The world of investing can be thrilling; finding high-potential companies and indexes, tracking their growth, and watching your portfolio strengthen over time. When it comes time to sell, however, understanding capital gains tax is crucial for making sure you get the most out of your investments—not to mention avoiding any fees or penalties for failing to pay state and federal capital gain tax.

Even if you're a seasoned pro in the world of investing, capital gains tax is a complicated subject that changes year to year, so staying on top of the latest adjustments can mean fast-tracking financial success and keeping as much of your hard-earned money as possible.

How is capital gains tax calculated?

Similar to income taxes, capital gains tax is a way for the federal and state government to take a share of the money individuals earn through investing in stocks, bonds, or other funds. Put as simply as possible, capital gains taxes are calculated by subtracting the purchase price of an investment from the price at which it's sold and then applying government-regulated tax rates to that number.

These tax rates depend on the type of investment sold, how long you owned that asset, and several other factors, and can even change from year to year depending on certain influences, such as:

- Legislative changes: Like almost everything to do with investing, capital gains tax rates can be influenced by new legislation passed by Congress. Major bills, such as the Tax Cuts and Jobs Act of 2017, can significantly alter these rates and the way gains are calculated.

- Inflation adjustments: Your tax bracket plays a central role in determining the capital gains tax you pay. Because of this, the federal government often adjusts these brackets annually to account for inflation and protect against what's known as "bracket creep," which would otherwise push investors into higher tax brackets without actually increasing their purchasing power.

- Economic and fiscal policy changes: Certain circumstances can sometimes necessitate policy changes that directly affect capital gains rates. Most commonly, the government may temporarily reduce capital gains tax rates in order to encourage investors during periods of economic slowdown. Changes in economic conditions or fiscal policies might prompt adjustments to capital gains taxes.

- State-level changes: On top of federal taxes, most states charge capital gains tax. These rates can vary significantly from state to state depending on the state's budget and needs, so living in the rate area can dramatically impact how much you earn from your investments when it comes time to pay capital gains tax.

The foolproof method for calculating capital gains tax

Although rates may change, the basic method of calculating capital gains remains more or less the same from year to year. Follow these steps to make sure you've got the most accurate numbers when tax time comes around.

1. Identify your basis and realized amounts

Typically, your cost basis is determined by taking the purchase price of an investment and adding commissions or fees paid during that original purchase. In some cases, this basis can also be increased by factors such as:

Improvements and additions: In cases where you would be charged capital gains tax for the sale of a physical asset, such as real estate or business equipment, any money you spend on improving that asset can be legally added to your cost basis. This includes money spent to extend an asset's lifespan or adapt it to a new use but typically doesn't include normal repairs or maintenance associated with that asset.

- Reinvested dividends: For mutual funds or stocks yielding dividends, reinvesting those dividends is considered by the government as purchasing more shares of that asset, which in turn will increase your cost basis.

- Capital improvements: Just like the physical improvements we mentioned earlier, capital improvements to any asset that increases its value or lifespan may also increase your cost basis. These can include fees related to modifying or updating a patent, significant website development, or money spent overhauling business processes to increase the value of a company.

- Fees and commissions: Any costs incurred while acquiring an asset, such as commissions, transfer taxes, or seller fees, can be added to the cost basis of an asset. Brokerage fees paid when buying stocks, for example, are included in the cost basis of stocks.

- Assessments for local improvements: Similar to the money you invest in physical improvements of real estate, any assessments you pay for to improve streets, sidewalks, or sewer lines can also be added to the cost basis of a real estate property. Keep in mind, however, that these assessments and improvements must meaningfully increase the value of the property in order to count.

- Legal fees: Although this may logically fall under "fees and commissions," legal fees are especially important to consider when calculating cost basis. Any legal fees directly involved in buying or improving an asset, such as drafting a contract, can be added to that property's cost basis.

- Installation and setup charges: When you first install or set up an asset, such as new business equipment, those expenses can be added to the cost basis of the asset.

Your realized amount, on the other hand, is generally much simpler: Subtract any commissions or fees from the sale price of your asset.

2. Calculate your realized gain

Once you know both your cost basis and realized amount, you can then continue to Step 2 of calculating capital gains tax. Simply subtract the cost basis of the asset from the realized amount, and what you're left with is known as your "realized gain" on that asset.

3. Determine the holding period of your investments

The capital gains tax rate you pay when selling an asset can vary greatly depending on how long you owned that asset. Classify your asset as short-term or long-term based on how long you've held it.

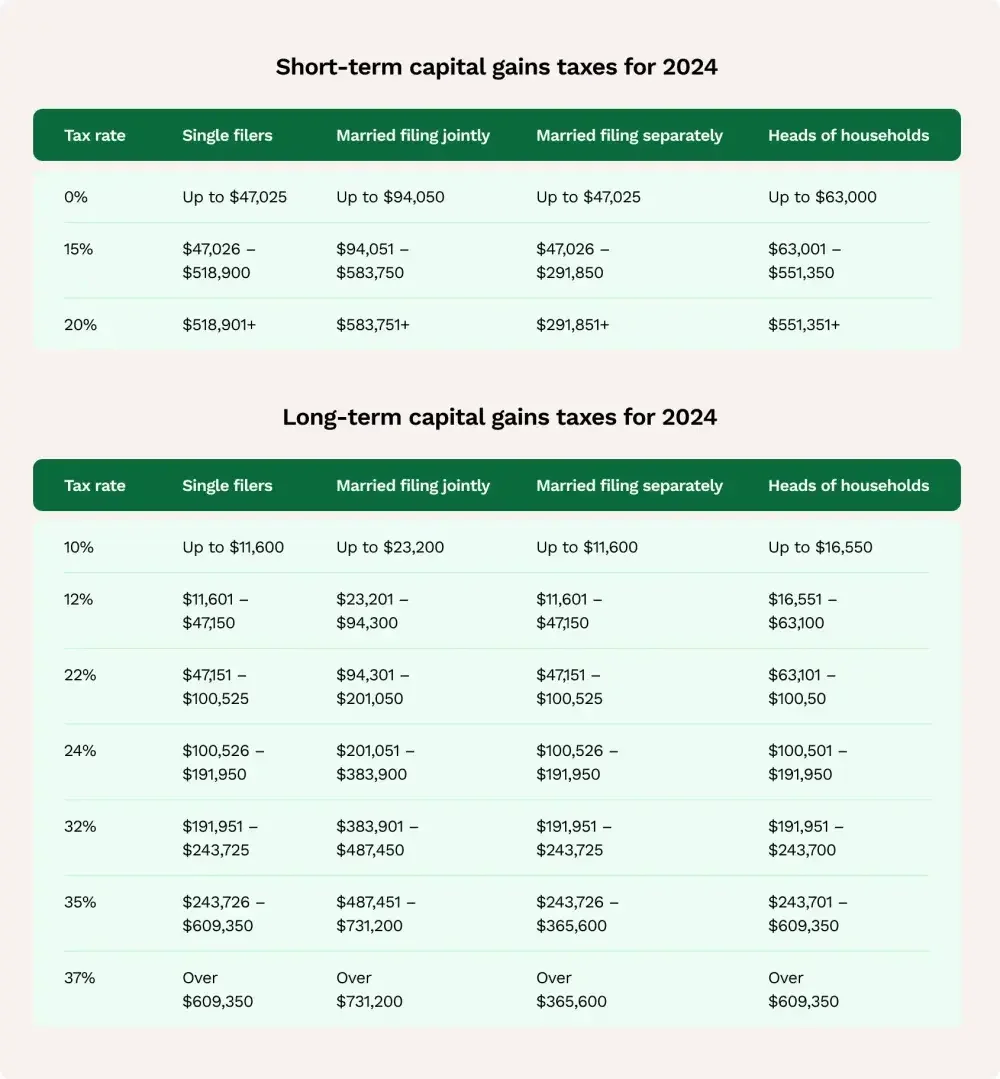

- Short-term capital gains: If you sell a short-term asset (which has been held for one year or less), any profit made on the sale is considered a short-term capital gain. These types of gains are taxed at the same rate as your ordinary income taxes, which vary from 10% to 37%, depending on your taxable income and filing status.

- Long-term capital gains: If you sell a long-term asset (which has been held for more than one year), any profit made on the sale is considered a long-term capital gain. These types of gains are taxed at much lower tax rates, generally 0%, 15%, or 20% depending on your taxable income and filing status. Keep in mind that in some cases, individuals with higher incomes may need to pay an additional 3.8% in the form of the Net Investment Income Tax.

To determine the holding period of an asset, look at the date of acquisition (or date of delivery) compared to the date of sale. It's important to keep careful track of these dates before deciding to sell an asset, as the dramatically lower capital gains tax rates for long-term assets is meant to encourage long-term investments.

4. Identify what tax bracket you're in

Similar to how you'd identify your tax bracket when filing a traditional tax return, you should double-check which bracket you fall into when calculating capital gains tax. Remember that these brackets are often adjusted year to year to account for inflation or new legislation, so staying up-to-date is key for producing the most accurate calculations possible.

5. Apply any special considerations or exemptions

In certain special circumstances, the sale of an asset may qualify for certain exemptions or considerations that reduce or postpone the amount of taxes you need to pay. Examples include inheritances, small business stock exclusions (Section 1202), or a like-kind exchange (where you exchange business-related real estate for another property of a similar type).

Often, correctly applying these types of exemptions can drastically reduce your capital gains taxes when selling an asset.

6. Multiply your realized gain by your tax rate

Now that you have both your exact realized gain and your capital gains tax rate (as determined by your tax bracket and the holding period of the asset), simply multiply the former by the latter to calculate the capital gains tax you'll owe.

How to report capital gains and losses

After you've calculated the capital gains tax you can expect to pay for selling an asset, you'll still need to properly report your gains (or losses). To report capital gains and losses on your federal tax return, you'll typically use one of several forms:

- Form 8949, Sales and Other Dispositions of Capital Assets: This is the primary form used to list all capital gains and losses throughout the fiscal year. Keep in mind that you must include details about each sale of an asset, including the dates it was purchased and sold, cost basis, sale price, and any adjustments to the asset relevant to its sale.

- Schedule D (Form 1040), Capital Gains and Losses: Using the data you input on Form 8949, you or your tax professional will complete a Schedule D form to summarize your total gains or losses throughout the year. The resulting numbers help you identify exactly how much capital gains tax you'll owe (or any capital loss deductions you may be eligible for).

- Form 1040, U.S. Individual Income Tax Return: After you have an exact number for your capital gains or losses, individuals will report that amount on their individual tax return. Remember to apply any deductions or exemptions in order to maximize your return.

Each of these forms can be obtained through the IRS website, physical mail, a tax professional, or certain libraries and post offices.

10 ways to reduce capital gains tax

A crucial part of any investment strategy is structuring sales in a way that reduces capital gains tax as much as possible—especially if you have significant investments in stocks or real estate. Here are some of the most reliable ways to minimize the amount you pay for capital gains:

1. Hold investments longer

If you're considering the sale of an asset but have held that asset for less than a year, it may be in your best interest to wait a little longer. Long-term capital gains (those from assets held for more than a year) benefit from a drastically lower tax rate than their short-term counterparts.

2. Leverage capital losses

Sometimes, selling investments that are underperforming can help you offset the gains realized from selling other assets. Because you experience both a capital gain and loss, the two will balance one another and reduce your overall capital tax liability. Be sure to avoid the wash-sale rule, however, which prevents any tax deductions for an asset repurchased within 30 days of when that asset realizes a loss.

3. Use retirement accounts

By structuring your assets within tax-advantaged retirement accounts, such as Roth IRAs or 401(k)s, you can defer taxes until retirement—or even exempt yourself from withdrawal taxes altogether.

4. Time sales carefully

Whenever possible, you should try to sell assets in years when your traditional income is lower than usual. By doing so, you can enjoy the reduced capital gains tax rates offered by qualifying for a lower tax bracket.

5. Donate assets directly

Charitable donations are one of the most powerful ways to reduce your capital gains tax. Specifically, donating appreciated assets directly to qualifying charities can help you avoid capital gains tax altogether and provide a charitable deduction for that asset's full value. Overall, this can provide a much greater deduction than if you had sold the asset and donated cash instead.

6. Use the home sale exclusion

When selling a home, check whether you qualify for the home sales exclusion. This allows you to completely avoid taxes on up to $250,000 of capital gains on real estate sales ($500,000 for married couples). Keep in mind, however, that this only applies to primary residences that meet several other criteria.

7. Invest in opportunity zones

Across the country, the government allows individuals to invest in what are known as “opportunity zones.” These are economically distressed areas in need of funds for economic and social growth. In return for providing those funds, investors may enjoy impressive tax breaks on capital gains.

8. Research like-kind exchanges

For real estate investors, investing proceeds from the sale of a property into a similar property may allow you to defer paying capital gains taxes.

9. Installment sales

In the event of especially large capital gains from the sale of a single asset, you may want to opt to receive proceeds in installments spread across several years. This can help keep income more consistent from year to year rather than having a large one-time gain.

10. Gift assets to family

If you have family members in lower tax brackets, you may want to consider making gifts of appreciated assets. Even though the gift's recipient will still assume the original cost basis of whatever asset you give them, they'll likely pay less capital gains taxes due to their regular income.

A note about tax-reduction strategies

No matter which of these strategies you employ to reduce your capital gains tax footprint, carefully go over your financial situation before making a decision. Whenever possible, consult a qualified financial advisor or tax professional to make sure you meet all criteria for the exemptions or deductions you claim.

With the right planning and expertise, you can greatly reduce the amount you owe when selling assets. That said, staying compliant with tax regulations is critical for your long-term financial success.

State capital gains taxes vs. federal capital gains taxes

In addition to the federal capital gains tax you pay for the sale of a capital asset, many states impose their own capital gains taxes on stocks, bonds, real estate, and other investments.

Unlike federal capital gains rates, state rates vary broadly from one state to another, with states like California and New York charging relatively high rates and others charging no capital gains tax at all.

In 2024, these are the states with no capital gains tax:

- Alaska

- Florida

- New Hampshire

- Nevada

- South Dakota

- Tennessee

- Texas

- Wyoming

Typically, you'll need to pay state capital gains taxes for any tangible asset, such as real estate, you sell within that state. For intangible assets, such as stocks, you typically will need to pay state capital gains taxes for the state in which you reside. You are typically required to pay state capital gains taxes in the state where the asset is located for tangible assets like real estate. For intangible assets like stocks or bonds, capital gains tax is usually paid to the state where you are a resident.

While these differences may seem like a headache for investors, a silver lining is the ability to reduce capital gains tax liability by carefully choosing where you live and invest. Those buying investment real estate, for example, may be wise to buy properties located in states with low or no capital gains tax whatsoever.

FAQs

What are capital gains and losses?

Capital gains are the profits an individual makes from selling an investment for more than the price at which it was purchased.

Conversely, capital losses occur when such an investment is sold for less than its original purchase price and can often be used to offset capital gains from other investments or even taxes on regular income.

What is capital gains tax?

These tax rates vary depending on your filing status, tax bracket, and how long the capital asset was held.

If you sell such an asset at a loss, you may use that loss to reduce your normal taxable income by up to $3,000 annually, with any losses over that amount carried forward to future tax years.

What is net investment income tax?

The Net Investment Income Tax (NIIT) is a special 3.8% tax applied to the investment income of individuals, estates, and trusts with incomes above a certain threshold. Unlike other taxes, the NIIT specifically targets income sources such as interest, dividends, capital gains, rental income, royalties, and income from certain other passive activities.

Can you avoid capital gains taxes?

Minimizing capital gains tax is a business unto itself, so hiring an expert is almost always your best choice. That said, there are some ways you can minimize your capital gains tax bill when it comes due. For example, consider holding assets for over a year to qualify for long-term capital gains tax rates, use the primary residence exclusion when selling your home, and leverage tax-advantaged retirement accounts to insulate your investments.

Additionally, gifting appreciated assets to family or donating them directly to charity can help you avoid capital gains tax altogether while also offering a sizable charitable deduction.