Before choosing a name for your business, you can use the Pennsylvania Department of State website to ensure there’s no one else currently using the name you want for your business. Your business name must be unique and not cause confusion between your business and someone else’s.

Below, we’ve included everything you need to know about Pennsylvania business search, tips on how to adhere to state business entity naming guidelines, and the implications of trademarks and domain availability. If you need help coming up with business name ideas, also consider checking out LegalZoom's free business name generator.

Pennsylvania Department of State business search contact information

- Website: https://file.dos.pa.gov/search/business

- Phone: 717-787-1057

- Email: RA-CORPS@pa.gov

- Address: 401 North S., Rm. 302, Harrisburg, PA 17120

Step-by-step guide to conducting a Pennsylvania Department of State business search

The PA Department of State’s business entity search page is set up so you can check if the business name you want to use is already reserved in the state of Pennsylvania. It can also provide you with information about other businesses and share public information about those businesses.

Step 1: Go to the Pennsylvania business entity search

Your first step in searching for a business entity is to go to the Pennsylvania Department of State business search website.

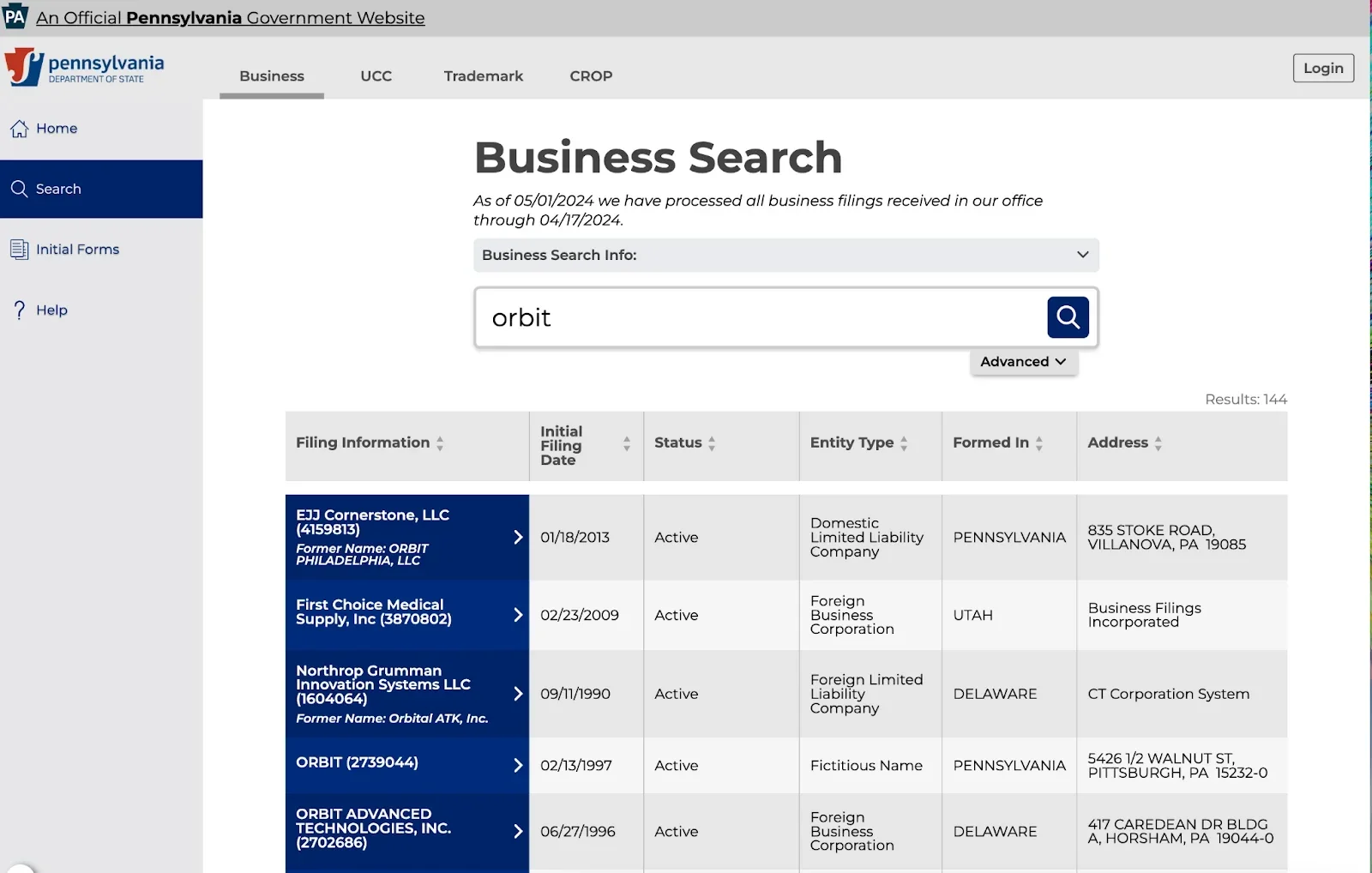

Step 2: Run your search

In the search bar, enter the business name or entity ID. Click the magnifying glass button to begin.

The results page will show you a list of all the Pennsylvania business entities that contain the words entered into the search bar.

You can click on the name of the business or entity number to view details about that specific business.

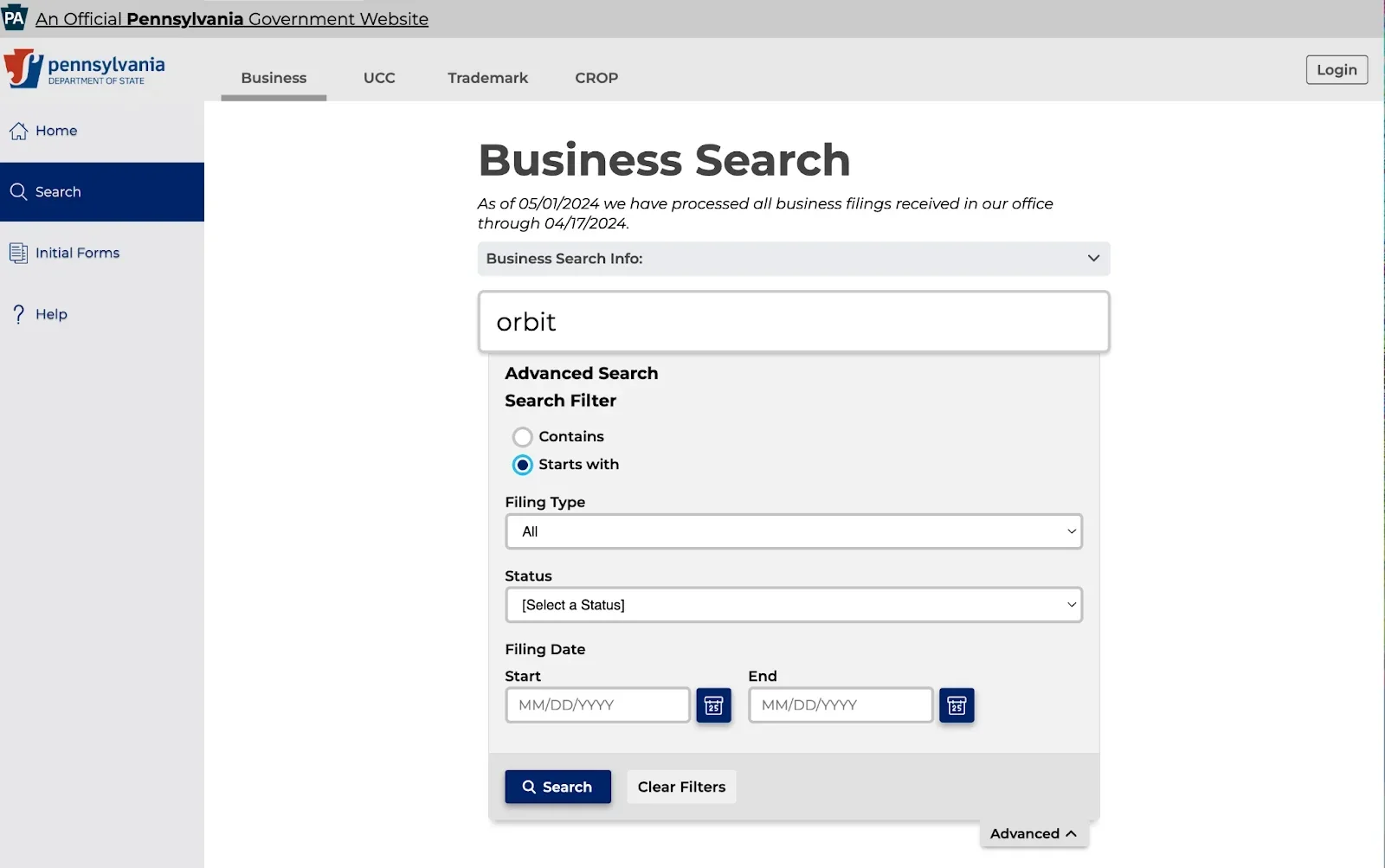

Step 3: Refine your search

To ensure that the name you want to use isn’t already in use, you’ll want to refine your search.

Select “Advanced” and a drop-down menu will appear.

You can narrow your search through these parameters:

- Designating the name to “contain” or “start with” the term you are searching

- Filing type

- Status

- Filing date

Click “Search” to continue. The results will show business entities matching your selected filters.

The advanced search can help you ensure you’ve eliminated all businesses with similar names. You can also sort by status to see if corporations are inactive or active companies.

It’s important to carefully consider names that are similar to yours. You’re not able to use a name that exactly matches the name of another business, but you could also face rejection (or legal action) if your name is too similar to others.

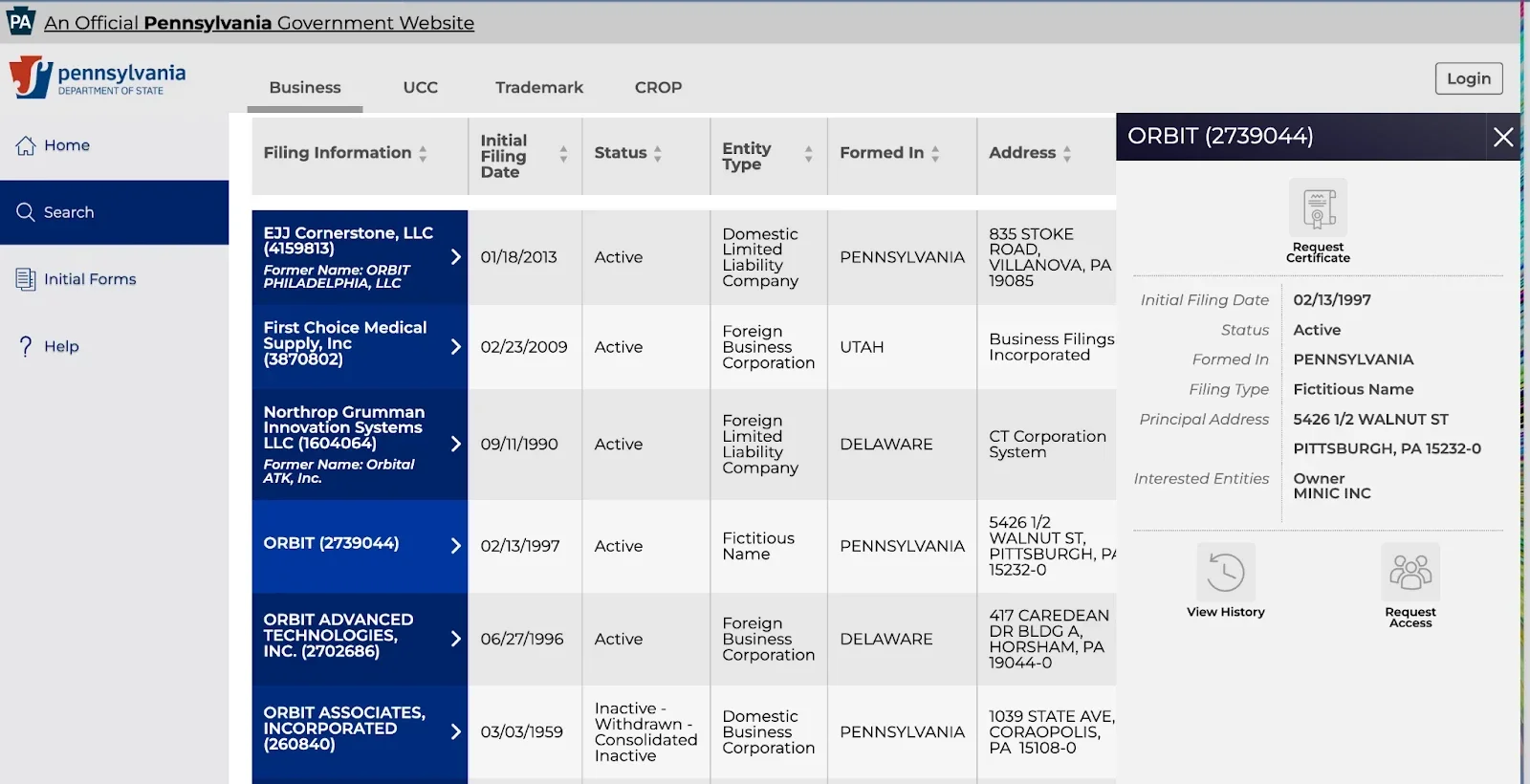

Step 4: Review your results

If you want to review the details of a specific business, you can click on the business entity name or entity number, which will open a side panel with the public details about that specific business.

From here, you can look at the business’s filing history or request a certificate or access to more information. You’ll need a login to request access to more information.

Step 5: Take action

Now that you’ve completed your search, you can choose to take action.

- If the name you’ve chosen for your business isn’t used by any other business, you can apply to use that name for your LLC, C-corporation, or S-corporation.

- If the name you’ve chosen is confusingly similar or is already in use, you’ll need to choose a different potential name and run another search.

Why conduct a PA entity search?

Before starting a business in Pennsylvania, you must confirm that the name you’ve chosen for your business isn’t already in use.

A PA entity search allows you to identify if another business has already chosen that name or uses a name that’s similar enough to cause confusion, which could lead to potential lawsuits. If either of those is the case, you’ll need to choose a different name for your business.

If the name you’ve chosen is available, then you can register your new business with the Pennsylvania Department of State.

If you’re not quite ready for that step, you can reserve the business name. To do that, you’ll file a name reservation form and pay a $70 filing fee.

Understanding naming guidelines in Pennsylvania

In Pennsylvania, there are a few business naming guidelines that you must follow:

- For sole proprietorships, the business’s name is your first and last name

- For a limited liability company (LLCs) and other corporations, you must include the business entity type designator at the end of your business’s legal name (e.g., LLC, Inc., Corp., Ltd.).

- Your business name must be distinguishable from other business names and can’t cause consumer confusion.

- Certain terms must be approved before use. Examples include: bank, insurance, college or university, engineer, or architect. For specialized and regulated industries such as these, you must provide evidence of industry-specific licenses, permits, and qualifications.

- Profanities or controversial language will undergo more intense scrutiny and are more likely to be rejected.

Other naming considerations

Before you reserve the name of your business, you’ll also want to ensure that you’re able to use that name online.

Checking domain name availability

For many businesses, your online presence is how you gain customers, build credibility, and sell products. Before registering your business name, be sure that you can purchase the domain name or URL and social media handles that match your business.

You can research availability by searching relevant social media sites and looking up URL availability on a hosting website like GoDaddy.

Conducting a trademark search

Federal trademark registration is more stringent and more expensive than state-level registration. The United States Patent and Trademark Office (USPTO) will carefully assess your mark to make sure it isn’t similar to any other registered trademark. If it’s not in use, they’ll grant you the trademark.

If you plan to operate a local brick-and-mortar or small business, you’re unlikely to need a trademark registration for your business name or brand logo.

Next steps to start your business or LLC in PA

Once you’ve identified or reserved the name you’ve chosen for your business, it’s time to file paperwork and register your business. There are a number of steps to fully set up your business in Pennsylvania.

- Choose the type of business entity you want (limited liability company, c- or s-corporations, sole proprietorships).

- File the appropriate paperwork with the state.

- Get your Employer Identification Number or EIN.

- If operating as a sole proprietorship, consider applying for a fictitious name or DBA.

- Apply for any necessary business licenses.

- Purchase your domain name and create a website.

- Set up your social media accounts.

The business registration steps differ slightly for a sole proprietorship and limited liability company. The Pennsylvania Department of Community and Economic Development has guides that can help you get started, or you can work with LegalZoom’s business formation services and let us take care of everything for you.

FAQs

Why do I need to do a business entity search?

Before you can file your business under the name you want to use, you must make sure no one else is using that name. A business entity search can help you do that.

How much does it cost to do a business entity search?

A Pennsylvania business entity search is free. To register your business, you will pay a $125 fee.

Can I reserve a business entity name?

If you’re not quite ready to start your business, you can reserve the name to use later. A name reservation requires a $70 filing fee.