Dear

In connection with your application for

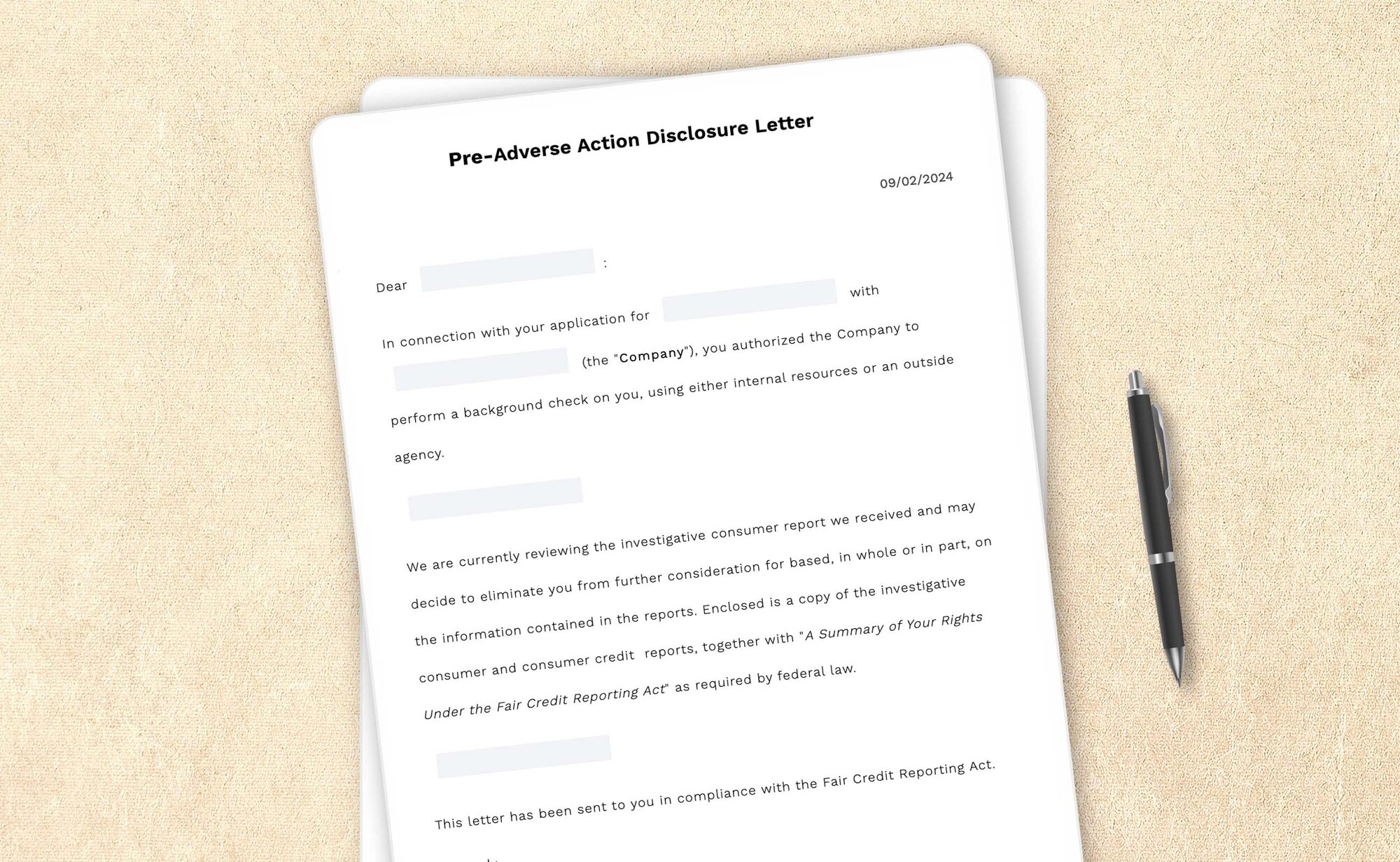

We are currently reviewing the investigative consumer

This letter has been sent to you in compliance with the Fair Credit Reporting Act.

| Sincerely, | |||||||||||||||||||||

_______________________________ Title: |

[PAGE BREAK HERE]

A Summary of Your Rights Under the Fair Credit Reporting Act

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. There are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about check writing histories, medical records, and rental history records). Here is a summary of your major rights under the FCRA. For more information, including information about additional rights, go to www.ftc.gov/credit or write to: Consumer Response Center, Room 130-A, Federal Trade Commission, 600 Pennsylvania Ave. N.W., Washington, D.C. 20580.

1. You must be told if information in your file has been used against you. Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment - or to take another adverse action against you - must tell you, and must give you the name, address, and phone number of the agency that provided the information.

2. You have the right to know what is in your file. You may request and obtain all the information about you in the files of a consumer reporting agency (your "file disclosure"). You will be required to provide proper identification, which may include your Social Security number. In many cases, the disclosure will be free. You are entitled to a free file disclosure if:

- - a person has taken adverse action against you because of information in your credit report;

- - you are the victim of identity theft and place a fraud alert in your file;

- - your file contains inaccurate information as a result of fraud;

- - you are on public assistance;

- - you are unemployed but expect to apply for employment within 60 days.

In addition, by September 2005 all consumers will be entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See www.ftc.gov/credit for additional information.

3. You have the right to ask for a credit score. Credit scores are numerical summaries of your credit-worthiness based on information from credit bureaus. You may request a credit score from consumer reporting agencies that create scores or distribute scores used in residential real property loans, but you will have to pay for it. In some mortgage transactions, you will receive credit score information for free from the mortgage lender.

4. You have the right to dispute incomplete or inaccurate information. If you identify information in your file that is incomplete or inaccurate, and report it to the consumer reporting agency, the agency must investigate unless your dispute is frivolous. See www.ftc.gov/credit for an explanation of dispute procedures.

5. Consumer reporting agencies must correct or delete inaccurate, incomplete, or unverifiable information. Inaccurate, incomplete or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to report information it has verified as accurate.

6. Consumer reporting agencies may not report outdated negative information. In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are more than ten years old.

7. Access to your file is limited. A consumer reporting agency may provide information about you only to people with a valid need - usually to consider an application with a creditor, insurer, employer, landlord, or other business. The FCRA specifies those with a valid need for access.

8. You must give your consent for reports to be provided to employers. A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer. Written consent generally is not required in the trucking industry. For more information, go to www.ftc.gov/credit.

9. You may limit "prescreened" offers of credit and insurance you get based on information in your credit report. Unsolicited "prescreened" offers for credit and insurance must include a toll-free phone number you can call if you choose to remove your name and address from the lists these offers are based on. You may opt-out with the nationwide credit bureaus at 1-888-OPTOUT (1-888-567-8688).

10. You may seek damages from violators. If a consumer reporting agency, or, in some cases, a user of consumer reports or a furnisher of information to a consumer reporting agency violates the FCRA, you may be able to sue in state or federal court.

11. Identity theft victims and active duty military personnel have additional rights. For more information, visit www.ftc.gov/credit.

States may enforce the FCRA, and many states have their own consumer reporting laws. In some cases, you may have more rights under state law. For more information, contact your state or local consumer protection agency or your state Attorney General. Federal enforcers are:

| add border | |

|---|---|

| TYPE OF BUSINESS | CONTACT |

| Consumer reporting agencies, creditors and other not listed below | Federal Trade Commission: Consumer Response Center - FCRA Washington, DC 20580 1-877-382-4357 |

| National banks, federal branches/agencies of foreign banks (word "national" or initials "N.A." appear in or after bank's name) |

Office of the Comptroller of the Currency Compliance Management Mail Stop 6-6 Washington, DC 20219 800-613-6743 |

| Federal Reserve System member banks (except national banks, and federal branches/agencies of foreign banks) |

Federal Reserve Consumer Help (FRCH) P O Box 1200 Minneapolis, MN 55480 Telephone: 888-851-1920 Website Address: www.federalreserveconsumerhelp.gov Email Address: ConsumerHelp@FederalReserve.gov |

| Savings associations and federally chartered savings banks (word "Federal" or initials "F.S.B." appear in federal institution's name) |

Office of Thrift Supervision Consumer Complaints Washington, DC 20552 800-842-6929 |

| Federal credit unions (words "Federal Credit Union" appear in institution's name) |

National Credit Union Administration 1775 Duke Street Alexandria, VA 22314 703-519-4600 |

| State-chartered banks that are not members of the Federal Reserve System |

Federal Deposit Insurance Corporation Consumer Response Center 2345 Grand Avenue, Suite 100 Kansas City, Missouri 64108-2638 1-877-275-3342 |

| Air, surface, or rail common carriers regulated by former Civil Aeronautics Board or Interstate Commerce Commission |

Department of Transportation Office of Financial Management Washington, DC 20590 202-366-1306 |

| Activities subject to the Packers and Stockyards Act, 1921 | Department of Agriculture Office of Deputy Administrator - GIPSA Washington, DC 20250 202-720-7051 |

How-to guides, articles, and any other content appearing on this page are for informational purposes only, do not constitute legal advice, and are no substitute for the advice of an attorney.

Pre-adverse action disclosure letter: How-to guide

As an employer, you might expect to have honest employees with the right skills working in your company. To achieve this, you can run a background check both when you’re hiring new employees and when you’re evaluating current employees for promotion or reassignment.

While running the check, it is necessary to comply with federal regulations to protect the privacy of this information. As an employer, you must follow these procedures when obtaining a consumer report on a current or prospective employee:

- Ensure that all of your applicants and employees know that you’re using consumer credit reports for employment purposes and that they agree to it.

- The applicants or employees must be notified immediately if you find any information in a consumer report that could result in a negative employment decision, like rejection of the application or denial of a promotion.

Pre-adverse action letters help set the right path toward the proper hiring process for your organization. Your organization can get verified information and bring the right staff to support the business.

To make the process of drafting a pre-adverse action disclosure letter easier, you can check out our template provided at the beginning of this page for a nominal price. Start creating your document by filling out the required information, editing it to suit your needs, and downloading it for free in a .pdf file once it is complete.

Along with providing templates for adverse action letters, LegalZoom also provides you with various other formal letter templates for professional use.

Best practices for hiring new employees

Following a professional pre-adverse action process, inform prospective employees in a timely manner of measures you might take based on the information received. It is ideal to create a document that can be used repeatedly, and that will ensure compliance with federal and state credit regulations.

1. Treat all job applicants equally

Treat all applicants equally and be consistent in your questions about qualifications for the open position. Use the same consideration in questions about a potential employee’s schools, employers, or listed references.

2. Give adequate time to review documents

Be professional and courteous to every potential employee. Allow applicants ample time to review and complete any employment-related documents. Anticipate and be ready to answer questions about the releases you provide.

3. Choose your questions carefully with the job applicant

Ask only for the release of information that’s absolutely necessary. This will reduce the risk of violating labor and federal credit reporting laws and save time and energy for everyone involved.

4. Protect the privacy of your potential candidate

Protect the privacy of the information you receive. Label any papers with that information “PRIVATE” and file them in a safe place. As a general rule of thumb, this information should be released on a “need-to-know” basis or if a court orders that information be provided.

Consider designating a high-level manager to be responsible for maintaining the privacy of your employee’s records. Conduct periodic evaluations of the security and efficiency of this recordkeeping system.

5. Comply with the Fair Credit Reporting Act (FCRA)

You must comply with the FCRA Act if you use a consumer reporting agency to do background checks on applicants or employees. This federal law requires you to inform those individuals that a consumer report is being used for employment decisions and requires their permission for the same. In addition, if you receive negative information from a background report that adversely affects the final decision (i.e., rejection of the application or denial of a promotion), those individuals must be contacted immediately with that information.

Note that this letter isn’t a notice of the intent to use consumer reports for employment purposes. It also can’t be used as evidence of the employee’s consent to a credit investigation. You’ll need to use a specific release of credit information form and notice for those purposes.

6. Explain the consequences of adding false information

Dishonesty on an employment application can provide grounds for later termination. If, for example, an applicant claims to have graduated from a particular school and the information released by your inquiry proves that to be false, they can be fired because of that lie. Applicants may also be denied unemployment benefits if they provide inaccurate information on their employment application.

If potential employees know the consequences of dishonesty and know that you’ll verify the information they provide through a background check, they may be more truthful in their answers. Moreover, your company will have documentation if there is suspicion of concealment or lies on the part of the employee.

7. Be careful while discarding important documents

Don't simply throw those documents into the trash when you decide to dispose of the credit reports you’ve obtained (when the document retention periods are over). Take reasonable steps to protect an applicant’s confidential information by shredding paper copies or erasing digital copies.

How an adverse action process works

The following steps will help you understand the terms of your adverse action letters and the process for providing them.

Step 1: Send a pre-adverse action notice

Before taking any intended adverse action, you must notify the applicant or employee in writing that you plan on taking adverse action based on the consumer report you received. Along with the pre-adverse letter, you must include:

- A copy of the consumer report

- A copy of the Federal Trade Commission document “A Summary of Your Rights Under the Fair Credit Reporting Act”

Also, provide the applicant or employee a chance to review the information you obtained and offer any corrections or additions. Consumer reports aren’t infallible, and individuals may be able to explain credit blips satisfactorily. Insert a reasonable time frame within which the employee or applicant must respond.

Step 2: Notify with a post-adverse action letter

As a potential employer, you must notify the applicant or employee that you’ve taken an adverse action with a post-adverse action letter. Along with this letter, include:

- A copy of the consumer report

- A copy of the Federal Trade Commission document “A Summary of Your Rights Under the Fair Credit Reporting Act”

Add the name of the credit reporting company you used to conduct the applicant's background check and the contact information, including the address and toll-free phone number of that business.

Frequently asked questions

What is an adverse action?

An “adverse action” is any negative act resulting from a background check. For example, rejecting a job application, reassigning or terminating an employee, or denying a promotion are all considered adverse actions from a company.

What's an adverse action disclosure letter?

If your business uses credit history and related information to evaluate potential employees, you must disclose this to those whose credit you check. An adverse action disclosure letter lets you inform potential employees about their credit checks and, if you choose, gives them a chance to respond to the information in their credit report.

What are the elements of a pre-adverse action letter?

Here are the essential elements needed to complete your adverse action disclosure letter:

- To whom you're sending the letter: Have their name and contact information ready

- Why you're checking their credit: Know the reason for the credit check, as well as the contact information of the credit reporting agency

- Information review: Decide if you’ll give the recipient a chance to review and respond to the information about them

Why should I comply with the FCRA while hiring?

Compliance with the Fair Credit Reporting Act (FCRA) can protect your company from costly litigation. You can also prevent tremendous damage to your company’s reputation and its ability to attract qualified employees. Using pre-adverse action notices allows your company to search lawfully for background information on an applicant, protect potential employees from unwanted invasion into their matters, and shield your business from claims that it has violated federal regulations.