A beneficiary is an individual designated to receive assets, benefits, or funds from a will, trust, or other financial instrument. Selecting a beneficiary is the core or heart of estate planning. While the term “beneficiary” might seem like legal jargon, it’s a simple concept. It’s all about ensuring your valuables are passed on according to your wishes.

In this article, we will define a beneficiary and give you a better understanding of its importance in estate planning. We’ll also explain the different types of beneficiaries so you can secure the financial future for your near and dear ones.

What is a beneficiary?

By definition, a beneficiary is someone or something (like an organization) you choose to receive any financial, legal, or physical assets owned by you after you die.

The scope of what a beneficiary can receive is quite broad, as it includes anything you own and wish to pass on. For instance, the beneficiaries can receive monetary or death benefits from your financial accounts, savings, retirement accounts, investment accounts, wealth management portfolios, brokerage accounts, insurance policies, and/or trusts. They can also receive physical assets like a car, family home, furniture, artwork, or jewelry.

Beneficiaries in estate planning

A beneficiary in estate planning can be a person or entity you legally appoint to receive death benefits, financial assets, or gifts in case of your death. Many people prefer to nominate a family member, a friend, or a charity they care about as a beneficiary. You can have one or more beneficiaries.

Here’s a simple explanation of how beneficiaries work in estate plans. Joanna has listed her daughter Lara as the sole or only beneficiary in her will, brokerage accounts, and investment accounts. Lara will receive 100% of the money from these accounts in case of Joanna’s death.

Types of beneficiaries

There are two main types of beneficiaries, primary and contingent. Let’s look at each.

What is a primary beneficiary?

The primary beneficiary is the first person named to receive a certain asset. This person is your top choice to inherit a certain financial payout or personal possession. In the above scenario, Lara would be considered a primary beneficiary.

In the case of a bank account or life insurance policy, the primary beneficiary is the person you list on the policy paperwork to receive the funds from those accounts.

What is a contingent beneficiary?

A contingent beneficiary, or secondary beneficiary, comes into play when the primary beneficiary is dead, incapacitated, or can’t be located to accept the assets. It’s helpful to think of the contingent beneficiary as your Plan B.

Here’s an example of how a contingent beneficiary receives your property or assets. You have listed your wife as the primary beneficiary and your sister as a contingent beneficiary on your retirement fund account. If your wife, the primary beneficiary, dies, your sister will now receive those retirement funds.

Advantages of having a beneficiary

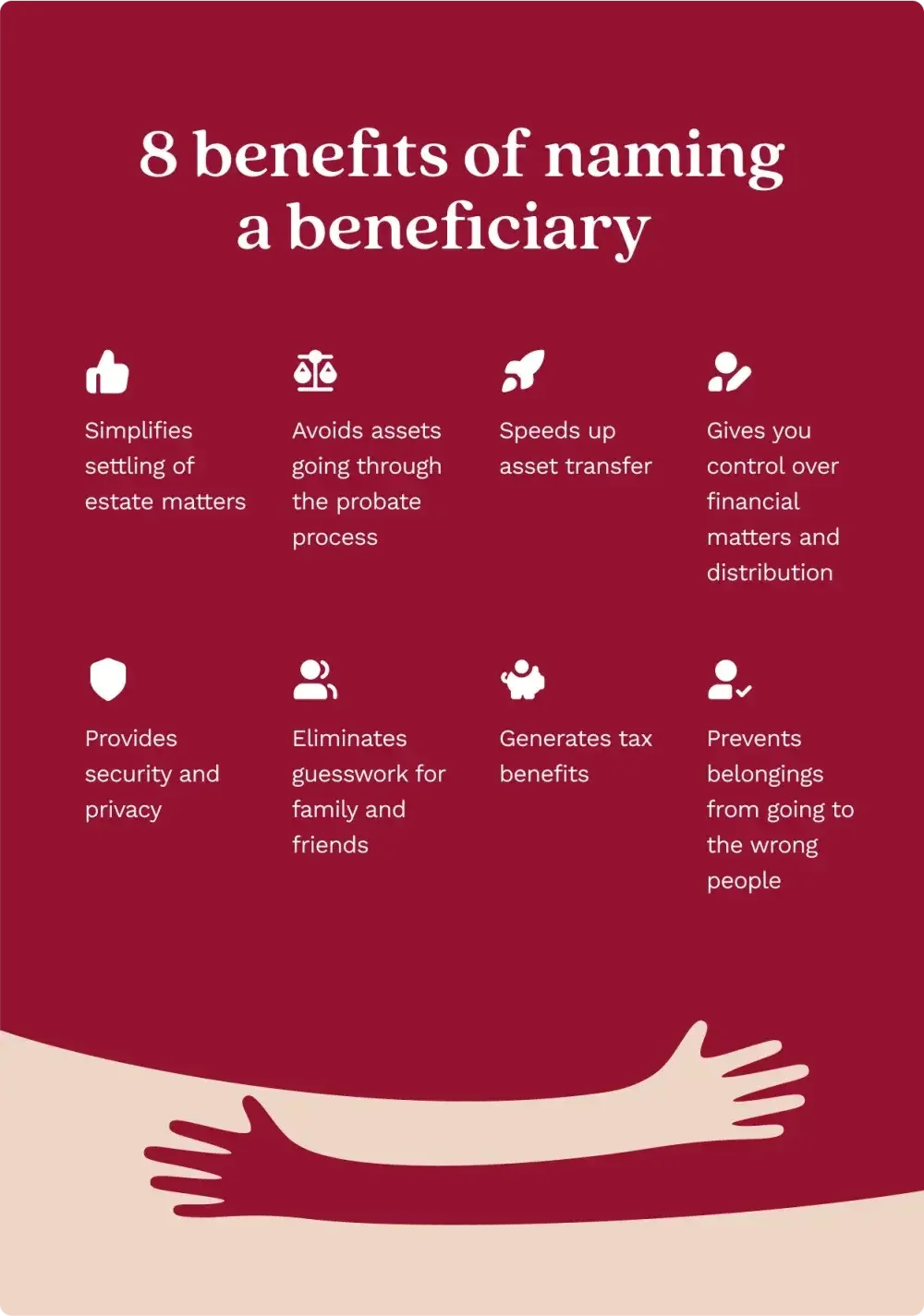

Here are several advantages to listing a beneficiary in your estate plans:

- Simplifies the settling of estate matters: A beneficiary’s appointment provides a clear plan for how your estate should be handled.

- Avoids the probate process: In cases where there is no beneficiary or will, the courts can decide how your assets will be passed on using a probate process. This lengthy court process can also be expensive.

- Speeds up the asset transfer process: A beneficiary list saves time as the transfer of funds can happen almost instantaneously. Otherwise, your loved ones or estate administrator will have to provide a significant amount of paperwork to receive the payout.

- Gives you control over money and asset distribution: You can decide who, when, and where gets the rights to your owned property.

- Provides security and privacy: Heirs or nominees listed on financial documentation are given privacy as those documents aren’t part of public records. Your will, on the other hand, becomes part of the public record once you die.

- Reduces stress and confusion for family members: Beneficiary designations clarify who is involved in the process. This also minimizes fights or arguments over possession where one sibling might think they deserve more than another.

- Prevents assets from going to the wrong person: An updated beneficiary listing prevents mistakes like passing funds to an ex-spouse or former friend.

- Provides tax advantages: Depending on your estate value, designating beneficiaries can help you minimize estate taxes.

How to choose a beneficiary

You can appoint almost anyone as a beneficiary and also have multiple beneficiaries. These beneficiaries could be family members and friends or entities like non-profit organizations, charities, trusts, and other organizations.

But remember that naming a beneficiary is a strategic decision. It’s not only about whom you wish to pass on your owned property to but also about how much of it. For instance, you might instruct that 50% of the life insurance payouts be used for a child’s education, while 100% of the funds from your retirement plan can be given to your spouse.

You can’t change the beneficiary after you are gone, so be sure to choose the right person, organization, or entity for your estate plans.

Here are some factors to keep at the back of your head while choosing beneficiaries:

- Relation and significance to you

- Age of beneficiary

- Income tax implications

- Special needs of the beneficiary

- Whether the person will accept being a beneficiary

Estate lawyers will also recommend that you avoid naming any of the following as your primary beneficiaries:

- Minors: Minor children can’t immediately access the death benefit or inheritance. You will have to set up a trust fund or appoint a legal guardian until they reach the age of majority.

- Pets: As much as you love your pet, they aren’t in a position to manage finances. Therefore you’ll need to appoint a caretaker who handles the funds and leave them with instructions for the pet’s well-being.

- Disabled beneficiaries: While you might want to provide financial support to your disabled or special needs beneficiaries, doing this might stop them from receiving government benefits like Supplementary Social Income (SSI) or medical benefits.

An estate planning attorney or LegalZoom attorney can help you understand the legal implications of the beneficiaries you have selected and choose the appropriate primary or secondary beneficiary.

Naming beneficiaries on retirement accounts

The Internal Revenue Service (IRS) has certain rules about how to name a designated beneficiary for your individual retirement account (IRA) through the federal SECURE Act. Whom you wish to designate as a beneficiary on your IRA is vital because it impacts who will receive the remaining funds from your account and how the payout will be made: a lump sum distribution or through the required minimum distribution.

The IRS considers the following as eligible designated beneficiaries for your IRA:

- Spouse

- Minor children

- Disabled or chronically ill person

- Someone who is less than 10 years younger than the account holder

Choosing beneficiaries for a life insurance policy

When choosing a life insurance beneficiary, consider these key points:

- State laws: In states such as Arizona and Texas, where community property laws prevail, the state’s laws might mandate that the spouse get 50% of the death benefit.

- Revocable vs. irrevocable beneficiary: This dictates your ability to change the beneficiary or not.

- Deciding how the payout will happen: Will the amount be split equally amongst multiple beneficiaries?

What is a revocable beneficiary vs. irrevocable beneficiary?

A revocable beneficiary is someone you designate to receive benefits, but you have the right to change your mind later. Revocable beneficiaries are commonly used for life insurance policies.

Revocable beneficiaries offer insurance policy owners a lot of flexibility. They also have no guaranteed right to claim any insurance payouts or benefits. The owner can change the revocable beneficiaries anytime during their lifetime.

Irrevocable beneficiaries of a life insurance policy are people who are guaranteed a payout. The beneficiary is permanent, and you can’t change your mind about them. They also need to be informed if you opt to cancel the policy.

5 mistakes to avoid while naming beneficiaries

To make sure your assets get passed on exactly as per your wishes and provide maximum benefit, steer clear of these common mistakes:

1. Providing vague descriptions

Refrain from using terms like “all my children” or “my spouse” while completing beneficiary paperwork. It’s better to avoid confusion and chaos by using the actual names of your children or your spouse.

We also recommend that you mention a specific percentage if you have one or more beneficiaries. For example, it’s better to state that 25% of my savings bank balance will go to child A, and 75% will go to child B. This, again, will eliminate the chances of confusion.

Pro tip: In addition to listing complete names, add Social Security numbers and addresses/contact information for each beneficiary. Make it easier for the insurance company or estate executor to identify the right party.

2. Forgetting to use legal names

Use the legal name of your beneficiaries with the proper prefixes and suffixes. The name needs to match the beneficiaries' proof of identity documentation. There could be multiple people with the same name, and this detail will help you minimize confusion.

3. Naming only one beneficiary

By naming only one person without a contingency beneficiary, your belongings are likely to get stuck in probate or end up with the wrong person. For instance, if the primary beneficiary dies, is not reachable, or refuses to accept the funds, you’ll have peace of mind that the valuable items will be passed on to the contingency beneficiary.

4. Having conflicting instructions

Ideally, your will, trust, and all other estate documents will have consistent information. Most people believe that the will overrides the nominees listed on a retirement or life insurance policy, but it doesn’t. The death benefits from either of these bank accounts will go to the person listed on the policy documentation.

Therefore, if you intend to make any modifications, ensure those changes are reflected across all your assets, bank accounts, and estate plans.

5. Selecting a trust

A trust can have unintended financial and tax implications. For instance, naming a trust as a beneficiary for your retirement account subjects the assets to minimum distribution payouts. In other cases, naming a trust can give creditors access to your estate, which could cause your family members to lose money. A state’s laws can also push a beneficiary into a higher tax bracket if there’s a trust.

So, before choosing a trust as a primary beneficiary, talk to an estate planning attorney or tax adviser to determine whether creating a trust aligns with your overall estate goals and interests.

What happens if I don’t choose a beneficiary?

It's important to designate beneficiaries because if you don't, your loved ones can experience a lot of confusion and stress. In some cases, state laws might come into play, and a third party will decide how your assets will be passed on.

For instance, in New York, the courts use intestacy laws to decide how to distribute assets, commonly known as the probate process. It’s an expensive and lengthy legal process, and you stand to lose money if things don’t go your way.

Also, by not appointing a beneficiary, your valuables could get stuck in probate court or end up going to the wrong person.

FAQs: beneficiary designations and more

These are some of the most common inquiries about beneficiary designations.

Can I name multiple beneficiaries for an asset?

Yes, you can designate multiple beneficiaries for a single asset. You can split the assets using percentages. For example, you can say that 50% of the money from your retirement account will go to your granddaughter, while the other 50% will go to your sister.

You can also appoint contingent beneficiaries who will inherit the assets if the primary beneficiary dies or is unable to inherit the death benefit.

Can I change the beneficiary?

Yes, you can update your beneficiary, and it’s important to do so. Life can be complicated and full of surprises, and it’s best to be prepared to deal with whatever might be thrown at you.

Here’s how to change the beneficiary on various financial accounts or estate plans:

- Investment account or retirement fund: Speak to your bank, financial institution, or employer. There might be a form you need to fill out. Employers and financial companies usually allow designated beneficiaries to be changed during the annual enrollment period.

- Insurance policies: You can only change the beneficiary if they are revocable beneficiaries. Contact the plan administrator to learn how to update the beneficiary list.

- Will: A will that’s part of your estate plan is a living document, and it can, too, be updated to reflect your current wishes. The best way to change a will and update beneficiary designations is to create a new will and revoke the old will.

The new will must be a written document, and it should mention that it supersedes any previous versions. The new will also needs to be signed according to your state laws. LegalZoom can help you create a new will or make changes to an old one.

When should I update the beneficiaries?

Your entire estate plan should be reviewed consistently to ensure it best represents your interests. We suggest revisiting the designated beneficiaries in your estate plan for every major life event, like the birth of a child, marriage, divorce, death of a loved one, adoption, or when a child reaches the age of majority.

Be proactive about updating your beneficiary designations so your estate accurately represents your latest wishes and circumstances.

What happens if my beneficiary is a minor child?

Say you want to leave your inheritance to your 14-year-old child. You can list them as a primary beneficiary in your will. However, minor children typically have to wait until they turn the age of majority (which could be 18, 19, or 21, depending on your state) to inherit assets.

Pro tip: It’s strongly recommended that you make special arrangements for minor children, like setting up a trust or appointing a legal guardian, to ensure the funds are protected during this time frame.

Finding the right estate planning lawyer doesn’t have to be difficult or expensive. LegalZoom’s attorney directory will let you search for the best and most qualified lawyer in your area within minutes.

What is a beneficiary in a bank account?

A beneficiary in a bank account is the person who will receive the money once the original account holder dies or is no longer in the mental or physical condition to manage their finances.

Is the beneficiary the owner?

No, the beneficiary is not the owner of the account or assets while the original account owner is still alive.

For example, you’ve listed your 24-year-old son as the primary beneficiary on your investment accounts. While you, the account holder, are alive and healthy, he has no ownership rights to those accounts. He will only become the official account owner and inherit assets when you die or become incapacitated.

What does a beneficiary do when someone dies?

If the beneficiary is mentioned in a legal and valid will, they don’t need to worry about much. The estate executor is responsible for informing them about the benefits they will receive and how.

If the beneficiary has been listed on a specific asset like a life insurance policy, then the beneficiary will have to contact the insurance company and provide the necessary paperwork like a death certificate, personal identification, and proof of relation to receive the death benefits.

However, if the beneficiary has not been named in a will or designated to a specific asset, then they will have to wait until the estate gets instructions from the probate court.

Does a designated beneficiary have to pay taxes on life insurance policy payout?

Typically no. A designated beneficiary is not required to pay income tax on the life insurance proceeds if they receive the payout immediately.

However, if the beneficiary instructs the life insurance policyholder to delay the insurance payout and the policy generates interest during the time frame, they might have to pay tax.

Take this example: The death benefit from a life insurance policy is $100,000. But the beneficiary waited a year before claiming it. During this time, the policy earned 15% interest. The beneficiary will have to pay taxes on the interest earned.

If the provider issues the life insurance payout as a stipend rather than a lump sum distribution, there could also be tax obligations. A financial professional would be the best person to talk to about the tax consequences.

Beneficiaries matter

Deciding what you should do with your assets is a personal decision. However, naming a beneficiary for the majority of your assets can make it easier for other family members and your spouse to manage things once you are gone. By specifying beneficiary designations, you are not only eliminating guesswork and reducing stress for those you have left behind but also providing them with financial support to maintain a standard of living.