Executors and trustees play important roles in distributing assets after a person's death. However, they are vastly different positions with disparate responsibilities.

Grasping the difference between these roles is vital for individuals and families planning their estates. Choosing the right person for each position ensures that your affairs are handled smoothly, your loved ones are cared for as intended, and your legacy is managed in accordance with your values and goals. Proper understanding helps prevent confusion, legal complications, and family disputes, making it a cornerstone of effective estate planning.

Key takeaways

- Executors manage wills and estates under court supervision, while trustees manage assets in trusts, often without court oversight.

- Executors are named in wills by the testator or appointed by a court. Trustees are appointed in the trust document by the trustor.

- Executors ensure a will's terms are met; hence, their role is short-term. Trustees manage trust assets for beneficiaries over a potentially long term.

- Both roles involve strict legal and ethical obligations to act in beneficiaries' best interests, with breaches leading to significant consequences.

- The same person can be both executor and trustee, which can simplify the process but also increase workload and potential conflicts of interest.

1. Definitions, considerations, and examples: Trustee vs. Executor

What is a trustee of a trust?

A trustee is an individual or institution appointed in the trust document to manage assets held in a trust for the benefit of designated beneficiaries. The trustee holds legal title to the property within the trust and must act in accordance with the terms set forth by the trust creator—who is the trustor of a trust, also called the grantor or settlor.

A trustee manages a trust for the entire life of the trust, which may begin during the trustor's lifetime and can continue for many years after their death. The responsibility could last for decades and requires long-term management of assets. A trustee typically does not report to a court.

A trustee is a fiduciary, which means they are legally and ethically bound to act in the best interests of the trust's beneficiaries. This responsibility requires impartiality, prudent asset management, and strict adherence to the terms of the trust. The trustee must put aside personal interests and carry out their duties with honesty and care at all times.

There are various types of trustees, each with distinct roles and implications for the administration of a trust.

- Individual trustee: This is typically a single person, often a family member, friend, or trusted advisor, appointed to manage the trust's assets and distribute them according to the trust's terms.

- Corporate trustee: This refers to a professional entity, such as a bank, trust company, or wealth management firm, that is appointed to serve as trustee.

- Successor trustee: A successor trustee is designated in the trust document to take over the role of trustee if the original or current trustee becomes unable or unwilling to serve.

- Co-trustee: This arrangement involves two or more individuals or entities serving jointly as trustees. Co-trustees can be a combination of individual and corporate trustees, or multiple individuals.

The abbreviation "TTEE" is often used in legal or financial documents to represent "trustee." For example, "John Smith, TTEE" indicates John Smith is acting in the trustee role.

What is an executor of a will?

The executor is a person or institution named in a will (or appointed by a court if there is no will) to administer the estate of a deceased individual. Executors distribute assets according to the terms of a will, under the probate court's supervision, after the death of the testator. This is a limited responsibility, with a lot of work in a short period, including collecting assets, paying debts and taxes, and distributing property to the beneficiaries.

There are several types of executors, and choosing the type depends on the complexity of the estate, the assets involved, and the testator's preferences.

- Professional executor: This is often an attorney, accountant, or a bank's trust department. They are typically used for large, complex estates or when there are no suitable family members or friends to act as an executor.

- Lay executor: This is a private individual, usually a family member or close friend. They are common for simpler estates.

- Substitute executor (or alternate executor): This person is named in the will to take over if the primary executor is unable or unwilling to serve.

- Co-executors: When two or more people are named to administer an estate jointly. This can be beneficial for shared responsibility and expertise, but can also lead to disagreements if not managed well.

- Executor according to the tenor: In some legal systems, a person who isn’t formally named as an executor but is clearly given duties in the will that amount to those of an executor.

While “executor" is a gender-neutral term for this role, an "executrix" technically refers to a female executor, though this distinction is now rarely used. A broader, more modern legal term is "personal representative," which encompasses executors (appointed by a will) and administrators (appointed by the court when there is no will). In some jurisdictions, this term may also include court-appointed trustees.

Our step-by-step online tool helps you make key decisions with confidence, at your pace.

Do you need both an executor and a trustee?

You would need an executor if your estate plan primarily consists of a last will and testament without a complex trust structure. This is common for individuals with straightforward asset holdings who are comfortable with their estate going through probate.

You would need a trustee if:

- Your will creates a testamentary trust. The terms of your will establish a testamentary trust and only come into existence after your death. Here, the executor initially handles probate and transfers the designated assets into the newly formed trust, after which the trustee assumes responsibility for ongoing management and distribution.

- You’ve created a living trust during your lifetime. With a fully funded living trust (revocable or irrevocable), the appointed trustee manages and distributes assets according to the trust’s terms, allowing most assets to bypass probate entirely.

In both cases, the trustee plays a central role in administering trust assets. In contrast, a pour-over will (which "pours" any remaining non-trust assets into the trust) might still need an executor to distribute those remaining assets. Still the trust’s administrative tasks would be the trustee’s responsibility.

To conclude, you would need both an executor and a trustee for a comprehensive estate plan. You might use a will to appoint an executor for assets not explicitly transferred into a trust (e.g., personal belongings, certain financial accounts), while simultaneously having a trust with a designated trustee to manage specific assets (e.g., real estate, substantial investment portfolios, funds for minor children). The executor would handle the probate of the "probate estate," and the trustee would manage the "trust estate."

Can an executor and trustee be the same person? Will their roles overlap?

Yes, sometimes, the same individual or institution is appointed as both executor and trustee. However, their roles can overlap, particularly when the executor is also named as the trustee of a trust established by the will (a testamentary trust). In such cases, the individual first acts as the executor to gather assets and settle the debts of the estate. Once the estate administration is complete and the assets designated for the trust are transferred, their role transitions to that of a trustee, managing and distributing those assets according to the trust's terms.

Here are the potential benefits and challenges to consider when naming the same person or individual as an executor and as a trustee.

Benefits:

- Streamlined administration. A single individual or entity managing both roles can offer a cohesive approach, potentially leading to more efficient asset transfer and distribution. They have a holistic view of the entire estate.

- Reduced confusion. Fewer parties involved can lead to streamlined communications and a clearer chain of command.

- Cost savings. While not always guaranteed, combining roles can sometimes result in lower overall administrative fees compared to hiring separate professionals for each role.

- Familiarity. If the executor becomes the trustee, they are already familiar with the deceased's assets, debts, and wishes.

Challenges:

- Increased workload and complexity. The combined responsibilities can be substantial, demanding a significant time commitment and expertise in both probate law and trust administration. This might be overwhelming for an inexperienced individual.

- Potential for conflicts of interest. A combined role could create conflicts as the decisions made as an executor (e.g., regarding asset sales to pay debts) could impact their subsequent role as a trustee (e.g., the assets available for trust beneficiaries).

Ultimately, the decision of whether you need an executor, a trustee, or both, and whether to combine these roles, should be made in consultation with an experienced estate planning attorney. They can help you understand the nuances of your specific situation, tailor an estate plan that meets your objectives, and ensure your loved ones are well-cared for according to your wishes.

2. Qualities: Trustee vs. Executor

Who you select as the executor of your will or trustee of your trust is an important choice. You should look for someone you trust implicitly, who can handle the responsibility, and someone who is likely to outlive you.

It's important to name an alternate for either position in case your first choice is not available. Before you select anyone as an executor or trustee, it's a good idea to talk to them and ask if this is a responsibility they feel comfortable taking on.

Most people prefer to choose a close family member, such as a spouse or a child. You can also consider close friends. It is possible to use a company that fulfills these roles if there is no one you feel comfortable with in your life or you don't wish to burden someone you love.

How to choose your executor or trustee

Here are a few qualities to consider when choosing a trustee or an executor:

- Financial acumen. Solid understanding of investment principles, budgeting, and financial reporting.

- Organizational skills. Effective record-keeping and attention to detail are paramount.

- Impartiality. Act in the best interests of all beneficiaries, without favoritism or bias.

- Relationship with beneficiaries. While impartiality is key, an individual who can communicate effectively and compassionately with beneficiaries is often preferred.

- Availability and time commitment. Both the executor and trustee must be dedicated to carrying out the trustor’s or grantor’s wishes.

- Understanding of the law. While not necessarily a lawyer, a good trustee or executor should have a basic understanding of their duties.

Here are some factors that might disqualify an individual or make them an unsuitable choice for an executor or trustee:

- Felony convictions. Some states may prohibit individuals from serving as a trustee or executor if they have certain felony convictions, particularly those related to fraud or dishonesty.

- Undischarged bankrupts. An undischarged bankrupt is someone still legally declared bankrupt but has not yet been released (or discharged) from their bankruptcy status by the court. They’re subjected to court restrictions on managing finances. Because of these limitations and potential conflicts of interest, such individuals might be deemed unsuitable for roles requiring financial trustworthiness, like executor or trustee.

- Mental incapacity. If the named executor or trustee is deemed mentally incapacitated, they would not be able to serve.

- Minors. Individuals under the legal age of adulthood cannot serve as an executor or a trustee.

- Conflict of interest. While not always a disqualifier, a significant conflict of interest could lead to objections from beneficiaries or the court.

3. Roles and responsibilities: Trustee vs. Executor

What are the roles and responsibilities of a trustee of a trust?

In a trust, the trustee’s responsibilities are:

- Hold legal title to the trust assets for the benefit of the beneficiaries

- Manage the trust assets during the life of the trustor (person creating the trust) and after their death, for as long as the trust is in existence. This is an extensive responsibility that involves making decisions about investments and long-term management of property as well as maintaining insurance on property and vehicles.

- Manage a bank account for the trust

- Maintain records of the trust and provide regular accounting to beneficiaries

- Pay the bills of the trust

- Distribute the trust assets according to the terms laid out in the trust, at the time indicated for distribution. This can include making payments on behalf of beneficiaries, as well as directly to them if indicated in the trust document

- Navigate any legal or tax implications related to the trust

A trustee's duties can be long-term, especially in cases involving trusts designed to provide for minor children, individuals with special needs, or to manage assets across several generations.

What are the roles and responsibilities of an executor of a will?

After the testator’s death, the executor’s responsibilities are:

- Obtain a copy of the will and offer it for probate with the probate court

- Appear in court on behalf of the estate and obtain a grant of probate, authorizing them to act on behalf of the estate

- Notify all interested financial institutions of the death (such as credit card companies and banks)

- Open a bank account for the estate

- Pay the bills and taxes of the estate

- Inventory all of the assets of the estate (real estate, bank accounts, investments, personal property)

- Manage all of the property of the estate and keep it in good condition until it can be distributed

- Distribute the estate's assets to the beneficiaries named in the will

- Close out the estate with the probate court

An executor's role is typically temporary, concluding once the estate has been fully settled and distributed, usually within a few months to a couple of years.

4. Fiduciary and legal duties: Trustee vs. Executor

Legal obligations or duties are the specific requirements imposed by statute and common law. These often codify and reinforce the principles of fiduciary duty. For example, state trust codes dictate procedures for trust administration, investment standards, and beneficiary notification requirements. Failing to meet these legal requirements can lead to penalties.

Trustee’s legal and fiduciary duties

The fiduciary duties of trustees are a legal obligation to prioritize the best interests of the beneficiaries over their own. This encompasses several key principles:

- Duty of loyalty. A trustee must act solely in the best interests of the beneficiaries and avoid any conflicts of interest. They cannot personally profit from their position as trustee or use trust assets for their own benefit.

- Duty of prudence. This requires the trustee to manage trust assets with the care, skill, and caution that a reasonably prudent person would exercise in managing their own affairs. This includes making sound investment decisions, preserving trust property, and avoiding undue risks.

- Duty of impartiality. If there are multiple beneficiaries, the trustee must treat them fairly and impartially, without favoring one over another, unless the trust document explicitly directs otherwise.

- Duty to administer the trust according to its terms. The trustee must strictly adhere to the terms and provisions outlined in the trust document. This means distributing assets as specified, following investment guidelines, and generally operating within the grantor's intentions.

- Duty to keep accurate records and accounts. Trustees are required to maintain clear and detailed records of all trust transactions, income, expenses, and distributions. They must also provide regular and accurate accounting to the beneficiaries, typically on an annual basis or upon request.

- Duty to inform and communicate. Trustees have an obligation to keep beneficiaries reasonably informed about the administration of the trust, including significant changes or decisions that may affect them.

Trustee liability protection

Trust documents often incorporate “trustee liability protection” provisions, such as indemnification clauses, which can shield a trustee from personal liability, provided they act in good faith and within their designated fiduciary responsibilities. For added security, trustees should consider having a trustee liability insurance (also known as errors & omissions [E&O] Insurance). This insurance policy protects trustees from personal financial losses if they are sued for alleged negligence, errors, omissions, or breaches of fiduciary duty while administering a trust. This coverage generally covers legal defense expenses, settlements, or judgments should the trustee be deemed responsible for errors or mismanagement during their professional duties.

Trustee’s duties explained, with examples

| Situation | Fiduciary action |

| Asset management. The trust owns a rental property. | The trustee promptly addresses maintenance issues, rather than neglecting the property or allowing it to fall into disrepair. The trustee ensures the property is insured, sets fair market rent, and keeps meticulous records of all rental income and expenses. |

| Distributions. The trust document stipulates that beneficiaries receive distributions for their education. | The trustee verifies educational expenses, ensures distributions are made promptly and in accordance with the trust's terms. |

| Communication with beneficiaries. A major investment in the trust experiences a significant downturn. | The trustee proactively communicates this news to the beneficiaries, explains the reasons for the downturn, and outlines the steps being taken to mitigate further losses, rather than concealing the information until it is unavoidable. |

| Record keeping. The trustee receives income from various sources for the trust. | The trustee maintains a clear ledger, meticulously recording every dollar received and spent, categorizing expenses, and reconciling bank statements every month, ensuring transparency and accuracy for future accounting. |

Trustee’s consequences of breach: What happens if a trustee fails in their duties?

A breach of fiduciary duty or legal obligation can have significant and detrimental consequences for the trustee. These can include:

- Trustee liability. The trustee can be held personally liable for any losses incurred by the trust due to their negligence, misconduct, or failure to act prudently. This means their personal assets could be used to compensate the beneficiaries for damages. A court can also order the trustee to return to the trust any profits they personally gained from a breach of duty or to compensate the trust for any losses it suffered due to their actions or inactions.

- Removal of trustee. Beneficiaries can petition the court for the removal of a trustee who has breached their duties. This can occur if the trustee is deemed incompetent, dishonest, or consistently fails to act in the best interests of the beneficiaries.

- Attorney's fees and costs. If litigation arises from a breach, the breaching trustee may be ordered to pay the legal fees and costs incurred by the beneficiaries or the trust.

- Reputational damage. A breach of trust can severely damage a trustee's professional and personal reputation, especially if the breach involves dishonesty or gross negligence.

- Criminal charges. In extreme trustee misconduct cases, such as embezzlement or fraud involving trust assets, a trustee could face criminal charges in addition to civil penalties.

Executor’s legal and fiduciary duties

At its core, fiduciary duty means acting solely in the best interests of another party, in this case, the beneficiaries of the estate. This duty is characterized by several key principles:

- Duty of loyalty. The executor must avoid any conflicts of interest and prioritize the estate's interests over their own personal gain. This means refraining from self-dealing or using estate assets for personal benefit.

- Duty of prudence. The executor must manage the estate's assets with the same care and skill that a reasonably prudent person would exercise in their own affairs. This includes safeguarding assets, making sound financial decisions, and investing wisely (if applicable and permitted by the will).

- Duty of impartiality. If there are multiple beneficiaries, the executor must treat them fairly and equally, avoiding favoritism or prejudice.

- Duty to account. The executor must maintain accurate and detailed records of all estate transactions, including income, expenses, and distributions. They are typically required to provide a formal accounting to the court and beneficiaries.

- Duty to inform. The executor must keep beneficiaries reasonably informed about the progress of the estate administration and any significant decisions being made.

Executor’s duties explained, with examples

| Situation | Fiduciary action |

| Managing investments | If the will dictates that certain assets should be invested for the benefit of minor beneficiaries, the executor must select prudent investments, monitor their performance, and act to protect their value. |

| Selling property | When selling estate property, the executor must obtain fair market value, acting diligently to market the property and considering all reasonable offers. |

| Paying debts | The executor must diligently research and verify all claims against the estate before making payments, ensuring that only legitimate debts are paid. |

| Maintaining records | All files—including bank statements, receipts, tax documents, and correspondence related to the estate—must be kept organized and accessible. |

| Avoiding conflicts of interest | If the executor is also a beneficiary, they must be cautious to avoid any actions that could be perceived as favoring their own interests over those of other beneficiaries. For instance, if the executor wants to buy an estate asset, they must ensure the sale is conducted at fair market value and is transparent to all beneficiaries. |

Executor’s consequences of breach: What happens if an executor fails in their duties?

A breach of fiduciary duty or legal obligations can have severe consequences for an executor, both personally and legally. These may include:

- Removal of executor. The court can remove an executor for failing to uphold their duties and appoint a successor to manage the estate.

- Executor liability. The executor can be held personally responsible for any financial losses to the estate due to their negligence or breach of duty. This may include reimbursing the estate for misused funds or compensating beneficiaries for any resulting losses.

- Litigation. Beneficiaries or creditors may sue the executor for damages or for an accounting of their actions.

- Criminal charges. In cases of executor misconduct, such as embezzlement or fraud, an executor could face criminal charges.

- Reputational damage. A breach of trust can significantly damage the executor's personal and professional reputation.

5. Impact of death on trust: Trustee vs. Executor

What happens if a trustee dies?

When a trustee dies, the management and distribution of assets held in trust can become complicated and require a clear understanding of the protocols in place to ensure the trust's continued operation. The specific actions taken will depend on the provisions outlined in the trust document and applicable state laws.

Here are a few crucial actions that must be taken immediately after a trustee dies to maintain continuity, comply with legal requirements, and safeguard beneficiaries’ interests:

- Reviewing the trust document. The trust document itself is the primary guide. Many trusts name successor trustees who can step in if the original trustee is no longer able to serve.

- Complying with the state laws. When a trustee dies, if the trust document doesn’t specify the successor trustee, state laws provide default rules for appointing a successor trustee or managing the trust. A court may need to appoint a new trustee, as these laws vary in every jurisdiction. This process can be time-consuming and costly.

- Discussing with the beneficiaries. In some cases, if all beneficiaries agree, they may be able to collectively appoint a new trustee without court intervention, provided the trust document doesn't explicitly forbid this. In some cases, the trust document provides the right to all beneficiaries to collectively agree and appoint a new trustee without court intervention.

- Managing the assets. Until someone new takes over as trustee, the trust assets could remain in a holding state. It's crucial to check the trust document and identify who has temporary authority to protect these assets from loss or mismanagement.

What happens if an executor dies?

It is important to plan for contingencies when appointing an executor, including what happens if they die before or during their duties.

- Reviewing the will. If the will designates an alternate executor, they typically assume the sole responsibility for administering the estate when the primary executor is unable to serve.

- Settling the executor’s personal affairs. If an executor dies before completing their duties, their own personal representative—the person handling the deceased executor’s estate—will step in to settle the executor’s personal affairs. As part of this, they may need to prepare a financial accounting of the original estate the deceased executor was managing, covering everything up to the date of death. This ensures transparency and allows the probate court to appoint an alternate executor to take over the original estate and continue the process without unnecessary delays.

- Seeking court intervention. If the will doesn't specify an alternate executor or co-executor, the court will usually appoint an administrator to manage the estate. This individual will fulfill the remaining duties of the executor.

6. Probate process and its effects: Trustee vs. executor

The probate process is the legal procedure through which a deceased person's will is proven valid, their assets are identified and inventoried, outstanding debts and taxes are paid, and the remaining assets are distributed to their heirs. This court-supervised process can be lengthy, public, and expensive, often incurring attorney fees, court costs, and executor commissions.

An executor’s primary responsibilities are entirely within the probate framework. A trustee’s responsibilities typically occur outside the probate process.

Probate assets:

|

Non-probate assets:

|

|

The assets held solely in the deceased person's name at the time of their death are subject to probate. 1. Real estate owned individually. 2. Bank accounts, investment accounts, and brokerage accounts held solely in the deceased's name. 3. Personal property such as vehicles, jewelry, and household goods. 4. Business interests owned directly by the deceased. |

Non-probate assets bypass the probate process when they have designated beneficiaries or are held in a specific ownership structure. 1. Assets with named beneficiaries like Life insurance policies, retirement accounts (401(k)s, IRAs), and payable-on-death (POD) or transfer-on-death (TOD) bank or brokerage accounts. 2. Property held as joint tenants with right of survivorship or tenants by the entirety automatically passes to the surviving owner(s). 3. Property transferred into a living trust (inter vivos trust) during the grantor's lifetime avoids probate because the trust, not the individual, legally owns the assets. |

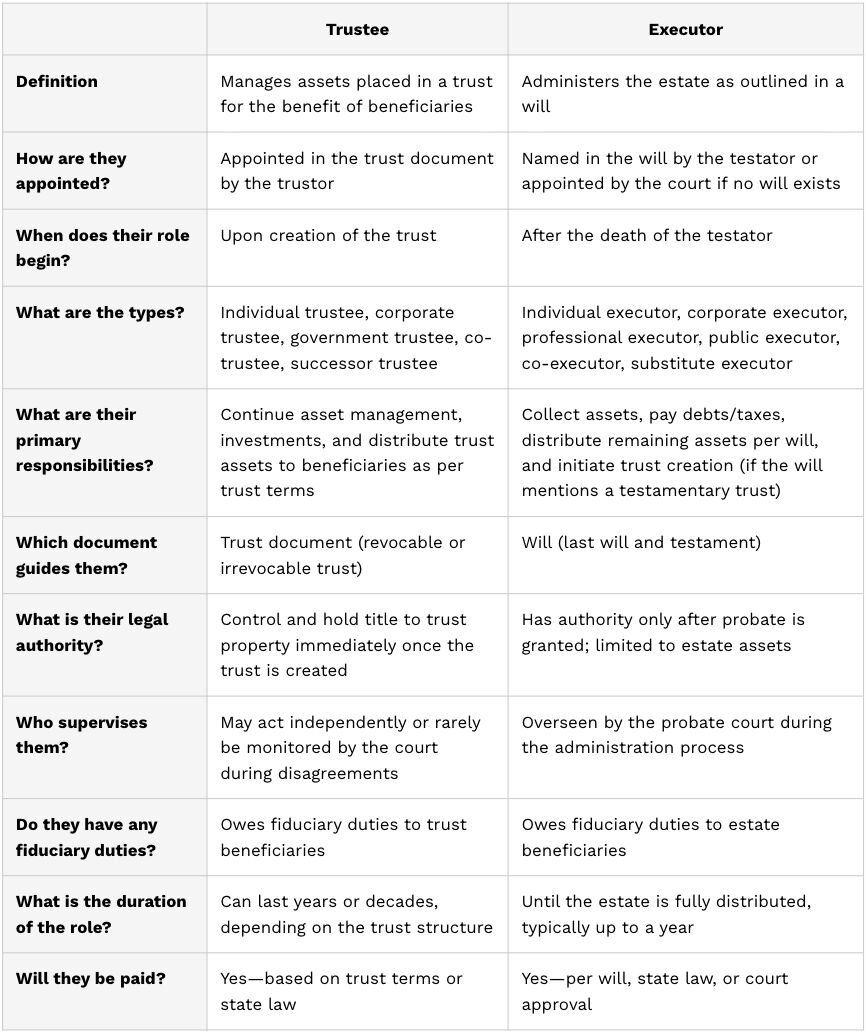

| Trustee | Executor | |

| Definition | Manages assets placed in a trust for the benefit of beneficiaries | Administers the estate as outlined in a will |

| How are they appointed? | Appointed in the trust document by the trustor | Named in the will by the testator or appointed by the court if no will exists |

| When does their role begin? | Upon creation of the trust | After the death of the testator |

| What are the types? | Individual trustee, corporate trustee, government trustee, co-trustee, successor trustee | Individual executor, corporate executor, professional executor, public executor, co-executor, substitute executor |

| What are their primary responsibilities? | Continue asset management, investments, and distribute trust assets to beneficiaries as per trust terms | Collect assets, pay debts/taxes, distribute remaining assets per will, and initiate trust creation (if the will mentions a testamentary trust) |

| Which document guides them? | Trust document (revocable or irrevocable trust) | Will (last will and testament) |

| What is their legal authority? | Control and hold title to trust property immediately once the trust is created | Has authority only after probate is granted; limited to estate assets |

| Who supervises them? | May act independently or rarely be monitored by the court during disagreements | Overseen by the probate court during the administration process |

| Do they have any fiduciary duties? | Owes fiduciary duties to trust beneficiaries | Owes fiduciary duties to estate beneficiaries |

| What is the duration of the role? | Can last years or decades, depending on the trust structure | Until the estate is fully distributed, typically up to a year |

| Do they get paid? | Yes—based on trust terms or state law | Yes—per will, state law, or court approval |

Draft your estate planning documents with LegalZoom

LegalZoom's Estate Planning services provide a user-friendly and affordable online solution for individuals and families seeking to protect their assets and ensure the well-being of loved ones, without the complexity of traditional estate planning. Through a combination of technology and optional attorney guidance and review, LegalZoom simplifies the creation of estate plans, empowering customers with peace of mind and control over their future.

- Simple & guided process: Our user-friendly online platform makes estate planning easy. We guide you step-by-step with clear instructions and helpful resources, so that you can create your plan with ease.

- Affordable peace of mind: Protect your loved ones and assets with our cost-effective solutions for essential estate planning documents.

- Comprehensive solutions: We offer a full range of estate planning documents and services, including wills, trusts, powers of attorney, and healthcare directives, to ensure a complete and personalized plan for your future.

Backed by over two decades of trusted experience in online estate planning and thousands of 5-star TrustPilot reviews, here is what LegalZoom’s customers have to say:

This process was easier than I thought ... The lawyer I worked with was very personable and knowledgeable.

- Colette W., estate plan customer

The explanation about the [pros and cons] of having a living trust instead of a will was great and made the process simple.

- Ryan S., living trust customer

Conclusion

To summarize, both trustees and executors play vital roles in estate administration, ensuring a deceased's wishes are honored. A trustee is named in the documentation of your trust and is the person who is responsible for distributing trust assets to beneficiaries according to the terms of the trust. On the other hand, an executor is named in your last will and is the person who is responsible for distributing your estate to your beneficiaries according to the terms set out in your will.

In some cases, the same person can serve in both roles, which may streamline the process, but this should be carefully considered depending on the complexity of your estate and personal dynamics. By understanding the differences between executors and trustees, you can make an informed decision in your selection of the person who will manage and distribute your assets, ensuring a smooth transition of assets and peace of mind for all parties. It's also wise to review your estate plan regularly and consult with an estate planning attorney and a financial advisor to keep it up to date with your wishes and life changes.

Frequently asked questions on Trustee vs. Executor

1. What are the disadvantages of being a trustee?

Being a trustee entails significant responsibilities, including legal liability and substantial obligations:

- Trustees are fiduciaries, obligated to act in the best interests of their beneficiaries by prudently managing assets, adhering to the terms of the trust, and meticulously keeping accurate records.

- The role is time-consuming and demanding, requiring constant attention to investments, distributions, and potential disputes.

- Trustees may face personal liability for mismanagement or negligence, which could result in significant legal and financial repercussions.

- Trust administration complexity often requires costly professional advice.

- The role can also be emotionally challenging due to family dynamics or difficult beneficiaries, making it a demanding and stressful undertaking.

2. What happens if there is no executor?

If an estate plan does not name an executor, or if the named executor is unable or unwilling to serve, the probate court will typically appoint an administrator to manage the deceased's assets and debts. This court-appointed individual will assume responsibilities similar to those of an executor, including identifying and valuing assets, paying off creditors and taxes, and distributing the remaining assets to beneficiaries according to the will or state law. The process of appointing an administrator can add complexity and delays to the estate settlement.

3. Can an executor override a trustee?

An executor generally cannot override a trustee because their roles and responsibilities are distinct within estate planning. An executor is responsible for managing a deceased person's estate, including paying debts and distributing assets as specified in the will. A trustee, on the other hand, manages assets held in a trust for the benefit of beneficiaries. While there might be some overlap or interaction if the will directs assets into a trust, or if the executor is also named as a trustee, their foundational powers originate from different legal instruments (the will for the executor and the trust document for the trustee) and govern different sets of assets.

4. Can the executor of a trust take everything?

No, the executor of a trust cannot take everything. The executor (more accurately, the trustee in the context of a trust) is legally obligated to administer the trust in accordance with the terms outlined in the trust document and applicable state laws. Their primary duty is to manage and distribute the trust assets to the designated beneficiaries, pay off debts and taxes, and uphold the grantor's wishes as expressed in the trust. Taking all assets would be a breach of their fiduciary duty and could lead to legal action by the beneficiaries.

5. Are trustees and executors paid?

Typically, both executors and trustees are compensated for their services. Their compensation can vary based on several factors, including the complexity of the estate or trust, the amount of assets involved, the time commitment required, and the specific terms outlined in the will or trust document.

Executors, who are responsible for managing a deceased person's estate, are typically paid a fee from the estate's assets, often based on a percentage of the estate's value or an hourly rate, as determined by state law or the terms of the will.

Similarly, trustees, who manage assets held in a trust, receive compensation from the trust's funds. This compensation can be a percentage of the trust's assets under management, an hourly fee, or a fixed annual amount, depending on the terms of the trust document and applicable state laws.

6. Can a beneficiary remove an executor or trustee?

Generally, removing a trustee or an executor is a complex legal process that depends on the specific circumstances and the terms of the will or trust. A beneficiary may petition a court to remove an executor or trustee if they are found to be breaching their fiduciary duties, mismanaging assets, or acting against the best interests of the beneficiaries.

However, mere disagreement or dissatisfaction with decisions is typically insufficient grounds for removal; there must be a demonstrable failure to uphold their legal obligations. The court will ultimately decide based on the evidence presented and what serves the best interests of the estate or trust.

7. What happens if an executor or trustee resigns?

If an executor or trustee resigns, the process for appointing a replacement is typically outlined in the will or trust document itself. Often, an alternate executor or a successor trustee is named. If no substitute is designated, or if they are unable or unwilling to serve, the court will usually step in to appoint a new executor for a will, or a new trustee for a trust. The court's primary goal is to ensure the proper administration of the estate or trust according to the deceased's wishes and legal requirements.

8. Who has more power, the trustee or the executor?

Both an executor and a trustee hold significant power, but their authority differs in scope and timing. An executor's primary role is focused on administering the will and the deceased's estate, acting in accordance with the will's instructions and applicable legal requirements. This authority is generally temporary, concluding once the estate is settled and administered.

A trustee, on the other hand, manages assets held in a trust for the benefit of designated beneficiaries. The trust document defines their power and can be long-term, lasting for the duration of the trust. Ultimately, neither inherently has "more" power; their authority is distinct and dependent on the specific legal documents governing their roles.

9. Can a trustee be a beneficiary?

Yes, a trustee can also be a beneficiary of the trust, provided certain conditions are met and there are no conflicts of interest that could compromise their fiduciary duties. This is common in family trusts, where a parent may serve as a trustee for their children and also be a beneficiary themselves. However, the trustee must always act in the best interests of all beneficiaries and adhere strictly to the terms of the trust document, especially when their personal interests as a beneficiary might diverge from their responsibilities as a trustee.

10. Can an executor be a beneficiary?

Yes, an executor can also be a beneficiary of an estate. There are no legal restrictions preventing an executor from receiving assets from the estate they are managing, as long as the will or trust specifies them as a beneficiary. However, the executor must still fulfill their fiduciary duties to all beneficiaries, acting impartially and in the best interests of the estate. Any potential conflicts of interest should be disclosed, and in some cases, it is advisable for an independent party to oversee certain transactions if the executor's personal interest could conflict with their duties to other beneficiaries.

Brette Sember, J.D., contributed to this article.