There are many reasons why you may want to dissolve a partnership. A partner may retire, financial situations may change, and some businesses might require a new structure.

If you've decided it's time to end your business partnership, you'll want to proceed cautiously to protect yourself and the company. Keep reading to find out how to approach the subject of dissolving a partnership and how to do so correctly.

What does it mean to dissolve a partnership?

Dissolving a partnership is the process of eliminating an existing partnership. While a general partnership, limited partnership, and limited liability partnership (LLP) fall under the same broader umbrella, they have differences when it comes to dissolution.

When does it make sense to dissolve a business partnership?

Partnerships get dissolved for many reasons, such as a partner choosing to leave for retirement, a mutually agreed upon expiration date, or disagreements that can't (or shouldn't) be mediated.

Here's a closer look at common reasons for ending business partnerships:

- Differing levels of effort: When a partner is not pulling their share of work within the company

- Strained personal relationship: When two partners disagree to the point of straining a personal relationship

- Strategy disagreement: When two partners can't reach an agreement regarding strategy

- Retirement: When one or more partners want to retire

- Expiring partnership: When a partnership has completed its mutually agreed-upon time frame

5 steps to dissolve a partnership

Dissolving a partnership includes reviewing your agreement, discussing the situation with your partner, preparing dissolution papers, closing accounts, and then communicating the change to relevant parties. Regardless of the situation and personal relationship, it's essential that you correctly and completely dissolve your partnership to mitigate your liability under the partnership arrangement.

1. Review your partnership agreement

Ideally, your partnership agreement contains a dissolution clause or terms of dissolution. Some partnership agreements may even include specific dissolution procedures for specified circumstances.

If your particular situation, or dissolution in general, is covered under your partnership agreement, you must follow the provisions outlined in the agreement for dissolving your partnership.

What if there is no provision for dissolution?

In such cases, you will need to sit down with your partner(s) and decide on the terms of dissolution together. There are several things that must be considered when dissolving a business, like:

- Finances

- Client retention

- Business continuation

If you have problems agreeing, you might consider hiring a third party to help you or applying for a court-ordered dissolution. But remember that a third-party mediator can be an expensive route that may not result in what you would consider an equitable solution.

2. Prepare and approach your partner to discuss the current business situation

Before speaking with your business partner, think about what you would be willing to accept and what you would be willing to give up to exit the business before you start this conversation.

When you agree about what will happen with the business—maybe one of you is buying out the other, or you've agreed to shut the whole venture down—it's time to make it official.

Heinrich Long, a privacy expert with RestorePrivacy, first met with his attorney about his partnership agreement to attempt an amicable solution.

So when he and his partner did meet about his desire to end the partnership, he was prepared. "We discussed potential opportunities and worked together on an exit strategy. It was probably the closest and most productive we'd worked together in a long time," he says. They even managed to maintain "a relatively good personal relationship." But this isn't always the case.

What if you want your partner to leave?

"If you want your partner to leave, you have to convince them and, in most cases, it's all about giving up something—a certain percentage of the revenue, for example," Adam Hempenstall, the founder and CEO of Better Proposals, says. Here's what to do:

- Be prepared. Prepare to find a happy medium that all parties are satisfied with.

- Make a decision. When you come to an agreement about what will happen with the business—maybe one partner is buying out the other, or you've agreed to shut the whole venture down—it's time to make it official.

3. Prepare dissolution papers

To confirm and formalize your agreement, you should have a qualified and experienced business attorney draft formal partnership dissolution documents.

According to Michelle DelMar of DelMar Law Offices, "A well-drafted agreement for the dissolution of a business partnership or limited liability company should address some important issues." These include:

- Ongoing expectations

- Rights, responsibilities, and limitations of each of the partners or members of the company

- Trademark assignment and/or right to use the company trademark

- Intellectual property assignment

- Final tax return details

- Liquidation of assets

- Releases of liability

- Closing of accounts and finances

Statement of dissolution (certificate of cancellation)

Each state has different requirements, but at the very least you'll be required to file a statement of dissolution—also known as a certificate of cancellation in some states.

- Please note: It can take up to 90 days from the date you file the statement of dissolution for your partnership to be dissolved.

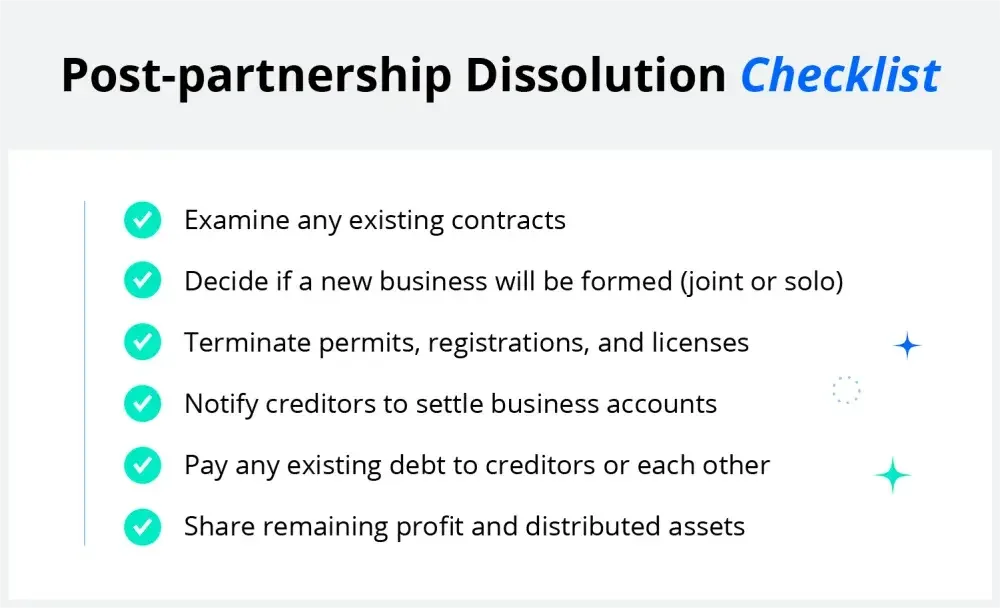

4. Close all joint accounts and resolve finances

Closing accounts should be addressed in the dissolution agreement, and once the partnership has ended, it's important to pay all debts and close all joint bank and credit accounts. If the business no longer exists, there should be no open leases, credit cards, loans, or other financial arrangements.

If one partner is taking over the business, they will be responsible for opening new accounts for the company in their name.

Creditors and taxes

Creditors should be notified and their accounts settled. If your partnership has employees, deposit payroll tax as required and file any necessary employment tax forms. Inform local, state, and federal tax agencies of your partnership dissolution.

Permits, licenses, and registrations

Terminate or cancel your partnership's business permits, licenses, and any business-related registrations, such as a fictitious name registration.

5. Communicate the change to clients, customers, and suppliers

Alert your customers, suppliers, advisers, and community members that there has been a change in the business.

While your state laws might require you to publish a notice of your partnership dissolution in a local paper, it's vital that you also directly notify all the people and businesses with whom you've done business.

Contracts, leases, and other agreements

Any contracts, leases, or agreements relevant to your partnership need to be examined to see how the dissolution will affect them. For example, some agreements may become void if your partnership dissolves, while others may require that the terms of the agreement continue to be carried out.

State laws surrounding a partnership dissolution

In addition to your partnership agreement, you'll need to check your state business laws, as the dissolution of partnerships is governed by state law. Your state's Secretary of State office or website should provide information regarding the process that applies to partnership dissolution, any applicable termination fees, and necessary paperwork. A simple Google search (for example, California Secretary of State's office) will return the results you need.

You'll be required to file a statement of dissolution (called a certificate of cancellation in some states) with your state.

Some states have differences when it comes to dissolution. For example, Texas relies on Texas partnership law. But most states require you to follow these steps to dissolve a business:

- File articles of dissolution

- File additional forms like the transfer of property report

- Pay any applicable termination fees

What happens after a partnership dissolution?

- The partners are liable to pay their debt. Partners are still expected to pay all joint debt and wrap up their affairs.

- The partners have to share the profit from the agreement. In accordance with the dissolution agreement, partners must split the profits as stated.

- The remaining assets of the business are distributed. What's left of the assets after debts are paid is distributed among the partners.

- A new business is formed, or it stops altogether: Depending on what the remaining partner(s) want to do, they can decide to start a new partnership or close up shop.

4 tips: How to dissolve a business partnership successfully

Dissolving a partnership can be challenging, but some ways can help ensure a good outcome.

- Stay civil: Mitigate conflict to avoid a messy legal battle fueled by emotion rather than tangible facts.

- Clearly define expectations: Communicating your goals and expectations with others can help steer you in the right direction.

- Pay attention: Keep your eyes open to legal details. Failing to pay attention can leave you liable for more than another partner with an equal stake.

- Ask for help: Seek professional counsel if you need more help than you're getting.