Ready to form a corporation in Alabama? This comprehensive guide covers everything you need to know about incorporating in the Heart of Dixie, including Alabama-specific requirements, forms, filing procedures, and costs.

What does it mean to incorporate in Alabama?

Incorporating in Alabama means creating a legal business entity under Alabama state law that is separate from its owners. When you form an Alabama corporation, you create a distinct legal entity governed by Title 10A, Chapter 2 of the Code of Alabama. This separation provides significant benefits:

- Liability protection. A corporation helps safeguard your personal assets, as the owners of a corporation (the shareholders) are generally not liable for the corporation's debts and obligations. A corporation can also help protect the owners if an employee is accused of wrongdoing.

- Business credibility. An Alabama corporation can enhance your business's credibility with customers, vendors, and financial institutions.

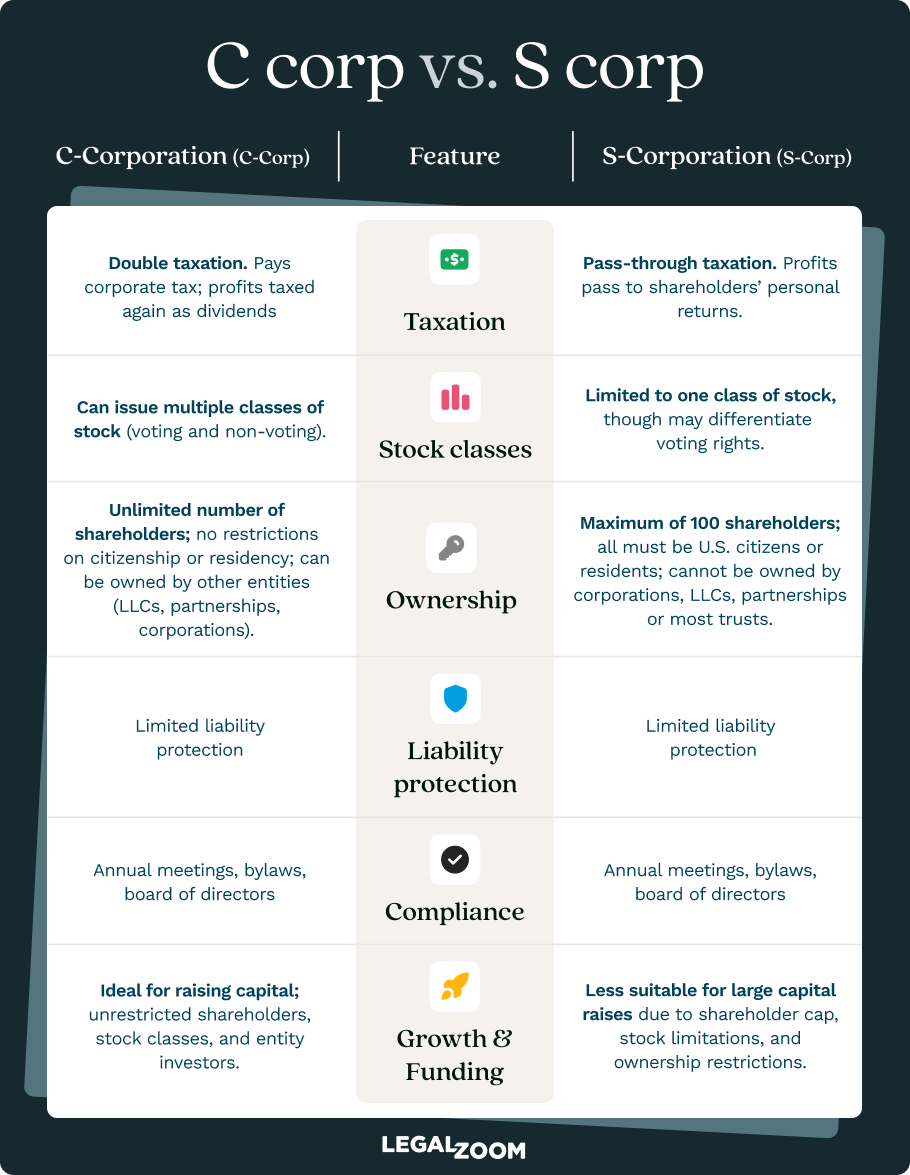

- Tax flexibility. Alabama corporations can elect S corporation status for potential tax advantages while maintaining corporate liability protection.

- Perpetual existence. Unlike sole proprietorships or partnerships, Alabama corporations can continue indefinitely, regardless of changes in ownership.

What are the requirements to incorporate in Alabama?

Alabama has specific requirements that must be met to successfully incorporate your business. Understanding these requirements upfront will help ensure a smooth process.

Basic eligibility requirements

Directors in an Alabama corporation manage the company’s affairs and make high-level business decisions on behalf of the shareholders. Incorporators are the individuals who file the formation documents and officially create the corporation with the state.

- Minimum directors: At least one director is required

- Minimum age: Directors must be at least 19 years old

- Incorporators: One or more incorporators are required to sign and file the articles of incorporation

- Residency: Neither directors nor incorporators need to be Alabama residents

Required documents and filings

To incorporate in Alabama, you must prepare and file a few key documents:

- Certificate of Name Reservation from the Alabama Secretary of State

- Articles of incorporation (also known as the certificate of formation)

- Corporate bylaws (not filed with the state but required for corporate governance)

How to incorporate in Alabama: Step-by-step process

Follow these detailed steps to successfully incorporate your business in Alabama.

Step 1: Reserve your business name

Before filing your articles of incorporation, you must obtain a Certificate of Name Reservation from the Alabama Secretary of State. This can be done through the Secretary of State's website.

First, choose a business name that follows Alabama’s naming requirements:

- Must include "incorporated," "corporation," or their corresponding abbreviations ("Inc." or "Corp.")

- Cannot be the same as or deceptively similar to another corporation registered or reserved with the Secretary of State

- Must be distinguishable from existing business names on record

Once you find an available name, complete the name reservation process:

- Perform an Alabama business search to verify availability.

- Submit a name reservation request through the Alabama Secretary of State's online services website.

- Pay the required $25 name reservation fee.

- Receive and print your Certificate of Name Reservation.

Step 2: Appoint an Alabama registered agent

Every corporation must have an Alabama registered agent to receive legal documents and official correspondence. Alabama registered agents:

- May be a person or a corporation

- Must have a physical street address in Alabama (not a P.O. box, mail service, or telephone service) where process may be personally served

- Must maintain a business office at the same address as the entity’s registered office

You’ll appoint your registered agent on your articles of incorporation by listing their name and address.

Step 3: Prepare your Alabama articles of incorporation

Your articles of incorporation must include specific information required by Alabama law. At minimum, the articles must contain:

- Corporate name: The exact name as reserved with the Secretary of State

- Principal office address: Street address of the corporation's principal office

- Corporate purpose: Alabama permits general purpose statements such as "the transaction of any or all lawful business for which corporations may be incorporated in Alabama under Title 10A, Chapter 2 of the Code of Alabama"

- Registered agent information: Name and registered office address

- Incorporator information: Names and street addresses of all incorporators

- Director information: Names and street addresses of initial directors

- Duration: Period of duration will automatically be perpetual unless you state otherwise

- Stock structure: Amount of stock and its par value

Step 4: File your articles and name reservation

You can print and mail your Alabama articles of incorporation to file by paper or complete the process online through the Secretary of State domestic filing website. If you mail your form, you need to send two copies, plus your name reservation certificate (if applicable), to:

Alabama Secretary of State

Business Services

P.O. Box 5616

Montgomery, AL 36103

How much does it cost to incorporate in Alabama?

Incorporating in Alabama costs $25 to reserve your business name and $200 to pay the filing fee for your articles of incorporation. However, there may be additional costs, such as the following.

- Alabama Business Privilege Tax: Alabama corporations must pay an annual Business Privilege Tax. The amount depends on your corporation's net worth in Alabama.

- Federal and state income taxes: Corporations are subject to both federal and Alabama state income tax on their profits.

- Registered agent service: If you hire a professional registered agent service, expect annual fees ranging from $100–$300.

- Attorney fees: Legal assistance with incorporation typically ranges from $500–$1,500 depending on complexity.

What happens after I incorporate in Alabama?

Successfully filing your articles of incorporation is just the beginning. Taking the following several important post-incorporation steps can help ensure your corporation operates legally and maintains good standing.

Adopt corporate bylaws

While not filed with the state, corporate bylaws are essential for governance. Alabama law requires that directors meet and approve bylaws after the articles of incorporation are filed, unless the articles give shareholders the right to approve the bylaws. Typical bylaw provisions include:

- Number and responsibilities of officers, directors, and committees

- Procedures for conducting directors' and shareholders' meetings

- Voting procedures and requirements

- Share transfer restrictions

- Amendment procedures

You can find corporate bylaws templates online, use our guide linked above, or use LegalZoom’s corporate bylaws service for quick, easy bylaws tailored to your business.

Hold an organizational meeting

After forming your Alabama corporation, holding an organizational meeting is an important first step to set up your company’s structure and officially begin business operations. Your initial board of directors must meet to:

- Formally adopt the corporate bylaws

- Elect corporate officers

- Authorize the issuance of stock certificates

- Approve initial corporate resolutions

- Establish banking relationships

- Set up corporate record-keeping systems

Obtain a federal EIN

Apply for an employer identification number (EIN) through the IRS website or by using an EIN service like LegalZoom. This federal tax ID is required for:

- Opening business bank accounts

- Filing federal tax returns

- Hiring employees

- Most business transactions

Register for Alabama state taxes

After you form your Alabama corporation, register for state taxes to connect your business to the state’s tax system and stay compliant. Register with the Alabama Department of Revenue for:

- Alabama Business Privilege Tax

- Alabama income tax withholding (if hiring employees)

- Sales tax (if applicable to your business)

Open a corporate bank account

Maintain proper corporate formalities by setting up a separate business bank account. When opening the account, you’ll want to provide your EIN confirmation, certified copies of your articles of incorporation, and your corporate bylaws with any board resolutions. Make sure that everyone listed as a signatory on the account is properly authorized to act on behalf of the corporation.

Establish corporate credit

Start building your business credit separate from your personal credit by opening business credit accounts and establishing trade credit with vendors. As you do this, make sure to maintain proper corporate formalities so your business remains legally distinct and credible.

What ongoing Alabama compliance applies to corporations?

Maintaining your Alabama corporation in good standing requires ongoing compliance with state and federal requirements.

Alabama Business Privilege Tax

All Alabama corporations must file an Alabama Business Privilege Tax Return annually. The rate is based on taxable net worth and ranges from $0.25 to $1.75 for each $1,000 of Alabama income.

- For taxable net worth less than $200,000, the tax rate is $1.00 per $1,000.

- For taxable net worth that is at least $200,000 but less than $500,000, the tax rate is $1.25 per $1,000.

- For taxable net worth that is at least $500,000 but less than $2,500,000, the tax rate is $1.50 per $1,000.

- For taxable net worth over $2,500,000, the tax rate is $1.75 per $1,000.

The Alabama Business Privilege Tax Return is due on the same date as your federal tax return, usually April 15. You also need to file an initial Business Privilege Tax Return within two and a half months after you incorporate your business.

Corporate record-keeping

Keeping detailed corporate records helps prove your Alabama corporation’s legal standing and protects your limited liability status. Alabama corporations must maintain:

- Articles of incorporation and all amendments

- Bylaws and amendments

- Board of directors meeting minutes

- Shareholder meeting minutes

- Stock transfer records

- Annual financial statements

Keep records at your corporation's principal office or registered office in Alabama. The following tips also help you maintain your liability protection:

- Hold regular board and shareholder meetings

- Maintain separate corporate bank accounts

- Avoid commingling personal and corporate funds

- Issue stock certificates properly

- Follow your bylaws and corporate resolutions

Updating corporate information

While Alabama doesn't require annual reports to the Secretary of State, you must be sure to maintain updated corporate information. If you change your registered agent or office, change your business address, or make any changes to your articles of incorporation, file the appropriate paperwork with the Alabama Secretary of State as soon as possible to avoid falling out of compliance.

How LegalZoom can help you form your business

LegalZoom offers comprehensive Alabama corporation formation services that cover everything from document preparation and filing to registered agent services, compliance support, and business banking assistance. Our experienced team understands Alabama’s specific filing requirements and helps make your incorporation process smooth and stress-free.

FAQs about incorporating in Alabama

Can I incorporate in Alabama if I live in another state?

Yes, you can incorporate in Alabama even if you live in another state by obtaining a certificate of authority from the Secretary of State, However, you must have a registered agent with a physical Alabama address, follow the state’s corporate laws and tax rules, and consider whether you’ll also need to register as a foreign corporation in your home state.

What's the difference between a corporation and an LLC in Alabama?

Corporations and LLCs in Alabama differ mainly in structure and flexibility. A corporation has a more formal setup with directors and officers, can elect S corporation tax status, allows for easier transfer of ownership through stock sales, and has perpetual existence. An LLC, on the other hand, offers a more flexible management structure, pass-through taxation by default, fewer formalities, and customizable operating agreements.

Do I need an attorney to incorporate in Alabama?

You don’t need an attorney to incorporate in Alabama, but one can be helpful for complex situations. An attorney can assist with advanced stock structures, special corporate provisions, compliance issues, and tax planning. For straightforward incorporations, many business owners use online formation services or handle the process themselves.

What is an S corporation and how does it work in Alabama?

An S corporation is a federal tax election that qualifying Alabama corporations can choose. It allows for pass-through taxation, which helps avoid double taxation. Your business must meet certain requirements, such as having no more than 100 shareholders, offering only one class of stock, and limiting ownership to U.S. citizens or residents.

What happens if I don't pay the Alabama Business Privilege Tax?

If you don’t pay the Alabama Business Privilege Tax, your corporation can face penalties, interest charges, and possible administrative dissolution. You may lose your good standing with the state, which can make it harder to conduct business in Alabama, and in some cases, your personal liability protection could be at risk.

Jane Haskins, Esq. contributed to this article.