Forming a corporation in Iowa provides business owners with liability protection, credibility, and potential tax advantages. This comprehensive guide walks you through the specific requirements, procedures, and costs for starting a corporation under the Iowa Business Corporation Act.

What is a corporation in Iowa?

An Iowa corporation is a legal business entity formed under Iowa Code Chapter 490 that exists separately from its owners and shareholders. Unlike sole proprietorships or partnerships, corporations provide limited liability protection and are recognized as distinct legal entities that can enter contracts, own property, and conduct business in their own name.

Iowa corporations differ from other business entities like limited liability companies (LLCs) in several key ways:

- Formal structure. Corporations require directors, officers, and formal governance procedures.

- Double taxation. C corporations face corporate income tax plus shareholder tax on dividends.

- Perpetual existence. Corporations continue indefinitely regardless of ownership changes.

Why form a corporation in Iowa?

Forming a corporation in Iowa gives your business more than just a legal structure—it provides protection and room to grow.

Limited liability protection

Forming a corporation limits your personal liability for the corporation's financial obligations. This means that creditors cannot pursue your personal assets—such as your home, car, or personal bank accounts—to pay corporate debts. This protection extends to situations where other employees are accused of illegal activities while conducting corporate business.

Business credibility and growth opportunities

Iowa corporations may enjoy enhanced credibility with customers, suppliers, and lenders, as well as more growth opportunities. The formal corporate structure can make it easier to do many important things:

- Obtain business loans and lines of credit.

- Attract investors and raise funds through stock offerings.

- Enter into contracts with larger companies.

- Establish business credit separate from personal credit.

Potential tax benefits

Iowa corporations are subject to state corporate income tax, which ranges from 5.5% to 7.1% depending on your business’s taxable income. However, you may be able to take advantage of other potential tax benefits:

- S corporation election. An S corporation is a tax classification at the federal level that allows pass-through taxation. This means the profits and losses are passed to your personal tax returns so you avoid double taxation at the federal level.

- Business expense deductions. Corporations can deduct legitimate business expenses, which can lower your taxable income.

Steps to form a corporation in Iowa

To form an Iowa corporation, you’ll need to file articles of incorporation with the Secretary of State. But before you do that, you’ll need to meet several prerequisites, like choosing a name and appointing a registered agent. Below is a detailed step-by-step guide you can follow.

Step 1: Choose a corporate name

Your Iowa corporation's name identifies your company and plays a part in your marketing and branding strategy. It must also comply with specific requirements under Iowa Code Section 490.401:

- Must contain "corporation," "incorporated," "company," or "limited"

- May use abbreviations: "corp.," "inc.," "co.," or "ltd."

- Must be distinguishable from existing business entities on file with the Iowa Secretary of State.

To see if your desired name is available, conduct an Iowa business search using the following steps:

- Visit the Iowa Secretary of State's Business Entities Search website.

- Search for your desired name and similar variations.

- Narrow down your results and try various names until you find one that’s available.

Once you find an available name, you can reserve it for 120 days by filing an Application for Reservation of Name through the Iowa Secretary of State's website or by mail. This gives you time to file your articles of incorporation using your chosen name.

Step 2: Appoint a registered agent

Iowa law requires every corporation to maintain a registered agent and registered office within the state. Business owners in Iowa have several options for appointing a registered agent:

- Serve as your own registered agent (if you're an Iowa resident).

- Appoint an Iowa resident friend or business associate.

- Hire a professional registered agent service, like LegalZoom’s registered office in Des Moines.

Regardless of who you choose to appoint, Iowa registered agents must fulfill several requirements:

- Must be an individual who is an Iowa resident or a corporation authorized to do business in Iowa.

- Must maintain a registered office with a street address in Iowa (P.O. boxes are not acceptable).

- May use the corporation’s own business address as the registered office.

- Must be available during normal business hours to receive legal documents.

Step 3: Determine your stock structure

According to Iowa Code Section 490.601, corporations must define their stock structure in the articles of incorporation. This includes:

- Authorized shares. Maximum number of shares the corporation can issue.

- Par value. Minimum price per share (or "no par value").

- Common stock. Basic ownership shares with voting rights.

- Preferred stock. Shares with special rights or preferences (optional).

If issuing multiple classes or series of shares, the articles must specify:

- Distinguishing designation for each class (e.g., "Class A Common," "Class B Common")

- Voting rights for each class

- Dividend preferences and liquidation rights

- Conversion rights between classes

- Any restrictions on transfer

Step 4: Specify incorporators and initial directors

When starting a corporation, two important roles come into play: incorporators and directors. Incorporators are the people who sign and file the formation documents to officially create the corporation. Iowa’s requirements for incorporators include:

- Must be at least one incorporator

- Must be a natural person (not a corporation or LLC)

- Must sign the articles of incorporation

- Responsible for filing articles with the Secretary of State

- Role ends after organizational meeting or when initial directors take control

You can also appoint initial directors in your articles of incorporation, which are temporary appointments who serve until new directors are elected. Initial directors:

- May be named in articles of incorporation or elected at organizational meeting by incorporators

- If not named in articles, incorporators must hold organizational meeting within 60 days of incorporation

Step 5: Prepare your articles of incorporation

Now that you have all the information you need, you’re ready to complete your articles of incorporation, which establish your corporation's legal existence in Iowa. Under Iowa Code Section 490.202, the articles must include:

- Corporate name (meeting Iowa naming requirements)

- The number of shares the corporation is authorized to issue

- Registered agent name and registered office address

- Each incorporator’s name and address

In addition to the required information, corporations have the option to include the following:

- Initial directors' names and addresses

- A par value for authorized shares or classes of shares

- Specific corporate purposes (beyond general business purposes)

- Provisions regarding business management and regulation

- Provisions limiting director liability, in accordance with the law

- Indemnification provisions

Step 6: File your articles with the Iowa Secretary of State

The easiest way to file your articles of incorporation is through the Iowa Secretary of State's Fast Track Filing system:

- Create an account. Log in and go to “Business Filings.”

- Click “File A Document,” then go to the “New Entities” menu and choose “Form an Iowa Corporation.”

- This will bring you to a form for the articles of incorporation. Select your corporation type and fill in your business name.

- Fill in the effective date and time, as well as the expiration date of your corporation. If you don’t have a set expiration date, choose “Perpetual.”

- Upload the articles of incorporation you filled out in step 5, in PDF format.

- Answer the question “Does the corporation hold an interest in agricultural land in Iowa?” by checking “yes” or “no.”

- Fill in the rest of the required information, including stock, registered agent, incorporator, initial director, and principal office information.

- Sign the document with a digital signature and click "Review & Pay.”

- Pay the required fee, which is $50 for domestic Iowa corporations. You can also pay an additional $50 for expedited, two-day processing.

- Review all information for accuracy and click “Submit.” You should receive a notification that your articles have been submitted.

- You’ll be notified by email when your filing is complete. You can then print your certificate.

You can also file by mail or deliver your forms in person. Send or bring your completed articles of incorporation with the $50 domestic corporation filing fee and any additional fees for expedited service to:

Iowa Secretary of State

Business Services Division

Lucas Building, 1st Floor

321 E. 12th Street

Des Moines, IA 50319

Step 7: Obtain approval and complete next steps

After the Iowa Secretary of State approves your articles of incorporation, you'll receive a certificate of incorporation and your business will be officially registered. However, you’ll still need to complete some additional steps:

- Obtain a federal EIN by applying online at irs.gov or using an EIN service like LegalZoom.

- Hold an organizational meeting to elect directors, adopt bylaws, and issue stock.

- Open a corporate bank account using your EIN and certificate of incorporation.

- Obtain necessary licenses like Iowa business licenses, professional licenses, and permits.

Step 8: Draft corporate bylaws

Bylaws govern your corporation's internal operations and are required under Iowa Code Section 490.206. They’re not filed with the Iowa Secretary of State, but you should keep a copy at your business office and easily available for shareholders. Iowa corporation bylaws typically include provisions about the following.

- Shareholders: Meeting procedures, voting requirements, record dates

- Directors: Number, qualifications, terms, meeting procedures, committees

- Officers: Titles, duties, appointment, removal procedures

- Stock: Issuance procedures, transfer restrictions, certificates

- Corporate records: Location, inspection rights, required books

- Amendments: Procedures for changing bylaws

How much does it cost to form a corporation in Iowa?

The minimum cost to form an Iowa corporation is $50 to file your articles of incorporation with the Secretary of State. Profit corporations also pay $60 to file their biennial report. There can be additional costs if you opt for other services or need licenses or permits.

- Name reservation: $10 (120 days)

- Certified copies: $5 each

- Registered agent service: $100-$300 annually

- Attorney fees: $500–$2,000 for incorporation

- Accountant consultation: $200–$500

- Business licenses: Varies by industry

Ongoing requirements for Iowa corporations

Iowa corporations must also comply with various ongoing requirements to keep their business in good standing with both state and federal authorities:

- File biennial reports every two years with the Iowa Secretary of State.

- Pay your Iowa corporate income tax and any other applicable taxes, like sales tax.

- Pay federal taxes including corporate income tax and employment taxes.

- Maintain a registered agent and office and ensure they’re available during business hours.

- Keep corporate records and hold required meetings.

How to obtain Iowa articles of incorporation

If you need a copy of your articles of incorporation, you can order a certified copy online through the Iowa Secretary of State’s website or request one by mail. Each certified copy costs $5, and you’ll need to provide your corporation name and file number. Once your request is submitted, processing usually takes about three to five business days.

If you only need an unofficial copy, you can download one for free from the Secretary of State’s business search database. While these aren’t certified, they work for many general business purposes and are a quick way to access your company’s records.

How to amend your Iowa articles of incorporation

Corporations sometimes need to update their articles of incorporation to reflect changes as the business grows. You might amend your Iowa articles for any of these purposes:

- Change your corporate name

- Increase authorized shares

- Add or modify stock classes

- Change your registered agent or office

- Modify corporate purposes

Follow this process to amend your articles of incorporation:

- Get board resolution. Directors must approve the proposed amendment.

- Obtain shareholder approval. Shareholders must also approve most amendments (unless it’s a board-only amendment).

- Prepare articles of amendment. Your articles of amendment should include the specific changes and other required information.

- File with the Secretary of State. Submit the amendment with the $50 filing fee.

- Update corporate records. Amend your bylaws and other documents as needed.

FAQs about Iowa corporations

Do I need a lawyer to incorporate in Iowa?

No, Iowa law doesn't require attorney representation for incorporation. However, legal counsel can be valuable for complex stock structures, multiple owners, or specific industry requirements. There are also online legal services companies like LegalZoom, which is not a law firm but can still prepare your incorporation documents, serve as your registered agent, and connect you to experienced Iowa small business attorneys.

How many directors are required for an Iowa corporation?

Iowa requires at least one director, with no maximum limit. The number of directors is typically specified in the articles of incorporation or bylaws. Directors need not be Iowa residents or shareholders.

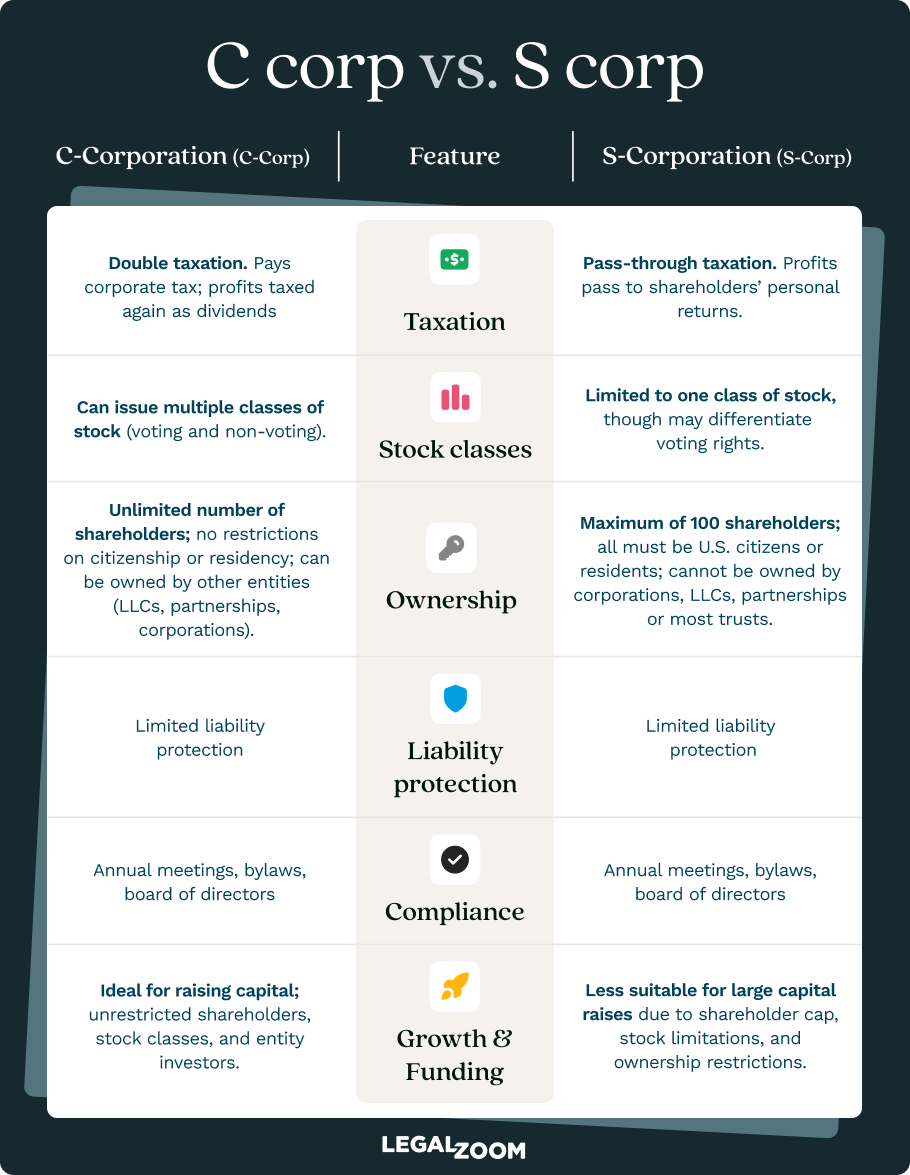

What's the difference between a C corp and S corp in Iowa?

The difference between a C corp and an S corp is related to federal taxation. Both are Iowa corporations, but S corporations elect federal pass-through taxation by filing Form 2553 with the IRS.

Can a nonresident incorporate in Iowa?

Yes, nonresidents can incorporate in Iowa, but the corporation must maintain a registered agent with an Iowa address. The incorporator and directors need not be Iowa residents.

How do I change my corporation's name in Iowa?

File articles of amendment with the Iowa Secretary of State, including the new name and board resolution, and pay a $50 filing fee. Make sure the new name is available and meets Iowa naming requirements.

Can I convert my LLC to a corporation in Iowa?

Yes, Iowa allows statutory conversion from LLC to corporation status. You’ll need to obtain member approval, then file articles of conversion and articles of incorporation with the Iowa Secretary of State. You can also form a new corporation and then merge the LLC into it, with member approval.

Due to the many differences between LLCs and corporations, it can be a huge administrative jump to convert your entity type. LegalZoom’s Conversion Concierge offers full service entity conversion, with a dedicated concierge who will guide your conversion from start to finish, plus help you get set up for the next steps.

Jane Haskins, Esq. contributed to this article.