Important note: LZ Books is a great solution for most small businesses but may not work for all. See below to learn more.

Tax season is here. In order to find all your tax deductions and maximize your tax savings, it’s important to have your books organized, and all transactions accounted for. This helps ensure our tax experts have the information they need to file an accurate tax return, making your tax prep process as smooth as possible.

You’ve probably heard the terms “getting your books in order” or having “clean books” before, but what do they mean? And how do you make sure yours are ready for tax time? For small business owners, being ready for tax time means making sure your financial records are up-to-date, accurate, and organized.

LZ Books has a built-in Tax Summary to help you stay on top of your business taxes. It includes important dates to keep in mind, like when your taxes are due, as well as an overview of your tax deductions and a checklist to make sure you’re ready for tax season. Just click on the Tax Summary tab within LZ Books to see yours.

Ready to get started? Follow these steps to prepare your books for your tax expert.

Step 1: Connect your business bank account so we can start finding deductions

By linking your business bank and credit card accounts, we’ll automatically import past and future transactions, then auto-categorize your income and expenses into tax groupings to find all your eligible deductions.

Even if you don't have a business bank account yet, that's OK. You can connect your personal accounts for now and start identifying expenses, like cellphone and home internet bills, that could be tax deductions. Later, when you get a business bank account, you can disconnect the personal account without losing previously imported transactions.

If you only have a few business expenses in a personal account and would prefer to add those manually, we’ll show you how in Step 3. To make bookkeeping easier in the future, we recommend opening a business bank account to cleanly separate your personal and business finances.

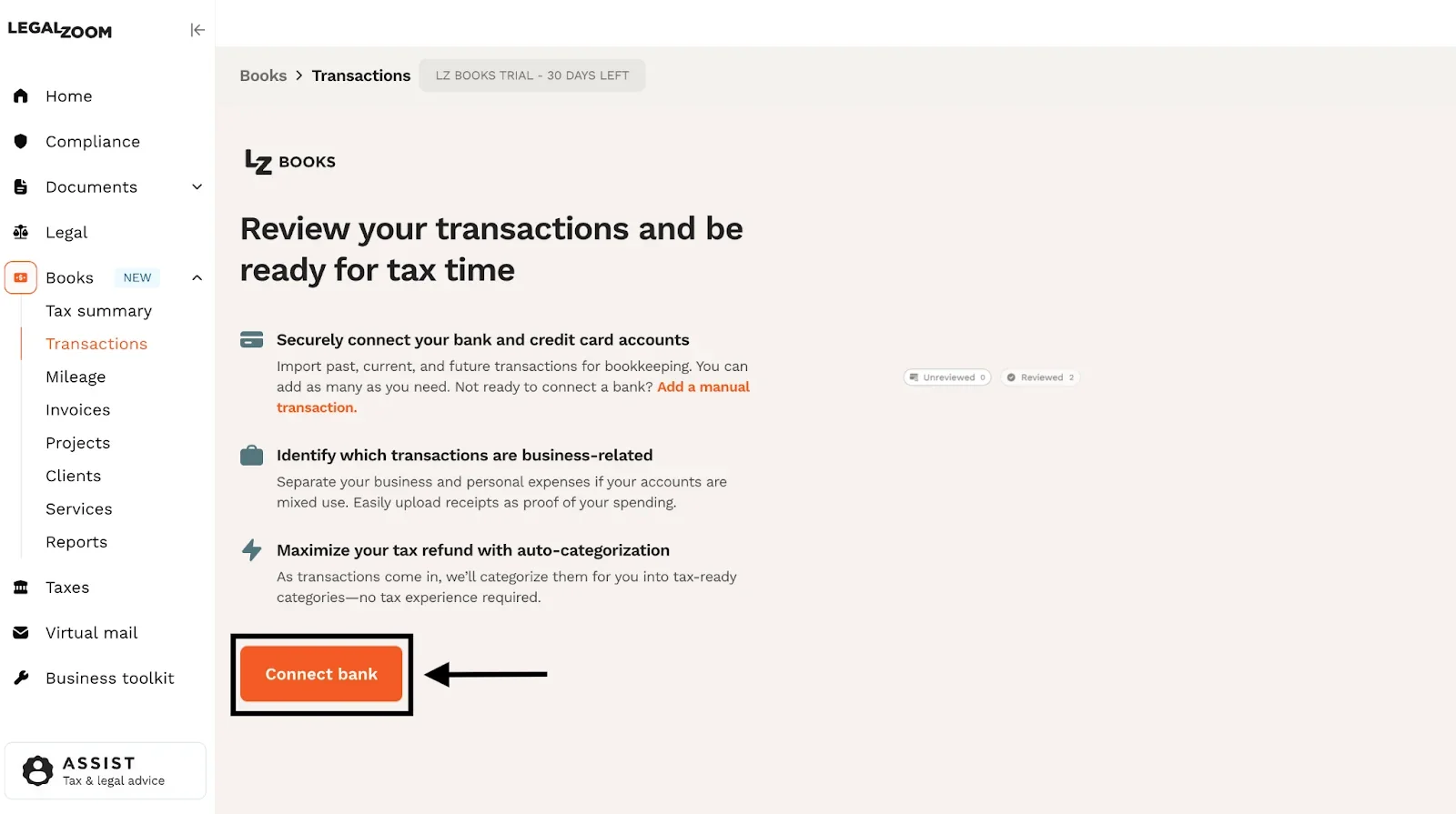

To connect your bank account, sign into your account and go to the Transactions tab within LZ Books.

Then click the Connect Bank button. This will take you through the workflow to connect a bank or credit card account through our secure integration with Plaid.

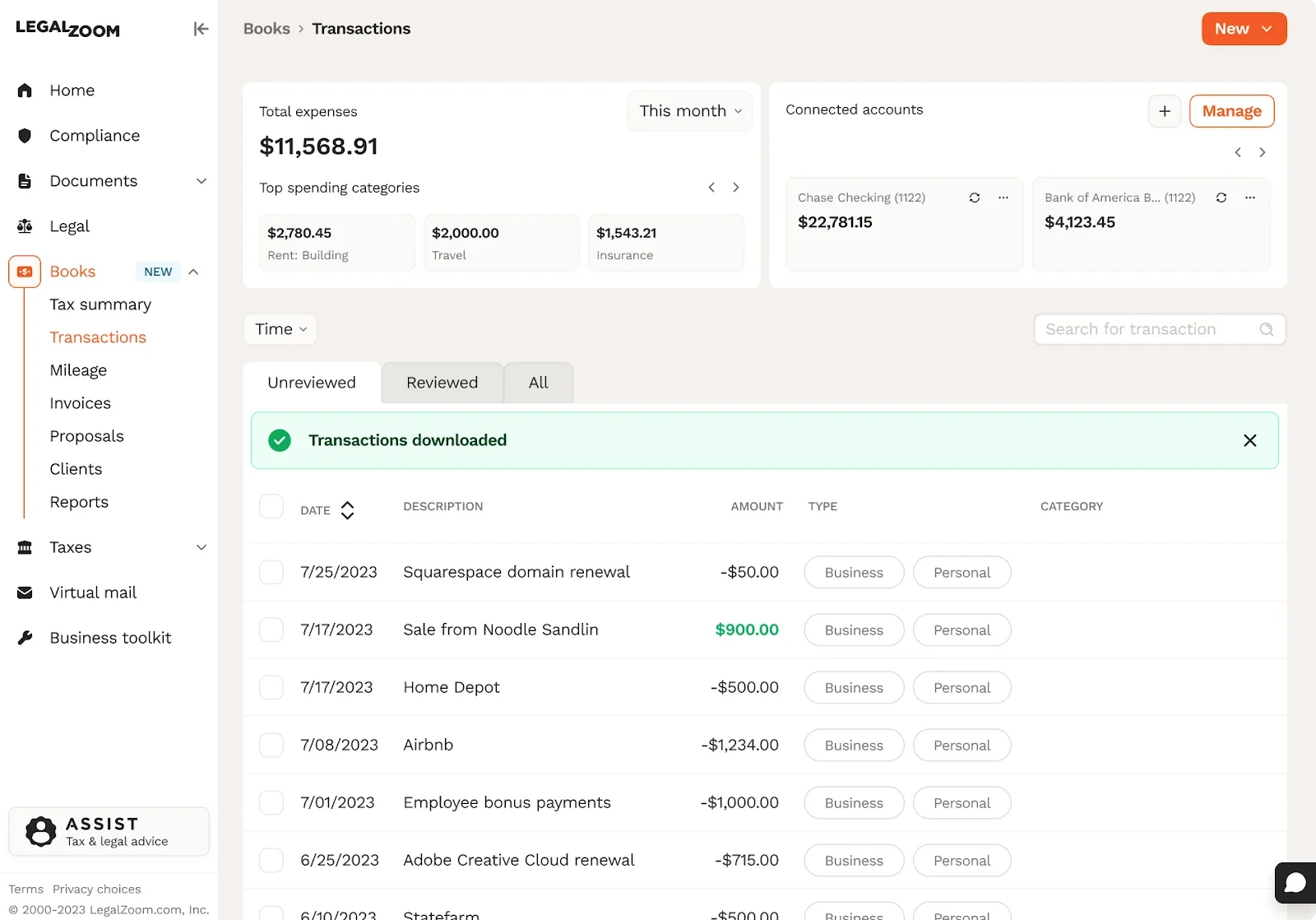

After completing all the steps and successfully integrating your bank account with LZ Books, you'll see all your bank transactions in a table format in the Transactions tab for easy review.

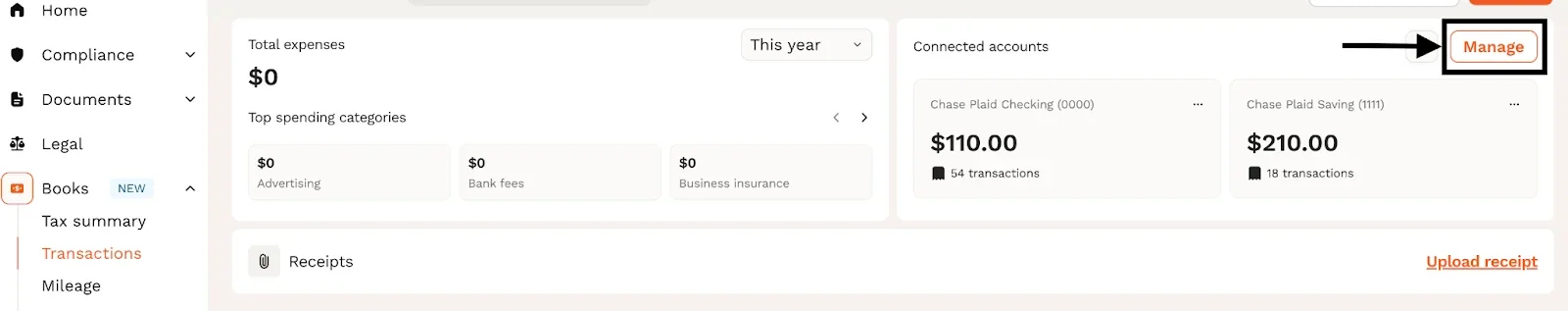

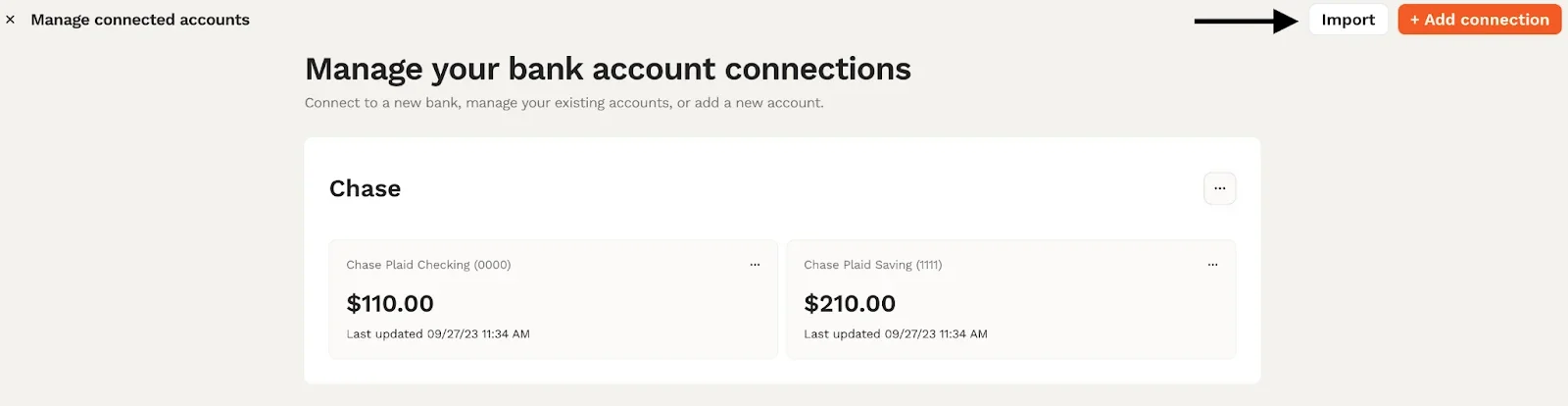

Need to add more than one bank or credit card?

If the additional account is from the same bank:

- Click on the Transactions tab

- Click on Manage in the top right of the connected accounts section

- Click on the "..." button "Manage connection." You’ll log in to your bank, and you should be able to select the additional credit cards/accounts you want to add

If the additional account is from another bank:

- Click on Manage in the top right of the connected accounts section.

- Select the Add Connection button and log in to the bank to connect the additional credit card(s)/accounts

You can also add transactions manually. See how in Step 3.

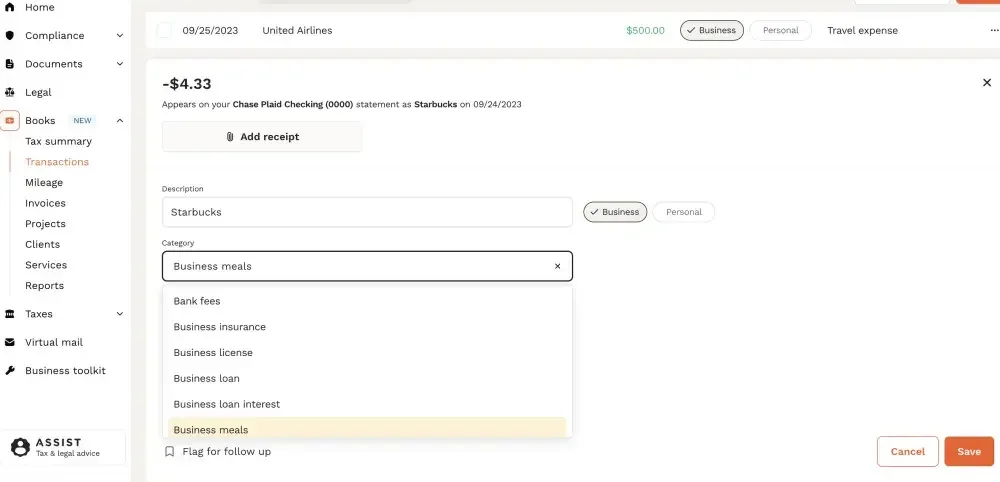

Step 2: Categorize your transactions

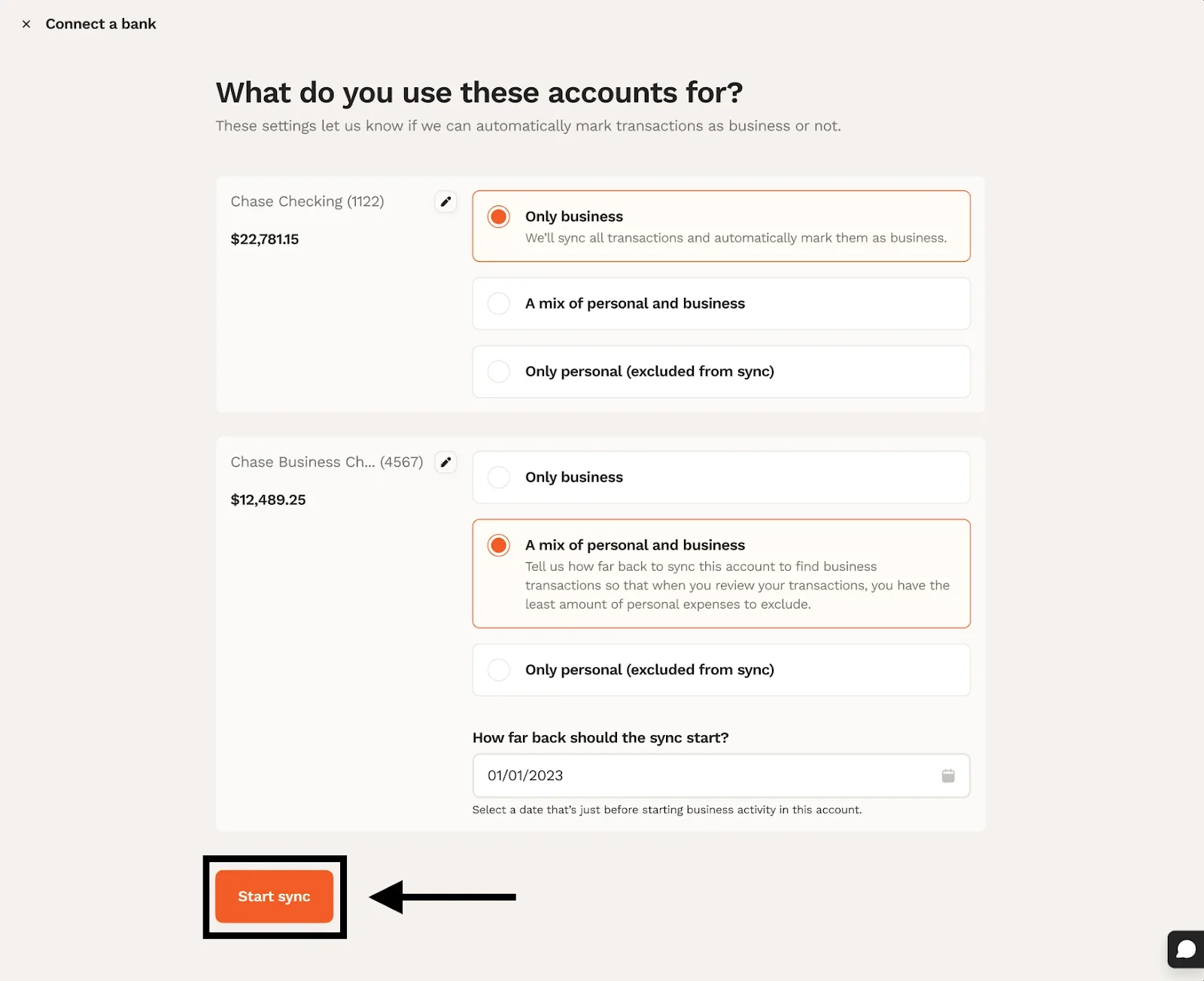

Once you have connected your bank account(s), we make it easy by automatically categorizing your transitions into tax-ready categories for accounts you’ve marked as “only business.” For “mixed personal and business” accounts, you’ll be able to mark each transaction as personal or business and review (or change) their category.

There are a few steps to take to confirm your transactions are categorized correctly, which will help speed up the tax prep process and maximize your tax savings.

On the Transactions page, if you see any transactions on the “Unreviewed” tab, you can categorize these manually. To do so, click on the transaction you want to update and select from the category dropdown.

On the “Reviewed” tab, you’ll see all transactions that were already categorized. Take a moment to review the auto-applied categories to ensure they are correct because accurate categorization will make tax prep easier. To re-categorize a transaction, click on the transaction you want to update and select from the category dropdown.

Step 3: Enter additional cash income, expenses, and mileage

Be sure to manually enter and categorize any business expenses not imported through a connected bank account so you have an accurate picture of your total income and expenses, ensuring you don’t miss out on any eligible tax write-offs.

LZ Books provides an option to manually add transactions to your Books. Examples of transactions to add manually include:

- Cash payments

- Mileage expenses for business-related travel

- Transactions incurred in accounts not connected to LZ Books

To manually add transactions in LZ Books, follow these steps.

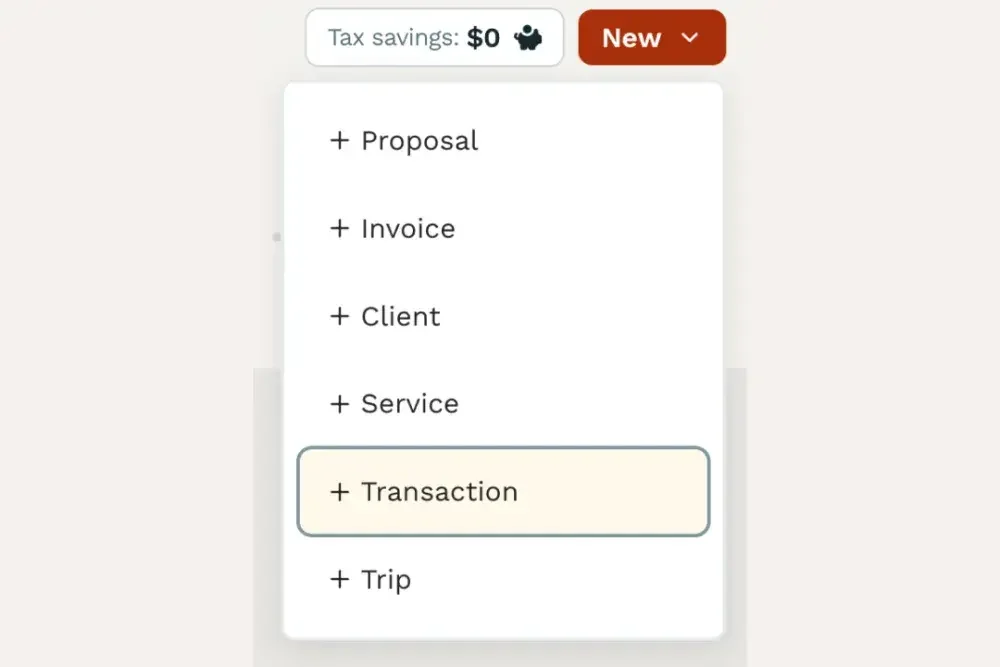

To add a single manual transaction:

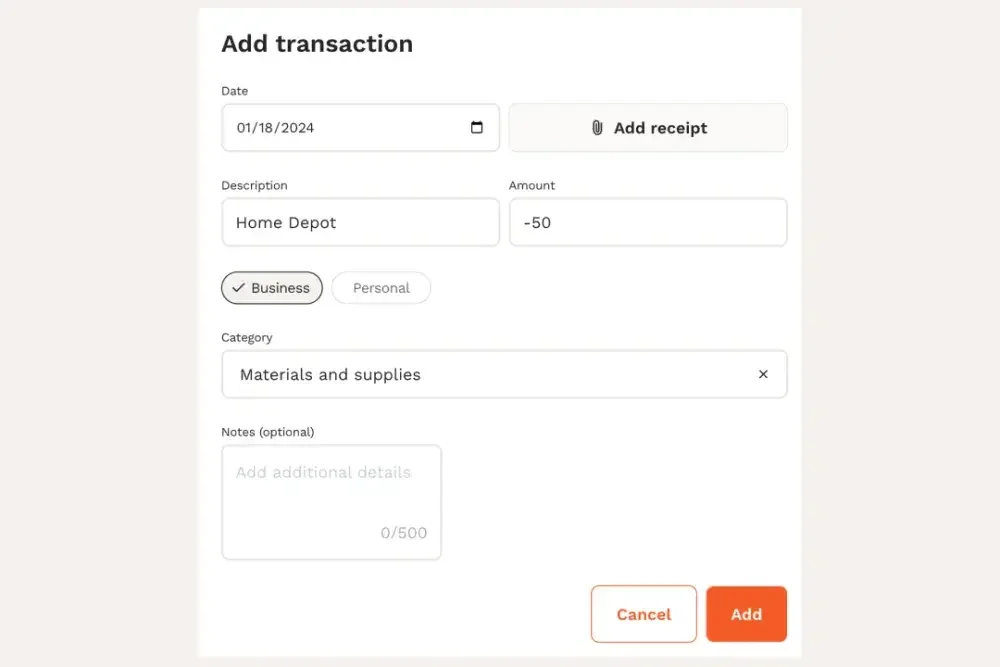

In LZ Books, click on the “+New” button at the top right corner and then select “+Transaction.”

To add multiple transactions at once

- If you already have a bank account connected:

- Go to the Transactions tab in LZ Books.

- Select Manage in the connected accounts section, where you’ll see the option to Import a .csv file of your transactions.

- If you do not have a bank account connected:

- Visit the Transactions tab in LZ Books, then select Connect Bank.

- Close out the Plaid bank connect workflow.

- Select Import in the top right corner. Follow the instructions to upload a .csv file of your transactions.

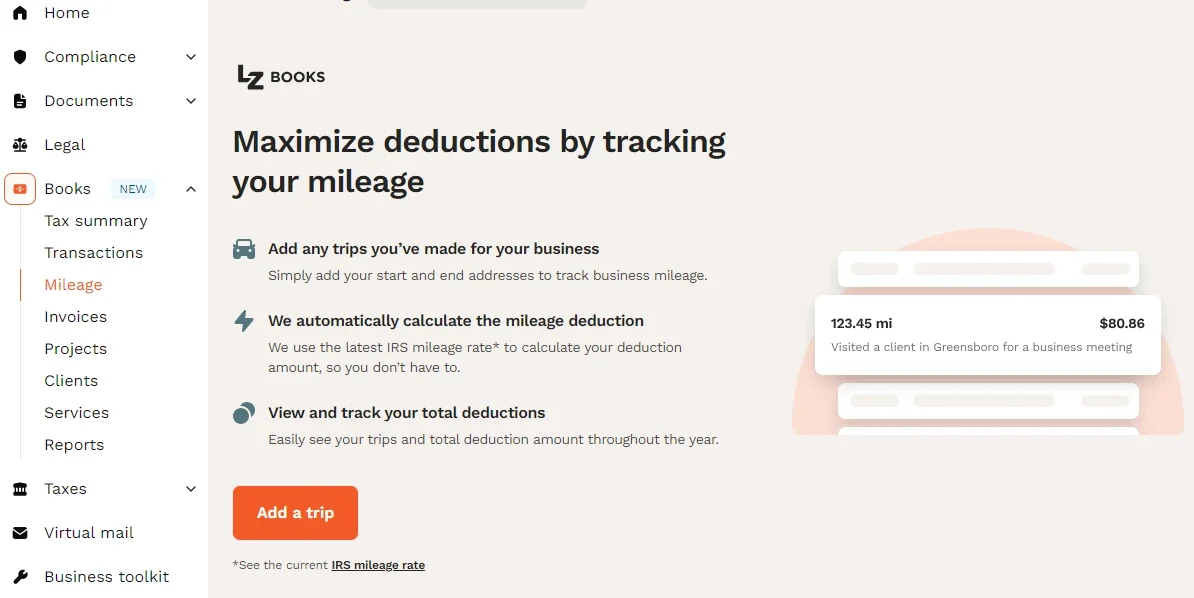

- To add mileage expenses, follow these steps:

- Go to the Mileage tab in LZ Books and click Add a trip

- Add your start address, end address, date, and business reason. Then we’ll automatically calculate the mileage expense using the IRS standard rate.

Step 4: Confirm your income and deduction amounts

Double-check your total income and deductions to make sure everything is correct. With LZ Books’ automation, most of the work will be done for you, but it’s still a good idea to confirm.

Step 5: Share with your tax expert

Once your books are ready, let your tax expert know. We’ll take it from there. Sit back and relax while we prepare your taxes from start to finish. We’ll reach out with any questions.

Have questions? Reach out for help by clicking on the black question mark icon in the top right corner of any LZ Books screen.

About LZ Books

LZ Books is a simple cash-based bookkeeping solution. This means that it is designed primarily for our Standard Tax Prep customers who are filing a personal tax return with a Schedule C to list business profits and losses. If you are a Complex Tax Prep customer, then LZ Books’ bookkeeping system is probably not right for you. (However, we encourage you to use LZ Books to send invoices and receive payments.) If you have any questions about whether simple cash-basis bookkeeping is right for you and your business, please reach out by clicking the “Message expert” button in the top right corner of the screen.