you may not need an EIN to operate, getting one opens the door to new avenues of growth.

IRS Form SS-4 FAQs

What is Form SS-4, and why do I need it for my business?

Form SS-4 is the application you fill out to get an employer identification number (EIN) from the IRS. You need this form when you're starting a new business, hiring your first employee, opening a business bank account, or changing your business structure. Banks often require an EIN to open business accounts because it proves your business legally exists. The IRS also needs this number to track your business taxes and keep them separate from your personal taxes.

How is Form SS-4 different from Form W-9?

Form SS-4 is what you use to apply for and get your EIN from the IRS for the first time. Form W-9 is what you use later to share your existing EIN with other businesses or banks. Think of it this way: SS-4 is like applying for your driver's license, while W-9 is like showing your license to prove you have one.

When exactly do I need to file Form SS-4?

You need to file Form SS-4 in several situations, with the most common being when you start a new business. You also need it when you hire your first employee, even if you've been running the business by yourself. You may also need a new EIN if you’re changing your business structure (like going from sole proprietorship to LLC), buying another business, or opening a business bank account.

How can I submit Form SS-4, and how long does it take?

You have three ways to submit Form SS-4, each with different processing times. The fastest way is online through the IRS website, which gives you your EIN immediately after you complete the application. If you can't apply online, you can fax your completed form to the IRS, and they'll usually process it within 4 business days, or mail the form in, which takes 4–5 weeks to process.

Who can be the responsible party on Form SS-4?

The person who has the legal authority to make financial decisions for the business is the responsible party on the form. For most small businesses, this is simply the owner or main person running the company. If your business is a corporation, the responsible party is usually the president, CEO, or another main officer. For LLCs, it's typically a member or manager. For partnerships, it's one of the general partners who can make decisions for the business.

What happens if I make mistakes on Form SS-4?

If you submit the form with errors, the IRS will usually send it back to you with instructions on what needs to be fixed. This means you'll have to resubmit and wait for processing again, which can delay getting your EIN by weeks.