Starting a corporation provides significant liability protection and business advantages for entrepreneurs and business owners in Arizona. This comprehensive guide walks you through specific incorporation requirements in The Grand Canyon State, from filing your articles of incorporation with the Arizona Corporation Commission to completing the mandatory publication notice and establishing corporate bylaws.

What is a corporation?

A corporation is a legal entity that exists separately from its owners (shareholders), providing limited liability protection and operational flexibility. A corporation is recognized as an artificial person that can enter contracts, own property, sue and be sued, and conduct business activities independent of its shareholders. Arizona Revised Statutes Title 10 provides all of the details for corporations in the state.

In Arizona, corporations offer several key advantages.

- Limited liability protection. Personal assets are generally protected from business debts and obligations.

- Perpetual existence. The corporation continues even if ownership changes.

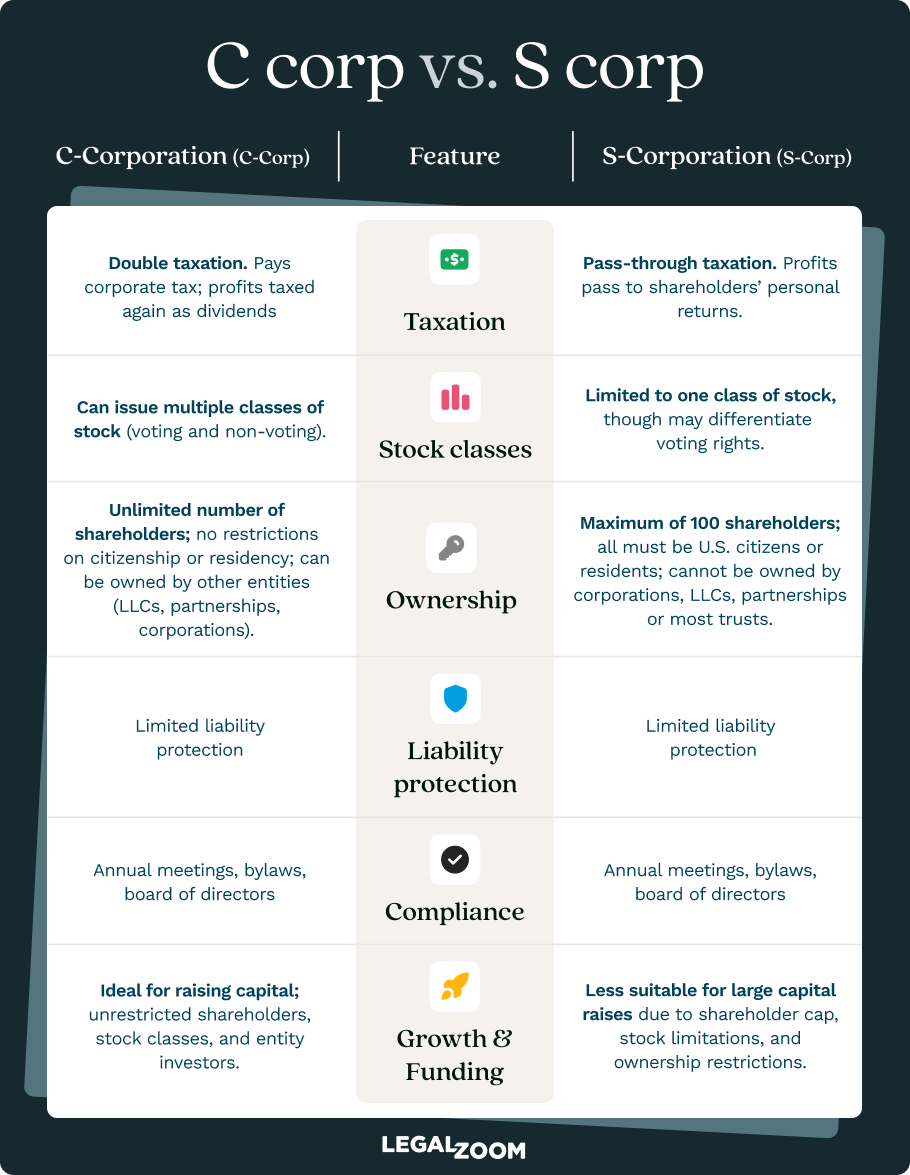

- Tax flexibility. Option to elect S corporation status for pass-through taxation.

- Enhanced credibility. Corporate structure often increases business credibility with customers, vendors, and lenders.

- Relatively low corporate income tax. As of January 2026, Arizona corporations are subject to 4.9% corporate income tax, which puts it near the bottom of the pack compared to other states.

Arizona corporation vs. LLC: Which is right for your business?

The differences between a corporation and a limited liability company (LLC) are significant when it comes to regulations and governance. Before incorporating, consider which one better suits your business needs.

Corporation advantages in Arizona

- Easier to raise capital through stock issuance

- S corporation election available for potential tax benefits

- Clear management structure with directors and officers

- Better for businesses planning to go public

LLC advantages in Arizona

- Simpler ongoing compliance requirements

- More flexible management structure

- No requirement for annual shareholder meetings

- Multiple tax structures, including S corporation election

- No annual report requirement

Key Consideration: Arizona corporations must file annual reports and maintain more formal recordkeeping requirements than Arizona LLCs, but they offer greater flexibility for multiple investor classes and employee stock options.

Steps to form a corporation in Arizona

Get your Arizona corporation up and running with these easy-to-follow steps.

Step 1: Choose your corporation name

Your Arizona corporation name must comply with specific state requirements administered by the Arizona Corporation Commission (ACC):

- Must include "Association," "Company," "Corporation," "Incorporated," "Limited," or abbreviations (Assn., Co., Corp., Inc., Ltd.)

- Cannot contain "Limited Company," "Limited Liability Company," or abbreviations (L.L.C., L.C., LLC, LC)

- Must be distinguishable from existing entity names on file with the ACC and Arizona Secretary of State

Be careful with the terms "bank", "deposit", "credit union", "trust" or "trust company". They can be used, but not if they mislead customers about the nature of your business.

Once you’ve chosen a name, conduct an entity search to see if your desired name is available:

- Search the name on the internet and social media sites.

- Search the ACC's online entity search database.

- Conduct a trade name search on the Arizona Secretary of State's online trade name database.

If the corporation name is available, but you’re not quite ready to file your articles of incorporation, you can reserve your chosen name for 120 days by filing Form C006-004 with the ACC and paying the $10 reservation fee. You will not be able to renew the name after the 120-day period.

Step 2: Appoint a statutory agent in Arizona

Arizona law requires every corporation to maintain a statutory agent (also known as a registered agent) to receive official correspondence and legal documents.

Statutory agent requirements

- Must be an individual residing in Arizona with an Arizona street address, OR a domestic or foreign corporation or a domestic LLC authorized to conduct business in Arizona

- Must have a physical Arizona street address (P.O. boxes are not acceptable)

- Must agree in writing to serve using the Statutory Agent Acceptance Form M002

Statutory agent responsibilities

- Receive service of process and legal documents at the given address

- Forward official correspondence from the ACC to the corporation

- Maintain current address information with the state

- Be available during normal business hours

You can be your own statutory agent, appoint someone (such as a spouse, a director of the corporation, or an employee), or you can hire a professional statutory agent service. LegalZoom's registered office in Chandler meets all state requirements and offers a fully-digital service. We'll scan any documents we receive and promptly notify you when they're uploaded into your unlimited cloud storage.

Step 3: Prepare and file your articles of incorporation

The articles of incorporation establish your corporation's legal existence in Arizona. File these documents with the ACC along with required supporting forms and payment.

Required information in articles of incorporation

- Corporation name (must comply with naming requirements)

- Corporate purpose (general character of initial business activities)

- Stock structure, including each class of authorized stock; the number of shares per class; series designations if applicable; and rights, limitations, and preferences for each class

- Statutory agent name and Arizona address

- Known place of business address of corporation (if different from statutory agent)

- Director names and addresses (initial board members)

- Incorporator names, addresses, and signatures (individuals responsible for filing)

Required filing documents

- Articles of Incorporation (Form C010.005)

- Cover Sheet

- Statutory Agent Acceptance (Form M002)

- Certificate of Disclosure (Form C003.005)

You can file all your documents online through ACC's eCorp system, in person at the ACC’s office in Phoenix, or via mail to their office address:

Arizona Corporation Commission

Examination Section

1300 W. Washington St.,

Phoenix, AZ 85007

Your filing will cost $60 and is typically processed within 13–15 days.

Step 4: Publish notice of incorporation

Once you receive confirmation your articles of incorporation have been approved, Arizona requires you to publish a notice of incorporation in a newspaper. Your publication must meet the following requirements:

- Must publish within 60 days of receiving ACC approval letter

- Must publish in a newspaper of general circulation in the county where the corporation's known place of business is located

- The newspaper must be approved by the ACC

- Publication must run for three consecutive publications

- Must include specific information as outlined in the ACC approval letter

Once it has run three times, you can obtain an affidavit of publication from the newspaper, which you must next file with the ACC. Keep in mind that the ACC may administratively dissolve corporations that fail to complete the required publication.

Step 5: Create corporate bylaws and hold initial board meeting

While not filed with the state, corporate bylaws are legally required and serve as your corporation's internal operating manual.

Essential bylaw provisions

- Number of directors and qualification requirements

- Director meeting procedures and voting requirements

- Officer positions, duties, and appointment procedures

- Shareholder meeting requirements and voting procedures

- Stock issuance and transfer restrictions

- Amendment procedures

- Conflict-of-interest policies

Initial board meeting requirements

- Adopt corporate bylaws

- Appoint officers according to the bylaws

- Authorize issuance of stock

- Approve corporate seal and stock certificates

- Establish fiscal year

- Authorize opening of bank accounts

- Document all actions in meeting minutes

Step 6: Issue stock and maintain corporate records

It is essential that your corporation issue its stock and keep its records organized correctly in order to maintain its corporate status and liability protection.

Stock issuance requirements

- Issue shares only up to authorized amounts in the articles of incorporation.

- Maintain a stock ledger documenting all issuances.

- Provide stock certificates to shareholders, if desired.

- Ensure compliance with federal and state securities laws.

Required corporate records

- Articles of incorporation and amendments

- Bylaws and amendments

- Board and shareholder meeting minutes

- Stock ledger and transfer records

- Annual reports filed with ACC

- Financial records and tax returns

Step 7: Obtain an employer identification number (EIN)

All corporations are required by the Internal Revenue Service (IRS) to have a federal EIN. This federal tax ID number is required for tax filings, opening business bank accounts, and hiring employees. Businesses can either apply for one on the IRS’s website or use LegalZoom’s EIN service.

Step 8: Register for Arizona taxes

Arizona corporations must register for various state taxes depending on business activities.

- Transaction privilege tax (TPT): which is Arizona's version of sales tax

- Withholding tax: Required for employers

- Unemployment insurance: Required for employers

- Workers' compensation: Required for most employers

You can register for your corporation’s taxes online with the Arizona Department of Revenue at azdor.gov.

Step 9: Comply with ongoing Arizona corporation requirements

Each year, you must file an annual report. This report should be filed online through the ACC's eCorp system in the 90 days before or on the anniversary date of your incorporation. The filing fee is $45.

You will also face the following ongoing compliance requirements:

- Maintain a statutory agent with a current Arizona address

- Hold annual shareholder meetings

- Maintain corporate records and meeting minutes

- File required federal and state tax returns

- File applicable amendments when there are corporation changes

If your corporation does not meet the ongoing requirements, it risks administrative dissolution by the ACC, which could result in the loss of limited liability protection as well as penalties and interest on late filings. It could also create difficulty reinstating your corporation’s good standing in the state.

Costs to incorporate in Arizona

When planning to incorporate, there are a few initial costs to consider.

- Name reservation: $10 (optional, 120 days)

- Articles of incorporation standard processing: $60

- Articles of incorporation expedited processing: $95

- Publication notice: $60–$300 (varies by newspaper and county)

Once your business is up and running, it will incur other ongoing annual costs.

- Annual report: $45

- Statutory agent: $100–$300 annually (if using a service)

- Arizona corporate income tax: Varies based on income

- Federal or state regulatory licenses/permits: Varies by type of license/permit

- Local business licenses: Varies by municipality

For more information on federal, state, and local licenses/permits, visit the Arizona Commerce Authority website.

Form your Arizona corporation with LegalZoom

Ready to form a corporation in Arizona? LegalZoom provides comprehensive Arizona corporation formation services, including preparation and filing of articles of incorporation, statutory agent services, and ongoing compliance support. Our experienced team understands Arizona's specific requirements and can guide you through each step of the incorporation process efficiently and in compliance with state law.

FAQs about Arizona corporations

Can I form a corporation by myself in Arizona?

Yes, Arizona allows single-person corporations. You can serve as the sole incorporator, director, and shareholder, though you must still appoint a statutory agent if you don't meet the state residency requirements.

What is the timeline to incorporate in Arizona?

- Articles of Incorporation: 13–15 business days

- Publication requirement: Must publish within 60 days of approval

- Total process: 2–8 weeks depending on publication completion

How many directors are required in Arizona?

Arizona requires corporations to have at least one director. There is no maximum limit, and the exact number should be specified in your articles of incorporation or bylaws.

Do I need to live in Arizona to form a corporation there?

No, you don't need to be an Arizona resident to form a corporation in the state. However, you must maintain a statutory agent with an Arizona address.

What is a statutory agent, and why do I need one?

A statutory agent (also known as a registered agent in other states) receives official correspondence and legal documents on behalf of your corporation. Arizona law requires statutory agents to ensure that the state and courts can always reach your business.

What happens if I don't publish my notice of incorporation?

Failure to publish the required notice can result in administrative dissolution of your corporation by the Arizona Corporation Commission (ACC). This is a unique Arizona requirement that many business owners overlook.

How do I convert an LLC to a corporation in Arizona?

Arizona allows LLC-to-corporation conversions through a statutory conversion process. You can file a Statement of Conversion (Form M085.005) with the Arizona Corporation Commission along with your articles of incorporation and a $50 filing fee.

LegalZoom offers personalized entity conversion with a dedicated conversion concierge who will handle your conversion with care from start to finish, plus help get you set up for success as a corporation.

How do I elect S corporation status in Arizona?

To elect S corporation status, file Form 2553 with the IRS within 75 days of incorporation (or by March 15 of the tax year). Arizona automatically recognizes federal S corporation elections for state tax purposes.

Jane Haskins, Esq. contributed to this article.