Building a business from the ground up is not for everyone and can take a physical, emotional, and financial toll on entrepreneurs.

But buying into an existing business with established demand and excellent profits can help reduce some of the stress and risk to you. Learn more about the pros and cons of purchasing a business, the steps to buying a business, the types of businesses you can buy, and tips to ensure that you're pouring your resources into a viable company.

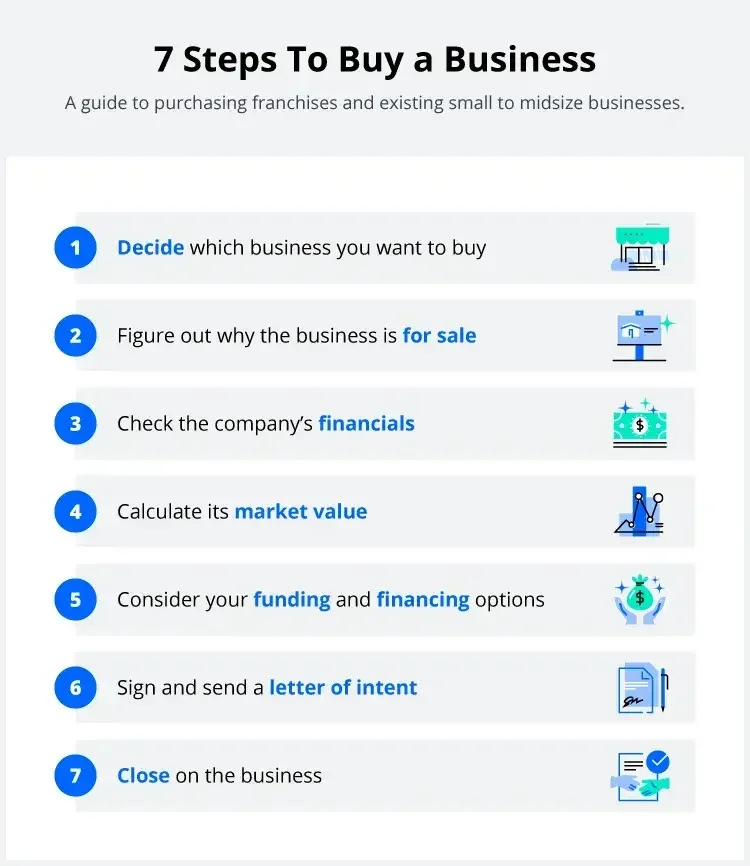

Buying a business in 7 steps

If you've decided you're ready to buy a business, here's everything you need to know to get started and feel confident about your purchase.

Step 1: Choose a business to buy

Financials and ROI aren't the only important considerations when making a responsible business decision. You also need to understand the company and industry. This will help you offer fresh insights that can take the company you acquire to new heights.

You should also have a working knowledge of industry trends and the company's offerings, business model, and target audience. Understanding these things will help you bring fresh insights and innovative ideas to the company.

For example, if you have any job experience at a store, it might make sense to acquire some kind of retail operation. You'll likely be able to brainstorm better promotions, know when to order more or less of a specific product, and how to create a better shopping experience for your customers.

There are numerous other factors that you should consider before choosing a business to buy. Consider your interests, passions, education, and professional experience to narrow down your ideal business opportunity.

How to find businesses for sale

You can find small businesses, franchises, and corporations for sale online, in advertisements, by networking with locals and community leaders, or by hiring a business broker.

- Online: Marketplaces like BizBuySell are good places to start looking for business acquisition opportunities.

- Advertisements: Some businesses may advertise on Craigslist or local swap sheets. You may also strike gold looking for businesses to buy in the classifieds.

- Network: Perhaps the best way of finding elite opportunities before the general public is by reaching out to friends, family, former colleagues, industry leaders, community members, and area small business owners.

- Outsource: If you don't have time to find the right business to add to your portfolio, a business broker can find the best deal, negotiate a great price, and assist with the purchase paperwork for a fee.

Step 2: Find out why the business is for sale

The reasons people may choose to sell their business are endless. Maybe they're retiring, they always intended to sell, profits are in the gutter, or they're struggling to catch up to more established competitors.

Some of these issues are yellow flags, but could potentially be resolved with some extra funding and a better business plan. Other issues may disqualify a business altogether. Some red flags include the following:

- Unhappy customers or a poor reputation

- Dissatisfied and unmotivated employees

- Lackluster online reviews

- Oversaturated markets and established competitors

- Poor location with insufficient foot traffic or parking

- Bad credit history

How to have an honest conversation about a business

Sometimes owners genuinely just want to retire and pad their savings account or take their career in a different direction at a time when they can cash out for a profit.

Other times, there are more sinister reasons for owners putting their businesses up for sale. The only way to find out is to talk to the owner and fact-check everything.

Here are some ways you can uncover potential issues:

- Talk to customers: A business is nothing without paying customers. Talk to clientele to see what they like and dislike about the company and the quality of its services.

- Read online mentions: This can tell you more about how people feel about the company and give you insight into its reputation. If they have an F on the Better Business Bureau (BBB), one star on Google My Business (GMB), and complaints and controversies surfacing on social media, you know to ask questions or nix the deal.

- Talk to employees: Some staff members may be hesitant to tell the truth, if it will put their job at risk, but many will give you valuable information about how the business is managed and areas where you can improve it.

- Assess competitors: Do some research to determine if the local market is oversaturated with companies similar to the one you want to buy. You should also ensure that there aren't any established companies with a monopoly on those services.

- Visit the business: Seeing a business in person can tell you a lot. Maybe it's in an awkward location, doesn't receive enough foot traffic, or has insufficient parking options.

- Run a credit report: Paying bills late or not at all may indicate hidden problems with the business, like cash flow problems or irresponsible management.

Questions to ask before buying a business

Once you've talked to everyone and done your due diligence, evaluate everything you've learned by asking yourself these questions:

- Why is the owner selling?

- Can I add value to the business?

- What is the company's financial status?

- Is it priced right for the amount of money it brings in?

- What assets are included in the sale?

- Who are the company's main competitors?

- Can you outpace the competitors, even if you're starting from behind?

- What does the industry outlook look like?

- How much money will you need to invest after the sale to make the business profitable?

- What licenses and permits do you need to acquire or maintain?

- Does the company have a good relationship with its employees and customers?

Step 3: Assess the company's financial health

Once you feel confident that the owner is selling the business for the right reasons and you're interested in moving forward, take an in-depth look at the business with an attorney and an accountant.

1. Sift through the founding documents

Every business should have articles of incorporation, a business plan, operating agreement forms, employee and NDA agreements, and business registration documents. If you plan to buy a company, you have a right to request the chance to review all of these. But take extra care to review the following:

- Articles of organization: Sift through these founding documents for LLCs and corporations to learn more about the business, including how long it's been around and who's involved in the enterprise.

- Certificate of good standing: Ask for a certificate of good standing to prove that the company is properly registered and current on all fees and filings.

2. Check business licenses and permits

In addition to checking in on the businesses standing with the state, you should also ensure that it complies with local laws. They should have all city- and state-mandated licenses and permits on file.

3. Review local zoning ordinances

Cities use zoning to divide the land up by purpose. Ensure that the work the company does complies with zoning and environmental regulations.

- Zoning laws: Ensure the existing business isn't violating the city's zoning regulations by checking area zoning laws.

- Environmental and health regulations: You should also look at the area's small business environmental regulations to ensure the business is in good standing before moving forward with the purchase.

4. Request all contracts and legal documents

Ask for copies of all legal documents. This may include leases, standing agreements with customers, distributors, contractors, union contracts, and other documents.

5. Review intellectual property records

Understanding a company's trademarks, patents, copyrights, and trade secret policies can help you better understand its priorities, products, and value. Intellectual property protection also helps safeguard assets unique to the company.

6. Examine tax and financial records

Examine tax and financial records from at least the past five years to determine if the business is following the law and how much it's worth. The financial records you should review include the following:

- Tax returns

- Cash flow statements

- Debt records

- Balance sheets

- Marketing and advertising costs

7. Evaluate sales records

In addition to the aggregate financial data, look at sales records monthly to determine which products and services sell the best and what times of the year might be slow for business.

You should also compare the business's prices with those of its competitors.

8. Take inventory of all business assets

Inventory all the business assets and note their age, condition, and value.

Some of these assets may increase the value of a business. But if things like tools and equipment are unsafe or outdated, it could be a liability and lower the company's value.

9. Check employee information

Look into the company's staff, salaries, benefits, and duties to ensure that it's on par with the industry.

Perhaps improving benefits will incentivize great employees to work hard and remain loyal to the company after ownership switches hands. Or perhaps you need to add more work to someone's plate if you're losing money based on their work-to-benefits ratio.

An honest assessment of employee skills, work ethic, and schedules also lets you know if you need to move people around or hire for an additional position.

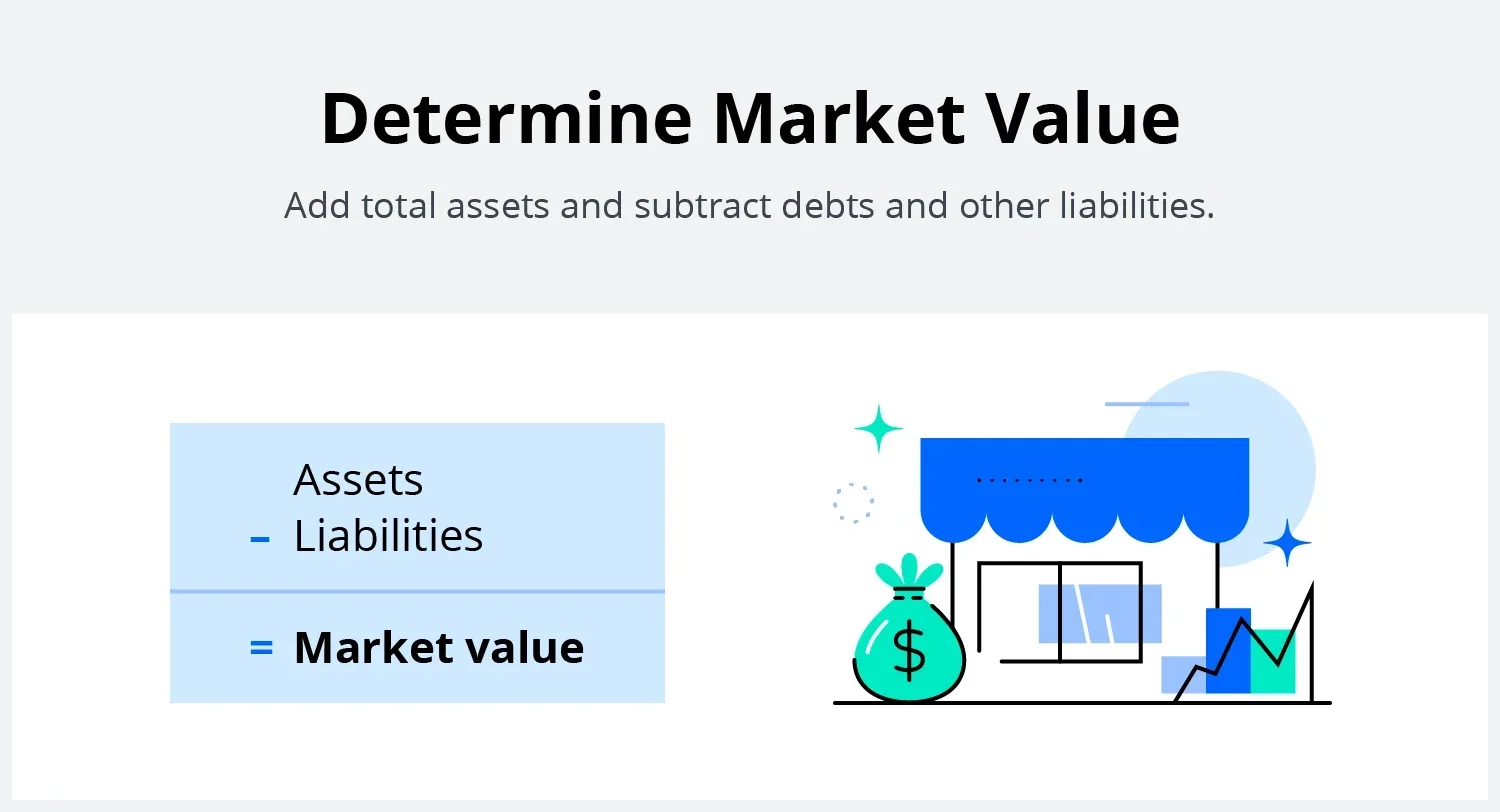

Step 4: Calculate the business's market value

Calculate the market value of any company you're considering buying using the business valuation formula.

Business valuation formula

Add the value of the company's assets (equipment and inventory), then subtract all of its debts or liabilities. The remaining total is the company's market value.

Step 5: Consider funding and financing options

If the business already produces fairly stable quarterly profits, you should know how much it's worth now and how much it will make in the future. The process only becomes murky if the business hasn't turned a profit, but you expect it to in the future.

In a situation like that, consider the value of the business' assets (equipment, inventory, real estate, intellectual property, etc.) and how those assets could bring in during future months.

To arrive at a fair valuation, many prospective buyers also look at how much comparable businesses have sold in the market. Local factors like location and consumer demand are baked into the price.

Income-based valuation methods

This determines the value of a business based on the income you expect a business to earn using one of the following valuation methods:

- Asset-based valuation: Determine the business' value based on the value of its tangible and intangible assets.

- Market-based approach: Determine the business' value based on the value of comparable businesses within the industry.

- Discounted future cash flows method: The discounted cash flow valuation method estimates how much a business is currently worth by looking at future cash flows.

- Capitalization of earnings method: The capitalization of earnings method shows the business's future profitability by looking at how much you expect the business to earn based on its current earnings.

Business purchasing financing options

To finance the acquisition of a company, you can:

- Use your savings or borrow money from family members

- Find a business partner to purchase the business with you

- Negotiate a rent-to-buy deal

- Take out a loan from the bank or set up a payment plan with the seller

- Explore additional loan options, like an SBA loan

But you should read up on the laws around seller financing. In many cases, other loans take a higher priority. For example, if you secure a loan from the U.S. Small Business Administration, you're usually required to pay that back before you pay a seller back.

Step 6: Sign a letter of intent

Before reaching a final agreement, consider drafting a letter of intent. Think of this as the first draft of your agreement.

It's typically short and sweet and includes the terms of the deal, price information, descriptions of any assets involved in the transaction, and other important information.

Letters of intent aren't typically binding. Instead, they're a way for buyers and sellers to negotiate a transaction without fully committing and to demonstrate that both parties are interested in the transaction.

Step 7: Close the deal

Finally, it's time to close the deal. In addition to settling on the appropriate price in your final agreement, you'll also want to consider how to transfer leases, vehicle ownership records, intellectual property, and other assets into your name.

6 Business purchasing mistakes to avoid

The business buying process is complicated, but there are some clear-cut things you can avoid to protect yourself and your investment.

- Don't purchase without knowing why the business is for sale

- Don't underestimate the value of goodwill toward a company

- Don't just skim the surface—make sure you do your due diligence

- Don't overextend your business purchasing budget

- Don't buy into an industry you know nothing about

- Don't buy to make a total overhaul immediately.

Pros and cons of buying an existing business

Buying an existing business has numerous advantages and disadvantages, but it's generally considered a low-risk way to become a business owner.

"If you buy a business, there are customers and clients, systems and processes in place, and documented financial performance that will allow a new owner to predict future income; and the future former owner is a mentor to help the new owner grow the business," John R. Allen III, the managing partner of Allen Business Advisors, a business brokerage firm, says.

Advantages of buying a business

When you start your own business, it can take several years of trial and error to hone in on your niche and develop a loyal audience. But when you purchase a business, you can skip over this tedious process altogether and enjoy numerous other benefits.

Perhaps the biggest advantage to buying over starting a business is the existing business's potential. You may see growth opportunities the current owner doesn't, or maybe you have a winning business plan in mind.

Your enthusiasm and excitement for the business can revive it and help it to flourish, and often relatively minor changes in advertising, personnel, or procedure can greatly improve profitability.

Some pros of buying a business are that you can:

- Get a glimpse at the company's operating history to understand its successes and brainstorm solutions for its failings.

- Understand which advertising efforts are most effective and will provide a high return on your investment.

- See if cash flow consistently outweighs operating expenses.

- Determine if you have enough money to purchase the company and make updates before making an offer.

When you start your own business, numbers are much more difficult to estimate, potential issues are harder to anticipate, and it can be more difficult to secure funding because investors consider start-up businesses higher risk.

Disadvantages of buying a business

There are also some disadvantages when you buy an existing business instead of building one. For one, you miss out on the excitement of growing something from the ground up.

It can also get expensive if the company is already underwater due to poor management, which is why you must do your due diligence before closing a deal.

Once you better understand the issues a company has, weigh them seriously against the advantages to decide if it's right for you.

You may decide some things are simply too much of a hassle. For example, you may need to:

- Re-staff, the company, collaborate with employees you don't know and didn't hire, or motivate employees who became complacent under old management.

- Deal with internal and external resistance to changes you make to company offerings and practices.

- Schedule health and building inspections and pay for updates.

- Do a deep dive into company financials and address any debts or account deficits.

- Think of ways to entice customers who shop there because they are loyal to the former business owner to continue working with the company.

If any of these things are applicable and too much of a red flag, pass on the business opportunity. Even if you don't notice any significant issues on the surface, keep in mind that the seller may try to downplay certain business problems.

How much does it cost to buy an existing business?

Generally, franchising costs new owners between $20K and $50K, and buying a successful existing business comes with a median sticker tag of $150K to $200K.

The cost of buying a business depends on several factors—the primary ones being the revenue the company generates each month and its debt.

To determine the value of a company, calculate all of its monthly earnings and recurring revenue and subtract its debts and recurring expenses. You'll want to pay off your debt and become profitable in two to three years, so you should only pay about one to three times the amount of the company's annual profits.

When does buying a business make sense as a business investment?

Many investment experts are encouraging younger generations of entrepreneurs to buy existing businesses. Of course, anyone who has the time, money, and drive to take on a new business and add some value to it could be a good business acquisition candidate.

"Buying from a seasoned owner allows you to learn from decades of [the seller's] experience, taking a shortcut in the school of life," Lisa Kipps-Brown, the author of Boomer Cashout: Increase Your Business's Value & Marketability to Sell for Retirement, says.

The type of business you should buy depends on who you are, your interests, and your experience.

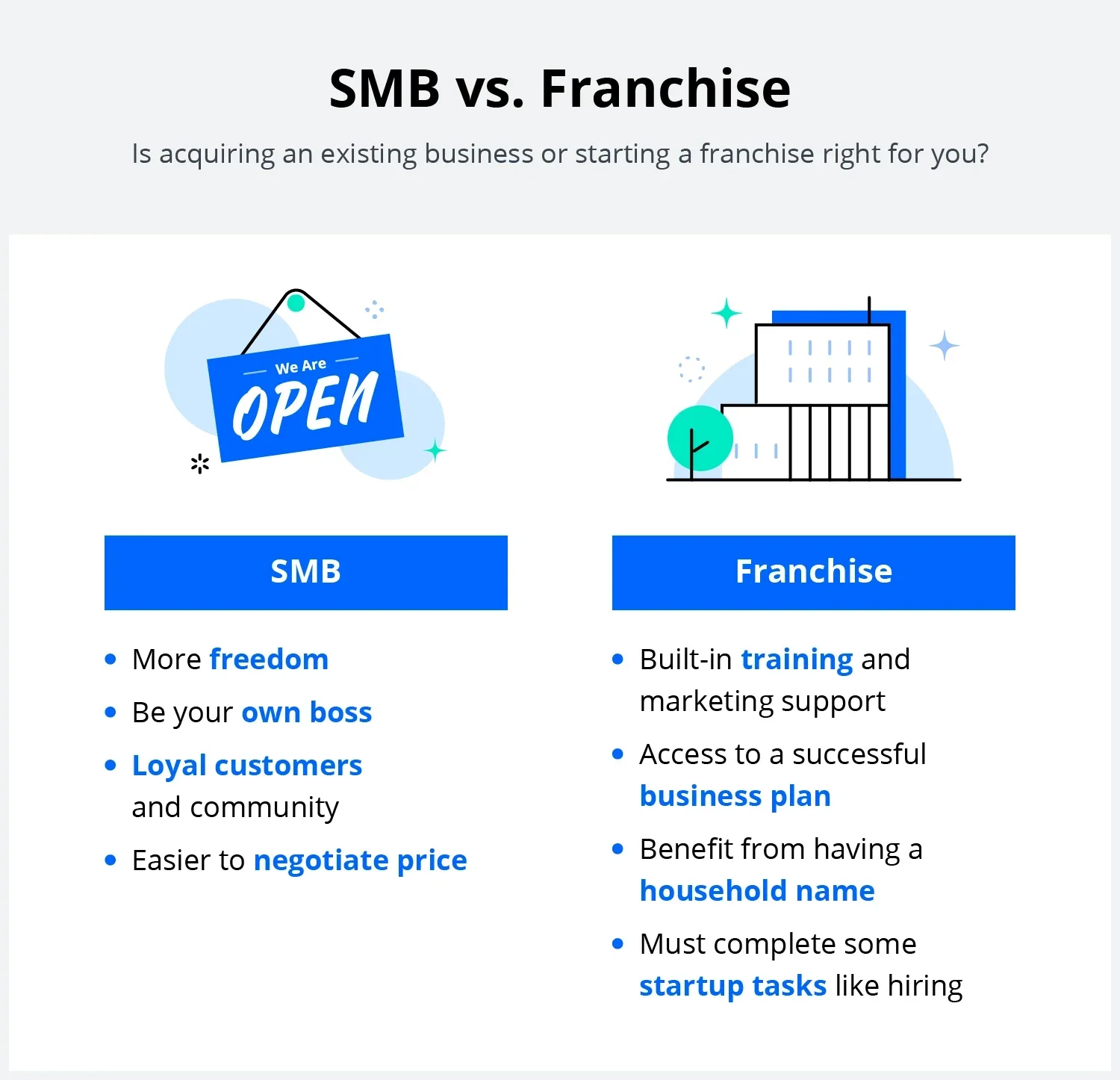

If you'd rather buy a unique company that might still be carving out a reputation for itself and could use your insights to take off, buy a small to midsize business (SMB).

If you'd rather have a business model that works and a wealth of resources at your fingertips to get started, a franchise might be a preferable choice.

Buy a small business

Considering community, loyalty, goodwill, and the chance to experiment, consider acquiring a local small business.

Just be careful not to completely overhaul the business or ignore the wishes of the people who live there, or you may alienate employees and clientele.

"Most existing businesses are a big part of their local community and have considerable goodwill. They're not just businesses; they're part of people's lives and a place where memories are built," Kipps-Brown says.

If you want to set up a shop in a small town, acquiring a local business and showing respect to its heritage and legacy customers can go a long way—especially if you aren't already a part of that community.

Safest SMBs to invest in

Buying a small business can be an excellent investment, especially if it's already successful, doesn't have a slew of competitors, and isn't drowning in debt. Some savvy small business buys you can make as a new investor for less than $250,000 include:

- Beauty salons, spas, and barber shops

- Landscaping, yard, and remodeling services

- Restaurants, bars, and taverns

- Dry cleaning and housekeeping services

Buy a franchise

Purchasing a franchise is a great option for anyone who wants to invest in a company with a business plan that works, hands-on training and marketing support, and a well-known name.

"A franchise is a business with training wheels," Tom Scarda, the CEO and founder of The Franchise Academy, a franchise coaching firm, says. "The franchise company holds the owner's hand and teaches the franchisee best practices from Day 1 until the owner sells. The owner will keep almost 100% of the proceeds from the sale of the business and daily income while it operates."

Of course, owning a franchise comes with its own advantages and disadvantages. When you buy a franchise, you are purchasing a recognized brand name without an existing customer base in the area. So, while you have a head start, you don't have the benefit of built-in customers like you would with an existing SMB.

Best franchise to own

You're probably aware of well-known franchises like Taco Bell, the UPS Store, KFC, and Burger King, but there are many more to choose from.

There are 753,770 franchises in the United States. They include businesses like grocery stores and gas stations, restaurants, retail stores, auto repair shops, real estate companies, gyms, and beyond.

Five of the most successful franchises with household names include:

- McDonald's

- Dunkin'

- Sonic

- Planet Fitness

- Ace Hardware

Typical franchise fees and recurring costs

Franchise owners typically pay an upfront fee to cover the cost of training and guidance. Once that's out of the way, they also pay ongoing royalties, usually a percentage of the revenue they generate.

"It is like paying tuition upfront," Scarda says. "A franchise owner pays for the training, know-how, and best practices within the industry it serves."

Don't let the royalties deter you too much, though, since most of them go to business maintenance and marketing—things you would need to pay whether your business was a franchise or not.

"Some of the royalties pay for public relations, marketing, branding, demographic studies, and research and development at a much better price than a private entrepreneur can pay. Some concepts also have call centers and customer-facing apps that a typical mom-and-pop startup couldn't afford."

What to expect

Buying a franchise is a happy medium between starting your own business and buying an existing one. Of course, the brand name and wholesale purchasing price give you a competitive edge over someone creating a startup.

You will have upfront costs and considerations. But unlike when you start your own business, you are not on your own. A parent company will guide you through the start-up process and operating procedures.

You bought the business; now what?

If you're about to close on a business or already have—congratulations! You just made a huge step in your life and career.

Take some time to pat yourself on the back, disclose the sale to the business's creditors, and try to score coverage in the local newspaper.

This works as free advertising while letting the public know changes are happening. Then, talk to your employees about your ideas and business plan, and ask them for their thoughts about where you can make improvements.

You should also try to keep in touch with the former owner and decide on reliable legal, HR, and accounting services if you don't have someone on staff to help guide you. You never know when you might have a question or even need business advice.